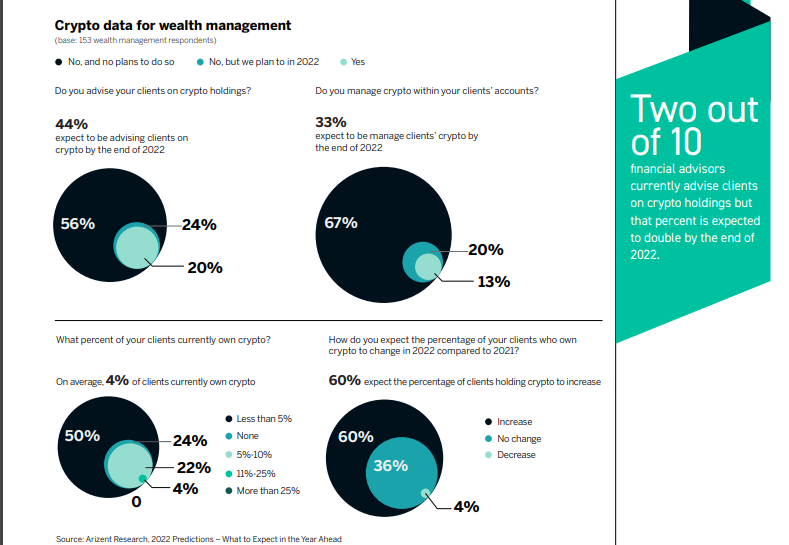

In line with the findings of a brand new survey, the variety of monetary advisors at the moment counseling crypto holding purchasers is predicted to double from the present two out of ten or 20% to 44% by the tip of 2022.

Solely 4 % Count on the Variety of Crypto Holding Purchasers to Lower

The variety of monetary advisors in the USA that at the moment counsel their purchasers on crypto holdings is predicted to double in 2022, a brand new examine has discovered. In line with the examine, which surveyed wealth administration specialists based mostly within the U.S., this predicted rise is within the variety of advisors to 44% is in tandem with their expectation that extra purchasers (about 33%) will seemingly grow to be holders of crypto by the tip of 2022.

As proven by the info that was obtained from the 153 respondents that participated in Arizent Analysis’s 2022 Prediction survey, about 60% of monetary advisors anticipate to see the variety of crypto holding purchasers improve. And with solely 4 per cent of the respondents anticipating to see this quantity drop, the examine findings recommend purchasers’ demand for cryptocurrencies will not be waning.

Different Aggressive Threats

Reasonably, the findings present that cryptocurrencies, which at the moment are extensively coated by the monetary press, “are [now] a giant theme in investing circles” Nevertheless, in line with the examine’s report, this progress in cryptocurrency’s recognition has added to banks’ listing of worries that already embrace the menace posed fintech and funds corporations in addition to the mooted U.S. digital foreign money. The examine report explains:

Solely 4 in ten banks see a rise of their funding in conventional bank cards with loyalty and rewards options throughout the subsequent three years. Which may be a mirrored image of different aggressive threats to bank cards, corresponding to digital fee alternate options like PayPal and Venmo and initiatives by the Federal Reserve.

That is along with one in 4 banks that sees an actual risk of a aggressive menace posed by shoppers banking within the U.S. Federal Reserve initiatives “corresponding to FedNow real-time funds, an alternative choice to conventional wires and ACH transfers” The potential creation of a ‘digital greenback’ foreign money can be seen as one other potential aggressive menace.

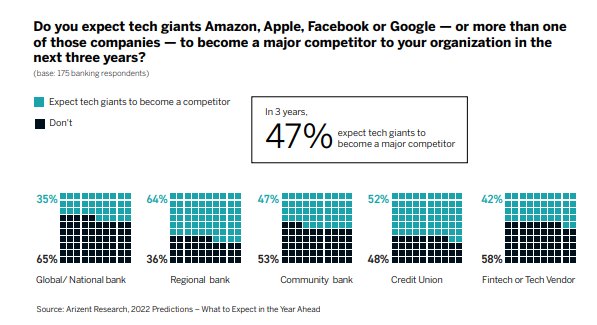

In the meantime, the examine additionally discovered the opportunity of massive tech corporations muscling their means into the monetary companies business to be a key fear for banks and insurers. As proven within the information, about “six in ten digital insurers fear that these forays are a aggressive menace.”

Then again, virtually half of all banks, “or 47%, anticipate Large Tech to grow to be a serious competitor inside three years.” The findings additionally present regional banks to be probably the most nervous with 64%.

What are your ideas on this story? Inform us what you assume within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.