KuCoin is the most well-known and largest cryptocurrency exchange in the market. The exchange was launched in August 2017 and has more than 200 cryptocurrencies. It also offers access to over 400 markets.

KuCoin’s exchange provides bank-level asset security. The interface is simple and user-friendly. There are many services available, including instant exchange services, margin and futures, built-in forex trading, P2P trading, instant exchange services and the ability to borrow crypto or stake via Pool-X. IEO Launchpad for crypto crowdfunding and non-custodial trade. KuCoin also has the lowest fees for trading among cryptocurrency exchanges. KuCoin fees can be understood easily. Participating institutions can enjoy significant savings on their trading fees. KuCoin spot trading charges Fixed 0.1% fees apply. You will get a discount on the trading fees if you have KuCoin Shares or 30 day trading volume. KCS tokens can be used to pay some trading fees.

KuCoin’s goal was to provide a secure and simple way for users to trade various crypto assets. KuCoin, a global cryptocurrency exchange has become a leader and serves every four crypto owners worldwide.

This KuCoin review will tell you all you need to know to start trading on KuCoin.

Let’s dive in!

Summary

| Feature | More Details |

| KuCoin Operation Platforms | Desktop KuCoin App for Android and iOS |

| Spot, Margin, and Futures | There are many options |

| KuCoin Bot | KuCoin trading software with built-in |

| Token | KCS Discount Token |

| Support for customers | 24/7 |

| Minimum Deposit | No |

| There is a deposit fee | No |

| Spot Trading Fees | Maker Fee – 0.1% to -0.005% Taker Fee – 0.1% to 0.025% |

| Futures trading fees | Maker Fee – 0.02% to -0.015% Taker Fee – 0.06% to 0.03% |

| There are withdrawal fees | The currency will determine the amount. |

Information regarding the Platform

| KuCoin user count | 8 Million |

| There are many cryptocurrencies | 370+ cryptocurrencies (BTC, ETH, MXR, DAG, BCH EOS, LTC, etc) |

| Prevalence | There are 400+ countries |

| Countries | More than 200 countries |

| To buy coins, you can use supported fiat currencies | 50 Currencies (AUD, CAD, CHF, CNY, CZK, DKK, EUR, GBP, HUF, IDR, ILS, JPY, KRW, NOK, NZD, PLN, RUB, SEK, TRY, USD, VND, ZAR, etc) |

| Supported languages | English, French, German, Russian, Dutch, Portuguese, Chinese (traditional, simplified), South Korean, Vietnamese, Spanish, Italian, Indonesian, Hindi, Thai, Turkish, Malay. |

Introduction

KuCoin was a cryptocurrency exchange that launched in September 2017. It’s a user-friendly and secure platform that provides several trading options to its Six million people around the world use this app. It is currently at number 41 in CoinMarketCap’s top 100 largest cryptocurrency exchanges, and has a 24-hour average trading volume of nearly $200 million. It’s on the Forbes list of best crypto exchanges in August 2021.

Experienced cryptocurrency traders can get the most out of KuCoin’s wide range of coins, low fees, advanced features, such as a trading bot, margin trading, futures trading, and various order types, such as lending, Limit, post-only and stop orders.KuCoin, however, isn’t licensed to be used in the U.S.

KuCoin is known for its early adoption of digital coins. KuCoin is a platform that allows traders to explore altcoins. KuCoin adds coins often before the coin appears on other platforms.

KuCoin’s decentralized cryptocurrency, KuCoin Shares or KCS (KuCoin), is based on Ethereum blockchain tokens (ERC20). This cryptocurrency works with all Ethereum wallets.

You can earn crypto by acquiring KuCoin Shares tokens from its native KuCoin (KCS). The token’s value has increased by about 5% since August 21, 2020. 700%In its cost. There is a constant supply 80,118 6,638 KCSKCS holders are rewarded by the exchange with daily bonuses. KCS holders get a variety of benefits, including reduced trading commissions and commission income. KuCoin institutional investors program participants also enjoy a number of benefits. Trade fee discounts of significant magnitude.

Platform has announced a buyback plan that aims to maintain a steady 100 million tokens market. According to KuCoin, the company will use 10% of each quarter’s net profit to buy back and destroy KCS.

KuCoin allows you to trade non-custodially directly from your private bank account. The technology is Arwen security. Arwen uses the blockchain itself as an escrow agent and doesn’t entrust a third-party authority.

KuCoin wallet features industry-level multilayer encryption and dynamic multi-factor authentication. It also includes offline storage in bank safes, funds escrow and periodic auditing by banks.

KuCoin: Who should choose it?

KuCoin has a simple design and is robust. It is easy to make a deposit and trade. KuCoin can be used by experienced users who want more sophisticated features to analyse pricing trends, such as candlestick bar bars and other similar indicators. Its low fees, wide variety of coins and other benefits will make KuCoin a great choice for traders.

