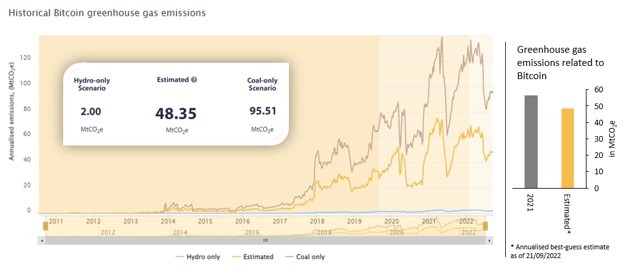

A recent report by The Cambridge Centre for Alternative Finance, (CCAF) states that bitcoin mining globally accounts for approximately 0.10% global greenhouse gas (GHG), or 48.35 Million Tons of carbon dioxide annually. Moreover, CCAF’s report details that “Bitcoin’s environmental footprint is more nuanced and complex” and because of complexity issues it “underscores the need for independent data.”

Cambridge Centre for Alternative Finance Study: ‘Bitcoin Network Produces 48.35 Million Tons of CO2 per Annum’

On Tuesday, the Cambridge Centre for Alternative Finance (CCAF) published a new report called “A deep dive into Bitcoin’s environmental impact,” which was written by the CCAF project lead Alexander Neumueller. The report highlights how bitcoin’s increasing popularity has put a spotlight on “environmental issues associated with the production of Bitcoin.”

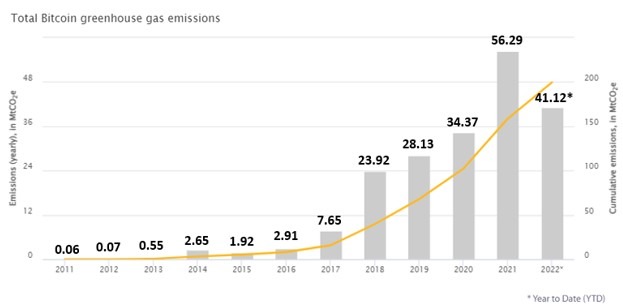

CCAF’s study claims that the Bitcoin network produces 48.35 million tons of carbon dioxide per annum. The metric equates to roughly 0.10% of global greenhouse gas emissions and Neumueller says it’s about “14.1% lower than the estimated GHG emissions in 2021.”

Neumueller’s research further details that 37.6% of the energy leveraged by bitcoin (BTC) miners derives from sustainable types of energy. CCAF’s “best-guess estimate” of 0.10% of global greenhouse gas emissions equates to the same amount of energy used by Nepal or the Central African Republic.

Just half of 100.4 million tonnes of annual carbon dioxide mining emissions is used by Bitcoin mining. Neumueller believes that the GHG emissions in 2022 were lower than in 2021 because of a “substantial decrease in mining profitability.”

CCAF points out that this may be due to a switch from lower-efficiency mining rigs, to higher efficiency next-generation machines. Neumueller says that CCAF’s assumption has been “confirmed by anecdotal evidence of Bitcoin miners.”

Miners face pressure from three angles: Falling BTC price, increasing hashrate & operating costs. While Rev per hash remains close to its ’20 lowest, energy costs and rev are increasing, ASICs have become more efficient. Consolidation is possible this year, but it’s not clear if the wheat will be separated from the chaff. pic.twitter.com/WRqbTD8raG

— Alexander Neumüller (@alexneumueller) June 16, 2022

In addition to changing out old hardware for newer and more efficient bitcoin miners, CCAF details that when China’s hashrate declined, the crypto asset’s “electricity mix became more diverse.” Neumueller and CCAF explain that data suggests the use of sustainable energy has declined in recent times.

Starting in 2021, data shows electricity mix fluctuations are now “visibly less” volatile. “Since it is not yet possible to comment on how the emission intensity changed from 2021 to 2022, as only January data is currently available, Bitcoin’s average emission intensity in 2020 (491.24 gCO2e/kWh) was compared to that of 2021 (531.81 gCO2e/kWh), suggesting that the sustainability of the electricity mix has deteriorated,” Neumueller notes.

According to the CCAF, the industry of bitcoin mining is constantly changing and the tools and research used by the CCAF continue to evolve. With real-world data available researchers are able to look at the situation with “greater granularity.”

The CCAF project lead ends the study by mentioning that “interesting concepts and developments are already emerging around bitcoin mining.” These include concepts like mitigating flare gas, waste heat recovery, and applied demand response applications.

“Time will tell if these are merely novel ideas that fail to deliver on their promise, or if they will become a more integral part of the Bitcoin mining industry in the future,” Neumueller’s report concludes.

Let us know your thoughts on the most recent bitcoin mining report from the Cambridge Centre for Alternative Finance. Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons. Cambridge Centre for Alternative Finance. Twitter.

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.