Once, while noticing the cost transforms, he saw that there was not a pattern but rather a responding development that swayed the market. In this way, he fostered a marker that would get these elements and sign inversions in the two bearings. The stochastic marker depended on the value bar’s significant boundaries – shutting, high, and low costs.stochastic oscillator best settings

The hypotheses

As per one of the hypotheses, there were at first many kinds of stochastic oscillators. Mixes of cost bar boundaries and their subsidiaries were figured on a mission to decide the best stochastic oscillator equation. Every recipe was named by consecutive letters of the Latin letter set: %A, %B, %C, and so on. In any case, just two choices, %к and %R, were fruitful.

A mix of the stochastic %к and its moving normal, named D (from the word deviation), turned into the most ideal choice.

In fact, D isn’t stochastic – it is a subsidiary from %K. Notwithstanding, it is called stochastic and even has a % image. This is the way the notable stochastic oscillator was made.

Simultaneously, the stochastic %R didn’t vanish. It very well may be tracked down under the name “%R Larry Williams Oscillator” or just “R Williams.”

How Does the Stochastic Oscillator Function?

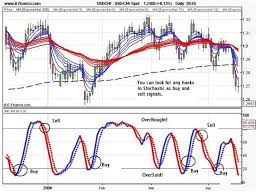

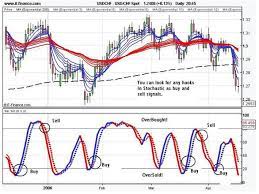

Traditionally, stochastic oscillators are addressed by two moving bends that move between two levels. Normally, these are 80% and 20%.

At the point when two lines are over the upper degree of 80% (set apart with blue zones at the top), the instrument is overbought. At the point when they fall beneath the base level line of 20% (red zones in the base), it’s oversold.

Line crosses have an extraordinary significance. In the event that it occurs in the overbought zone, it’s a sign of a short position. On the off chance that it is in the oversold region, you ought to open a long exchange.stochastic oscillator best settings

All things considered, exchanging utilizing just stochastic oscillators is not suggested. In the least complex stochastic oscillator methodology, signals are separated by the pattern heading. For example, if a downtrend wins, open just short positions. On the off chance that there is a vertical pattern, place long exchanges.

On the EURUSD outline, there is a negative pattern.

That is the reason we search for a highlight open a short exchange overbought zones. A potential passage point is set apart with a red oval. As there is a hybrid of the pointer lines above 80%, a momentary remedy ought to end, and the downtrend will proceed.

Stochastic Energy File (SMI) Made sense of

Notwithstanding the exemplary stochastic pointer, a changed variant called the Stochastic Force List marker, or SMI, is generally utilized. It consolidates the previously mentioned device with energy, which gives smoother flags and is less reliant upon market commotion.

In SMI, bends are worked around a zero line and move in either a positive or negative heading. One of the bends is called smoothed or quick; another is present moment. As you can figure, these lines contrast by period.

A portion of the stochastic force pointer’s experts are its dependable section and leave signals when the market is level. In any case, even in such a case, it merits utilizing the SMI with other specialized devices. Concerning the directional development, the SMI gives a lot of phony signs.

You can download the Stochastic Force Record here.

The standard establishment process is through MetaTrader4. For amateur merchants, check the bit by bit clarification utilizing the case of the Bollinger Groups marker here.

Introduce and run the marker. In the “Information boundaries” tab, you can change boundaries, for example,

- «Period_Q» – a time of the calculation’s essential bend

- «Period_R» – essential smoothing of the fundamental line

- «Period_S» – auxiliary smoothing of the fundamental line

- «Signal» – the boundary liable for the smoothing of the auxiliary sign bend

In the event that both the principal and sign bends (the green and red lines on the graph above) will be over the zero line (blue), the market is overbought; if underneath, the market is oversold.

A sell signal is shaped when the primary force line crosses the sign line topsy turvy.

On the outline over, the red bolt denotes this second. On the off chance that the stochastic pointer splits the sign line base up (green bolt), open a long position. A stop-misfortune can be put somewhat underneath nearby essentials inside a few candles from the section point. Close the situation at either a take benefit level, which is 2-3 times greater than stop-misfortune, or when an inversion signal happens.

Stochastic Pointer Estimation and Recipe

How about we think about the stochastic oscillator’s equation.

%K is determined as follows:

LiteFinance: Stochastic Oscillator: Extreme Aide and Best Settings | LiteFinance (ex. LiteFinance)

Where:

- max (Hn) – a top inside a n period;

- min (Ln) – a low inside a n period; and

- C0 – a nearby cost of the ongoing candle.

