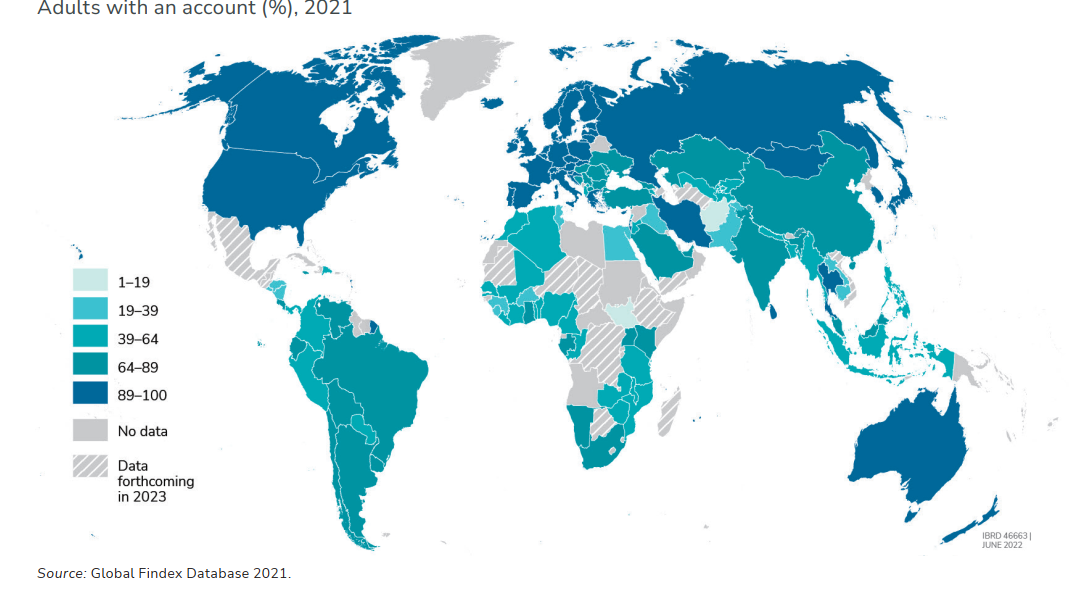

Between 2011 and 2021, the share of the world’s adult population that had bank accounts rose from 51% to 76%, the findings of the latest World Bank Global Financial Index survey have shown. The survey shows that 1.4 billion adult are not yet banked. This is because they don’t have enough money nor the right identification to open a banking account.

Sub-Saharan Africa: Mobile money narrows the financial exclusion gap

According to the findings of the 2021 Global Financial Index (Findex) survey, the percentage of the world’s adult population with a bank account is now 76%, a fifty percent increase from the 51% that was recorded in 2011. The average account ownership rate in developing countries rose 8 percentage points between 2017-2021, from 63%-71% to 71%.

While in the past it was China and India that accounted for most of the growth, the latest survey report notes that the “recent growth in account ownership has been widespread across dozens of developing economies.”

Concerning Sub-Saharan Africa, where a significant portion of unbanked adults is found, the survey findings show that “55 percent of adults had an account, including 33 percent of adults who had a mobile money account.” According to the survey, this is “the largest share of any region in the world and more than three times larger than the 10 percent global average of mobile money account ownership.”

The same region is also home to some 11 economies wherein a larger proportion of adults “only had a mobile money account rather than a bank or other financial institution account.” Besides helping adults without bank accounts, mobile money may have created opportunities to better serve marginalized groups, the survey report noted.

‘Enabling Infrastructure Has Important Role to Play’

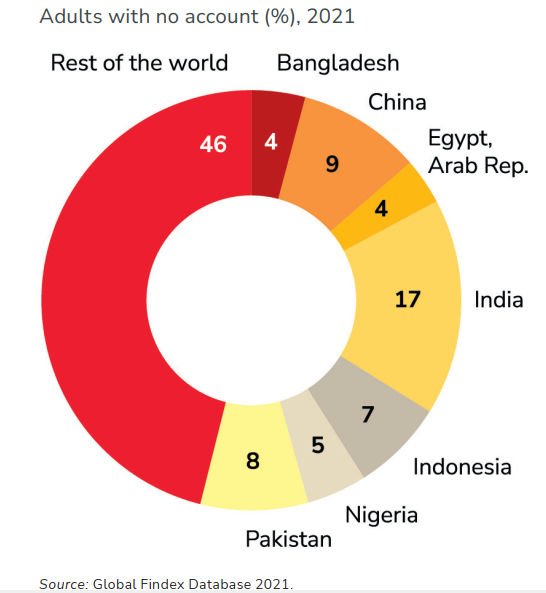

Yet despite the encouraging findings, the survey study still found that as many as 1.4 billion of the world’s adult population are still unbanked. This could be due to a lack or money, distance from the closest financial institution or lack of identification documents required to open an account.

The survey concludes that barriers that prevent hundreds of millions of adult customers from opening bank accounts are easily overcome with the help of the right infrastructure.

“Enabling infrastructure has an important role to play. For example, global efforts to increase inclusive access to trusted identification systems and mobile phones could be leveraged to increase account ownership for hard-to-reach populations,” a summary of the survey report states.

In addition, the summary asserts that the “chief actors” in any efforts aimed at further reducing the number of unbanked adults “must also invest in regulations and governance to ensure that safe, affordable, and convenient products and functionality are available and accessible to all adults in their economies.”

Just like other studies, this survey concluded that the Covid-19 outbreak aided in the adoption of and increased use of digital payment. The report cites India as an example of this claim, where more than 80 millions adults were forced to pay digital merchant payments for the first-time due to restrictions on human movement. Similar trends are evident in other developing countries. Excluding China, “20 percent of adults [in developing economies] made a digital merchant payment in 2021.”

Register here for a weekly email update with African news.

Let us know your opinions on Global Findex’s latest survey. Comment below and let us know how you feel.

Credits for the imageShutterstock. Pixabay. Wiki Commons

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.