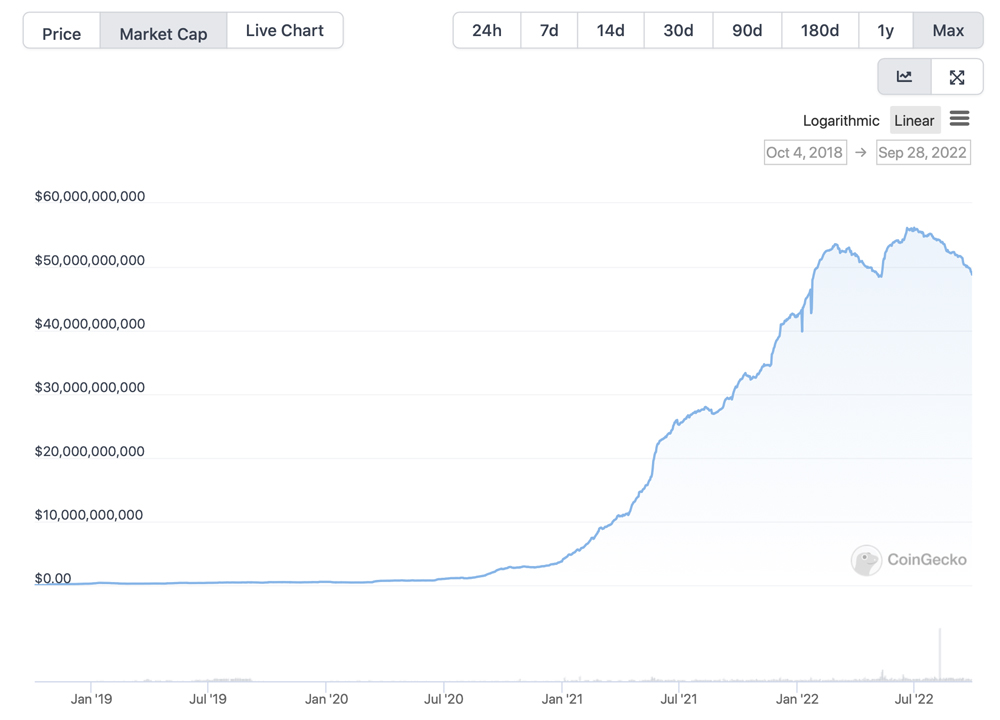

Just over two months or approximately 83 days ago, the stablecoin usd coin (USDC) had a market valuation of around $55.52 billion and since then, USDC’s market capitalization has lost 12.05%. For most of 2022, the second largest stablecoin by market capitalization, USDC has been above the $50 billion mark, but this week the crypto asset’s market valuation is around $48.82 billion.

Following Tether’s Recent Stablecoin Reduction, USDC’s Market Cap Drops 12%

In mid-June, Bitcoin.com News reported on the largest stablecoin asset tether (USDT), as USDT’s saw more than $12 billion erased from the market cap in two months and at that same time, usd coin’s (USDC) market cap rose by 9%.

However, USDC’s market cap has shrunk a great deal during the last 83 days, as it has dropped by $6.7 billion since July 7, 2022. At the time of writing, at 4:15 p.m. (ET) on Wednesday afternoon, USDC’s market valuation is $48.82 billion and on July 7, it was much higher at roughly $55.52 billion.

USDC’s market cap today is under the $50 billion zone but for most of 2022, the stablecoin’s market valuation remained above that region. USDC achieved the $50 Billion mark on February 1, 2022 in terms market capitalization. The USDC mark remained at that level until April 17.

USDC regained a market value above $50 billion on May 13 and stayed that way for 130 days. While USDC’s market valuation shrunk by 12.05% during the last 83 days, 6.6% of the loss was erased from the market cap during the past 30 days.

USDC’s market cap drop follows the company’s recent partnership with Robinhood Markets, but it also follows the recent auto-conversion moves by Binance and Wazirx. Both Binance and Wazirx auto-converted their customer’s USDC holdings (and other stablecoins) into BUSD if they did not withdraw the USDC by a specific date.

On September 28th, statistics show USDC’s 24-hour global trade volume of $4.31 trillion. The stablecoin’s market cap dominance represents 4.985% of the crypto economy’s $983 billion in fiat value. USDC’s top trading pair today is tether (USDT) as it accounts for 32.25% of today’s usd coin trades.

Tether is followed by EUR (27.16%), USD (22.56%), and GBP (6.51%) in terms of USDC’s top pairs on Wednesday. Since the fall in fiat currencies against the greenback, stablecoins such as tether (USDT), and usd coin(USDC) have experienced a substantial rise in euro-pound trading pairs.

What do you think about USDC’s market valuation sliding by more than 12% during the past 83 days and 6.6% over the last 30 days? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.