KuCoin does not have a license to be operated in the United States.

KuCoin Products & Services

KuCoin provides a wealth of services and features, from crypto-asset trading and derivatives to crypto token lending.

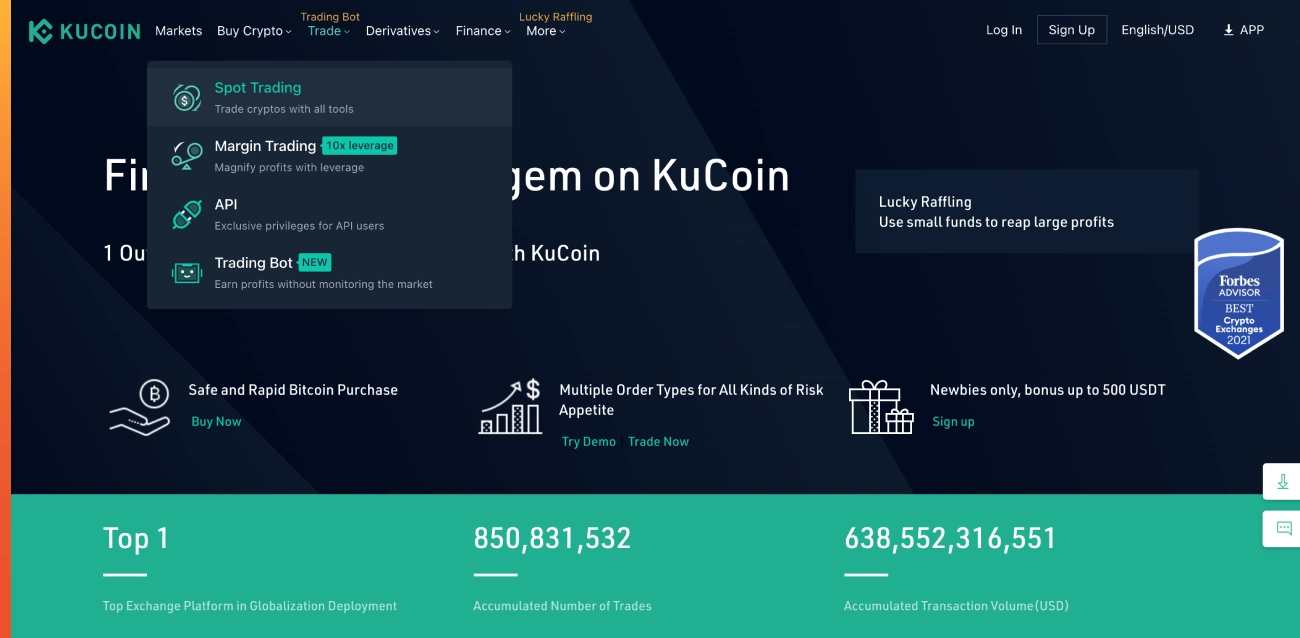

- Spot trading

- Margin trading

- Futures Contracts

- Pool-X

- Crypto Loans

- Soft Staking

KuCoin offers these services as well:

- KuCoin P2P

- KuCoin Trading Bot

- API users receive special benefits

Spot trading

Instant trading, also known as spot trading (or instant trading), allows you to instantly buy and sell cryptocurrency at the spot exchange rate. KuCoin spot traders fees cost 0.1%. It is quite low in comparison to other crypto exchanges such as Binance, Coinbase and EOS. KuCoin shares holdings and a trade volume of 30 days are the likely reasons for low trading fees (0.01%).

KuCoin: Spot trades

Our step-by–step guide will help you spot trade.

- Choose the “Spot Trading” option from the “Trade” tab

You can trade USDT, BTS and ALTS on the trading market. There are also different trading pairs available in other markets at differing prices.

KuCoin has the following four order types available:

Limit Order, Market Order Stop Limit Order Stop Market Order Stop Market Order Stop Market Stop Loss Order

You have the option to choose from one of these orders, depending on what you prefer. These buttons display the proportion of the total amount.

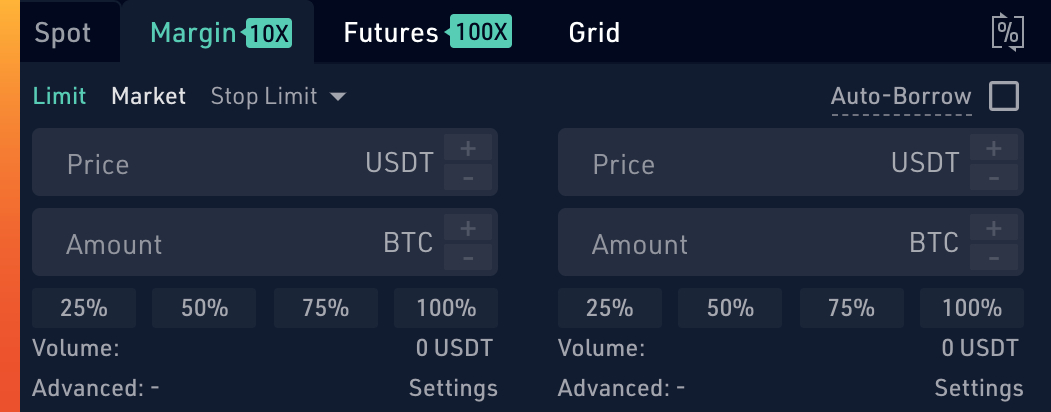

Margin trading

KuCoin provides Margin trading leverage up to 10x. KuCoin will add KCS to its margin assets in 2019, supporting the KCS/USDT trade pair.

