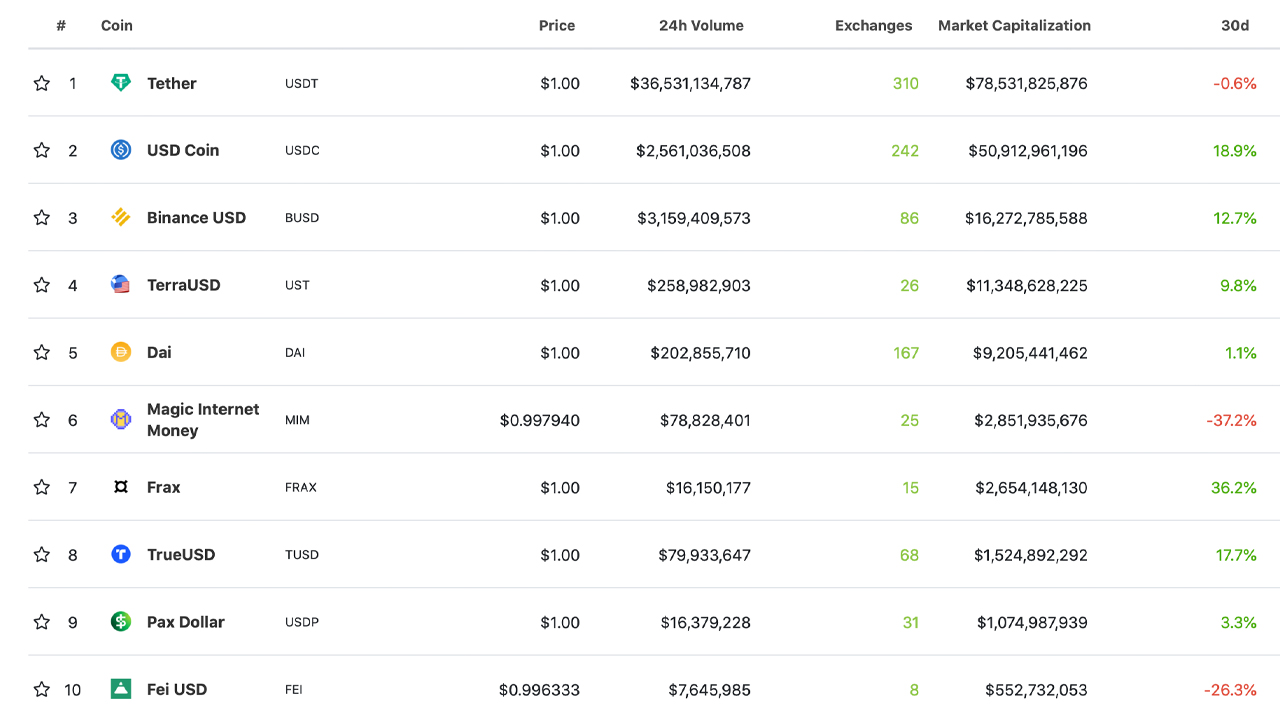

As your entire lot of 12,333 digital currencies hovers simply above $1.8 trillion in worth, the stablecoin financial system has just lately swelled to $178.8 billion or 9.9% of your entire crypto financial system. Out of the highest 5 stablecoins, usd coin (USDC) noticed its market capitalization leap essentially the most, rising 18.9% over the last 30 days. The 18.9% improve has pushed USDC’s market capitalization above the $50 billion mark.

USDC Market Cap Rises Above $50 Billion, Stablecoin Represents 2.83% of the Crypto Financial system’s USD Worth

Stablecoins proceed to develop in 2022, as quite a few fiat-pegged token initiatives have seen their issuance ranges improve through the first month of the yr. On the time of writing, the USD worth of all of the stablecoins immediately is $178.8 billion.

Tether (USDT) is the biggest stablecoin mission when it comes to market capitalization, with a valuation of round $78.5 billion. USDT’s total valuation represents 4.34% of your entire crypto financial system’s $1.8 trillion. Tether, nonetheless, noticed no development over the last month as the general valuation has remained static.

USDC, however, has grown 18.9% during the last 30 days and the market valuation is now over $50 billion. USDC’s market capitalization is 2.83% of your entire crypto financial system’s USD worth.

Each USDT and USDC mixed characterize 7.17% of the fiat worth of all of the cash in existence immediately. Whereas these caps are a lot smaller than bitcoin’s (BTC) 39.2% dominance and ethereum’s (ETH) 17.7% dominance, they nonetheless characterize the third and fifth largest crypto valuations.

Stablecoin FRAX Grew Extra Than 36% Final Month

In the meantime, out of the highest 5 stablecoins by market cap, the third-largest USD-pegged token, BUSD, noticed its capitalization improve by 12.7% to $16.2 billion this month. Terra’s stablecoin UST elevated by 9.8% to $11.3 billion in 30 days.

Makerdao’s DAI noticed its $9.2 billion market capitalization improve by 1.1% this previous month. The Avalanche-based magic web cash (MIM) noticed its $2.8 billion valuation slide 37.2% decrease than it was final month. The seventh, eighth, and ninth-largest stablecoin markets noticed their market caps rise.

The seventh-largest USD-pegged coin frax (FRAX) has a market capitalization of $2.6 billion which has elevated 36.2% over the last month. Trueusd’s (TUSD) cap spiked 17.7%, and pax greenback (USDP) rose by 3.3% during the last 30 days.

The tenth-largest stablecoin, fei usd (FEI), has decreased by 26.3% this previous month. Each FRAX and USDC noticed the biggest will increase final month.

What do you consider the stablecoin financial system’s improve over the last month and USDC’s rise previous $50 billion? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Coingecko.com,

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.