Because the market capitalization of the stablecoin tether nears $80 billion, with its present $77.9 billion valuation, information from onchain researchers at Santiment signifies that tether addresses valued at $1 million personal greater than 80% of the complete provide.

Tether’s Whales Command Extra Than 80% of the Provide

The U.S. dollar-pegged stablecoin has grown exponentially throughout the previous couple of years and in accordance with right now’s metrics there’s 77.9 billion tether (USDT) in circulation right now. Tether is probably the most dominant stablecoin out of all of the stablecoins in existence by way of market capitalization.

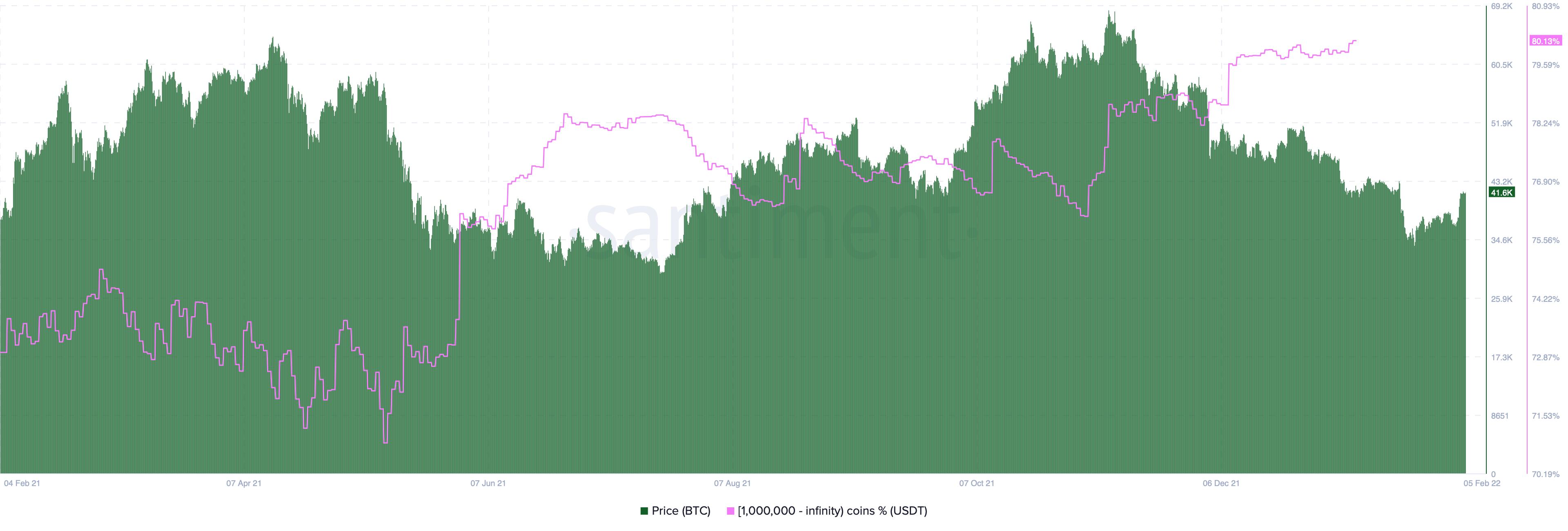

USDT’s market capitalization of $77.9 billion additional represents 3.79% of the $2 trillion crypto financial system. Moreover, current information from Santiment reveals that USDT’s focus of bigger holders valued at $1 personal greater than 80% of the complete provide.

“Tether’s addresses valued at $1M are on the cusp of returning to proudly owning 80%+ of $USDT’s provide for the primary time in 3 weeks,” Santiment tweeted. “Typically, whale stablecoin addresses growing their shopping for energy is an efficient prospect for crypto’s long-term future.”

On the time of writing, Santiment’s metrics present USDT addresses valued at $1 million command 80.13% of the 77,922,851,073 tether provide in circulation. Into the Block signifies that the focus of huge tether (USDT) holders right now is 46%.

