While inflation data in Europe and the U.S. has risen significantly higher last month, Russia and members of the BRICS countries revealed leaders in the five major emerging economies are in the midst of “creating an international reserve currency.” Analysts believe the BRICS reserve currency is meant to rival the U.S. dollar and the International Monetary Fund’s (IMF) Special Drawing Rights (SDRs) currency.

Vladimir Putin Announces Creation of a Reserve Currency International at the 14th BRICS Summit —Turkey, Egypt and Saudi Arabia Should Consider Joining BRICS

Inflation has been soaring in the West over the past month. Political leaders in Europe, the U.K. and America have attempted to attribute the recent economic downturn to a variety of factors, such as the Ukraine-Russian conflict and Covid-19.

Data from last month’s consumer prices in America and Europe have climbed to all-time highs and many analysts say western countries are in a recession or about to experience one. BRICS countries met for the 14th BRICS Summit at the end June to discuss international affairs.

During the BRICS Summit, Russian president Vladimir Putin announced that the five-member economies — Brazil, Russia, India, China, and South Africa plan to issue a “new global reserve currency.”

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review,” Putin said at the time. “We are ready to openly work with all fair partners,” he added. Turkey, Egypt and Saudi Arabia also consider joining the BRICS Group. Analysts believe the BRICS move to create a reserve currency is an attempt to undermine the U.S. dollar and the IMF’s SDRs.

“This is a move to address the perceived U.S.-hegemony of the IMF,” the global head of markets at ING, Chris Turner, explained at the end of June. “It will allow BRICS to build their own sphere of influence and unit of currency within that sphere.”

While some may find the announcement of a BRICS reserve currency surprising, certain accounts about the countries which are opposed to the U.S. dollar were reported for a long time. At the end of May 2022, a Global Times report noted members were urged to end their dependence on the dollar’s global dominance.

Russian Business Relations Increased and BRICS Countries Expand — China’s President Xi Jinping Says Countries That ‘Obsess With a Position of Strength’ and ‘Seek Their Own Security at the Expense of Others’ Will Fall

Putin explained the following month that “Contacts between Russian business circles and the business community of the BRICS countries have intensified.” The Russian president further noted that Indian retail chain stores would be hosted in Russia, and Chinese cars and hardware would be imported regularly. Putin’s recent statements and commentary at the BRICS Summit have made people believe the BRICS members are not “just a ‘talk shop’ anymore.”

Russia also has provided weapons and increased aid to Sub-Saharan African states. In specific statements made by media, Putin and the other BRICS leaders are pointing out that America’s hegemony is being challenged and that it has been a victim of its exceptionalism.

At this year’s St. Petersburg International Economic Forum, Putin addressed the crowd with a 70-minute speech and talked about the U.S. ruling the world’s financial system for years. “Nothing lasts forever,” Putin said. “[Americans]Think of yourself as extraordinary. And if they think they’re exceptional, that means everyone else is second class,” the Russian president told the forum attendees.

In a biennial speech, Putin spoke with Russian ambassadors and said that the West is losing a lot of its economic power. “Domestic socio-economic problems that have become worse in industrialized countries as a result of the (economic) crisis are weakening the dominant role of the so-called historical West,” Putin remarked to the ambassadors. “Be ready for any development of the situation, even for the most unfavorable development.”

Russia and Putin claim the U.S. financial dominance has been reversing over time. Putin stated that the U.S. would sanction specific countries, including Russia, in October 2018 at the Valdai forum. This could undermine the trust and value of the U.S. dollars.

Russian President noted the common mistake made by most fallen empires. “It’s a typical mistake of an empire,” the Russian leader declared at the time. “An empire always thinks that it can allow itself to make some little mistakes, take some extra costs, because its power is such that they don’t mean anything. But the quantity of those costs, those mistakes inevitably grows.” Putin continued:

And the moment comes when it can’t handle them, neither in the security sphere or the economic sphere.

