Balancer Execs

- Absolutely decentralized

- Market Maker protocol

- Diminished gasoline charges

- Automated portfolio supervisor

- On-chain liquidity supply

- Customized Automated Market Makers

- Multi-asset Balancer pool perform

Balancer Cons

- Complicated for newcomers attributable to a number of features

- Malicious switch tokens can nonetheless be added as in any DEX

- No fiat buying and selling

The crypto sector provides an abundance of buying and selling platforms and cryptocurrency exchanges to purchase, promote, and commerce crypto belongings. The Balancer decentralized trade (DEX) is likely to be a reasonably new addition to the bunch, nevertheless it has turn into a market chief with its revolutionary multi-token swimming pools, that are nice choices for merchants and liquidity buyers. Learn on our Balancer app evaluation to study the whole lot you want to find out about Balancer’s choices, transient historical past, Balancer options, buying and selling charges, Balancer professionals, cons, and decide if its buying and selling platform is an efficient match for you.

Let’s dive in!

Introducing Balancer

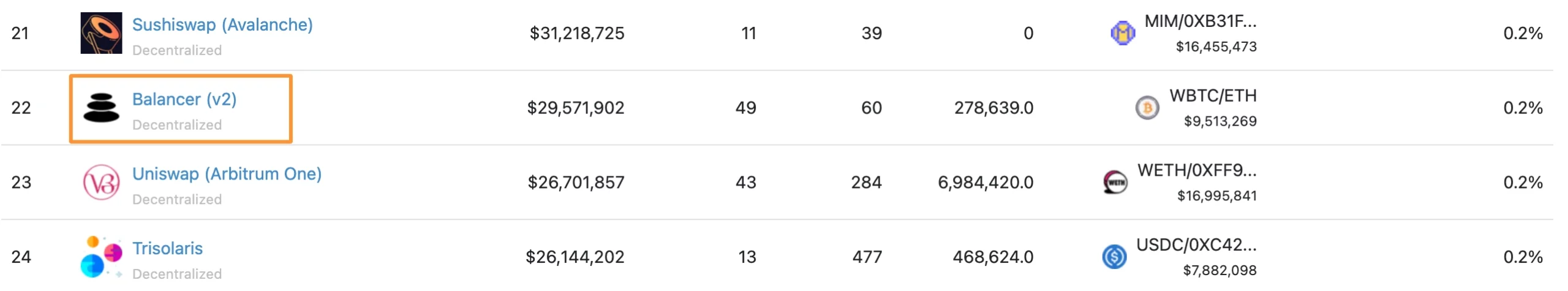

The Balancer platform was launched in March 2020 by Mike McDonald and Fernando Martinelli. The trade rapidly gained reputation amongst merchants and buyers, making Balancer one of many high DEX platforms by way of each buying and selling quantity and locked worth. The Balancer DEX is at present ranked #22 by buying and selling quantity amongst decentralized exchanges on the coin monitoring platform CoinGecko.

Moreover, it’s the fifth largest DEX by complete worth locked (TVL), in accordance with DeFi monitoring web site DeFiLlama.com.

Regardless of the latest ubiquitous crypto decline, Balancer Protocol TVL stood at 2.83 billion in Feb 2022.

How Is Balancer Totally different

Balancer is constructed on the Ethereum blockchain and provides ERC-20 token buying and selling solely in a trustless, permissionless setting. In contrast to centralized exchanges, Balancer gives an open and accessible platform, and all you want for buying and selling is a legitimate pockets.

The Balancer DeFi platform has broad performance. It permits customers to commerce cryptocurrencies and generate earnings by staking BAL tokens and incomes rewards. It’s additionally a liquidity supplier and options computerized portfolio administration of ERC-20 tokens. The aim of Balancer is to offer a versatile platform for programmable liquidity. In Balancer, as a substitute of paying charges for portfolio managers to make use of rebalancing methods and actively handle the fund, the pool balances itself. Sensible swimming pools could be created that are managed by a sensible contract. Let’s take for example the liquidity bootstrapping pool (LBP) template by the Balancer staff, which serves to create deep liquidity for a brand new token difficulty with out costly market making. Liquidity swimming pools and complicated algorithms are used to cost belongings and permit trades to happen with out requiring centralized permission.

Like most decentralized exchanges, the Balancer protocol doesn’t assist fiat buying and selling. i.e., you can not deposit your funds in fiat currencies and can’t commerce them for ERC-20 tokens on the platform. As a substitute, you possibly can deposit funds from a pre-existing crypto pockets, which we’ll talk about later.

Balancer has a local token, BAL, dubbed the Balancer token, with a broad utility on the platform.

Balancer Options

Now, let’s dive deeper into the Balancer Protocol’s core options and why liquidity suppliers and merchants may select the platform over different related DEXs.

- Market makers, in any other case often known as liquidity suppliers, profit from Balancer by accumulating buying and selling charges whereas sustaining a usually and robotically rebalanced portfolio.

- Merchants are supplied with a variety of buying and selling pairs in a permissionless market that’s all the time open.

- The platform gives a excessive stage of management for Balancer pool house owners.

- Balancer helps revolutionary multi-token swimming pools. The house owners of the multi-asset swimming pools can incorporate as much as 8 totally different belongings. Transactions don’t have to be routed by way of Ether, making them much less vulnerable to slippage.

- When merchants swap tokens inside the swimming pools, they’re rebalanced robotically and obtain charges relatively than paying a dealer to rebalance the pool. In consequence, a Balancer pool with many token pairs advantages from extra potentialities to earn buying and selling charges.

Benefits for Traders

Balancer provides a number of key benefits to merchants and buyers alike that helped the platform transfer up the ladder and acquire reputation.

Balancer provides the next perks to buyers:

- Easy portfolio setups.

- Swimming pools characteristic dynamic buying and selling charges. Based on the altering market situations, they modify to offer buyers with a maximal revenue.

- No center man. Permissionless platforms like Balancer present extra freedom than centralized exchanges, permitting buyers to handle their very own cash.

- BAL token rewards. Traders can profit from depositing belongings into incentivized liquidity swimming pools.

- Excessive safety. The platform claims to have examined its sensible contract repeatedly to make sure they’re secure sufficient. Moreover, Balancer has a historical past of safety audits by main companies and a 1,000 ETH bug bounty.

Benefits for Merchants

Buying and selling on Balancer is quick and simple for everybody concerned. Customers can trade any quantity of ERC-20 tokens with out authorization, which many different platforms require. As a substitute, the Balancer protocol is an open crypto market that gives customers entry to real-time value knowledge with out compromising safety.

Moreover, buying and selling on Balancer has a number of key advantages:

The Balancer CoWSwap Protocol (BCP) is the default buying and selling interface on the Balancer app, enabling customers to learn from free signature trades.

- MEV (Miner Extractable Worth) safety

DEX merchants usually face value slippage and elevated gasoline prices if an trade does NOT characteristic MEV safety.

Merchants don’t have to provide management of their belongings to a center man. The trade permits transactions on a full peer-to-peer foundation.

Key Balancer Merchandise

To assist Balancer customers get essentially the most out of their buying and selling expertise, Balancer provides 5 key merchandise completely described on the web site.

1. The Vault

The Vault is just like the mind or the Treasury of the protocol. It’s a sensible contract that shops all tokens in liquidity swimming pools. Customers might retailer Inside Balances within the Vault and make trades to and from these balances. The Vault is among the most vital elements of the system and in addition acts as a gateway for all transactions carried out on the platform.

