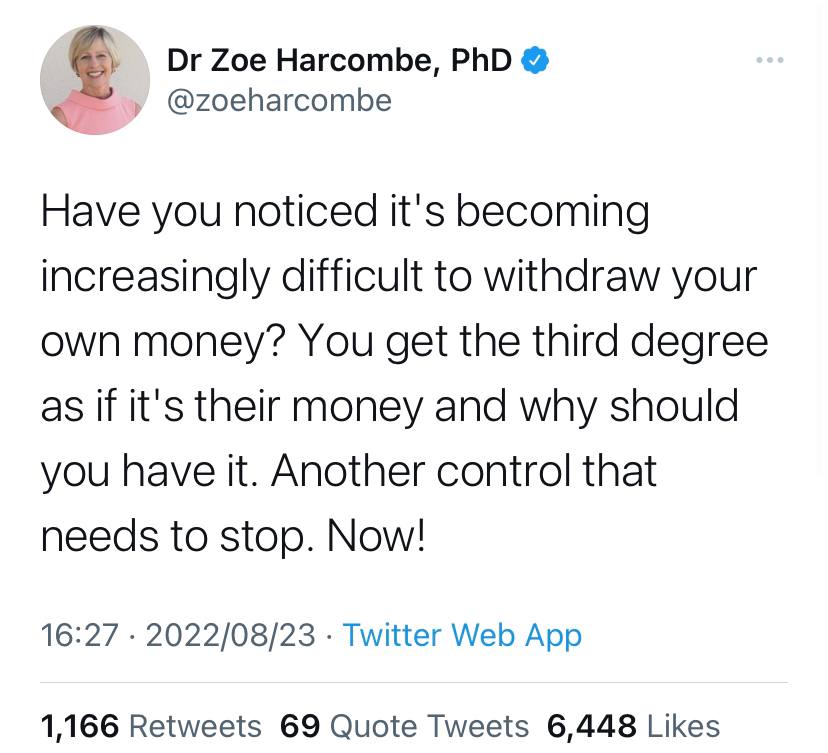

There is no privacy. There is no property. No prosperity. If you follow the news, you’ve seen the trend — putting legal limits on cash transactions, the emergence of surveillance-oriented, central bank digital currencies (CBDCs), and more recently, crypto mixing platform Tornado Cash being sanctioned by the United States Treasury. There is a new wave of propaganda increasingly demonizing individual financial privacy and “private” cryptocurrencies and protocols. You’ve likely experienced the dystopian push in your own life, as banks and financial institutions demand more and more sensitive, personal information, and freeze your hard-earned money while telling you to prove you are not a criminal or terrorist before you may access it.

World Economic Frustration

What is a “canary in a coal mine”? The Free Dictionary defines it as “Something or someone who … acts as an indicator and early warning of possible adverse conditions or danger.” The saying hearkens back to the “practice of taking caged canaries into coal mines. The birds would die if methane gas became present and thereby alert miners to the danger.”

Some in cryptocurrency have accurately described a future that will be dark with the Office of Foreign Asset Control’s (OFAC), ban on Tornado Cash crypto-mixing platform Tornado Cash. This is something that has already been massively realized. This is if people around the world don’t start speaking out against economic tyranny.

An advocate for ethereum has been identified Beobserved:

The U.S. has sanctioned Ethereum addresses today [with] a privacy service called Tornado cash. Circle immediately blocked the USDC accounts. Github banned contributors to Tornado. If you were waiting for the opening shot of big brother’s assault on crypto this was it.

A related arrest was made. The question of the nature and freedom to speak is now again being asked.

Arguably there have been many such proverbial canaries since bitcoin’s inception in 2009. Indeed, from the beginning of the unfortunate merger of money and the state, they haven’t stopped. The divorce of dollars from gold, the rise of quantitative easing, and absurd and misleading claims about “zero percent” inflation in times of rampant inflation. The innovation known as Bitcoin allowed these poison-gas-filled coal mines, called states, and financial institutions to be bypassed from the beginning. There have been many canaries, but it’s also arguable that never has the assault on crypto privacy, financial freedom, and the impoverished world been so obvious as it is now.

Waging War Against the Poor While Praising ‘Inclusion’

In an effort to co-opt and disrupt the freedom and prosperity that crypto has already brought about, especially in poor countries with horrible economic circumstances, globalist governments, central banks, and intergovernmental organizations now employ buzzphrases like “financial inclusion,” “sensible regulation,” and “banking the unbanked,” to mask what they are really doing: divesting all of us of our financial privacy, freedom, and autonomy.

Take Ghana as an example. The failure of Ghana’s cedi currency has prompted people to look for other ways to keep their value. They are now trading in foreign currencies. The state’s inclusive response? Go include yourself in a jail cell. Meanwhile, the central bank is pushing a surveillance-oriented electronic version of the already failed traditional currency. Nigerians are also being fed similar anti-crypto propaganda and pro-free-market propaganda. Nigeria, of course has a digital currency central bank (CBDC).

Cash transactions exceeding 15,000 shekels are not allowed in Israel. 6,000 shekels if you’re a company. Columbia’s government is plotting to infringe on financial freedom by imposing a trackable and programmable CBDC (citizens can expect automatic penalties and seizures as well as deductions and deducts that you don’t have any control over) CBDC upon them. They also plan on limiting the private money they can spend. The trend is increasing worldwide and will continue to get worse.

While the European Central Bank considers Bitcoin “problematic,” it shamelessly praises CBDCs as a “holy grail.” Here’s what a United Nations agency had to say about crypto in developing nations: “Global use of cryptocurrencies has increased exponentially during the Covid-19 pandemic, including in developing countries.” The agency, UNCTAD, even acknowledges crypto is helping people, noting that “cryptocurrencies can facilitate remittances,” but, of course, they add that “they may also enable tax evasion.” The UN agency emphasizes:

The monetary sovereignty and independence of countries could be threatened if cryptocurrencies are widely accepted as a means to pay or even substitute for domestic currency (a process called Cryptoization).

Yes. That’s the point. We don’t want you to be in danger. We are trying to destroy the existing, energy-saving, and violent monetary system. The globalist elitists cite tax evasion but never own up to the fact that they don’t have real jobs by any sensible estimation, and live as parasites on the hard-earned incomes of those they claim to protect. Oftentimes, as unelected, self-appointed ‘leaders.’

UNCTAD notes that “In this way, cryptocurrencies may also curb the effectiveness of capital controls, a key instrument for developing countries to preserve their policy space and macroeconomic stability.” If you want an accurate translation of “policy space,” of course, it’s control.

These developments are not unique. Atlantic Council notes that “105 countries, representing over 95 percent of global GDP, are exploring a CBDC.” 11 have already launched. And in countries where inflation is rampant and the currencies are being devalued into oblivion, and economies unilaterally shut down by engineered panic — this creates problems that can literally be life and death. It is possible that you will not make your own substitute currency in order to ease the pain. With threats of violence and even death if your resistance is not accepted, you can only use state-approved garbage money, while all of your hard earned savings go to Keynesian, statist lunacy.

The ‘Wild West’ Strawman

“So what,” asks the critic, “we just have no regulations and the world descends into chaos, where any unethical monopoly created by warlords can corner the market?” Aside from the fact that massive, literal monopolies on violence (ask Barack Obama or Elon Musk, they agree) called nation states (actual warlords), have already done this, and despite the fact that there is no one governing the governments themselves, or the central banks and “intergovernmental bodies” themselves (they exist in anarchy), the “Wild West” trope that central bankers and regulators repeat ad nauseum, is a myth.

Regulating can and does happen, but not through violence or threats to peaceful people. Each day there are nearly infinite trade transactions among consenting parties. Under a privatized, free market paradigm, regulation, enforcement of rights, defense and security, legal systems, etc., can be handled by the market — as they already are in many cases — without the need for self-appointed “elites” and politicians living on taxes (literal extortion), in parasitism. And without the unfortunate result of “qualified immunity” and lack of real accountability that which government engenders due to guaranteed funding.

Think about your daily life to see how it illustrates the absence of any need for state-wide, violent regulation. You go to the barber. Are you afraid that the staff will suddenly shave your eye because they don’t have any police? You are not.