Moreover, in June, Bloomberg published a report about the BRICS Summit and noted that China’s president Xi Jinping suggested that NATO was responsible for antagonizing the Russian Federation. Xi stated that countries which support exceptionalism would suffer from security weaknesses.

“Politicizing, instrumentalizing and weaponizing the world economy using a dominant position in the global financial system to wantonly impose sanctions would only hurt others as well as hurting oneself, leaving people around the world suffering,” Xi detailed. “Those who obsess with a position of strength, expand their military alliance, and seek their own security at the expense of others will only fall into a security conundrum.”

Financial World Divided in Half: Stockpiling Gold and Alternative Payment Rails.

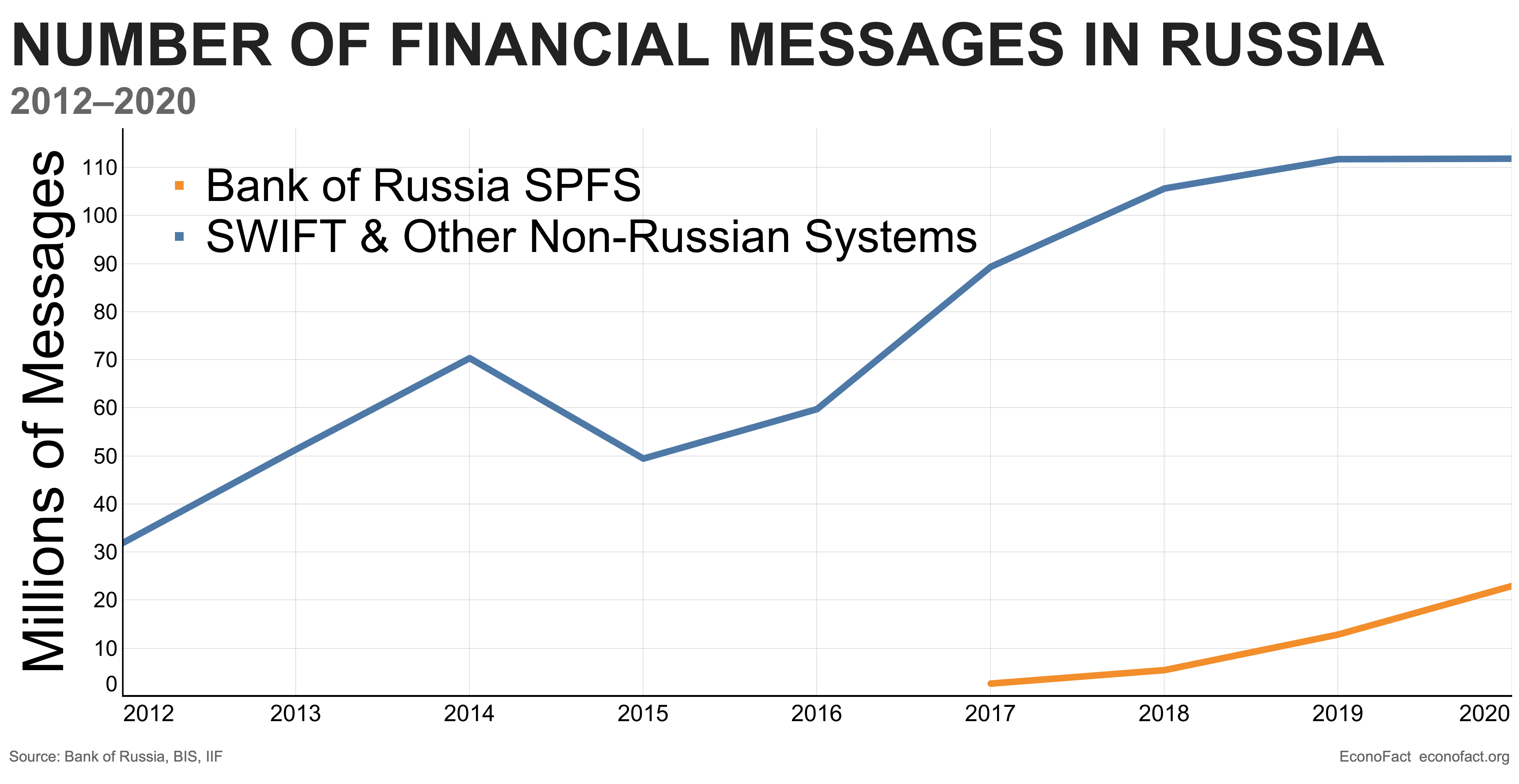

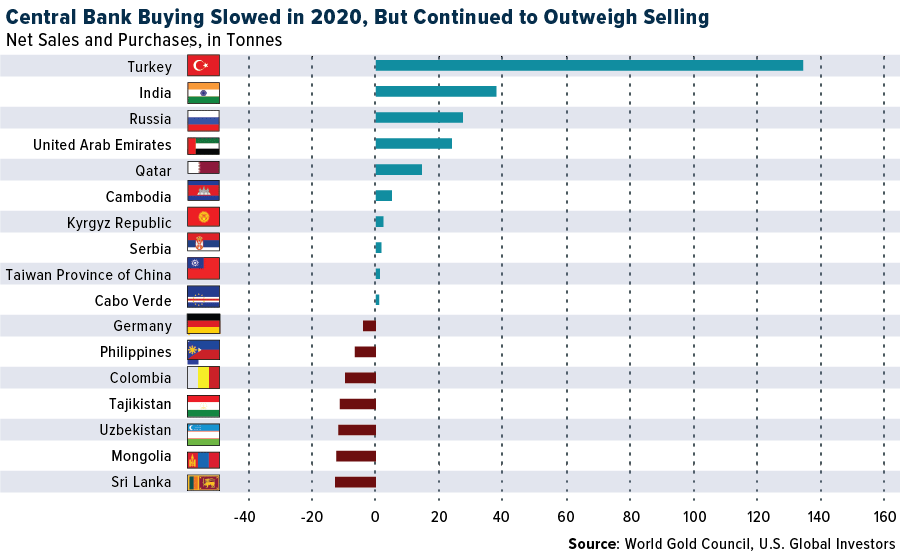

Since before conflict in Ukraine, the BRICS countries have been strengthening. For instance, in 2014, Russia developed the System for Transfer of Financial Messages (SPFS), and later the Mir payment system was launched. Russia also began stockpiling large quantities of gold as a response to Crimea’s annexe in 2014.

China also has been hoarding large amounts of gold, since both countries increased their gold reserves purchases by a lot in the years prior to war. Russian banks have also joined China International Payments System. This makes it much easier to trade with the Russians. A report by Reuters states that China allowed billions in gold imports to enter its territory last April.

