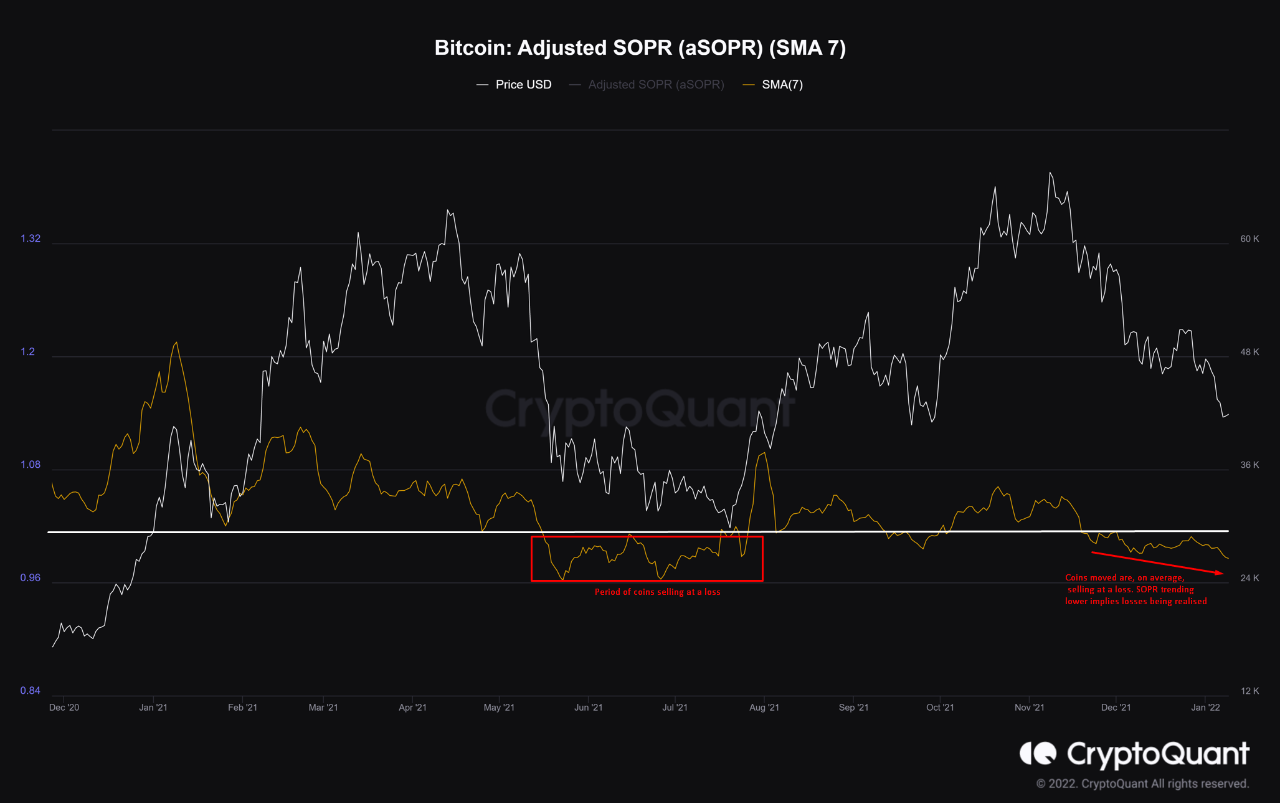

According to the on-chain indicator SOPR, Bitcoin owners have been selling at a loss for some time now. Similar to the behavior seen in May-June 2021’s mini bear period, this behaviour is now.

Bitcoin Investors Have Continued To Dump At A Loss For A Month Now

An analyst pointed out in CryptoQuant that the BTC SOPR showed that current holders were selling at a loss.

The “Spent Output Profit Ratio” (or SOPR in short) is an indicator that tells us whether coins moved on a given day were sold at a profit or a loss.

You can measure the metric by looking at the coins on your chain and checking the current price. This is followed by the calculation of the ratio between current and previous prices.

If the indicator’s value is greater than one, this means that the holders of the indicator are selling on average at a profit.

However, if the SOPR is less than 1, it means that investors are losing their Bitcoins overall.

There is also the situation when the indicator has a value equal to 1. The market breaks even with BTC sales during this period.

Is The Bitcoin Hashrate Recovering From Kazakhstan’s Crisis?| Is The Bitcoin Hashrate Recovering From Kazakhstan’s Crisis? Fear Aides

Here’s a chart showing the change in Bitcoin SOPR value over the last year.

It appears that the indicator's value has been below one in recent months. Source: CryptoQuant| Source: CryptoQuant

The above graph shows that the Bitcoin SOPR has a current value of less than 1. This means that holders are losing money.

Related Reading: Bitcoin Open Interest Continues Its Rise, With a Short Squeeze Incoming| Bitcoin Open Interest Continues To Rise, Short Squeeze Incoming?

For the past month, this trend has continued. The indicator dropped below 1 for a long time after the May 2021 crashes.

It’s possible that the current trend of low SOPR values will continue for a while, just like back then. A mini-bear-market was evident in May and June. If the trend continues, another bear market could emerge.

BTC Prices

Yesterday, Bitcoin’s price briefly declined below the $40k mark, but since then has jumped back up. As of this writing, Bitcoin’s price is at $41.7k. That 10% drop in seven days has caused the currency to float around $41.7k. In the last month, crypto lost 13%.

Below is a chart showing the change in BTC’s price over the past five days.

BTC has been moving sideways over $40k for the past few days. Source: BTCUSD at TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts