Solana had a downward trend as bulls lost steam following the fall below the $38 support level. In the last 24 hour, Solana lost 4%. The last week saw a drop of 8%. The price of Solana was increased to $33, but at press time, the coin traded slightly higher than the support line.

Bitcoin also struggled to below $20,000 and altcoins followed the same price trend. The altcoin bearish pressure continues due to market weakness. Solana formed an ascending triangle on the daily chart but managed to break the top.

It could fall below the $30 mark if the current trend continues. The altcoin currently has a vital support level of $33. The daily chart saw a decrease in buying pressure as SOL was met by a sell-off. Today’s global cryptocurrency market is valued at $924 billion. 3.1%In the past 24 hours, there has been a negative shift.

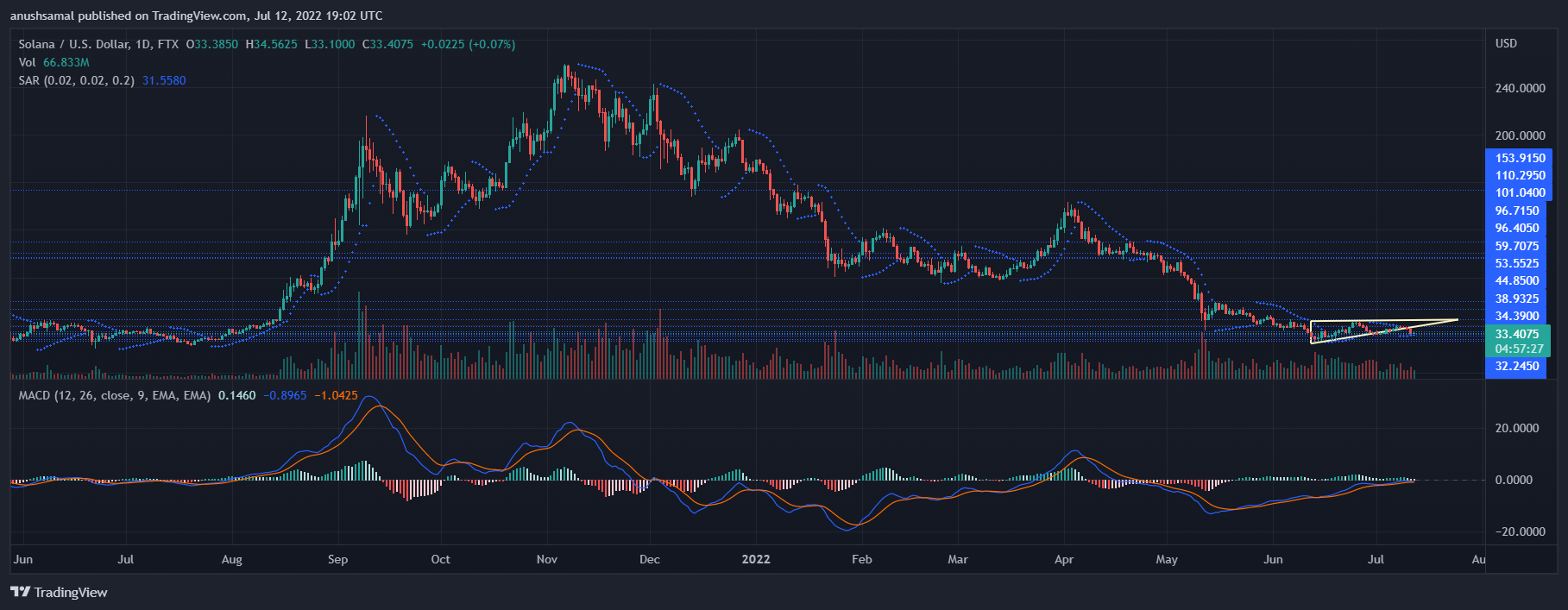

Solana Price Analysis: One Day Chart

SOL traded at $33.40 as of the writing. It was trading at $33.40, which is very near the crucial price floor of $33. SOL will be dragged to $30 if the price drops below $33. Then to $27 if it falls to $30.

SOL fell below the ascending triangular (yellow) due to greater bearish power

Continued downward movement can cause another 18% fall on SOL’s chart. Solana could surpass the $34 level, and overturn the $38 price point to invalidate the bearish thesis.

Initial resistance was $34 followed by $38. The trading volume in Solana was slightly lower, but the bar was green. It indicated that buyers tried to maintain their position on the chart.

Technical Analysis

SOL’s buying strength has remained delicate with the coin witnessing regular sell-offs in the market. Solana saw high selling pressure during May, June, and July.

The Relative Strength Index fell below half the line, which means that the sellers controlled the market.

SOL price was below the 20 SMA which indicates that sellers are responsible for the current market momentum.

Suggested Reading: Solana Glints Have 14% 3-Day Rall – Is SOL Going to Keep Beaming!| Solana Glints With 14% 3-Day Rally – Will SOL Keep On Beaming?

SOL’s chart displayed mixed technical signs. Moving Average Convergence Divergence illustrates price momentum and trend reversals. MACD was subject to a bullish crossover, and the green signals bars are shown.

These green signals are linked to the buy signal. This might indicate a favorable sign for the coin, as it could signal a possible change in price direction during the next trading session.

ParabolicSAR calculates price direction. The dotted lines beneath the price candlesticks indicate an expected price change.

The strength of the wider market is vital for the currency to rise.

Similar Reading: Glassnode – Bitcoin LTHs who bought during 2017-2018 aren’t selling yet| Glassnode: Bitcoin LTHs Who Bought During 2017-2020 Aren’t Selling Yet

Featured image taken from BusinessToday.in and charts from TradingView.com