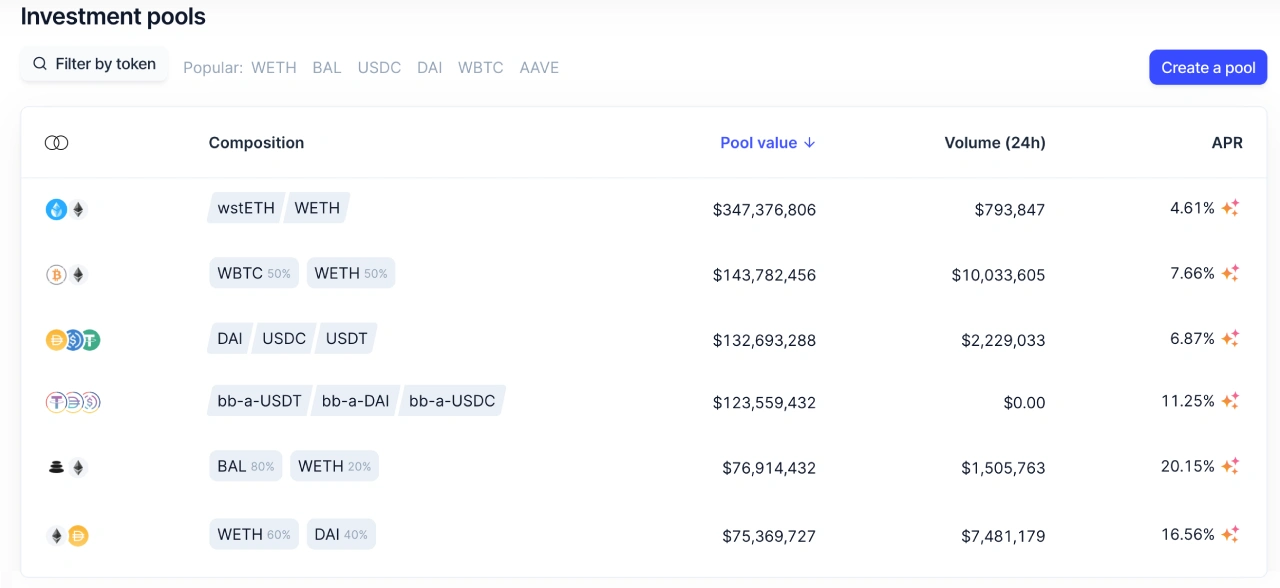

2. Balancer Swimming pools

Balancer swimming pools have excessive versatility as in comparison with many different DEXs. The protocol helps swimming pools with any composition and underlying math. Any person can construct their very own pool, which ends up in versatile pricing choices and features.

The next pool decisions can be found on the Balancer Protocol for varied token combos: Weighted Swimming pools, Steady Swimming pools, MetaStable Swimming pools, and Liquidity Bootstrapping Swimming pools.

3. Sensible Order Router

Sensible order routing is a system via which merchants can uncover the very best pricing for his or her desired swap. The worth sensor will increase in confluence with the variety rise inside the Balancer Swimming pools. So when Balancer customers create extra swimming pools with distinctive configurations, it enriches the SOR and develops it additional.

4. Merkle Orchard

The Orchard permits merchants to assert the tokens from the contracts. Claiming digital belongings by way of Merkle Orchard merchants save on gasoline charges, particularly once they want to declare a couple of weeks’ worths of rewards and/or a number of tokens.

5. Balancer Gnosis Protocol

The BGP is the default protocol on the Balancer app. The system gives entry to different DEXs to verify merchants get the absolute best value. It’s related to the Vault, which makes certain BGP can handle small transactions with minimal buying and selling charges.

You have got in all probability already determined whether or not you need to register on Balancer or not. When you select to go for it, learn on to discover ways to begin buying and selling on the Balancer Alternate!

Buying and selling On Balancer Platform

Buying and selling on Balancer Platform doesn’t require KYC (know your buyer) verification, and you can begin buying and selling right away if you have already got a cryptocurrency pockets. The platform doesn’t assist fiat transactions, so you possibly can’t join your account to a credit score/debit card or your checking account.

Pockets Setup

Connecting your pockets to the Balancer is straightforward and handy. The platform offers you 4 choices to select from. The Metamask pockets, considered one of Ethereum’s main pockets choices, is the most well-liked choice you should use with Balancer.

Pockets Join, Portis, and the Coinbase pockets are additionally accessible. It’s price noting that, Coinbase is the most important centralized trade within the US and permits fiat deposits. If you’re new to crypto and the Balancer, a Coinbase pockets is a good shortcut. Open a Coinbase account, deposit your fiat onto Coinbase, purchase any ERC-20 token as a fiat pair, then entry your pockets via Balancer.

Balancer Buying and selling

Like most different buying and selling platforms, Balancer provides a Buying and selling View chart in your comfort. It lets you hold observe of the tokens you want to purchase or promote in real-time. Furthermore, it’s pretty comfy for newcomers and skilled merchants alike.

Balancer Charges

The Balancer swimming pools are customizable; the charges would range from one pool to a different. The Pool developer is liable for setting the price they really feel acceptable, with a ensuing big selection from 0.0001 – 10%. Nonetheless, the automated market maker device Sensible Order Router considers the charges earlier than providing the very best deal attainable to merchants.

Swap Charges

Every dealer collaborating in a pool pays Swap Charges. These charges typically go to LPs (liquidity suppliers) in trade for depositing their tokens into the pool to facilitate the trades, i.e., present liquidity. The charges are collected instantly after the swap, rising the pool’s steadiness. The price additionally is determined by the quantity of the tokens. The next system displays the Balancer price coverage clearly:

The system acts as a solution to hold the LPs proportion within the pool the identical whereas the pool itself grows.

In V2 Balancer, a small protocol price can also be charged, which is a share of the swap price. V2 Balancer has additionally created dynamic price swimming pools that maximize returns for LPs. Moreover, the Balancer web site comprises detailed details about the trade’s buying and selling price system and will reply all the extra questions.

