The safety of the DeFi and especially the FTM ecosystem is shaking as “Tomb Fork” projects seem to be the perfect place for scams to thrive. Even after thorough investigation, even a project that appears to be safer can turn out not to have been.

PulseDAO became rugged recently. Their own dev might have turned against them. KYC may not be sufficient to hold the person responsible.

Rug Pulls and Tomb Forks

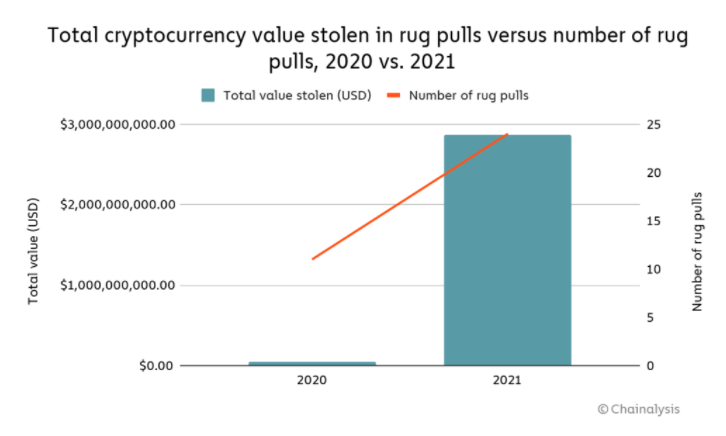

Chainalysis data indicates that DeFi rug draws took in over $2.8 Billion worth of cryptocurrency in 2021 and represented 37%, as opposed to 1% for 2020.

Tomb Fork, a model often FTM-based and risky, is perfect for rug pulls, so many investors are falling in.

Tomb Fork, a model often FTM-based and risky, is perfect for rug pulls, so many investors are falling in.

Pulse allowed users to create their own websites. to “create their own prediction markets about anything.” They launched a token model with the promise of rewarding “all participants fairly, while also making the network resilient.”

PulseDAO is a Tomb Fork. Tomb Finance describes Tomb Forks as algorithmic stablecoin projects which link their token with another coin. Originally FTM, they were called Tomb Finance.

In the case of Tomb Finance, they intend to “create a mirrored, liquid asset that can be moved around and traded without restrictions.”

Rug by PulseDAO

The rug was confirmedRugdoc.io warned earlier that this project was at risk from governance mishandling. Therefore, they required their contracts be audited by an independent auditor. These were the risk factors they highlighted:

-

Not KYC’d with RugDoc

-

There are currently no credible audits

-

Liquidity is not locked with RugDoc

-

Multisig is not recommended. Because of the governance risk, it is highly recommended that you use one with trusted third parties or community members as your approver.

They then discovered that Here, the contract owner removed 4243 FTM from the project. It seems like they pulled out almost all of the project’s liquidity.

“It appears Tomb forks have inherent governance risks, which is why it is critical to have renounced contracts and KYC in place before entering.”

RugDoc also missed the fact that PulseDAO performed KYC with ApeOClock. But, this was insufficient for safety and is something investors should consider. Does KYC suffice? You can read more about that here.

