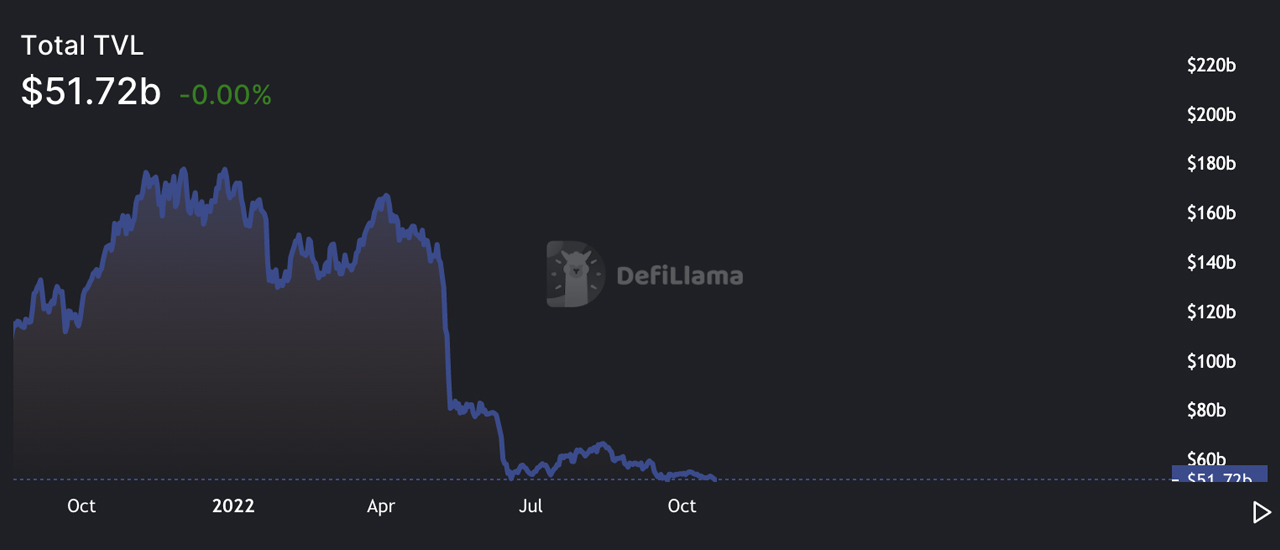

In the region of $50 billion to $65 trillion, the TVL (total value locked) in decentralized financial (defi has fluctuated over the past 125-day period. The TVL in defi has shed significant value during the past six months as it dropped from $161 billion on April 1, down more than 67% lower to today’s $51.72 billion.

TVL drops more than 67% over 6 months. Defi Market Action is still ineffective after 4 months

In terms of total value, Defi has slowed down a lot in the six-months since. The TVL in Defi stands at $51.72 Billion on Saturday October 22nd 2022. Collateralized Debt Position (CDP), protocol Makerdao, commands 14.76%. $7.64 Billion was available Saturday morning (ET).

Makerdao was not alone. Lido (curve), Aave (and Uniswap) are the five biggest TVLs. The liquid staking protocol Lido is just below Makerdao with a TVL of around $6 billion and $5,839,046,587 of Lido’s TVL is staked ethereum (ETH).

Makerdao experienced a 30% increase in value due to the TVL jumping 4.82% more last month. Sushiswap experienced a noteworthy increase with a 41.27% rise in the 30 days prior and a 38.70% jump in the yield protocol Aura over the month.

