Idex Pros

- Secure and encrypted trading

- Integrated with Nano S and Metamask

- Reward system that works

- Rapid transactions

- Structure a website that’s intuitive

- Many tutorials are available. You can also get prompt customer support.

IDEX Cons

- Trade pairs with limited trading

- Trading of ERC-20 tokens is restricted to ERC-20 only

- Bitcoin transactions not permitted

- No minimum order requirements

- Navigation is challenging for newbies

- App not available (as at publication).

People’s interest in crypto and blockchain technology has recently skyrocketed, and cryptocurrency tokens are being treated as an asset class and traded on exchanges, centralized and decentralized (DEXs) alike. DeFi has seen a rise in crypto-users who use it to trade and exchanging crypto assets. With so many cryptocurrency exchanges available, it can be quite difficult to find the one that suits your needs.

Our IDEX review will reveal everything you need to know about the IDEX decentralized exchange, its features, services, trading fees, etc., to help you decide if it’s a suitable platform for you.

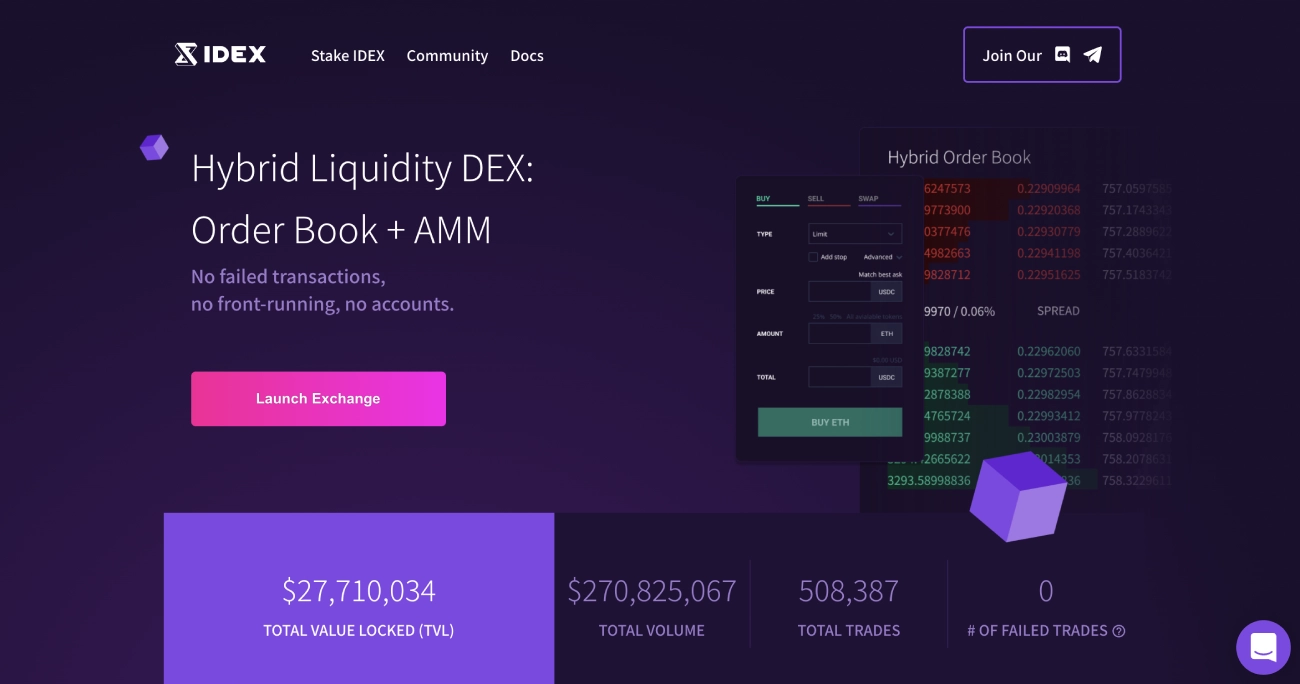

IDEX is a decentralized, decentralized digital exchange. It combines all the advantages of centralized and uncentralized exchanges in order to make it a more user-friendly platform for trading digital assets.

Let’s take a closer look at what you can expect from the IDEX trading platform!

What exactly is IDEX?

In 2012, the IDEX Decentralized Exchange was established. It is registered in Panama. It is available on Ethereum as well as Binance Smart Chain. As of recently, it’s also available on Polkadot as a part of the project IDEX Multichain. IDEX utilizes order books for the execution and initiating of exchanges between supported cryptocurrencies. Layer-2 Optimistic rollups are also used to maximize functionality and speed. You can trade cryptocurrencies that are supported by Ethereum and Polkadot as well as Binance Smart Chain. It aims to allow for thousands of transactions in a matter of seconds.