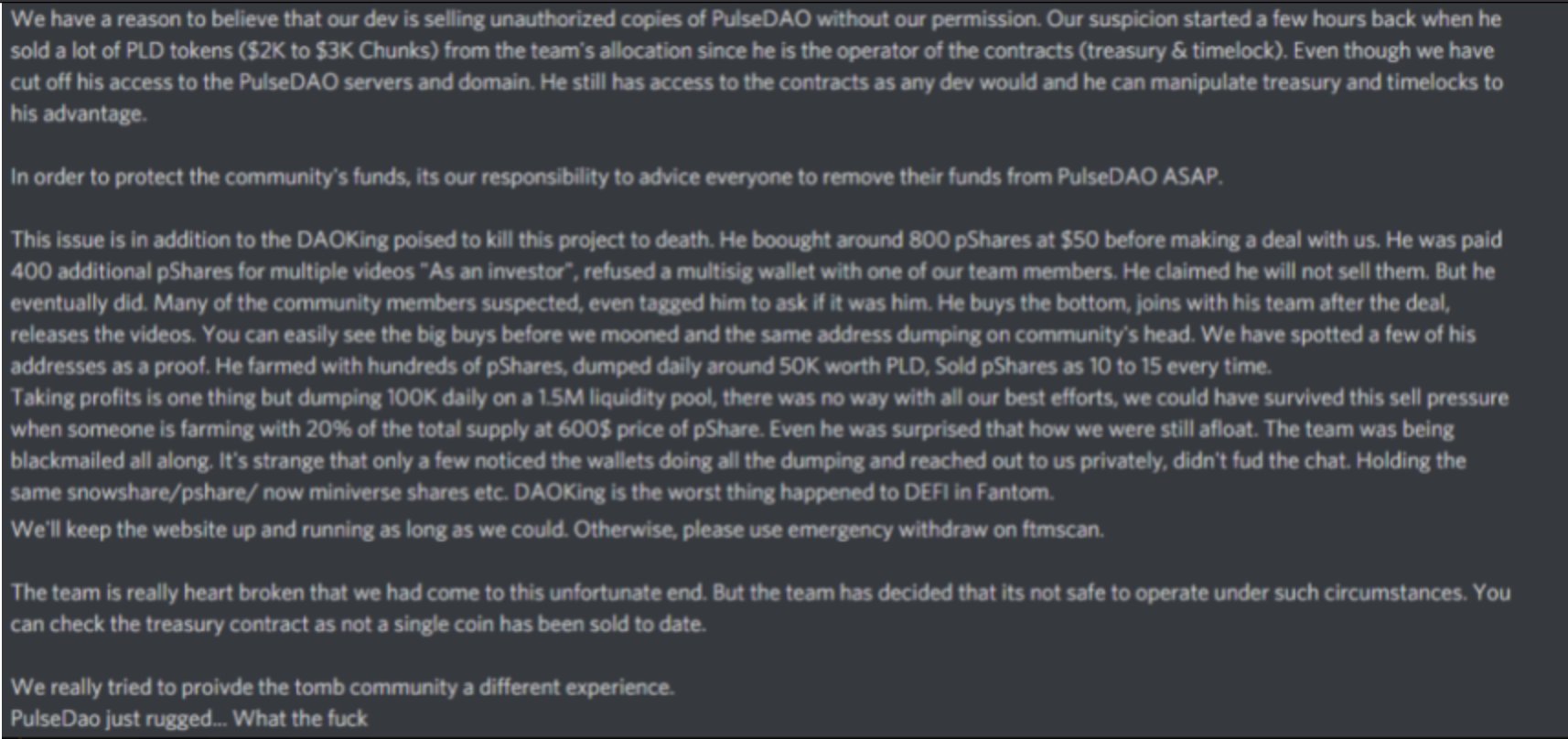

PulseDAO announced via Discord 5 days ago that they were experiencing issues with cross-chain bridges. But nothing further. All websites and accounts were either deleted or downed after 13 March.

Although there isn’t much data, they did scrape screenshots from messages sent by the team.

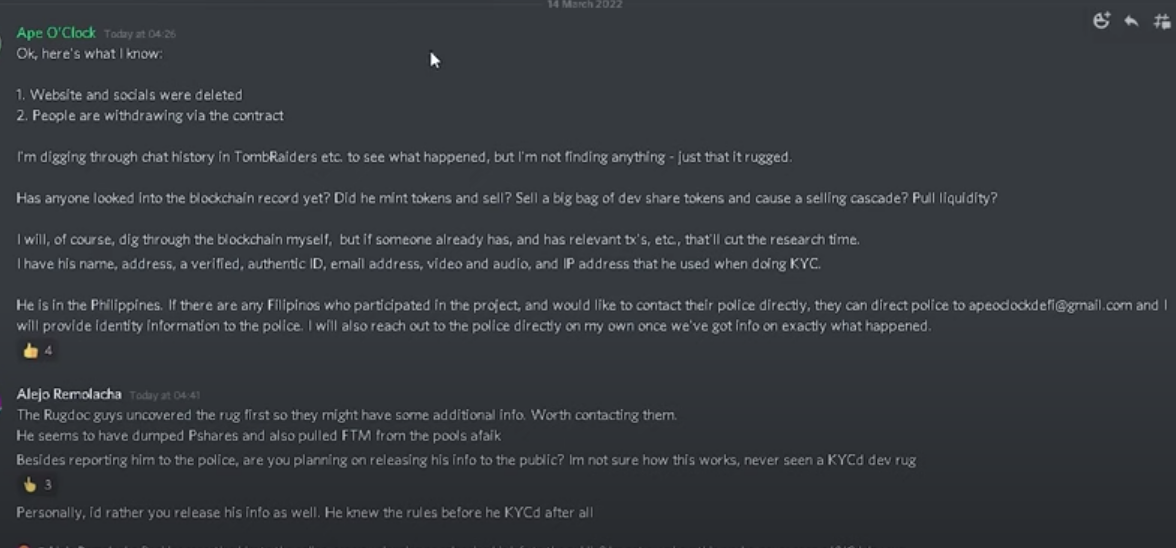

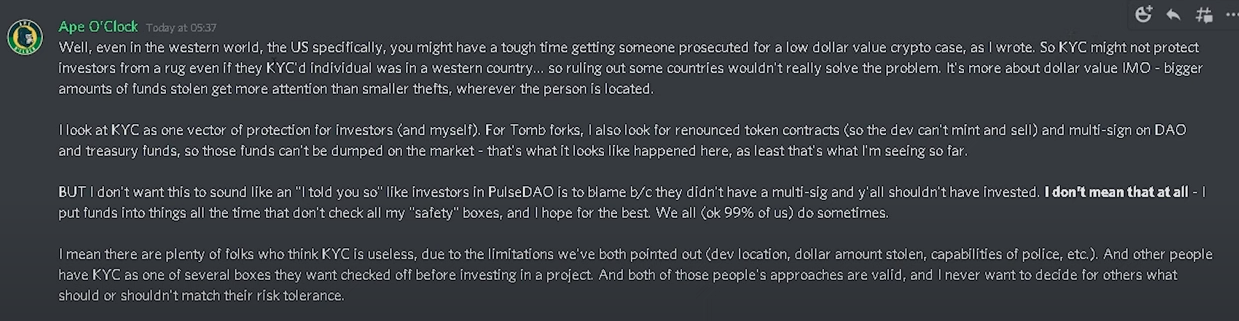

But even Ape O’Clock, the platform they used for their KYC, was confused:

The team’s cited a person who was “poised to kill the project”, “DAOKing”. The YouTuber is said to have made an agreement with PulseDAO for him to watch their videos. According to this YouTuber, he was used as a scapegoat by them and is now one of their biggest holders. He also got rough.

In a video, he listed his wallet. FTMScan can check the movements of any other wallets. Some people claim it’s unclear whether he has other wallets. However, he seems to be actively collaborating with Ape O’Clock to investigate the pull and take action.

The whole thing appears to have been developed.

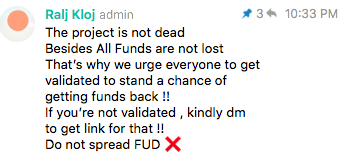

According to PulseDAO Telegram, the following are claimed:

The team also said they are investigating the “attack” and fixing their website and will take responsibility.

They also claimed the reason they took their Discord channel and Twitter down was that they need “encouragement, support and optimism not FUD and disheartening comments” while they manage to restore services.

It is not a wise decision to remove all information sources.

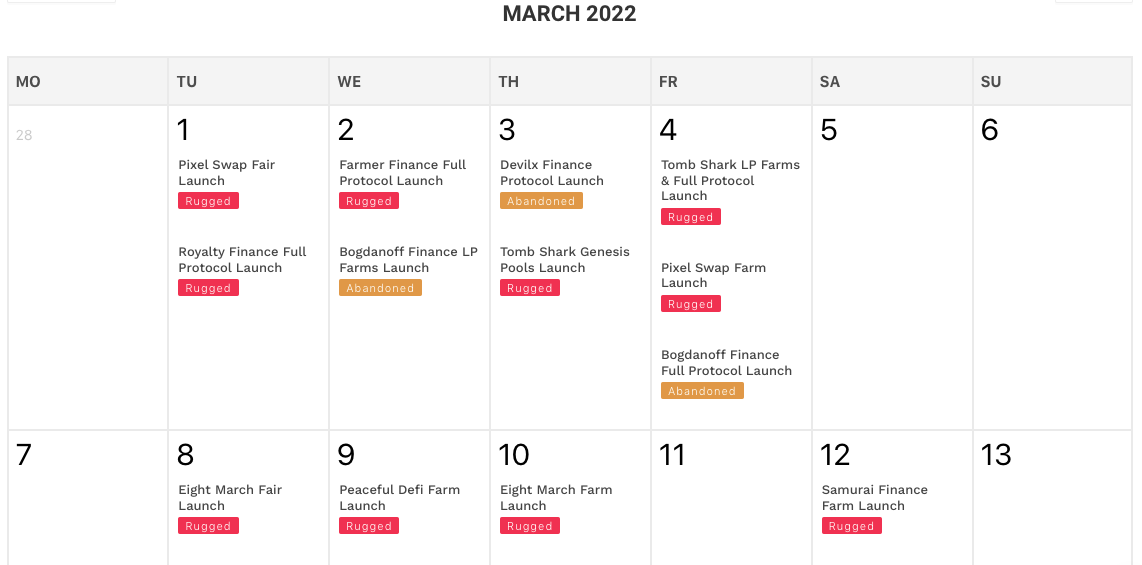

Rug pulls can also be patterned.Tomb Forks, a non-sustainable model is highlighted.

These are often labelled hard pulls and indicate that devs have coded the token using a malicious backdoor.Some are hard pulls and the project is thrown out.

A Race For The Truth: Fantom Vs. Rekt, What Went Down| A Race For The Truth: Fantom Vs. Rekt, What Went Down

Why KYC Didn’t Matter

Investors often check the safety box when projects have KYC. But, PulseDAO’s example shows that it is not strong enough.

There are some possible reasons why it may not be worth the effort.

- It can sometimes be very difficult, or impossible to recover crypto thefts from certain countries.

- Smaller crypto projects might be overlooked by authorities.

- Scammers may not be held responsible in many countries, as the rug pull is often grey.

A user pondered: “How do we expect DeFi as a whole to develop and grow if the is no safeguard in place?”

FTM Price

Fantom (FTM), which trades at $1.08 per day, has fallen 5.50% over the past 24 hours. Due to the departure of its main developers, investors have been afraid of Fantom. According to the foundation, this won’t affect their plans.

Why Fantom Fell 22% Following Key Personnel Exit| Why Fantom Fell 22% Following Key Personnel Exit