In the two most-traded crypto assets, stablecoins have been traded with a variety of digital currencies. 66 days ago on April 11, 2022, tether’s market valuation was over $82 billion with 82,694,361,442 tethers in circulation. Over 12 billion Tethers have been withdrawn from circulation since then due to the Terra blockchain collapse, recent crypto market destruction, and the rumors swirling around Celsius and Three Arrows Capital (3AC).

Over 12 billion Tethers have left the Crypto Economy since April 11.

According to market data, the number of tether (USDT) in circulation has dwindled down from over 82 billion to today’s 70 billion. Bitcoin.com News reports on the rising stablecoin value for all fiat-pegged tokens, as the stablecoin economic system neared $200 Billion.

After a 33% growth in the previous month, approximately 82,694,361,442 Tethers were in circulation on that date. According to metrics.coingecko.com, 15.30% of the circulating supply has been removed since then. It is now 70,038,816,028 US Dollars.

Many people have been noticingThe number of tethers available is falling, according to crypto advocates discussingThe subject is also discussed on social media. Many of the USDT currently in circulation have been removed following the terrausd de-pegging event. As of May 12, 2022, there were 82.79 trillion tethers.

According to archive.org stats, the total number of tethers was down by 7.25% on May 14 to 76.70 Billion USDT. Another 8.73% was removed from circulation in the 33-day period since May 14.

USDC’s Market Cap Grows Over the Last 2 Months, Tether Commands Lion’s Share of Global Trade Volume

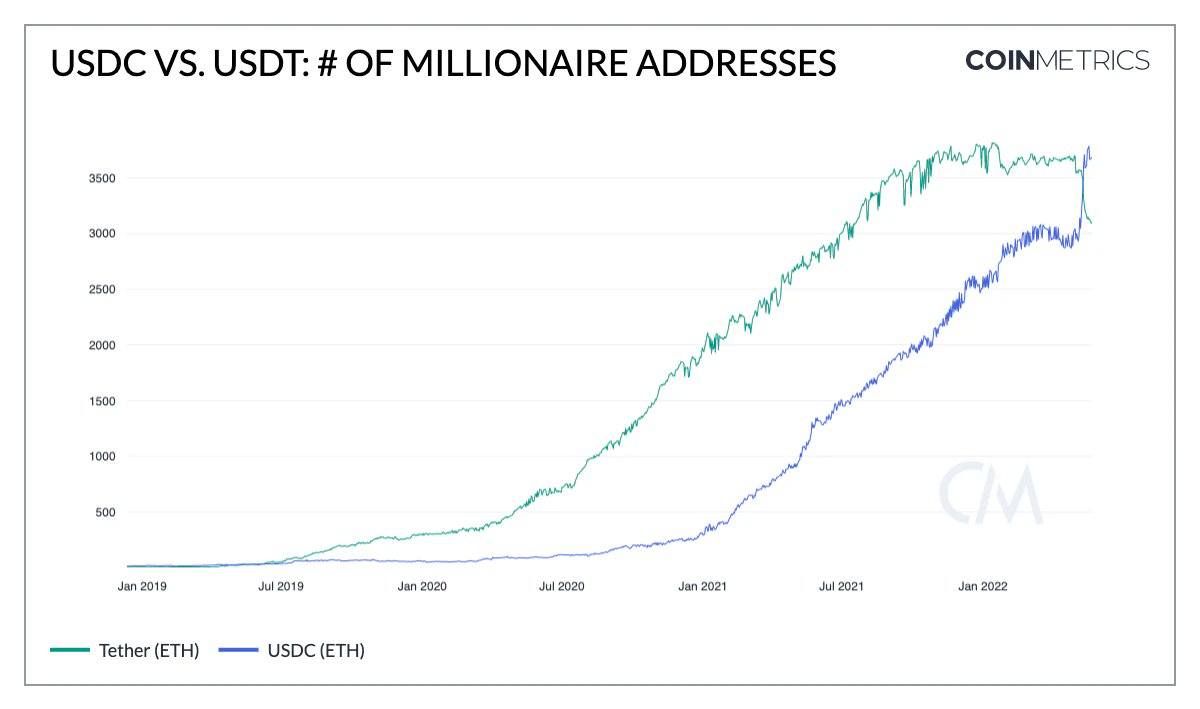

Meanwhile, tether’s competitor usd coin (USDC) has grown during the last two months. According to archive.org metrics, USDC’s total circulation reached 50,090.822,252 tokens on April 16th 2022. The USDC number has increased to 53,522,713,063, which is 8.96% more, in the last two months.

During the terrausd fiasco (UST), the USDC number dropped to 49.122.170.211 on May 12. In June 10, the USDC was in circulation at 53,804,005,416. This is an increase of 49.12 trillion. Since then, USDC has seen a modest increase in issuance. Circle also revealed the launch of Euro coin (EUROC), backed 1:1 by the euro.

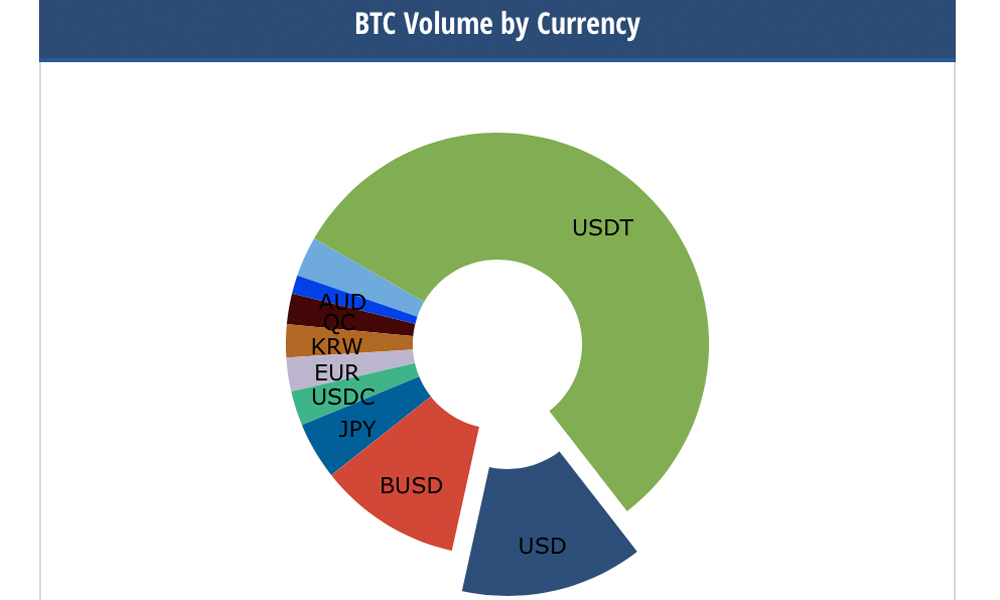

Data recorded on June 16 shows that USDT commands the lion’s share of the global cryptocurrency trade volume, as it accounts for $51.41 billion of the $96.31 billion in volume on Thursday. USDT is the pairing that accounted for 53.37% in all crypto trades Thursday.

USDC trades on June 16 were insignificant compared to the USDT’s $5.93 Billion or 6.15 percent of global crypto trading volume over the past 24 hours. Cryptocompare data recorded on June 16 shows USDT trades accounted for 56% of bitcoin’s (BTC) trade volume. On Thursday, USDC was responsible for 2.7% of all BTC transactions.

How do you feel about the declining number of tethers? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.