Through on-chain data, a quant pointed out similarities in the summer 2020 Bitcoin market.

Bitcoin Exchange Supply Ratio has Rapidly risen Recently

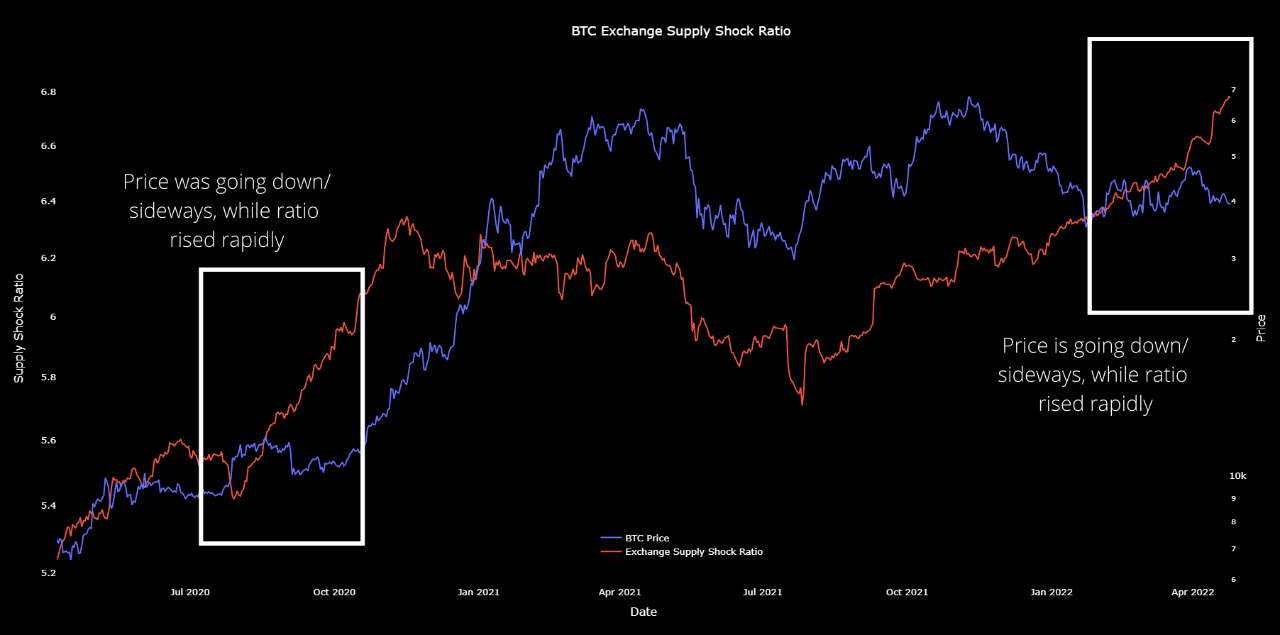

An analyst explained in CryptoQuant that there are some similarities between current market trends and those of summer 2020.

The “exchange supply” is an indicator that measures the total amount of Bitcoin present on wallets of all exchanges.

This is the supply that investors usually transfer to crypto exchanges to sell their cryptocurrency.

However, the supply is being kept in cold wallets by investors for accumulation purposes and will not be sold.

The ratio between this investor wallet supply and the exchange reserve is called the “exchange supply shock ratio.”

If this metric rises, that means there is less supply and more investors.

Related Reading: Bitcoin Futures Base Nears One Year Lows. How will This Affect BTC| Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Conversely, a downtrend would suggest a push to buy from sellers who deposit Bitcoin to centralized platforms.

Below is a chart showing how the BTC Exchange Supply Shock Ratio has changed over the years.

Source: CryptoQuant| Source: CryptoQuant

As you can see, quant highlighted the similarities between Bitcoin market of the summer of 2020 as well as the current Bitcoin market.

The price seemed to be trending downward or sideways in both periods while the rate of the shock exchange was increasing rapidly.

Institutional Investors Bearish On Bitcoin, Ethereum.| Institutional Investors Bearish On Bitcoin, Ethereum. Here’s What They’re Buying

Investors are still interested in crypto despite the current low price.

What followed a few months after the summer of 2020 was the start of a new Bitcoin bull run due to the resulting “supply shock.”

The BTC price is heavily tied to the stock market currently, and the analyst believes it’s possible that once it decouples, a similar shock could be there this time as well.

BTC price

At the time of writing, Bitcoin’s price is trading around $39.8k, down 7% in the past week. The crypto’s value has dropped 15% over the past month.

The chart below shows how the cryptocurrency’s price has changed over the last five business days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Unsplash.com featured image, Charts from TradingView.com and CryptoQuant.com charts