While many Americans believe the U.S. Federal Reserve is the caretaker of the country’s monetary system, its also believed to be one of the worst financial institutions ever created. The possibility of an enormous monetary shift is possible in 2022. This will be amid a depressed economy, global crisis, and war. These years, which were filled with panic and uncertainty are similar to those that lead to the formation of the Federal Reserve System.

The Panics That Led to the Last Transition of Wealth May Help Us Understand Today’s Monetary Transformation

During the last few years, just before the onset of Covid-19, discussions about a “Green New Deal,” a “Great Reset,” and a “New Bretton Woods Moment” have increased a great deal. This has led people to believe that there is an enormous wealth transition taking place. The consortium of modern central banks are helping to facilitate this change. These changes occur so quickly that many people are unsure how and why they happen. Understanding such shifts is easiest if you look back at the huge wealth transition that occurred in the 1800s and the 20th century.

In 1913, the Federal Reserve System was established. It marked the first significant historical event. It is well documented that the Fed was born on December 23, 1913, after president Woodrow Wilson signed the Federal Reserve Act, but the central bank’s inception started years before Wilson’s Act. What most people don’t know is that J.P. Morgan and the “Money Trust” or the “House of Morgan” helped fuel the creation of an American central bank. None of the evidence is hidden from the public as the Pujo Committee, a congressional subcommittee that operated from 1912–1913 investigated the group in great detail.

As a result of a financial cartel that had used American funds for proposition bets and bucket shops, Americans began to distrust banks in the 1800s. Morgan founded the Morgan-Guarantee Company in 1896 to combat financial manipulation. From the beginning of the following decade, to the end of the summer in 1907 the U.S. economic system was highly volatile. While the ‘Panic of 1907’ or the ‘Knickerbocker Panic’ is well known in history. Already in 1873, and 1893 there had been bank runs and panics. Morgan and his friends reportedly monopolized a great deal of businesses, and more specifically Morgan controlled close to half of the country’s railroads.

Tim Sablik and Gary Richardson from the Fed’s Bank of Richmond branch explain that the “Panic of 1873 arose from investments in railroads.” That summer in 1907, the U.S. economic system broke and a large swathe of financial institutions and corporations went bankrupt. Knickerbocker Trust, New York City’s financial institution, and Westinghouse Electric Company are the most notable failures. Richardson, Sablik and others noted that the Panic of1884 was caused by two New York City financial institutions failing. Both of the bank’s owners made “speculative investments” and Marine National Bank and Grant and Ward went bust.

In 1907 the U.S. Treasury attempted a rescue by funneling millions of money into financial institutions that were failing. Although liquidity was difficult for American bank customers and depositors alike, many businesses and banks have created cash alternatives. J.P. Morgan stepped into the breach after cash substitutes and attempts by Treasury failed to work. Morgan and America’s leading finance men channeled lots of money into weak banks with help from the government and the country’s business leaders.

3 Financial Crises, Jekyll Island, and the Aldrich Plan — Are Panics and Crises Preceding Today’s Monetary Shift?

A majority of Americans believed that the United States bank system was corrupt after three major financial crises (1893, 1893 and 1907) In collusion with many U.S. business leaders after the Panic in 1907, the bureaucrats convinced the public that reform needed to be done in America’s banking system. Because the public was tired of seeing banks spend their savings on speculative investments, bucket shops and other nonsense, they demanded that reform be implemented. The U.S. government then decided to implement strict regulation reform. Congress passed stop-gap legislation as well as the National Monetary Commission.