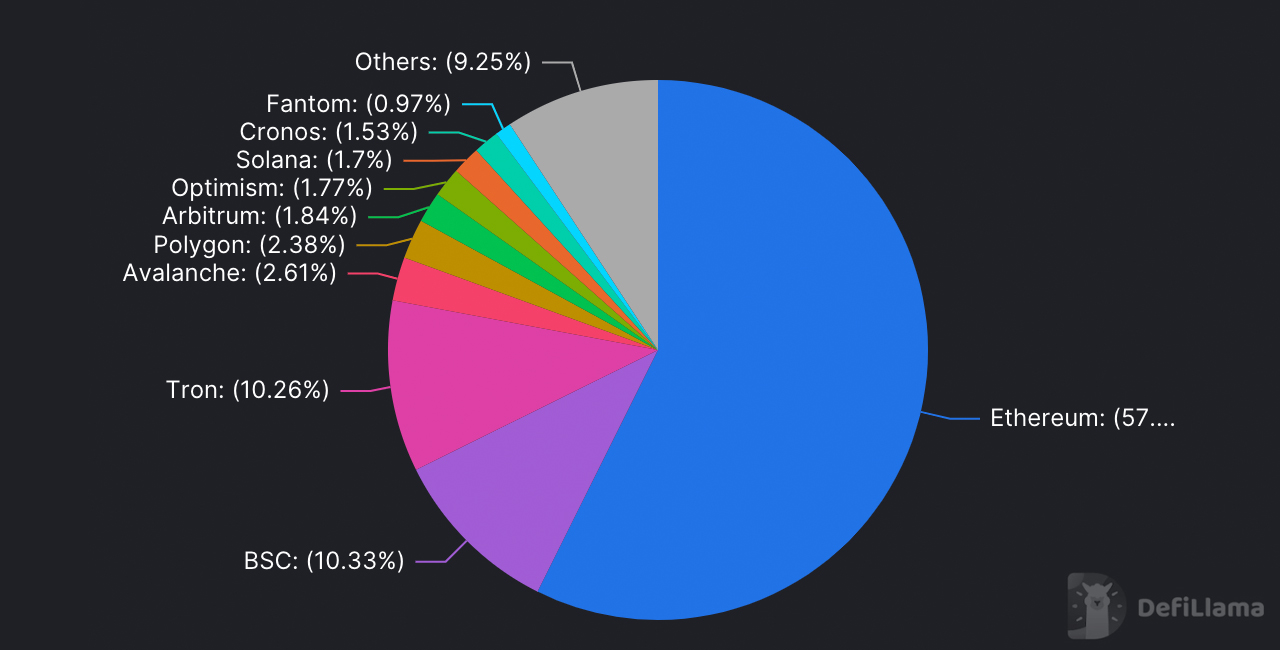

Ethereum holds 57% or more of today’s $51.72billion worth of total blockchain value. ETH holds $29.56 trillion, Binance Smart Chain, which has $5.32 Billion, or 10.33%, of the total value, and ETH is second with around $29.56 Billion.

In terms TVL by Blockchain, ETH and BSC are followed closely by Tron, Avalanche and Polygon. Statistics show that there are currently 607 protocols for decentralized exchanges (dex), with $21.57 trillion locked.

On Saturday, there are 189 loan defi applications with $13.96 Billion locked. 57 CDP protocol commands $10.37 Billion. There’s also a total of 45 liquid staking applications that hold $7.91 billion in value today.

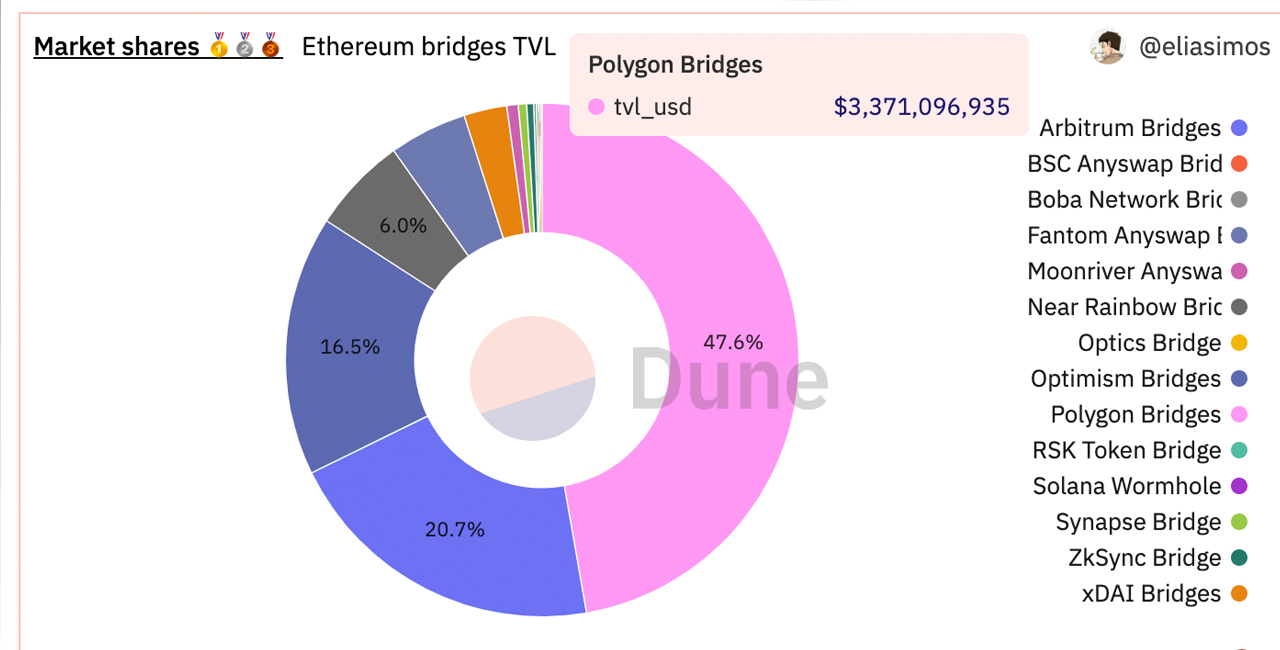

In the past 30 day, cross-chain bridge platform’s value also fell 22%. 7.80 billion has been locked in decentralized cross chain bridge platforms, which have 13,178 unique depositor addresses.

Polygon leads the bridge pack, with a $3.37 Billion TVL. However, the TVL has fallen 6% in the last month. Arbitrum is currently at $1.44 billion, which is 22% more than it was the month before.

The Polygon, Arbitrum, and Fantom bridges follow. Today’s smart contract platform token market capitalization is $281 billion, and has increased 1.4% in the past 24 hours.

Ethereum (ETH), BNB (BNB), Cardano (ADA), Solana (SOL), polkadot (DOT) are the top smart contract tokens in terms of market capization. Over the past week, losses have been recorded in ADA, SOL and DOT. ETH and BNB have remained green over the last seven day, with 0.3% to 0.8% increase this week.

How do you feel about decentralized finance today? What are your thoughts on smart contract tokens and smart contracts platform tokens? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.