The Ethereum-based USDT wealthy record stemming from coincarp.com reveals there are 4.4 million ETH addresses holding tether. The highest ten USDT holders personal 28.4% of all of the ERC20 tethers in circulation whereas the highest 100 command 47.71%.

Stablecoins USDC and UST Have a Important Focus of Giant Holders

Whereas Santiment’s USDT information reveals that USDT addresses valued at $1 million command 80.13%, USDC statistics point out that USDC addresses valued at $1 million command 86.8% of the stablecoin’s provide.

USDC has roughly 51,570,858,520 U.S.-dollar-pegged tokens in circulation right now. Into the Block’s focus of huge USDC holders additionally reveals the metric is greater than USDT’s at 63%.

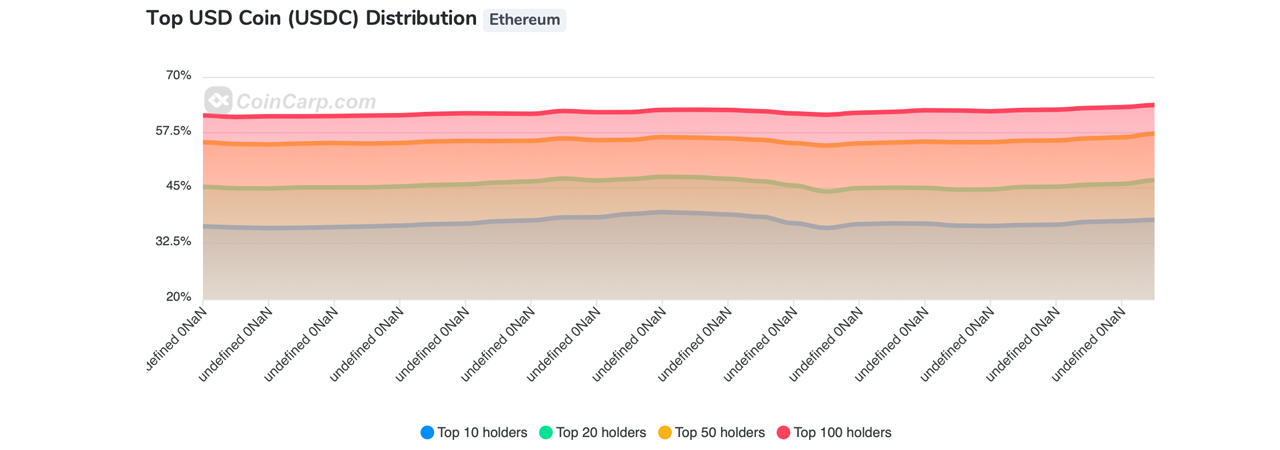

Coincarp.com’s USDC wealthy record metrics present the focus of holders leveraging USDC on the Ethereum community. Presently, there are 1.35 million ETH addresses holding USDC and the highest ten addresses holding probably the most USDC command 38.11% of the circulating provide.

Furthermore, the highest 100 USDC ETH-based addresses personal 63.79% of the stablecoins on that particular chain. Terra’s UST additionally has a big focus of holders in accordance with Santiment’s UST information.

Knowledge regarding Terra’s UST stablecoin (UST issuance on Ethereum) recorded by coincarp.com signifies that ten ethereum-based addresses maintain 73.77% of the UST provide. After all, this information relies on EVM-based UST and the 28,737 holders.

The highest 100 UST stablecoin addresses on Terra maintain 97.70% of the cash in circulation. Coingecko.com information reveals there’s roughly 11,256,872,859 UST in circulation on February 8, 2022. On the similar time, EVM-based UST stands at 947.5 million in circulation right now.

Whereas there’s $179 billion value of fiat-pegged tokens in existence right now, stablecoins are usually not as liquid as circulation metrics counsel, particularly in terms of the focus of huge holders.

With the appearance of stablecoin liquidity swimming pools, many homeowners are merely holding stablecoins as a result of they’re much less unstable and might accrue an annual share yield (APY) of as much as 18% or extra.

What do you consider the tether addresses that maintain $1 million in cash commanding greater than 80% of the availability? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.