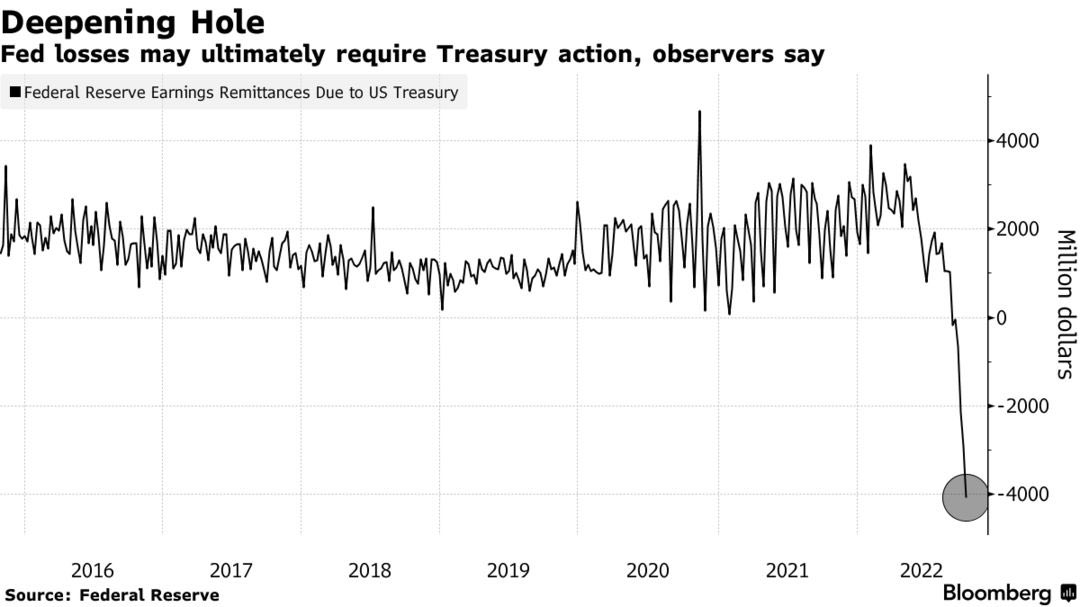

U.S. Federal Reserve raised the benchmark bank interest rate through a string of rate rises. However, U.S. Treasury markets as well as global bond markets experienced the largest sell-offs in nearly a decade. The Fed’s actions has fueled criticism toward the U.S. central bank as some strategists believe the onslaught of interest rate hikes could spur illiquidity in the world’s largest bond market. Moreover, a report published on Tuesday, explains that the Fed and foreign central banks worldwide are “losing billions” by paying more interest.

Fed Loses Billions

Federal funds rates (FFRs) have been raised by the U.S. Federal Reserve on several occasions in this year. Three times consecutively, 75 basis points (bps), were added to the rate. The rate hikes have caused politicians and the investment bank Barclays to question the central bank’s need to slow down the rate hikes. Even the United Nations Conference on Trade and Development(UNCTAD), urged Fed to increase spending and slow down.

However, market observers and Fed members working together suspect that another 75bps rate increase will be made next month. On Tuesday, Bloomberg reported that, as of right now, the U.S. central bank is “losing billions.” Bloomberg contributor Jonnelle Marte says “without the income from the Fed, the Treasury then needs to sell more debt to the public to fund government spending.” Despite, the need to sell more debt the chief global economist for Morgan Stanley and former member of the U.S. Treasury, Seth Carpenter, insists the losses have no material effect on near-term monetary decisions.

Carpenter added:

The losses don’t have a material effect on their ability to conduct monetary policy in the near term.

Reporter Says ‘Other Central Banks Are Also Dealing With Losses as Rates Go up’

Marte is a Bloomberg reporter tweeted that the “higher rates mean the central bank is now paying more interest on reserves than it collects from its portfolio.” Marte added that this situation could lead to “some political headaches.” “I won’t break out the accounting lingo, but the short version is that the Fed used to send its income to the Treasury,” Marte’s Twitter thread added. “Now that the Fed is losing money, the losses are piling up into an IOU that the Fed will pay later with future income.”

Bloomberg reporter added:

Others central banks face similar losses due to rising rates around the globe in an effort to fight inflation. These accounting losses could fuel criticism about asset purchasing programs that were designed to save economies and markets.

The report that notes the Fed is losing billions and wreaking havoc on other central banks worldwide, follows a number of analysts insisting that the Fed is trapped because hiking the FFR too high could lead to “blowing up the Treasury.” The founder of the hedge fund Praetorian Capital, Harris Kupperman, said this could happen in a blog post published on October 18. J. Kim of skwealthacademy substack also predicts that a “U.S. Treasury bond market flash crash is inevitable under these market conditions.”

The experts Marte interviewed explained, however, that the U.S. central bank’s losses can be recapitalized. Jerome Haegeli from Swiss Re, the chief economist, told Bloomberg that central banks can be recapitalized at any time. However, they will still face criticism for the way that they are implementing policy.

“The problem with central bank losses are not the losses per se — they can always be recapitalized — but the political backlash central banks are likely to increasingly face,” Haegeli said in a statement to Marte.

Let us know your thoughts on the U.S. Federal Reserve report and other central banks that are losing billions worldwide. Comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki commons. Credit: Bloomberg.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.