IDEX, a decentralized platform, has elements similar to centralized exchanges. Users must complete Know Your Customer verification in order to open an account. It also offers a stop loss function that is often found on centralized platforms.

CoinGecko cryptocurrency monitoring platform says that IDEX is the 52nd most active decentralized exchange in daily volume of trading ($4.4 million).

The IDEX Exchange is built on Ethereum. It supports ERC-20 token transaction and ERC20 trading pairs. Smart contracts allow the users to control their private keys, trade securely in peer-to-peer environments and manage their personal data. IDEX, a crypto-tocrypto platform, does not allow fiat trading or deposits.

IDEX Exchange Features

IDEX was established and created by Alex Wearn (under the name Aurora) in 2017. Aurora was rebranded as IDEX in 2019 to reflect its goal to be the first non-custodial real-time exchange. It combines a centralized system to match orders with decentralization. The website’s interface is rather intuitive. Let’s look into IDEX exchange’s key features:

- Peer-to-peer (P2P) trading

- Supportive and responsive customer service

- Before processing your deposit, confirm it

- Ethereum and Binance Chain Support

- Security high

- 14 trading pairs, including ETH/USDC, IDEX/ETH, MATIC/USDC, etc.

IDEX Exchange also has several crypto tokens like Flexacoin Fantom and Chainlink. In addition, it also features smaller coins, like Celsius, Everex, and Quant, before they hit centralized exchanges, allowing you to get in early before something hits an exchange with more volume.

Protection and privacy

Security and privacy are two essential parameters of DEXs, and this IDEX review wouldn’t be complete if we didn’t assess how safe the platform is. DEXs offer a non custodial environment in which cryptocurrency users can have complete control over their funds and keys. There is no risk of counterparty loss with most DEXs. IDEX is not an exception. IDEX reviews praise the exchange’s security and safety. IDEX is an exchange that runs on Ethereum. It uses the security perks such as encryption to trade.

IDEX also offers enhanced security with HTTPS technology. Users are provided with a private key that eliminates the need for any third-party intervention. The exchange’s smart contracts keep funds locked until the private key signs a transaction to move them. All funds are held in smart contracts on the Ethereum blockchain, so there’s no threat of someone hacking into a wallet reserve because IDEX doesn’t hold user funds in one. External data is also used to communicate with the network. IDEX can connect to networks such as Ethereum or Binance Smart Chain. This requires Oracles, which adds an extra layer of security. Node operators are incentivised to validate transactions on the network using an automated system. IDEX (the utility token) is used to protect the protocol by means of staking. Node operators will need to stake IDEX in order to run the network.

IDEX’s Ledger Nano S Integration is another benefit. It, together with all its security measures, makes trading one of the safest experiences.

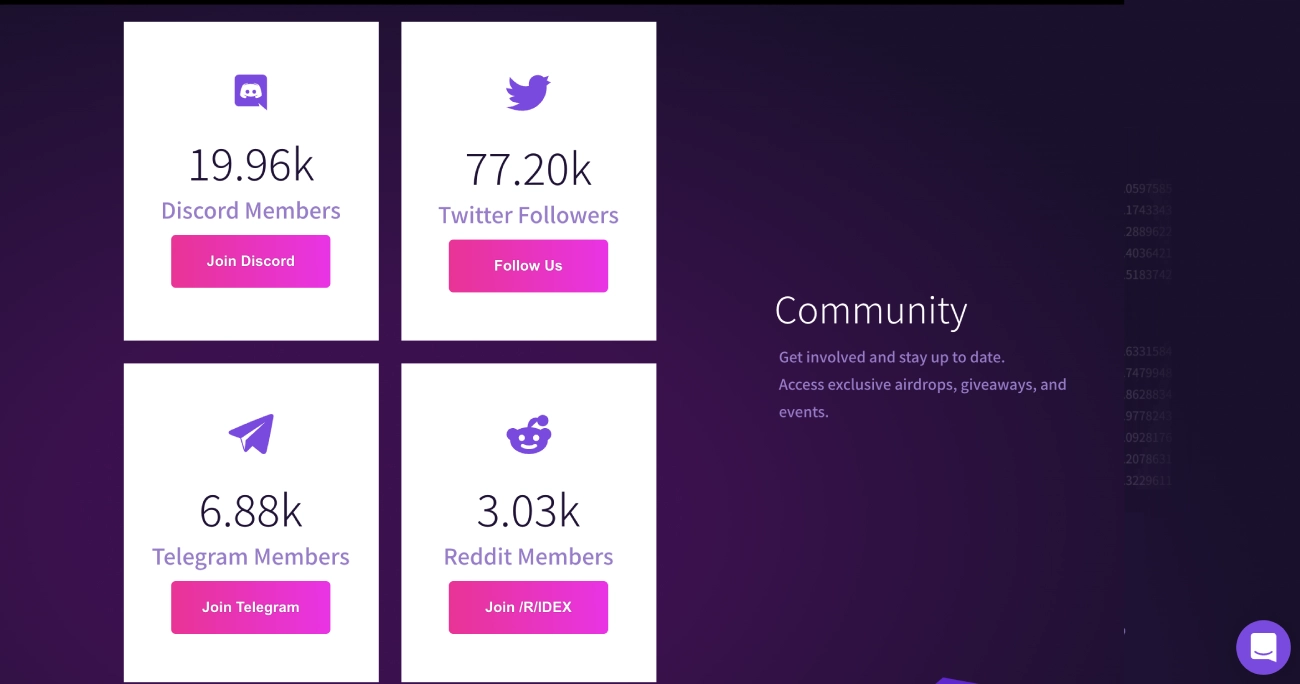

Customer Support

IDEX offers a variety of tutorials and guides that can help you solve any problems. The exchange also has an active social media presence with many followers willing to help one another. Aside from the community, IDEX offers a help page on its website, a “live chat” box in the bottom right corner of the screen, and an array of FAQs. Telegram and Reddit are their communities.

Now let’s continue our IDEX exchange review by introducing the trading process on the platform!

How to trade on IDEX

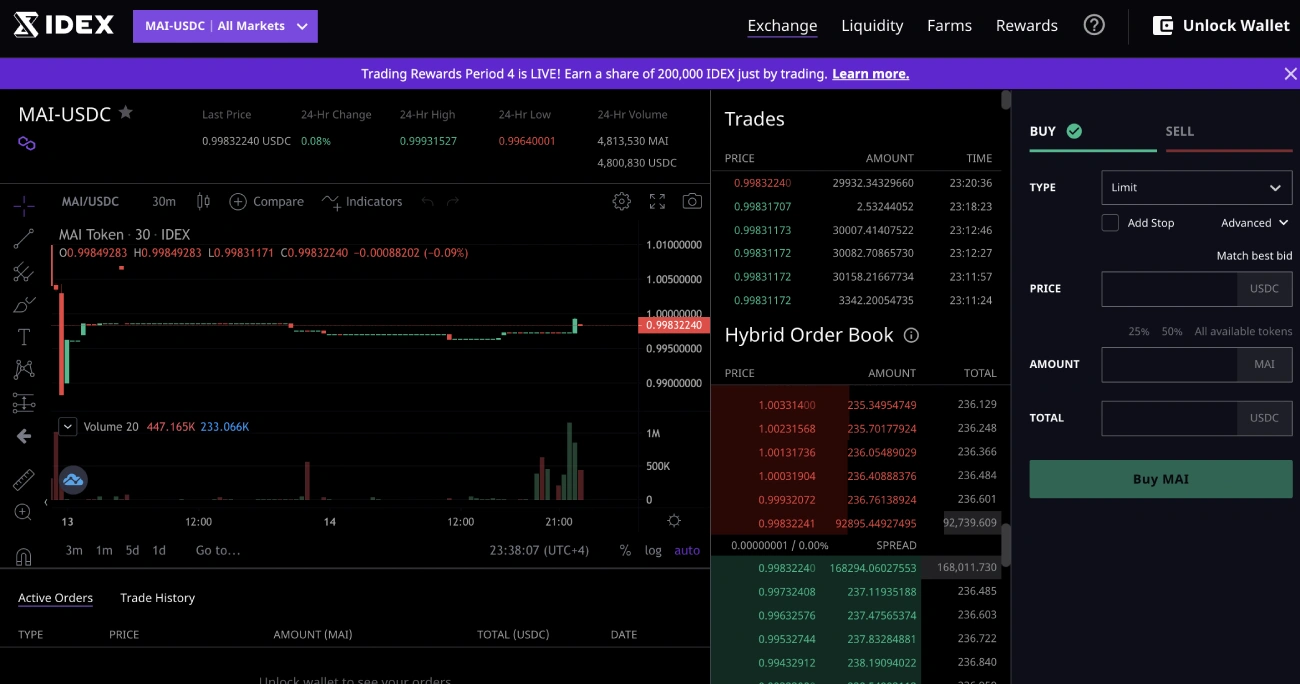

Once on the exchange, you’ll have everything you need to trade, such as your wallet balances, the trading chart, order book, trading pairs, etc., displayed on a single page. You can read our IDEX exchange review to get started.

Getting Started

IDEX does not require you to register. The website allows users to access their MetaMask wallets, Trust Wallets, Toshi, Blue Wallets, and other MetaMask accounts.

After you have accessed the website to unlock your wallet, it is ready for use. IDEX offers the ability to select a type of wallet or enter a private key.

You can start trading right away with the 14 trading pairs offered by the website. However, if you don’t have a wallet locked and loaded, you can use the one IDEX offers.

Create a wallet

Many traders use digital ledger wallets. IDEX makes it easy to set one up right from your computer. After clicking on the “New wallet” icon, you’ll be required to create a wallet password.

NOTE: You cannot change your password once it’s encrypted, so choose wisely.

Then you’ll receive a JSON file, sent directly to your email, containing the private key of your new wallet. You can download it and keep it in your user account. To grant you access to your wallet, the system will need both the JSON file as well as the password.

Fund Deposit

This step can be skipped if your wallet has crypto funds in it already. However, if you are using the wallet you just created on IDEX, it’s essential to deposit crypto funds to start trading.

You can deposit money directly to your bank account using a variety of free wallets. You can also transfer the fiat money to cryptocurrency. IDEX can accept deposits in ETH tokens, which can then be traded later for any of the 12 tokens on the platform. Website will request confirmation for your deposit. Make sure you double-check that amount. Once the transaction goes through, it’s not reversible.

You can order any type of product

The IDEX Exchange Review will review the types of orders that are available. You can choose from:

- Order of the marketMarket Order entails the trading of crypto spot-on at current prices. It’s a simple order type that doesn’t include a prognosis of any kind or particular knowledge of the market.

- Limit orderLimit orders are used to purchase or sell coins with restrictions on price or minimum value.

- Limit maker: This order adds liquidity to your order book.

- Order Stop LossA stop loss order allows you to purchase or sell an asset at a specified price.

- ProfitThis order will specify a price for closing an unclosed position to make a profit.

IDEX lets you create limit and market orders. And unlike other DEXs you can cancel trades with no gas cost. Once you select the order type that best suits your needs, you’re all set to start trading!

Trading on the IDEX Exchange

This exchange allows only crypto-to-crypto transaction of ERC-20 tokens. Trading page displays a TradingView chart showing the selected token pairs. To the right of the screen is the order book. Once you start the process and commence a transaction, you’ll also see your trading history.

IDEX Token and Staking

The IDEX token, which is the main token on the platform, performs many important functions. Ownership of tokens can be a boon for users in many ways.

Users can use IDEX as their main payment method, and IDEX acts as the underlying asset of all network operations. Users can earn rewards for staking their IDEX tokens, which are typically 50% of the transaction fees. The staking functionality supports the platform’s financial stability and helps maintain the exchange’s infrastructure.

Now let’s get more information on IDEX withdrawal fees.

IDEX fees

Petroleum Fees

According to the IDEX exchange website, the platform’s Hybrid Liquidity (HL) automatically manages gas rates to reduce the costs and eliminate failed trades. To move funds to IDEX smart contract, users pay direct gas fees. Gas fees for subsequent transactions, such as trade, withdrawals, liquidity addition/removal, are deducted from the user’s balance to “offset settlement gas costs,” similar to the collection of trading fees.

Trade Fees

Trade SettlementThe fee here is usually paid by the taker. It’s calculated by deducting the current gas price from the number of assets withdrawn to the wallet.

Withdrawal/Deposit:IDEX does not charge withdrawal or deposit fees. Only the applicable trade and taker fees are charged.

| Types of trade | Maker | Taker | The Pool Earnings | Earnings on Protocol |

| There is a limit | 0.10% | 0.25% | N/A | 0.35% |

| Pool | 0% | 0.25% | 0.20% | 0.35% |

Most Frequently Asked Questions

IDEX is extremely safe, and it uses many protocols that maximize security. Private keys that can be accessed via the exchange are encrypted. The browser memory stores them; however they are not accessible from any other IDEX apps. It is also possible to plug into your wallet. This makes it easy and quick.

KYC is required for IDEX Exchange

Many exchanges use Know Your Customer (KYC). However, KYC requires you to provide personal data, which traders consider an invasion of their privacy. IDEX does not require KYC if you don’t open an account on the platform. You only require a Metamask and any compatible wallet in order to trade on IDEX.

How to Withdraw funds from IDEX

The process of withdrawing funds is quite simple. Click on “Balances” on top of the navigation bar, and after you locate the assets, tap on “Withdraw.” Enter the amount you wish to withdraw or click on “Maximum” if you want to take all of it. Once the system has received your confirmation, you will see the transaction in your balance history.

Where do I buy IDEX Tokens?

You can buy the IDEX token directly on the platform as well as Binance exchanges, Gate.io Balancer and UniswapV2.

Conclusion

Our IDEX Exchange Review covered the most important features and services, along with the Pros and Cons. It is our hope that you will be better informed on the IDEX withdrawal fees and trading pairs.

IDEX can be used to trade ERC-20 tokens in a safe and hassle-free environment. Although the exchange may seem complicated for novice traders, experts will find IDEX a trustworthy option because of the staking options, reward system and intuitive interface.

For any question you may still have, here are some FAQs.

TIP! Always research cryptocurrency before you invest and make sure to double-check the trading amount.