More than one year has passed since 2021’s NFT boom. NFTGO reports that the NFT market capital peaked at $36.8 Billion in March 2022. NFTs’ trading volumes and market caps began to decline as the market became less liquid. The crypto innovation grew its reach beyond crypto communities and created a large market that also led to DeFi and NFTs. NFT platforms for lending, NFT aggregators and NFT markets have been apparent in the market. The second DeFi Lego that NFTs can enable is now. One has to wonder if these products are being built in response to real market needs and if the false proposition they created is of any market value. Today we’ll examine NFT-fi and whether it is viable.

More than one year has passed since 2021’s NFT boom. NFTGO reports that the NFT market capital peaked at $36.8 Billion in March 2022. NFTs’ trading volumes and market caps began to decline as the market became less liquid. The crypto innovation grew its reach beyond crypto communities and created a large market that also led to DeFi and NFTs. NFT platforms for lending, NFT aggregators and NFT markets have been apparent in the market. The second DeFi Lego that NFTs can enable is now. One has to wonder if these products are being built in response to real market needs and if the false proposition they created is of any market value. Today we’ll examine NFT-fi and whether it is viable.

Figure As of June 1, 20221: Market Cap & Volume of NFTs | Source: nftgo.com | As of June 1, 2022

There are many NFT liquidity solutions and NFT structured products in today’s market:

1. NFT Fragmentation: ERC20 tokens are FT tokens that were created by the division of NFT ownership. NFT fragmentation projects include Fractional.art, NFTX, etc.

2. NFT lending markets. Holders are able to borrow short-term loans using their NFTs as collateral. NFTfi and BendDAO are the most prominent NFT lending market.

3. NFT leasing: NFT holders can rent NFTs from users who are in dire need to earn rents. NFT lease projects include Double and reNFT.

4. NFT aggregators. These aggregators such as Gem.xyz bring together transactions data from several NFT exchanges. This allows them to get the lowest NFT transaction price at one time and provides users with greater liquidity and other options.

5. NFT derivatives – NFT derivatives can include NFT options such as Putty as well as NFT perpetual contracts such as NFTprep.

These projects represent early efforts to connect NFTs with DeFi. NFT fragmentation and NFT aggregators are aimed at addressing the issues of low NFT liquidity, high market threshold, and poor NFT liquidity. NFT lending markets for NFT and NFT lease projects are also designed to improve NFT liquidity. NFT derivatives, which are structured products that can be used to increase capital utilization, are more complicated. These projects are not able to be adopted on a large scale due to limitations in the NFT logic as well as the space for development. We will then examine the true demands and falsified propositions for NFTs.

Real Requirements

1. NFT holders should have better capital utilization. They can collateralize NFTs to get partial liquidity if they run out of cash.

2. NFT holders should address the liquidity issue and be able to buy/sell NFTs quickly.

False Proposes

Is the NFTs’ capital utilization higher than before?

The problem of NFTs’ capital utilization can be seen in two aspects: 1) Users need to quickly buy and sell NFTs, and the transaction frequency should not be affected by the poor liquidity of NFTs; 2) Users should be able to quickly exchange their NFTs for liquidity and obtain cash for other purposes. With FT tokens capital utilization can also be improved by leverage and staking. There are very few options for users to increase their capital utilization in NFT markets. Additionally, NFT and finance can be combined to significantly raise the learning cost. Right now, most NFT holders still rely on the “buy low and sell high” strategy. These holders don’t make up the majority of NFT loan users, as only NFTs that are blue-chip and have sound liquidity are eligible.