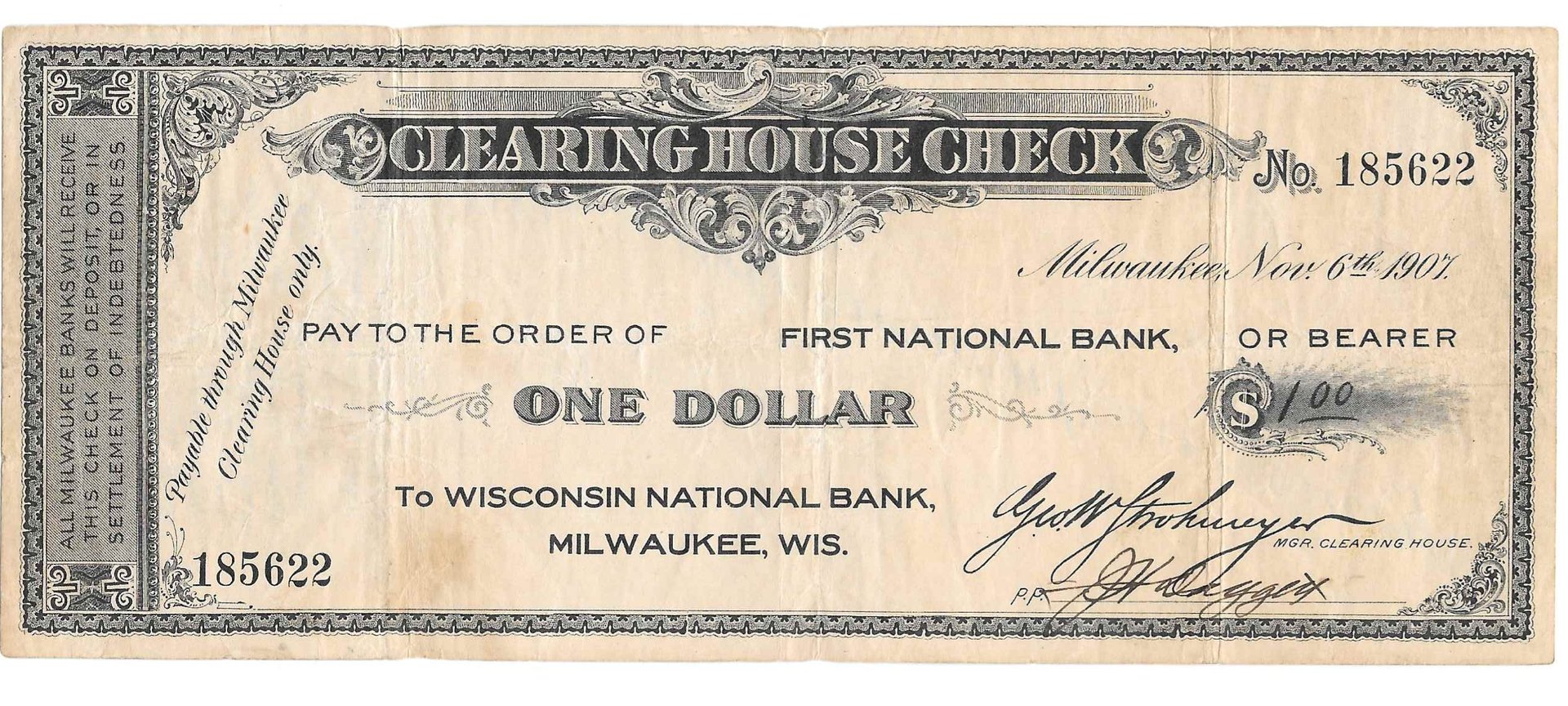

In the case of a national liquidity crisis, U.S. banks could set up national currency associations under the Aldrich-Vreeland Act (1908). The initiation of the Federal Reserve was sparked by the liquidity crises mentioned above, and through the Aldrich-Vreeland Act, banknotes were backed by the institution’s securities and government bonds. Government library documents further show the Panic of 1907 “made people want a powerful central bank that could ‘protect’ the common man from the ‘abuses of the Wall Street bankers.’”

The recent economic woes America faces today are similar to those of Europe. Due to Covid-19 lockdowns, disruptions caused by the war in Europe and other factors, previous financial crises (1873-1893) and 1907 triggered one the biggest monetary shifts ever recorded. While most Americans are taught in high school that the Fed’s system manages the money and credit throughout the country, G. Edward Griffin’s 600-page book “The Creature from Jekyll Island” paints a different story. It explains how the “House of Morgan” and a favorable U.S. president colluded to create the U.S. central bank.

Nelson Aldrich, a descendant of the Rockefellers was involved in secret meetings at the Jekyll Island Hunt Club. The Federal Reserve System was crafted by Morgan’s ‘Money Trust,’ select politicians, and Nelson’s foundational design called the “Aldrich Plan.” In recent times, descendants of the Rockefellers from the Rockefeller Foundation have been accused of designing plans called “lock step” in 2010, which is eerily similar to the Covid-19 lockdowns that happened ten years later. According to a New York-based report on philanthropy, governments could use lockdown measures to control an influenza-like pandemic.

While Wilson’s December 23, 1913 signing is well documented, most Americans don’t know about the secret meeting held on Jekyll Island in 1910. It is not something history classes or books discuss. Those who know the history of the Fed and believe it is manipulating the market continue to want it abolished. “The Fed has become an accomplice in the support of totalitarian regimes throughout the world,” Griffin writes in his Jekyll Island book published in 1994.

The previous years that led to the consortium of modern central banking and the Fed are very similar to today’s economic crises, and it’s safe to say panic fuels changes. The signs point to a transformational outcome that was planned many years ago, if there is a significant transition in wealth. It’s uncertain what the monetary shift will look like, but looking back at history and things like the creation of the Federal Reserve system, clearly shows that certain people are likely to benefit more than others.

What do you think about today’s transition of wealth and comparing it to the panics and crises that happened over 100 years ago during the last great monetary transition? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons