Bitcoin’s next bull market is nearing its peak. In the meantime, the bears have continued to dominate the market. The bitcoin price has fallen below $29,000 over the last 24 hours. Unfavorable circumstances may force traders to delay the end of the bear market.

Bitcoin to Retrace

Bitcoin does not shy away from retracements higher than 20%. More substantial corrections have occurred in Bitcoin’s history than this current one.

If you can recall past meltdowns of 50% or more in less than one month, those who know enough will tell you that this is not a major problem. Since Bitcoin’s inception, there have been around seven price corrections, with the price dropping by half. Each of these price corrections has seen Bitcoin bounce back.

Bitcoin dropped by 83% over a brief period in April 2013. It dropped by another half-million dollars in April 2013, when Bitcoin was banned in China.

BTC/USD drops below $30k TradingView

2018 was difficult. It reached an all time high of $20,000 in December 2017 but was worth only $3,000 by December 2018.

Recent investors may be familiar with March 2020’s Bitcoin meltdown. In just a few days, Bitcoin fell 50%. The same thing happened in May 2021.

New Data Shows China Still Controls 21% Of The Global Bitcoin Mining Hashrate| New Data Shows China Still Controls 21% Of The Global Bitcoin Mining Hashrate

Markets are still in turmoil today. Bitcoin is down over 20% and 50% since its November 2021 peak.

The 200 week moving average(WMA) is probably the most dependable and straightforward chart to provide some information on Bitcoin’s present position . It typically recovers rapidly from the 200 WMA. Bitcoin fell below the 200WMA twice before, but both were short-term. It has not been below 200 WMA for more than one month.

Bitcoin’s 200 WMA is now about $22,000. It currently trades at $29,000 and may go down, although it is unlikely to drop.

Bloomberg Analyst: BTC to Plummet

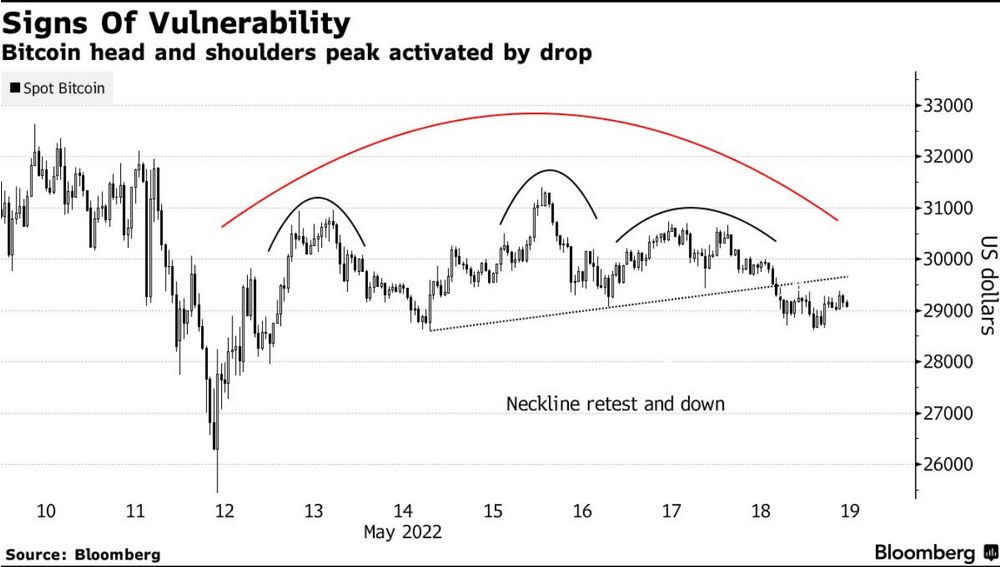

Bloomberg analysts predict that the main cryptocurrency will fall despite a 15% rise from its lows last week. BTC appears more fragile now than it was previously.

According to the article, Bitcoin’s recent rally has resulted in the formation of a “saucer-top” pattern on an hourly BTC chart. It has a Head and Shoulders pattern, which indicates a change in trend from bearish to bullish.

Bloomberg

After BTC dipped beneath the formation’s neckline, the pattern was activated.

The Bitcoin price should now rise to $30,800 in order not to drop further.