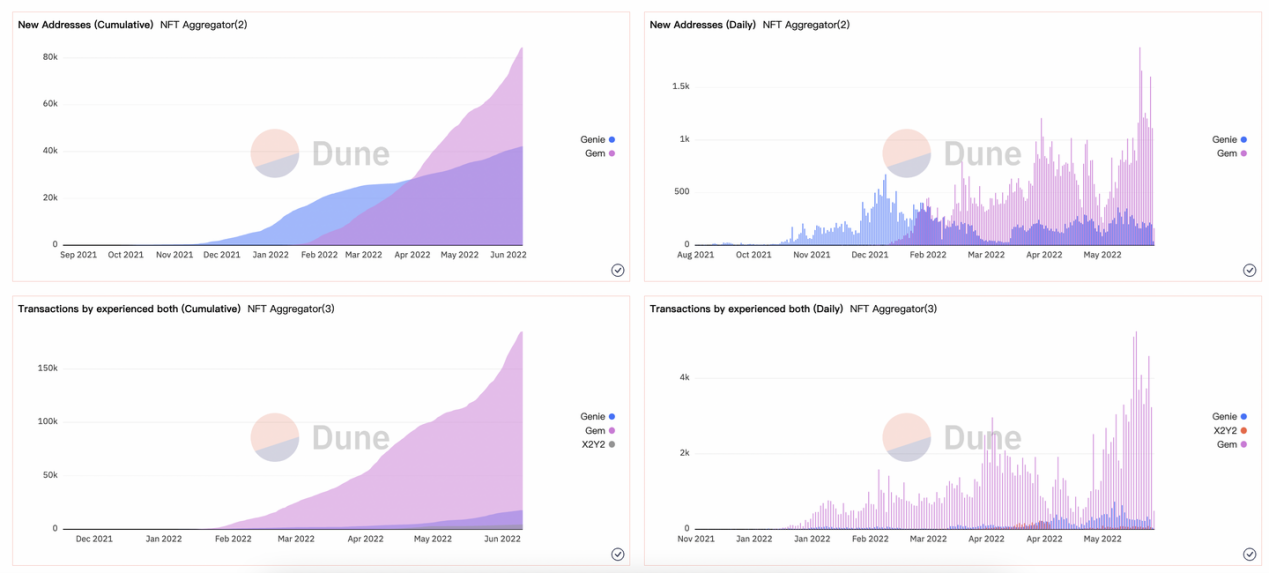

The market is small enough that most users can be absorbed into secondary markets or aggregators operating at low thresholds. They have also not seen significant improvements in capital utilization. Genie, a NFT aggregator, is seeing a steady increase in the number of addresses. Gem transactions are becoming more frequent. Genie and Gem are still far from their full potential to improve NFT capital utilization, owing to the slowing market conditions.

Figure 2: Transactions and new addresses for NFT Aggregators | Source: Dune @sohwak

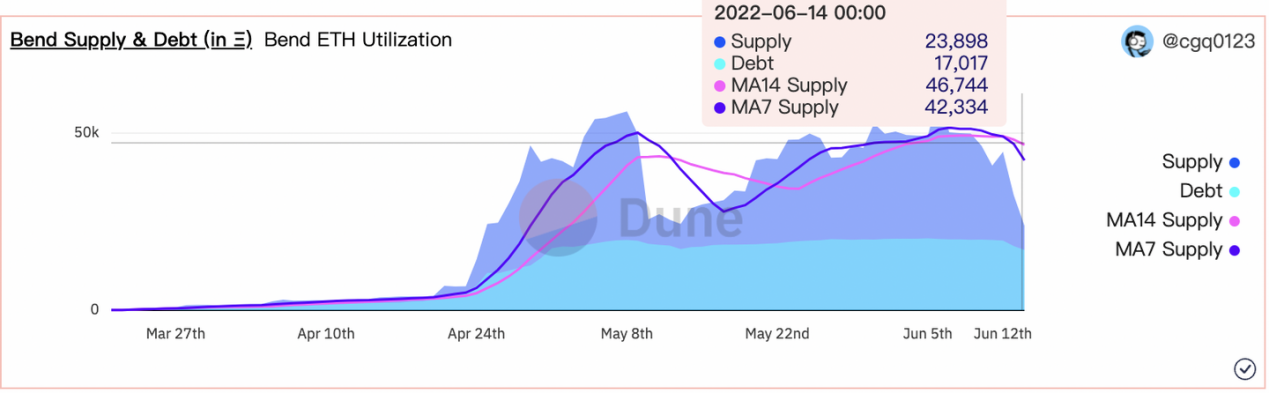

Let’s turn to the capital utilization of mainstream lending projects. BendDAO uses the liquidity pool model to lend ETH. Holders can collateralize their blue-chip NFTs with ETH borrowed from the pool. Due to recent market fluctuations, a large amount of ETH deposit in BendDAO’s liquidity pool has been withdrawn, which resulted in decreased ETH supply. Despite this, the ETH loans remain at 19,000 ETH while the MA14 supply is at 46,000. As such, we can make the rough estimate that BendDAO’s capital utilization is about 41%.

