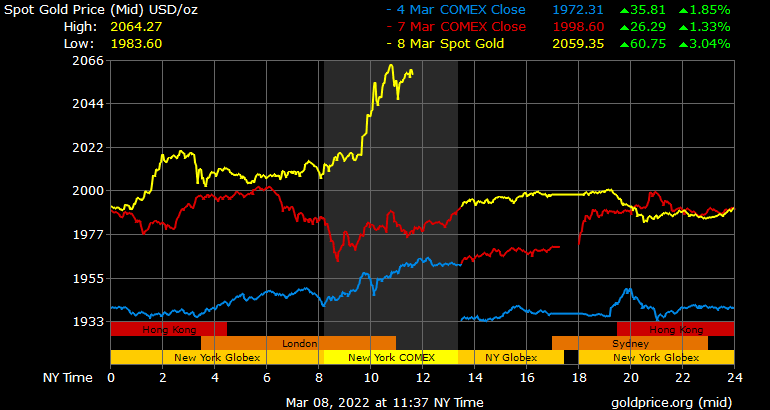

The price of gold shot up Tuesday morning as the cost of an ounce exceeded $2K during early morning trading hours (EST). The Russia-Ukraine War and the surge in demand for global commodities led to gold hitting a record high of $2064.27/ounce just hours later.

Gold’s Value Surges Higher Amid Commodities Boom

As the Russia-Ukraine conflict has created a large demand for oil barrels, commodities, energy stocks and precious metals, gold is now being traded for prices that have not been seen since August 2020. Over the past 24 hours, a pound of.999 gold has increased in value by more than 3.15%, while a pound of.999 silver saw 4.38% increase. After surpassing the $2K mark earlier today (EST), an ounce gold unit has reached a peak of $2,064.27.

Of course, after gold tapped fresh new highs, the gold bug and economist took to Twitter to praise the shiny yellow metal over bitcoin’s current performance. “Gold is up over $50 per ounce this morning, above $2,050 for the first time ever,” Schiff tweetedTuesday. “Meanwhile CNBC hasn’t even mentioned the record-high. Instead, the network is covering the irrelevant rise in bitcoin, which is still trading well below $39,000 and on the verge of a major crash,” the economist added.

As the price of precious metals soar, Asian, European, and U.S. equity markets have been floundering since Monday’s trading sessions. Nasdaq, the Dow, NYSE, and S&P 500 are all down in value at the time of writing. CNBC’s Wall Street coverage called it the “worse selloff since October 2020.” In addition to the massive jump in value both gold and silver experienced during the last 24 hours, a barrel of crude oil rallied northbound to $129 per unit. Gas stations around the world are raising prices for petroleum by increasing crude oil’s price.

Aluminium has also been rising in value, while copper has surged, and palladium has hit all-time highs. This is alongside iron, wheat and zinc. AlastairGeorge, chief investment strategist at Edison, spoke out to sharemagazine.co. He discussed the decline in risk assets while the value of gold soared. George highlighted the Russia-Ukraine war and that its “both Putin’s and Russia’s interest for the war to be stopped.”

“This would lead to a rapid reversal of negative sentiment towards risk assets and significant falls in energy and food prices,” the Edison investment strategist added. “With implied volatility in European equity markets already matching the highs of March 2020, it is already too late to ‘panic-sell’, in our view.”

How do you feel about gold’s price exploding above $2K per ounce Tuesday? Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons