Whereas reserve-based crypto property like gold tokens and stablecoins have been capable of climate the crypto market carnage over the past two weeks, rebase tokens like wonderland (TIME), and Olympus (OHM) have seen large losses. Wonderland is down greater than 96% for the reason that crypto asset’s all-time excessive (ATH), and OHM is down over 95% because it’s personal ATH. Moreover, the Wonderland undertaking is surrounded by controversy because it’s been assumed that one of many founding members was a former Quadrigacx worker.

Rebase Token Financial system Drops From $3.2 Billion to $1.74 Billion

The full worth locked (TVL) throughout all of the decentralized finance (defi) protocols in existence immediately is just below the $200 billion mark. Whereas many defi initiatives have managed to stave off the current crypto market rout, others have seen their valuations slide over the past two weeks. Numerous funds have moved into reserve-based crypto property like stablecoins and gold-backed tokens in an effort to hedge in opposition to the value fluctuations.

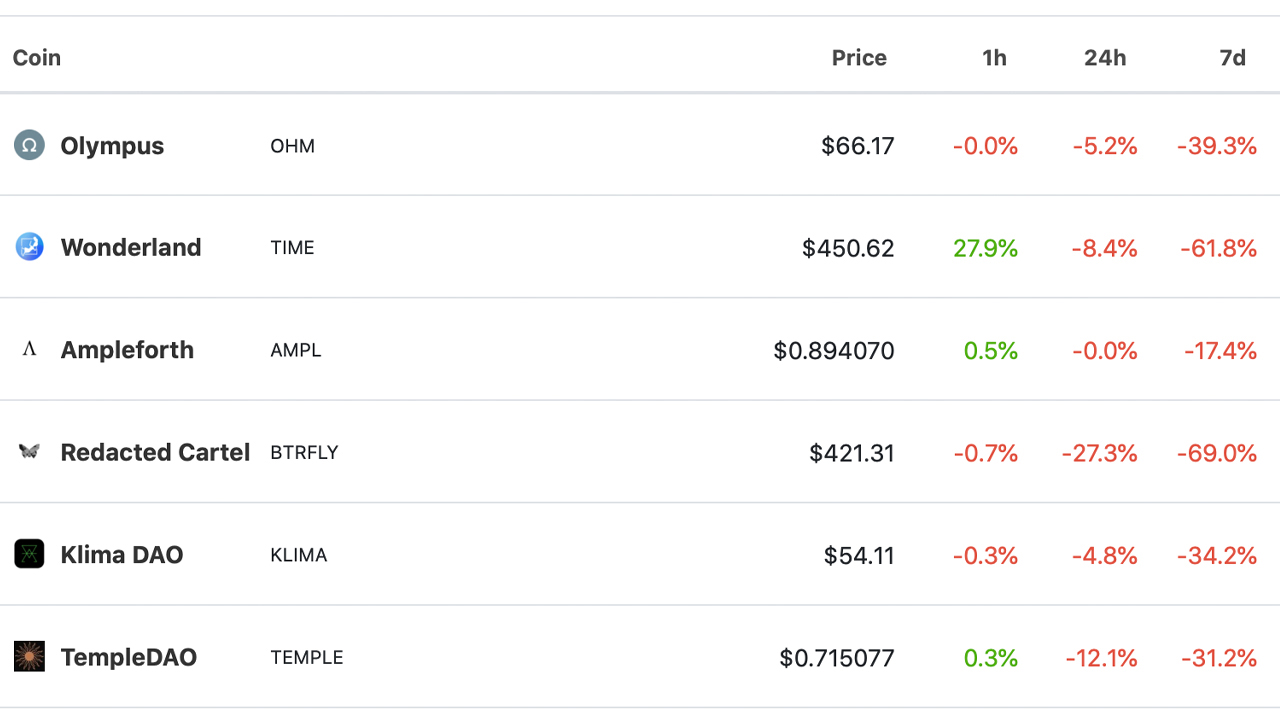

Stablecoins and gold tokens have been capable of maintain their pegs, particularly to the particular asset the tokens are linked to, such because the U.S. greenback or one troy ounce of .999 fantastic gold. Alternatively, reserve-based rebase tokens have seen large losses over the previous few months and much more so over the past two weeks. Your complete listing of greater than two dozen rebase tokens listed by market valuation is value $1.63 billion, because it misplaced 11% over the past day. The crypto asset olympus (OHM) has dropped 39.3% this previous week and is down 95.3% from the crypto asset’s $1,415 per unit ATH.

Wonderland, an Avalanche undertaking primarily based on the Olympus protocol, has seen its two native crypto-assets wonderland (TIME) and wonderland (WMEMO) observe the identical destiny as OHM. TIME’s falter over the past two days has been worse than OHM’s drop, as weekly metrics point out TIME’s worth is down 61.8%. Wonderland (TIME) has misplaced 96.4% of its worth since tapping a $10,063 ATH three months in the past.

Wonderland Venture Surrounded by Controversy

Along with the foremost losses, Wonderland creators have been beneath scrutiny in current instances. According to a crypto supporter on Twitter, Wonderland group member @0xsifu or “Sifu” helped co-found the bankrupt Canadian crypto trade Quadrigacx with its founder Gerald Cotten. Quadrigacx collapsed in 2019 and there was loads of controversy surrounding Gerald Cotten’s dying and his associates. Sifu has been working Wonderland’s treasury with the undertaking’s founder, Daniele Sestagalli. In a weblog put up, Sestagalli confirmed the accusations regarding Sifu and additional careworn that Sifu should step down from his Wonderland position.

Sestagalli wrote:

Now having taken a while to replicate, I’ve determined that he must step down until a vote for his affirmation is in place. Wonderland has the say to who manages its treasury not me or the remainder of the Wonderland group.

Sestagalli additionally discussed the community’s issues with Sifu on Twitter. “I’ve no bias about @0xsifu he has turned a good friend and a part of my household and if my fame of judgment might be hit by his dox, than be it. All frogs for me are equal,” Sestagalli said. “As I struggle for him I’ll struggle for anybody else that has confirmed to me to be a great actor regardless of the previous,” he added.

Hardcore Wonderland supporters are known as “frogs” and in addition to the contentious points with Sifu, frogs are additionally upset in regards to the falling worth. Wonderland-based Twitter threads and the group’s Discord and Telegram channels are crammed with offended frogs.

“We must always not need to pay on your error in judgment,” one particular person wrote on Twitter. “Simply supply [a] clear refund or proper the ship. You say he wants [a] second probability. Get up there are dodgy doings within the undertaking as effectively.”

The Wonderland protocol itself can also be linked to in style defi initiatives just like the stablecoin magic web cash (MIM), Popsicle Finance, and Abracadabra.cash. As OHM, TIME, and WMEMO have shed monumental quantities of worth, rebase token market caps beneath them have additionally shuddered considerably. Ampleforth (AMPL) shed 17.4% this previous week and redacted cartel (BTRFLY) misplaced 69% in seven days. Klima dao (KLIMA) misplaced 34.2% over the past seven days and temple dao (TEMPLE) has decreased in worth by 31.2% this previous week.

What do you concentrate on the rebase token market rout and the controversy surrounding the Wonderland undertaking? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Coingecko, Dealer Joe

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.