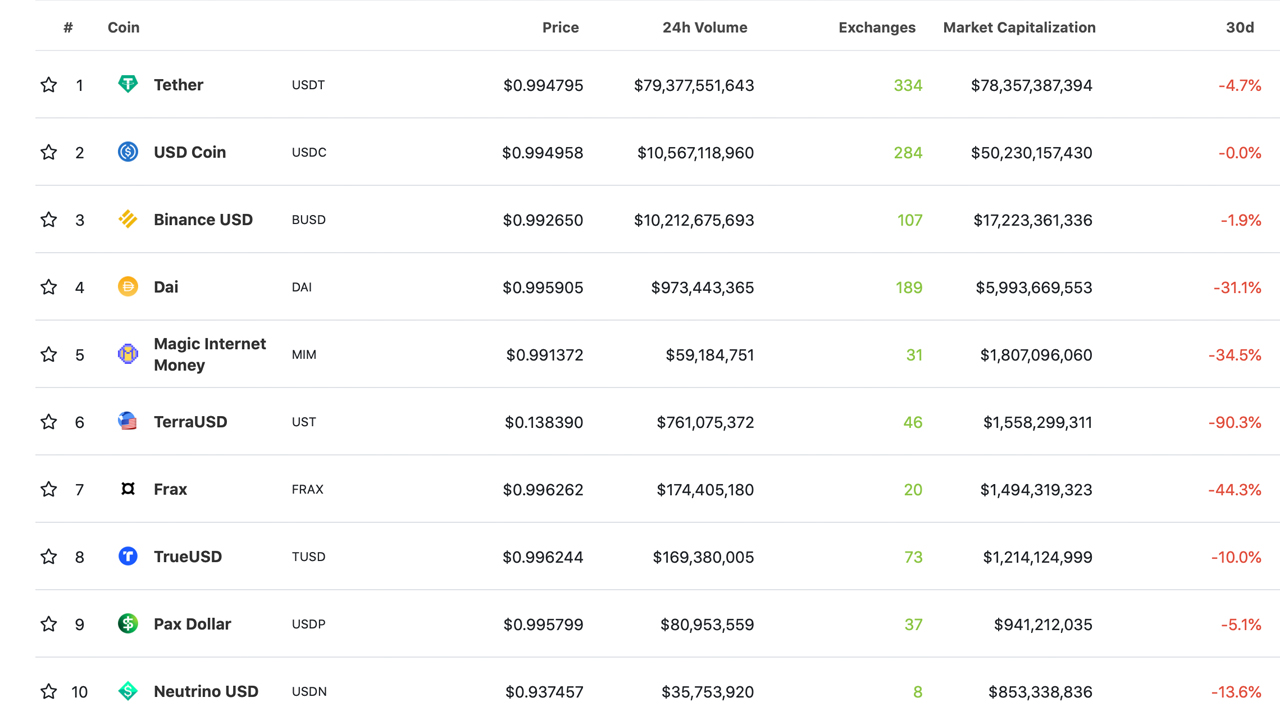

The top 10 stablecoins in market capitalization were valued at $163.7 Billion on Friday May 13. This is after the stablecoin economic was close to $200B last week. Of course, the climactic terrausd (UST) failure wiped out billions from the stablecoin economy, and Binance’s stablecoin BUSD has recently entered the top ten crypto market capitalization positions. Just as it caused carnage in the crypto economy, Terra’s recent downfall has caused a great shift within the stablecoin ecosystem.

The Stablecoin Economy’s Great Shift

It was only a week ago when the stablecoin economy was awfully close to surpassing the $200 billion mark, but Terra’s recent collapse changed all that. Terra’s once stable token terrausd (UST) was once the third-largest stablecoin in existence until it lost its $1 parity. The token that’s supposed to be pegged to a U.S. dollar’s value is now trading for under $0.20 per unit. Still, the market valuation makes it the sixth-largest market cap in coingecko.com’s “Stablecoins by Market Capitalization” list.

The stablecoin projects experienced no growth in the last month among the top ten stablecoins based on market valuation. USDC fell by 0% in the past 30 days while the rest of the top stablecoins experienced 30-day drops. BUSD currently holds the third-largest stablecoin token, with a market capitalization of $17.3 billion. BUSD also moved into the top 10 crypto coins by market value, taking the ninth spot among 133,000+ coins.

Makerdao’s DAI token is now the fourth-largest stablecoin market capitalization with $6 billion today. Makerdao’s native token MKR jumped 15% in value during the past 24 hours taking on some of UST’s fallout. In fact, most of the stablecoins that have managed to remain stable and have reaped the benefits of UST’s crash.

While Some See the Need for ‘More Regulatory Framework’ Around Fiat-Pegged Coins, Some Believe a Decentralized Stablecoin Is Still Needed

On May 12, 2022, Circle Financial’s CEO Jeremy Allaire tweeted: “USDC/USDT is the trade of the day. Flight to quality.” The Circle executive appeared on CNBC’s broadcast “Squawk Box,” and noted that there needs to be “more regulatory framework around stablecoins.” A number of people have been watching the performance of so-called decentralized and algorithmic stablecoins extremely closely since Terra’s downfall.

Despite the recent Terra UST carnage, many still believe there’s a great need for decentralized and algorithmic stablecoins among the centralized giants. Avalanche (AVAX) founder Emin Gün SirerConsiders that a crypto ecosystem must have a decentralized stablecoin.

A day before LUNA went under a U.S. penny, Gün Sirer said: “Even fully-collateralized fiat stablecoins have de-pegged. Some of them are even weak [algorithmic] stablecoins have recovered.” The AVAX founder also stated that he had “always said that [algorithmic] stables are subject to destabilizing bank runs.” Despite the bank run risk, Gün Sirer explained that a decentralized stablecoin is still needed in the industry.

“We need a decentralized stablecoin,” Gün Sirer detailed. “Fiat-backed stables are subject to legal seizure and capture. A decentralized economy needs a decentralized stablecoin whose backing store cannot be frozen or confiscated.”

How do you feel about this week’s stablecoin economy shuffle? Please comment below to let us know your thoughts on this topic.

Credit for the imageShutterstock. Pixabay. Wiki Commons