- Here is an illustration of the stochastic’s equation that utilizes three periods.

LiteFinance: Stochastic Oscillator: Extreme Aide and Best Settings | LiteFinance (ex. LiteFinance)

On the diagram, the bar with which we work out the stochastic marker is set apart with green. The nearby cost is 1,17972. The green line features the greatest cost for the last three candles – 1,17994. The red line denotes the base of the past three candles, which is 1,17948.stochastic oscillator best settings

As indicated by the equation above:

%K = 100 * ((1,17972 – 1,17948)/1,17994 – 1,17948) = 100 * (0,00024/0,00046) = 52,17%

This is the manner by which merchants used to ascertain stochastic readings. These days, it appears to be incredibly awkward.

On the other hand, you can utilize a robotized pointer incorporated into the LiteFinance online stage, Metatrader 4, or download the stochastic oscillator as a Succeed mini-computer here. The guideline of how this adding machine functions is direct. It is like the Succeed Bollinger Groups Table (the connection to the directions is here).

Stochastic Marker Translation: Perusing the Outlines

While utilizing the stochastic pointer on Forex, there are many signs. That is the reason this device is frequently utilized with different markers for additional exact signs. In the accompanying areas, we will make sense of the particulars of the sign kinds, techniques for understanding, and discovery.

Quick, Slow and Full Markers

How would you set the stochastic marker? Typically, the boundaries are characterized by three implications. One for each % K, % D, and smoothing coefficient. 5, 3, 3 is one of the exemplary blends.

Where:

5 is a time of %K-the main stochastic bend. As you would recall that, we have previously separated how to compute this boundary. The stochastic recipe seems to be this:

The worth 5 implies that maximums and essentials will be determined for the last five candles. In the recipe, this boundary is introduced by n.

3 mirrors the time of %D, a supposed sign line. It’s a straightforward moving typical based on the last boundaries of %K.

LiteFinance: Stochastic Oscillator: Extreme Aide and Best Settings | LiteFinance (ex. LiteFinance)

3 is the last boundary of the sluggish stochastic oscillator. It’s utilized to smooth the %K bend, making it more streaming without market clamor. As such, beginning %K is determined with an averaging coefficient.

In such a case, the equation for %K is as per the following:

LiteFinance:

Stochastic Oscillator: Extreme Aide and Best Settings | LiteFinance (ex. LiteFinance)

The %D bend will be based on the normal worth of %K. It will be twofold smoothed, truth be told. Such an impact permits you to channel clamor and lessen the quantity of phony signs, yet it additionally builds the marker’s slack. That is the reason it’s called sluggish.stochastic oscillator best settings

If you would rather not use smoothing, you ought to involve 1 as the last boundary. Such stochastic markers are called quick.

The full adaptation of the stochastic oscillator permits you to change each of the three boundaries and even how %D stochastic is smoothed.

LiteFinance upholds four kinds of smoothing:

Straightforward is exemplary smoothing and utilizes a basic moving normal (SMA)

Dramatic smooths utilizing a remarkable moving normal (EMA)

Straight Weighted smooths utilizing Direct Weighted Moving Normal (LWMA)

Smoothed is twofold smoothing because of the component of the Smoothed Mama (Smoothed Mama).

Such capabilities permit the client to set stochastic oscillators for any exchanging apparatus and market. There are no severe standards on what smooth settings to utilize, yet it’s crucial to consider their disparities for effective exchanging tests.

How about we outwardly look at how they vary.

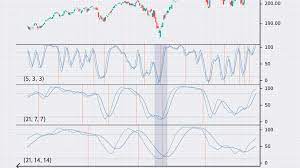

There is a cost outline above where numbers compare to five signs of the stochastic oscillator on Forex.

Obviously the second and fourth signals are phony. The first and fifth ones mirror the nearby revision. The most significant sign is the third one, which shows a pattern inversion.

Note! Here, the signs are a cross of %K and %D lines above 80% and underneath 20%. Afterward, we will discuss marker signals exhaustively. Presently, it ought to be recognized as a condition for the trial.

On the graph above, we see the accompanying stochastic oscillators:

Quick

Periods for all stochastics are comparative: %K – 5, %D – 3. A smoothing period for numerous types with the exception of quick stochastic is 3.stochastic oscillator best settings

Ends:

A quick stochastic oscillator responds to the market developments quicker than different sorts. It works nearly immediately, however the quantity of phony signs is enormous.

Slow stochastic oscillators with SMA and LWMA are practically indistinguishable in regards to the slack and number of phony signs.

The channel of the sluggish stochastic pointer with Smoothed Mama was areas of strengtheness for too smothered practically all signs. It gave just the last