Equities, crypto markets, and treasured metals did nicely in the course of the early morning buying and selling classes on Wednesday, simply earlier than the U.S. central financial institution wrapped up its Federal Open Market Committee (FOMC) assembly. Whereas the Fed stated in an announcement that the benchmark rate of interest would rise quickly, the central financial institution’s lead Jerome Powell stated the committee “is of a thoughts to boost the federal funds price on the March assembly.” Powell’s statements following the assembly, alongside discussions of decreasing the stability sheet, have been considered as hawkish amongst traders and world markets dipped in worth.

FOMC Says It Plans to Increase the Federal Funds Fee ‘Quickly,’ Fed Chair Jerome Powell Insists Charges Will Change in March

Following every week of dismal markets, the extremely anticipated Federal Open Market Committee (FOMC) assembly passed off, and members of the committee unanimously accepted the choice to maintain charges at near-zero ranges.

“With inflation nicely above 2 % and a robust labor market, the Committee expects it’s going to quickly be acceptable to boost the goal vary for the federal funds price,” the FOMC stated in an announcement on Wednesday. Whereas the monetary establishment’s assertion highlighted “quickly,” it meant that the U.S. central financial institution plans to maintain the baseline rate of interest vary untouched, at the very least for now.

Fed chairman Jerome Powell spoke after the assembly and defined that the benchmark price could rise in March. Powell additionally famous that getting the Fed’s stability sheet down will take a while.

“The stability sheet is considerably bigger than it must be,” Powell informed the press. “There’s a considerable quantity of shrinkage within the stability sheet to be carried out. That’s going to take a while. We wish that course of to be orderly and predictable.” As everybody was nonetheless clinging to the FOMC’s “quickly” assertion, Powell pressured:

The committee is of a thoughts to boost the federal funds price on the March assembly assuming that the circumstances are acceptable for doing so.

Shares, Crypto Markets, Valuable Metals Sink Decrease Following Fed Statements

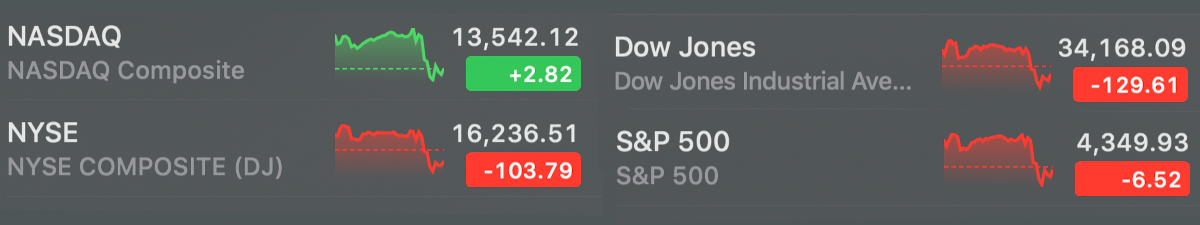

When inventory markets closed, NYSE dipped 103 factors, and the Dow Jones Industrial Common was down about 129 factors. Nasdaq’s index managed to remain above just a few percentages and S&P 500 shed just a few percentages.

The value of 1 ounce of .999 superb gold slipped 1.77%, and the worth of 1 ounce of .999 superb silver misplaced 2.48%. After all, gold bug and economist Peter Schiff threw in his two cents concerning the Fed’s assembly and Powell’s statements.

“Powell stated the Fed will start shrinking its stability sheet on the acceptable time,” Schiff tweeted. “He then stated he actually has no concept when which may be because the FOMC hasn’t even mentioned that but. Actually? What precisely do they discuss once they meet, sports activities? We’re screwed they usually realize it.” A couple of individuals trolled Schiff as a result of the worth of gold slipped after Powell’s statements.

The worldwide cryptocurrency market capitalization didn’t do too nicely both, because it dropped greater than 2% to 1.71 trillion. The main crypto asset bitcoin (BTC) was fairly risky and inside two five-minute candles earlier than the Fed’s statements have been revealed, BTC jumped from $37,400 to $38,946 on Bitstamp.

Metrics present bitcoin (BTC) had a 24-hour worth vary between $35,300 and $39,310 per unit in the course of the course of the day. Many different high ten crypto belongings misplaced between 2% to 7% just a few hours following Powell’s statements.

What do you concentrate on the FOMC assembly and Jerome Powell’s statements? What do you concentrate on the market response that adopted? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.