After the TSX-listed Voyager Digital revealed that it was owed $655 million from Three Arrows Capital (3AC), the company secured a $500 million credit line from Alameda Ventures in order to “safeguard customer assets.” Five days later on July 1, Voyager announced the crypto company was “temporarily suspending trading, deposits, withdrawals and loyalty rewards.”

Another Crypto Firm Freezes Withdrawals, Voyager CEO Says ‘It Was a Tremendously Difficult Decision’

- According to a press release, Voyager Digital, a struggling digital currency company (OTCMKTS : VYGVF), announced Friday a temporary withdrawal and deposit suspension. Voyager explained that it was “temporarily suspending trading, deposits, withdrawals and loyalty rewards, effective at 2:00 p.m. Eastern Daylight Time today.”

- “This was a tremendously difficult decision, but we believe it is the right one given current market conditions,” Stephen Ehrlich, the chief executive officer at Voyager said in a statement.

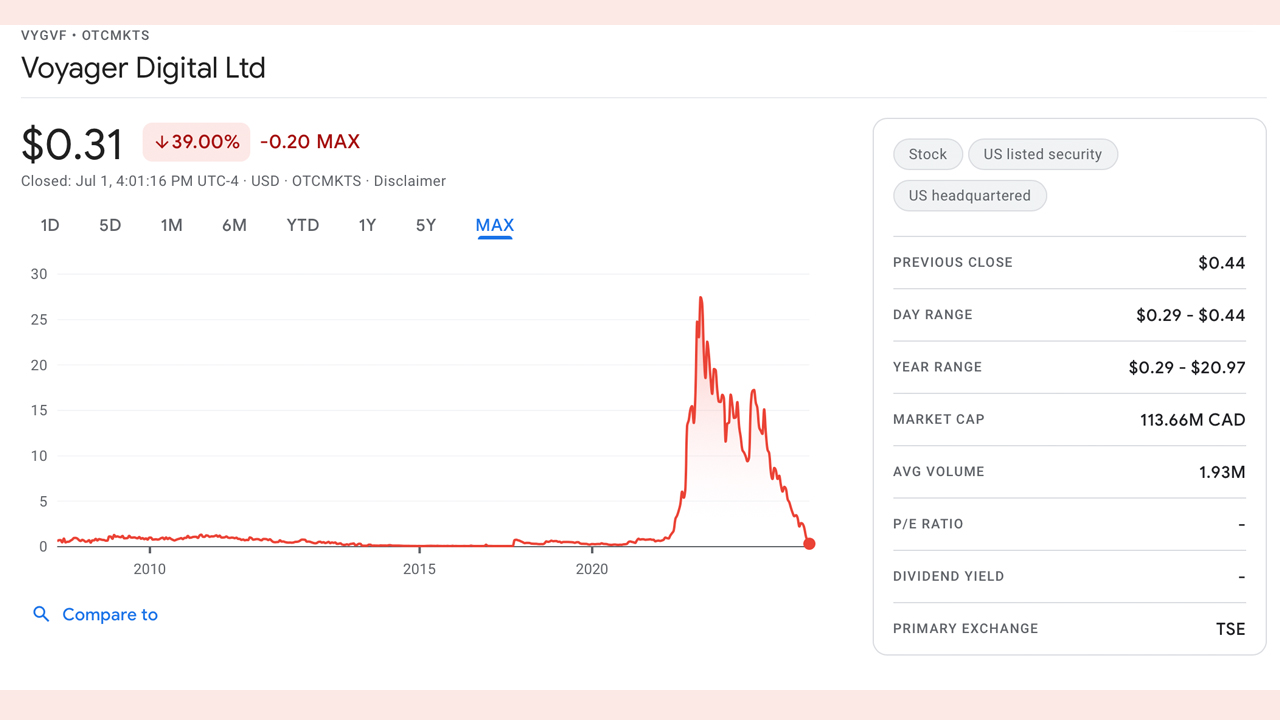

- VYGVF shares plunged to $0.29 per sen after falling below the $0.44 share price on Thursday. Shares have lost 99% since the stock’s all-time high at $27.39 per share on April 1, 2021.

- “This decision gives us additional time to continue exploring strategic alternatives with various interested parties while preserving the value of the Voyager platform we have built together,” Ehrlich added. “We will provide additional information at the appropriate time.”

- In addition to the update concerning deposits, withdrawals and loyalty rewards, Voyager summarized 3AC’s debt to the company. “Voyager also provided the following financial and balance sheet updates, per requirements of Canadian securities laws,” the company explained.

- Voyager announced last week that it opened a credit card line with Alameda Ventures. It claimed to have secured a 500 million dollar revolving credit line from the company. Voyager had revealed it owed $655million in bitcoin (BTC), and stablecoin USDC (USDC)

- Furthermore, Voyager has also disclosed that it is working with Kirkland & Ellis LLP for legal assistance and Moelis & Company and The Consello Group for financial advice.

- Voyager’s withdrawal pause follows the suspension of withdrawals the crypto lender Celsius initiated weeks ago. Celsius has yet to update the community concerning the company’s official plans to resolve its financial hardships.

- However, on Thursday, Celsius published a blog post that says the firm is “focused and working as quickly as we can to stabilize liquidity and operations.” Celsius further said that it was “pursuing strategic transactions,” and “restructuring” liabilities, “among other avenues.”

- On the same day Voyager temporarily froze the exchange’s main operations, Blockfi co-founder Zac Prince disclosed that Blockfi lost roughly $80 million due to 3AC exposure and stressed it was “a fraction of losses reported by others.”

- Voyager’s announcement also discussed “the court-ordered liquidation process in the British Virgin Islands” as the crypto firm said that it was “actively pursuing all available remedies for recovery from 3AC.”

Voyager Digital temporary suspending withdrawals: What are your thoughts? Please comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons. Editorial Photo Credit: T. Schneider/Shutterstock.com

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.