Figure 3. Bend ETH Utilization | Source: [email protected]

NotificationMA14 is the moving average over 14 days; MA7 the average moving in seven days

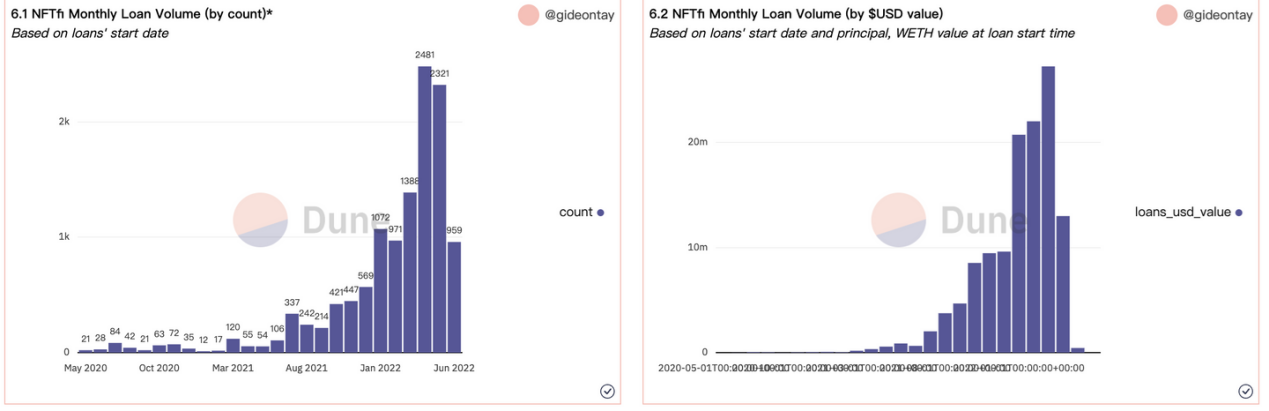

NFTfi follows the P2P lending model. NFTfi loans are governed by NFT lenders as well as liquidity providers. The loan rates and amount can be adjusted more easily. NFTfi has increased the number of monthly loans from 21 to 2000+ (May 2020) and reached $27.52 millions (March 2022). However, only 1% of NFT market caps was represented by this amount (as reported NSN BlueCHIP 10).

Figure 4: NFTfi Monthly loan Volume by Count/Value| Source: [email protected]

JPEG’d is also a P2P model lending protocol, and it now only provides collateralized lending for Cryptopunks, EtherRocks, BAYC, and MAYC. Once you have staked NFT, your holders will get PUSD (a stablecoin) provided by the protocol. Additionally, JPEG’d also features a 32% capital utilization limit on lending.

Of course there are many other NFT derivatives platforms at early stage, but we haven’t seen mature products so they cannot be analyzed for capital use. However, such NFT derivatives are likely to have higher learning costs because they were designed for professionals traders who take greater risks. As such, their growth potential is limited in today’s NFT market.

Asset Pricing and Liquidation Risks?

The pricing of NFTs has been so frequently discussed that it has now become a cliché. Because NFT derivatives and NFT lending are at risk, people are worried about the pricing of NFTs. BendDAO began several liquidation auctions after NFT prices declined in the last few months.

Although most of the lending protocols out there have adopted over-collateralization, in the face of wild price swings, many NFTs would be liquidated and sold in marketplaces. Due to the low liquidity of NFTs and this, panic selling could result in a downward spiraling price, eventually leading to bad loans.

Pricing NFTs can be affected by many factors. You can manipulate it, too. A large number of holders may raise the floor price to malignly liquidate NFTs. Additionally, an NFT might see a plunge in price due to hacking, smart contracts loopholes, or other factors. NFT pricing can also be affected in other ways. The price of NFTs could rise if celebrities suddenly purchase them or if they are the subject to a new airdrop.

Lenders cannot estimate their intrinsic value, so they could be liquidated if they borrow money or use leverage. NFT derivatives and NFT lending have yet to gain mass acceptance. Blue-chip NFT owners are concerned about the possibility of losing their NFTs in any of these scenarios. This is why collateralizing NFTs is a risky move.

Blue-chip NFT holders truly need NFT loan?