Tokens that can be used to create a buy or sell operation. You will leverage many funds with less capital to increase your profits. This function allows traders to obtain a larger capital sum for their leverage positions. Crypto lending is available to traders who are able to set up margin trading. Investors use KCS (KuCoin shares), BTC and ETH for this kind of trading.

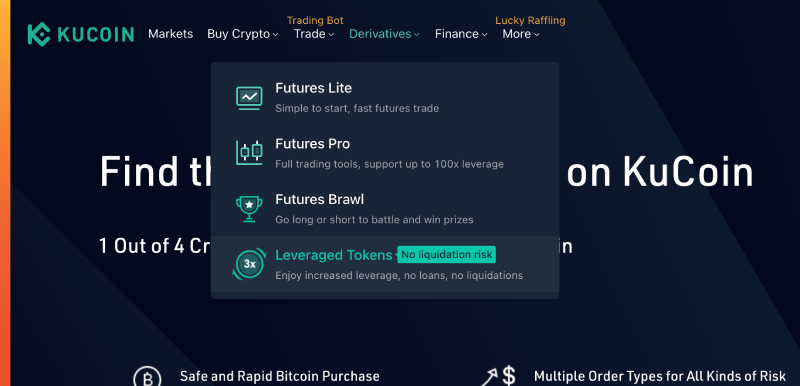

KuCoin Leveraged Coin Tokens

Select ‘Leveraged Tokens’ under the ‘Derivatives’ tab.

KuCoin’s leveraged tokens were officially introduced in March 2021. Users could trade them on the KuCoin Sandbox. BTC3L and BTC3S were the first to be introduced as leveraged tokens. ETH3L was also available.

The new crypto derivative Leveraged Tokens is a type that does not have a due date. The trading interface is similar to that of the Spot market. The leveraged tokens traders have the ability to increase their investment returns and can be used as perpetual contracts for KuCoin Futures. Leveraged tokens have the unique advantage that they cannot be sold.

KuCoin Futures Trading

KuCoin futures (contract) trading allows users to buy or sell the assets’ future standard contracts. Futures contracts are an obligation to purchase or sell crypto at a future date and at the agreed price. The buyer must place the order specifying a price and time (future), while the seller must deliver crypto assets at agreed-upon terms.

The platform is now one of the most popular global Futures trading platforms. KuCoin can support futures trading at up to 100x leverage. KuCoin users can trade futures contracts with a higher leverage than their trading funds.

Pool-X

Pool-X, a staking site that invented the free market and solved the issue of crypto liquidity liquidity, is Pool-X. Traders participate in staking and receive both staking rewards and POL Credits (Pool-X’s own token). Trades in staking assets can be made on the liquidity trading marketplace. Traders also have access to higher liquidity. You can use cryptocurrencies such as TOMO, ATOM and KCS to mine cryptos within the pool.

Soft Staking

Soft Staking is part of KuCoin’s Pool-X. The essence of soft Staking is the earning rewards for crypto coins. Investors have the opportunity to earn as much as Earn 15% annuallyFor holding tokens.

Soft Staking means that you can use your coins at any time you wish. Soft Staking allows you to keep your coins in an account that generates passive income. As there is no locking or unlocking period, it’s a great addition to staking, considering the volatile nature of crypto.

Crypto Loans or Crypto Lending

KuCoin’s platform has a number of unique features, including crypto loans. The KuCoin platform allows cryptocurrency investors to borrow their crypto tokens at a certain rate.

KuCoin allows users to lend cryptocurrency to others and earn interest in USDT (BTC), ETH, and other currencies. The loan terms can be specified by lenders only. They need to indicate the loan amount, daily interest rate (anywhere from 0 to 0.2%), and the term of the loan – 7 days, 14 and 28 days. Standard default is for a 28-day period. Cryptocurrencies available for this service include USDT, ETC, ZEC, LTC, ADA, TRX, and more.

KuCoin P2P

KuCoin peer-2-peer service allows users to swap cryptocurrencies from their accounts without intermediaries. P2P Fiat Trade also offers many benefits: there are no transaction costs, the settlement process is fast, payments are secure and merchants can be trusted. There are multiple payment options available locally.