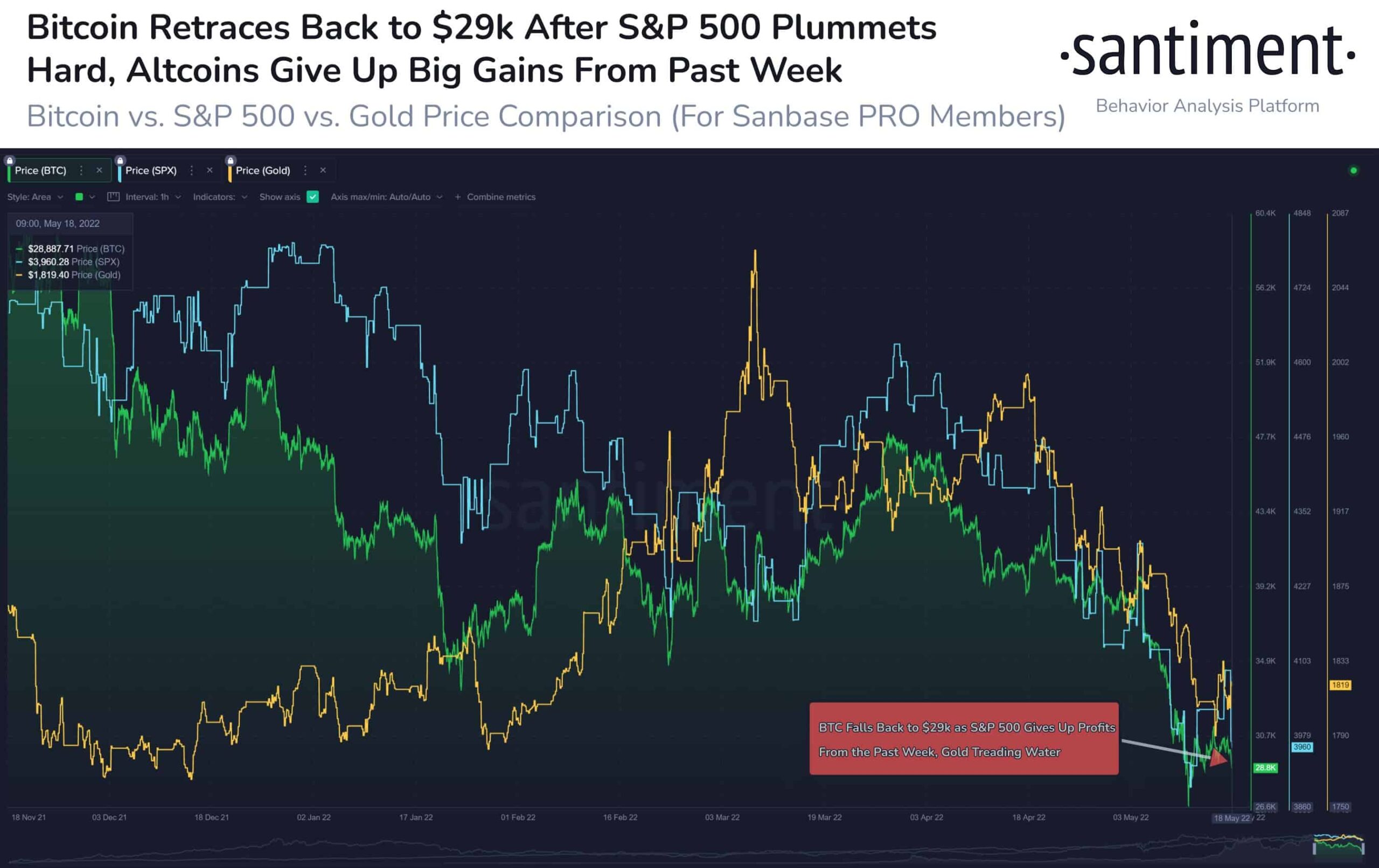

Santiment’s Bitcoin statistics shows a lackluster market sentiment as traders remain indifferent. On May 18, the S&P 500 fell more than 3%, dragging Bitcoin down with it. In fact, Bitcoin prices have been rising steadily since 2022 when the Nasdaq-100 correlation has held steady.

Blockchain-USA Equity Market Correlation. Source: Santiment

At the time of writing, Nasdaq 100 futures and U.S. Index futures were down around 1.5 percent. This suggests that Bitcoin prices may fall further. Today, the Asian and European stock market are both down over 2%.

On the contrary, whales appear to anticipate a bottom to keep accumulating. According to Rekt Capital, Bitcoin’s RSI has now reached the level where long-term investors have historically gained the most.

Funding Rates Fall To Yearly Lows Following Bitcoin’s Fall Below $29,000| Funding Rates Fall To Yearly Lows Following Bitcoin’s Fall Below $29,000

Charts by TradingView| Charts by TradingView