Business isn’t because people fear police and other penalties. People behave normally. While most people don’t want to cause harm, they are not necessarily psychopaths. Those who are in government jobs are usually the ones that are more likely to do so. Business works secondarily because there are incentives. There is no incentive for the state to protect your rights. Only the barber can do that. Because if you are unhappy with the service, you have other options. Regulators like the SEC don’t care about your prosperity, they care about preserving their monopoly on legality. The globalists fear that the individual will prosper as innovation and decentralization proliferates unabated. They see their dictatorial cult as harmful and ineffective.

Free Market ‘Globalism’ vs New World Disorder

Globalism is a good thing when it is individuals trading freely, and freely competing currencies seeking to become the most saleable good in the world economy, as gold has been and some might say, still is — and as bitcoiners hope Satoshi’s creation will one day be. This is not the World Economic Forum’s vision of globalism, however.

CBDCs are promising to revolutionize payment and provide efficiency for consumers (retail, commercial). However, it remains unclear how the architecture of CBDCs accommodates an identity layer. The digital identity layer must be created independently from other components of payment processing and systems such as authorization/authenticating transactions or application.

The quote above is from the June 2022 WEF Insight Report titled: “Future Focus 2025 Pathways for Progress from the Network of Global Future Councils 2020-2022.” Amidst flowery quotes and fanciful ideas about climate change, vaccines, and surveillance-friendly money tied directly to your ID with override mechanisms to reject transactions, are quotes like this:

It is more important than ever to coordinate international tax issues, particularly in order to tackle the pressing taxation challenges of multinational companies and individuals who use offshore accounts for tax evasion. Climate change is the top priority for international tax coordination.

You might be wondering why private jet-setting climate crisis Davos classes are directly linking concepts such as carbon credits, biometrics and digital ID to AI, vaccine certification, CBDCs and vaccination certificates. When you hold paper money in your hand, or gold, or silver, or cryptocurrencies in a non-custodial fashion, and you trade peer-to-peer with others, these transactions cannot easily be “shut off.” If, however, CBDCs rise to ubiquity, any single excuse — from vaccination status to too much use of your lawnmower — could result in deductions from your account, or worse, and there will be nothing you can do about it. “You’ll own nothing, and you’ll be happy.”

You have no privacy and you don’t own any property.

Go green. Restore the earth. Reduce your use of fuel and energy. We hear this from private pilots who travel the world in their private aircraft.

Bitcoin consumes too much energy. It’s not sustainable. These are the words of those who continue to wage endless wars, causing immense climate damage and wasting huge amounts of energy, and killing countless innocent children.

Make use of our CBDCs. Everybody should prosper. Trust us to use protocols that are custodial and off-chain. You can trust us if you use these protocols to imprison violent traders, illegally make free exchange, lock the accounts of starving and shut down entire economic systems under threat from violence.

Why would you believe them?

It is easy to see why unsupervised and controlled central banks, government-lobbying financial organizations, and governments are purchasing hard assets such as real estate and assets like BTC. They also clamp down on peer-to-peer cash exchange and cryptocurrencys. They will make you a slave.

The term property refers to something that an individual, or group, has the exclusive right to use. Take, for instance, my body. It is mine to decide what happens. No one has more rights than me. Are you interested in borrowing my car? Sure, no problem. But without my express permission, it’s theft. I own the exclusive rights to it.

Because only I know the seed phrase to my bitcoin wallet, I’ve effectively given myself exclusive use. I can no longer use the bitcoins if the seed phrase has been stolen. Once private property like one’s body, car, money, or house are not recognized as such, the privacy is invaded by violence. Meanwhile, the power elite continue their private business and plot to destroy the power and wealth of everyone who is not on the same page with them. To do this, you must demonize privacy and eliminate it. It is time to end private property. The root of private ownership is self-ownership.

These people are putting into doubt your right to live as an individual free of any restrictions and to benefit from your labor. It is your right. Everyone who claims the opposite is an enemy.

Do we want to watch as politicians ignore all rules? Is it possible to defy the evil system?

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This is not an invitation to purchase or sell directly, nor a suggestion or endorsement of products, services or companies. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or be attributed to the author or the company.