Blue-chip NFTs are the most important target market for NFT lenders, however many blue-chip NFT owners don’t need loans. These holders are more concerned about the NFTs than they are about themselves. This is similar to how billionaires wouldn’t use their collection as collateral for loans. NFT loans are not without risks. Blue-chip NFT owners will often refuse to take out such loans after considering the potential risks and the possible benefits. NFT loans come with significant learning costs and many users may not be able to understand the principles behind them.

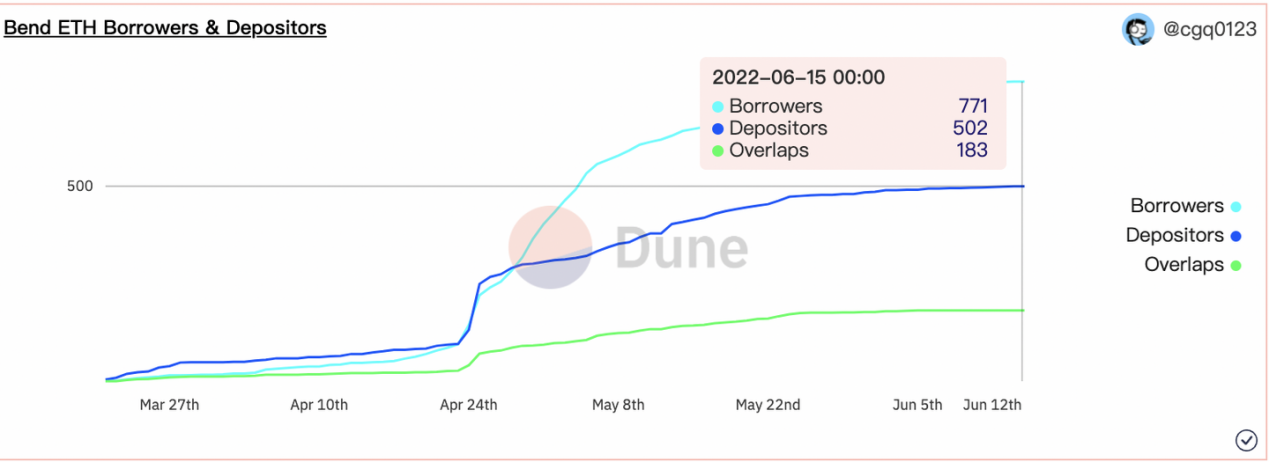

Let’s compare the user base of the major NFT lending projects. There are approximately 2.4million holders of NFTs as of June 15th. 27,833 have blue-chip NFTs. According to NFTGO, a user will only be considered a bluechip NFT holder if he or she owns more than one NFT. BendDAO currently has 771 borrowers. NFTfi is home to 1,038 and Arcade hosts 51. As users must first deposit/collateralize their NFTs before applying for a loan, we can regard all these borrowers as blue-chip NFT holders. It’s clear, therefore that the majority of blue-chip NFT holders don’t use NFT lending market.

Figure 5: Bend ETH Borrowers & Depositors | Source: [email protected]

Are NFT-fi project users receptive to the same incentive as before?

Lending or derivatives projects also bear the task of improving the protocol’s liquidity. These projects often offer native tokens for depositors or NFT holders to help them recruit. This is similar to DeFi liquidity miners platforms which are attractive to speculators who pay high APYs. The problem with this is that they wouldn’t be able maintain liquidity if APYs dropped. The old strategy of attracting users by offering token incentives remains effective. This strategy may create large users at the beginning but no one can predict how long they will stay with the protocol.

BendDAO gave BEND tokens out to people who had made deposits of blue-chip NFTs, ETH, and other cryptocurrencies when the project first started. BEND is also used to pay interest subsidies. However, when BEND prices dropped, the interest rates went down, slowing down growth for new users.

Attracting users who offer high APYs to their services is just the beginning. Retention of new users requires that they further investigate the lending mechanism, deal with the Oracle pricing problem, and minimize liquidation risks. They should also develop flexible products that allow for NFT lending to be expanded. They could provide risk assessments, reduce the learning costs, and deliver more user-friendly experiences.

Conclusion

NFT-fi refers to the evolution of a market from its infancy into a mature stage. However, it is also inevitably a process that’s full of doubts, traps, and problems. NFT projects that seek to fulfill real demand will need to be able to admit to falsifying propositions. Today’s NFT market is like a newborn child who needs to grow up and stick through challenges. NFT is a promising attempt but there are still many challenges ahead. NFT projects must continue to explore their logic in order to gain market recognition.