Since World War I, the U.S. dollar has been the world’s global reserve currency and America emerged as the largest international creditor. Today, the USD has not seen a decline in its performance against other currencies. This year, the U.S. dollar currency Index (DXY), grew by more than 10% and outpaced stronger currencies like Japanese yen.

The euro recently reached parity with its counterpart the dollar. Other currencies such as the Indian rupee and Polish zloty and Colombian peso have struggled against the greenback over recent years. The Russian ruble is a strong rival to the dollar and one of 2022’s best-performing fiat currencies.

With inflation soaring and interest rates getting hiked by the Federal Reserve, Kamakshya Trivedi, the co-head of a market research group at Goldman Sachs stressed that it’s been a “pretty tough mix” to deal with. An analyst at Goldman Sachs says that despite the uncertainty, the dollar should remain strong for the time being. But in comparison to the greenback’s recent spike in value, most of that rise is in the past, Trivedi remarked.

“For now, we still expect the dollar to trade on the front foot,” Trivedi wrote on July 16. “There might be a bit more to go, but probably the largest part of the dollar move may well be behind us.”

What do you think about the BRICS nations creating a new international reserve currency to rival the U.S. dollar and IMF’s SDRs? Comment below and let us know how you feel about the subject.

Images Credits: Shutterstock. Pixabay. Wiki Commons. World Gold Council. Econfact.org. 14th BRICS Summit.

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.