Governance

Tokenization is a well-liked means for DEXs to arrange and implement the governance characteristic, and Balancer will not be the one one to take that route. Members of the group who personal BAL tokens can vote on proposals regarding the platform and the vector of its growth. Merchants on Balancer earn BAL tokens by offering liquidity, which they later make the most of for Balancer Governance. Furthermore, the governance vote constitutes the ultimate authority, which can’t be overruled. Balancer claims it’s an open, clear, and intuitive protocol that wishes to advance “brazenly and truthfully.”

The Balancer governance votes happen on Snapshot, a platform that gives off-chain and gas-fee alternatives to carry votes, producing simply verifiable outcomes. Moreover, the Governance votes have the authority to alter protocol charges charged on the platform and select how these charges ought to be spent to advertise Balancer higher.

Safety and Privateness

Balancer is a DEX, so it doesn’t want any verification of your id on the subject of privateness. Whereas Coinbase may require a legitimate ID, {photograph}, and cellphone quantity for giant trades, Balancer wants solely a legitimate pockets. Moreover, there are not any backdoors or admin keys on Balancer Labs, which makes the platform trustless. The absence of a center man additionally means the Balancer itself doesn’t have any management over the belongings within the liquidity swimming pools. As a substitute, it makes use of sensible contracts to regulate the trade. Nonetheless, Balancer’s sensible contracts do carry dangers, which any dealer ought to think about earlier than signing as much as commerce with any centralized or decentralized trade.

In the case of flawed tokens, Balancer has a means of scanning the swimming pools, dubbed “Configurable Rights Swimming pools.” The system makes certain that every one tokens work together with the pool securely. But, the chance of getting a rip-off token remains to be there, as DEXs have a token itemizing process totally different from CEXs.

Bug Bounties

As talked about earlier, bug bounties are a typical apply on Balancer. Because the DEX is totally managed by sensible contracts, discovering flaws within the contracts and eliminating them will increase safety and cuts the possibilities of potential malfunctions. The Balancer Labs provides rewards for bugs, nevertheless it additionally has guidelines: “Solely the primary reporter of a given contract vulnerability will likely be rewarded, and findings already found as a part of a proper audit are ineligible,” reads the announcement.

Balancer Group

DEXs usually don’t have centralized buyer assist. As a substitute, they’ve energetic communities that may reply all of the pending questions and assist with anomalies or issues that may happen. Likewise, there’s an energetic Balancer group on a number of social media websites, together with LinkedIn, Twitter, Medium, and Github. Relying on the difficulty, you possibly can select the corresponding channel.

Remaining Ideas

In a brief span of time, Balancer grew to become probably the most used platforms permitting you to commerce and make investments trustlessly and permissionlessly.

Like many different DeFi apps, Balancer makes transactions via liquidity swimming pools and chooses whichever will safe the very best fee for the client. The platform accommodates ERC-20 token buying and selling solely, so you can not commerce different tokens or fiat foreign money. All you want to do is connect with your pre-existing crypto pockets and begin buying and selling.

FAQ

Is Balancer Out there in the US

Balancer permits US buyers to take part within the liquidity swimming pools. Nonetheless, attributable to strict laws inside the US, DEXs may get in bother for buying and selling’ unregistered securities’. That’s the primary cause behind many exchanges being unavailable within the US. The Securities and Alternate Fee, the regulation enforcement company that offers with securities buying and selling and registration inside the nation, is liable for monitoring all crypto exchanges.

Nonetheless, as talked about, Balancer will not be on the naughty listing.

What Is Bal, and How Do I Use It

BAL is the governance token on Balancer Protocol, providing holders the chance to vote on any group selections. Balancer customers can get BAL tokens in trade for turning into a Liquidity Supplier and locking funds in a liquidity pool.

Can I commerce Bitcoin on Balancer

You possibly can commerce Wrapped Bitcoin (WBTC), which is a token “adjusted” for buying and selling on Ethereum-based decentralized apps. It has the identical worth as BTC and could be traded on Balancer, amongst different Ethereum-based dApps.

The Balancer Ecosystem Fund is at present valued at over $100M, and a complete of 5M $ BAL tokens have been put aside for strategic partnerships.

Funding recommendation Disclaimer:

This content material, together with any info contained therein, is offered to you solely for informational functions and doesn’t represent a suggestion by CoinStats to purchase, promote, or maintain any safety, monetary product, or instrument talked about within the content material. Retail investor accounts ought to rigorously think about all of the elements earlier than investing.