SOPR is a Bitcoin long-term holder that may hint at the fact that Bitcoin has only made it one-third way through the bear market.

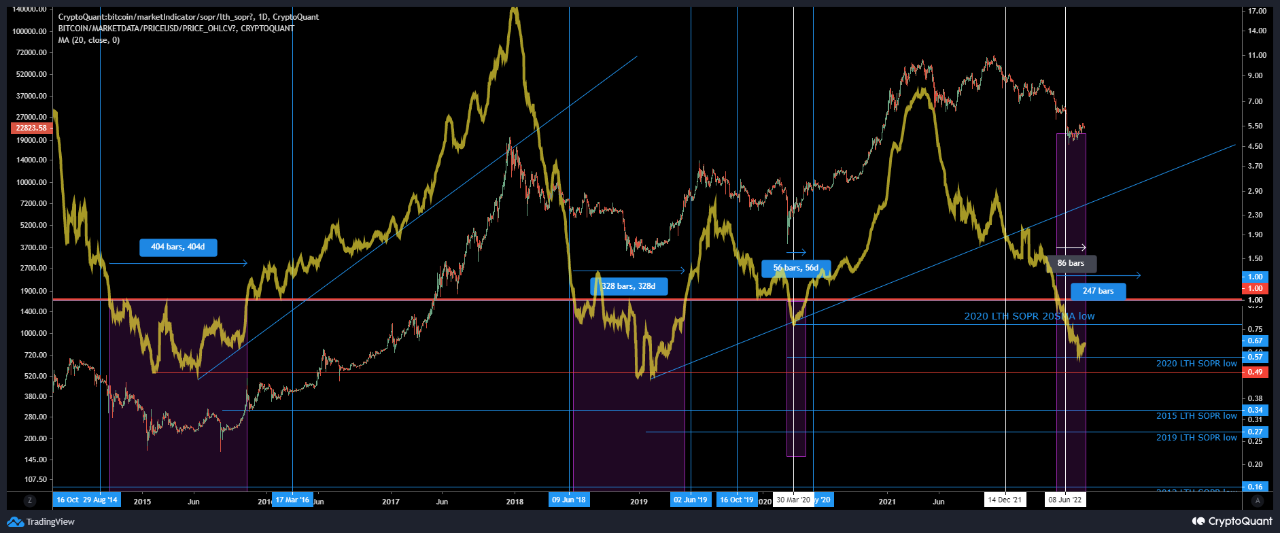

SMA 20-day Bitcoin Holder Long-Term SOPR has Only Been 86.2 Days into Bottoming Zone

A CryptoQuant analyst points out that crypto still has a long way to go before reaching the historical average of 260 day bottoming.

The relevant indicator here is the “Spent Output Profit Ratio” (or SOPR in brief), which tells us about whether the average Bitcoin investor is selling at a profit or at a loss right now.

To calculate the metric, we look at the price at which each coin was sold in the past on the chain. The coin is sold profitably if its previous selling price was lower than its latest BTC value. However, if that previous price was lower than the current value, this particular coin may have suffered a loss.

If the SOPR’s value is higher than 1, it indicates that the entire market is making a profit.

The indicator that is less than 1 indicates the average holder of coins is losing money at the moment.

The “long-term holders” (LTHs) is the Bitcoin cohort that includes all investors who have held onto their coins for at least 155 days without selling or moving them.

Here is a chart showing the trends in BTC SOPR (the 20-day MA), specifically for LTHs, over the past several years.

It seems like the value for the metric is quite low in recent times. Source: CryptoQuant| Source: CryptoQuant

As you can see in the above graph, the Bitcoin LTH SOPR (20-day SMA) dipped below the “one” mark a while back.

The quant also marked the appropriate zones of the trend in the chart in relation to bear markets.

The historical bottoming periods appear to last whenever the metric is below the breakeven point.

Based on LTH SOPR, bear markets in the past have averaged around 260 days. The coin is currently at the bottom of the cycle and has been there for 86 days.

If Bitcoin’s bear market ends in the same amount of time as the average, the crypto will still be only one-third through.

BTC price

At the time of writing, Bitcoin’s price floats around $23k, down 2% in the last week. In the past month, Bitcoin’s price has increased 13%.

Cryptocurrency's value seems to be moving in a sideways direction over the past few days. Source: TradingView, BTCUSD.| Source: BTCUSD on TradingView

Featured image by mana5280 at Unsplash.com. Charts from TradingView.com and CryptoQuant.com.