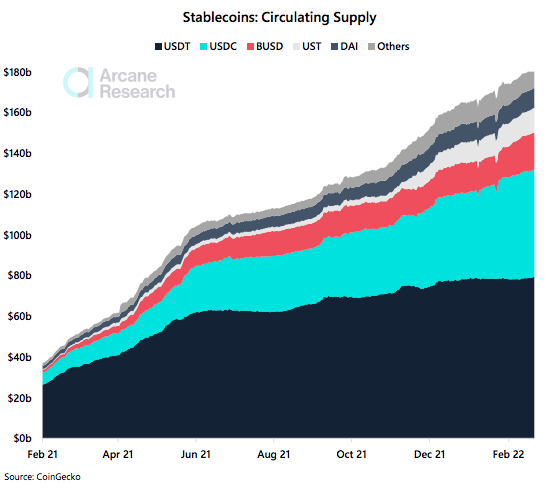

The supply of stablecoins has experienced significant growth over the past year. Stablecoin market capital is approximately $181 billion. That is over 11% from the crypto market total. It is also $1,6 billion after losing over $140 billion over the last two days because of geopolitical worries. Data shows that the stablecoin market is growing much more quickly than this year’s crypto market.

Crypto Market is Faster

Arcane research data has shown that stablecoins, such as USDT and USDC, BUSD, UST and DAI, have grown at a faster rate than the crypto market.

With a market share of 44% and a market capitalization of $79 billion at the time, Tether (USTD), still leads all stablecoins. USD Coin, (USDC), follows with a 29% marketshare and a capitalization in excess of $57billion. With a market share of 20% and a $18 billion market capital, Binance USD (BUSD), takes the third position. Below is a chart showing the total supply of around $200 billion.

The stablecoin USDT, which has grown 1% since 2022, hasn’t reported any significant growth. USDC, on the other hand has experienced a rapid growth rate since last year and reported a 20% increase in 2022.

Arcane Research predicted that USDC’s rapid growth would surpass USDT in 2021. They now expect USDC to surpass USDT in market cap by June, based on their previous projections.

Moreover the Terra UST algorithmic stablecoin (UST) experienced a 19% year-over-year growth and DAI 9%.

Furthermore, while the crypto market’s Fear and Greed Index has sunk to the extreme fear area again, trader Byzantine General had noted that “It is a historic bottom when the tether dominance falls below 4.5% or 5%. $BTC. Seems like sentiment reaches peak fear around that level.”

Byzantine General explained that “It’s considered Bearish when USDT dominance goes up because it means people want to get out of coins and flee to something more stable.”

He further pointed out that “Some people think a high tether price and dominance is Bearish. Some people believe the market cap is increasing due to new print. bullish .”

Similar Reading| Stablecoins Total Market Cap Breaches $179 Billion Mark – Can It Go Higher?

Is the government ready for a giant stablecoin?

The Federal Reserve System and the Financial Stability Board, however, have been unsurprisingly cautious about stablecoins. The report highlighted their correctness. Analysis of the Financial Stability and Risks of Crypto-assets Published February 16, 2009.

In this report, the authorities claimed that “Crypto-assets markets are fast evolving and could reach a point where they represent a threat to global financial stability due to their scale, structural vulnerabilities and increasing interconnectedness with the traditional financial system.”

“The Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (CPMI-IOSCO) are coordinating with the FSB to determine regulatory approaches for GSCs, including those intended for use in mainstream payments.”

Some experts think that stablecoins could become too large to fail if they continue their rapid growth rate, thus proving the FED’s concerns wrong.

Fed Chair Jerome Powell Argues Private Stablecoins Can Co-exist with US CBDC| Fed Chair Jerome Powell Argues Private Stablecoins Can Co-exist with US CBDC