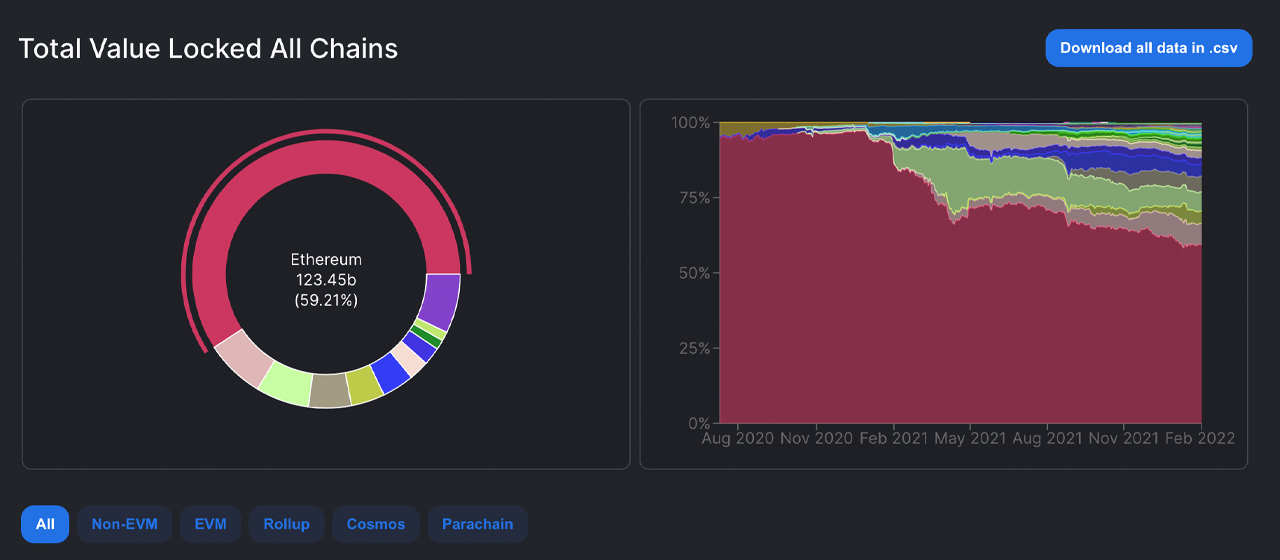

The total value locked (TVL), in decentralized finance platforms (defi) was at just above $200 billion on February 15th, following a temporary dip below this region last week. Ethereum, which has 532 protocols and commands 59.22% today’s TVL in Definitive Finance (defi), is the most valuable. In the past seven days, metrics have shown that a lot of undiscovered defi protocols have experienced significant TVL percentage growths.

In 24-Hour Trade Volume, Defi TVL Rises to 3% and $4.5 billion

Today’s total value locked (TVL), in defi, is around 3.3% higher than the previous 24 hours at $208.45 trillion. Curve Finance is the defi protocol that has the highest TVL with $19.75 million.

Curve’s TVL is up 1.22% this week across eight different blockchain networks. Curve’s TVL is followed by Makerdao, Aave, Convex Finance, WBTC, and Lido respectively.

Terra is the 2nd-largest Blockchain TVL today, with $123.45 Billion. Ethereum holds 59.21%. Terra, a blockchain network with $15.05 Billion locked, and Anchor command 55.81%.

Terra is followed closely by Binance Smart Chain, (BSC) at $13.36 billion; Avalanche, $10.8 billion; Fantom, $8.46 billion and Solana, which has an $8.07 trillion total value.

The 362 decentralized trading platforms (dex) have a total of $70.24 Billion TVL and allow token swapping in decentralized manner.

Today, there’s $4.5 billion in dex trade volume across the globe and over the last 30 days, dex platforms have seen 168,095,541 visits. Uniswap v3 is the top-ranked dex, followed by Pancakeswap and Serum. Spookyswap was last.

There are 110 defi loans applications that have $45.62 trillion in value and 11 cross-chain links with $24.34 million. There are 45 stake apps worth $12.88 Billion and 295 protocols with a yield of approximately $24.02 Billion.

There are a number of unexplored Defi protocols that see large TVL percentage gains

All ten of the top smart contract platforms by market cap are currently in green. The biggest winner is Avalanche, which has risen 14% in the past 24 hours. Other platforms have experienced percentage gains of between 5.8% to 11.5%.

It is not common for defi platforms to see significant percentage increases in the past seven days. Hakuswap’s TVL, for instance, has increased 11,497% this week. Wigoswap’s TVL jumped 10,163%, and Acumen saw its TVL increase by 5,174%.

Cougarswap (229%), Dopex (1.990%) and Polkex (551%) followed these defi protocols. Dehive (471%) was the last.

What do you think about this week’s action in the world of decentralized finance (defi)? Comment below and let us know how you feel about the subject.

Image creditShutterstock. Pixabay. Wiki Commons. defilama.com.

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.