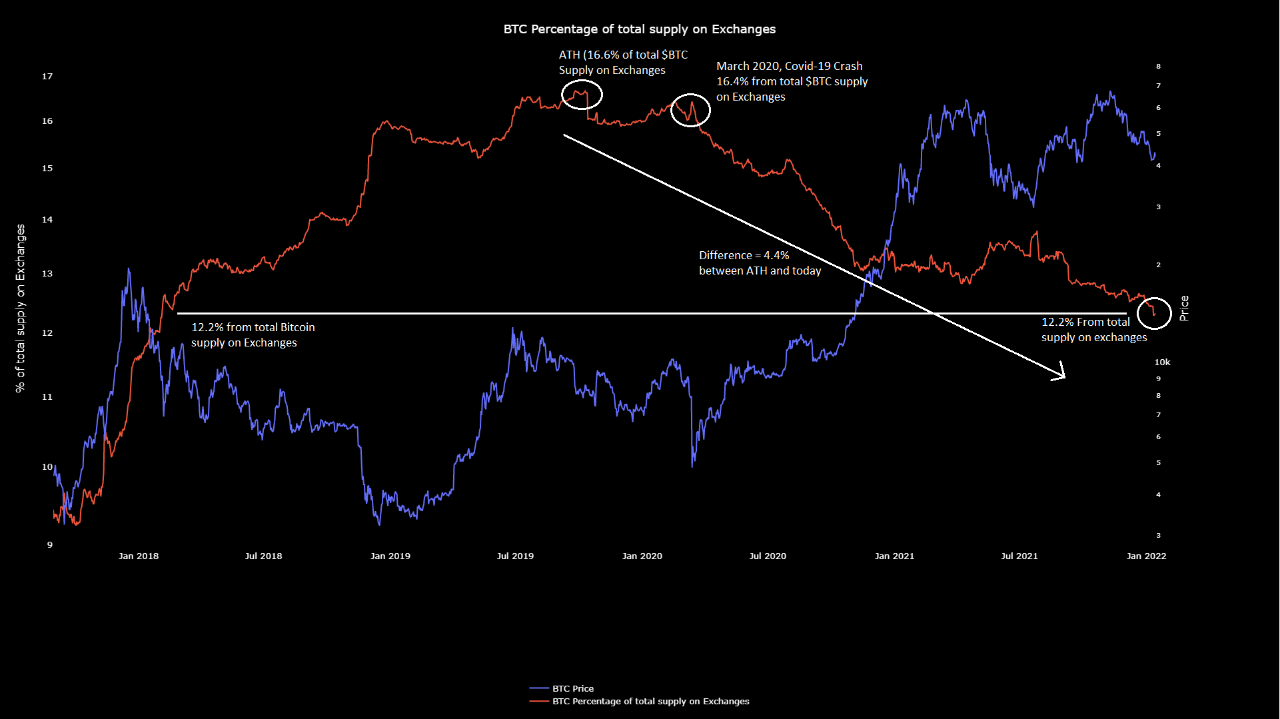

Share of the Bitcoin provide on exchanges has dipped additional all the way down to 12% just lately, as the availability shock continues to deepen.

Simply 12% Of Bitcoin Provide Is Now Held By Exchanges

As identified by an analyst in a CryptoQuant submit, the proportion of BTC provide saved on exchanges has now dropped down to simply 12%.

The all exchanges reserve is an on-chain indictor that measures the whole quantity of Bitcoin at present held by wallets of all exchanges.

The “share of BTC provide on exchanges” is a metric that tells us the ratio between the alternate reserve and the whole provide of the crypto.

When the worth of this indicator strikes up, it means alternate wallets are receiving a internet quantity of cash. As buyers often ship their cash to exchanges for promoting functions, this provide is also known as the promote provide of the market. Due to this fact, an uptrend in it may be bearish for the value of the crypto.

Then again, when the metric’s worth strikes down, it means holders are withdrawing their Bitcoin from exchanges. Extended such development can suggest there’s accumulation occurring available in the market, and the out there provide is shrinking. Therefore, downwards motion of the indicator may be bullish for BTC.

Associated Studying | Bitcoin Miners Present Sturdy Accumulation As Their Inventories Spike Up

Now, here’s a chart that reveals the development within the worth of this metric over the previous few years:

Appears to be like like the availability on exchanges has been heading down since some time now | Supply: CryptoQuant

As you may see within the above graph, the proportion of the Bitcoin provide on exchanges has shrunk down to simply 12% now.

The indicator’s final all-time excessive (ATH) was made at round 16%. Since then, the metric has been steadily making its approach down, and has now dropped 4% in worth.

Associated Studying | Jack Dorsey’s Block To Democratize Bitcoin Mining With Open Supply Mining System

Some merchants imagine that this lower within the provide on exchanges could also be making a provide shock available in the market. Such a state of affairs could be bullish for the value of Bitcoin in the long run.

Nonetheless, some latest information goes towards the narrative, arguing that the availability has merely redistributed itself within the type of funding autos like ETFs.

BTC Value

On the time of writing, Bitcoin’s worth floats round $42.7k, up 3% within the final seven days. Over the previous month, the crypto has misplaced 11% in worth.

The under chart reveals the development within the worth of the coin over the past 5 days.

BTC's worth has as soon as once more began to maneuver sideways within the $40k to $45k vary over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com