Data from the Bitcoin blockchain shows that Bitcoin supplies older than two decades have moved to derivative exchanges, which suggests that whales might be positioning for futures.

A Derivative exchange inflow of Bitcoin supply older than 2 years has risen

In a CryptoQuant article, an analyst noted that there has been a decline in short-dominant open rates while older coins are being shifted onto exchanges.

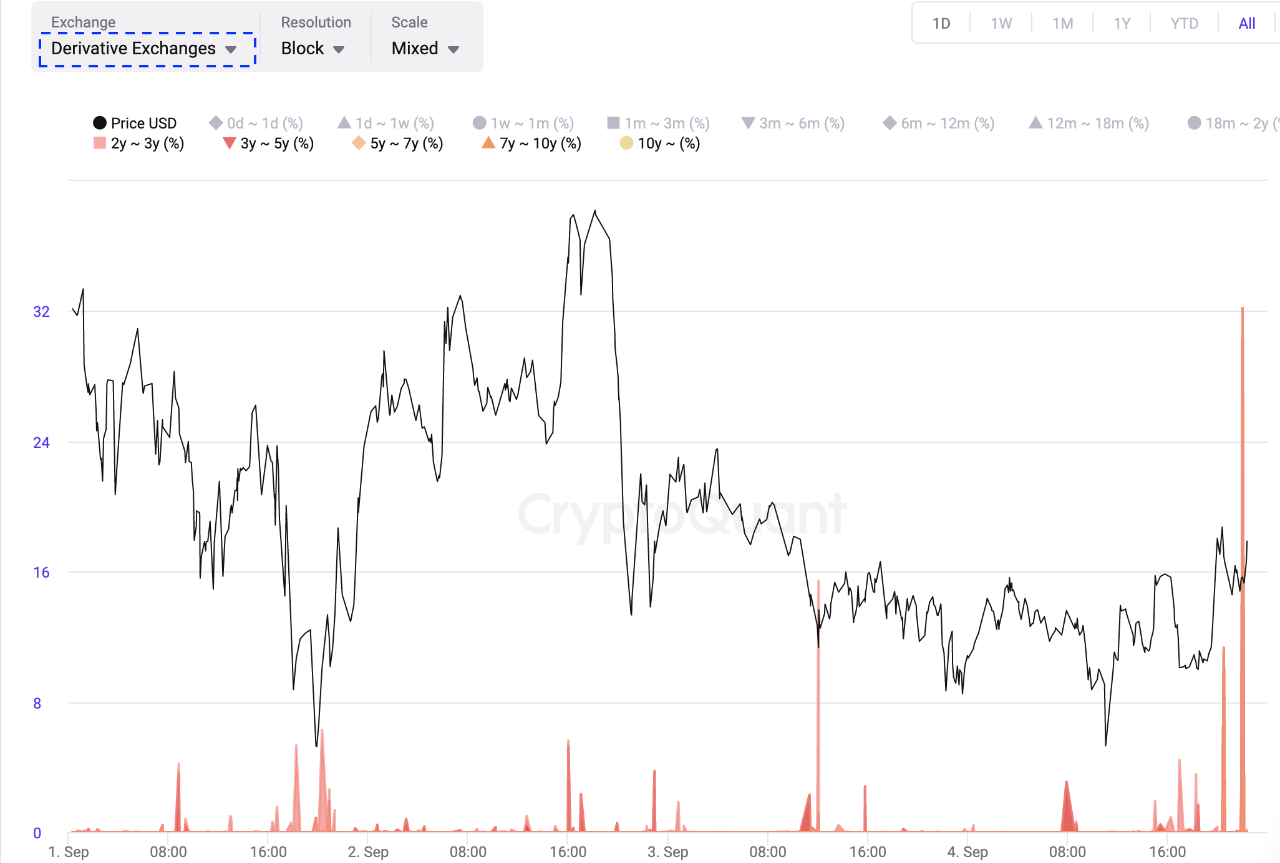

The relevant indicator here is the “derivative exchange inflow,” which measures the total amount of Bitcoin moving into wallets of all derivative exchanges.

A modified version of this metric, the “inflow spent output age bands,” tells us what the individual contribution has been from the various holder age groups to the total inflows.

Investor cohorts of interest are people who hold onto their coins for at most 2 years and have not sold them or moved them before now.

Source: CryptoQuant| Source: CryptoQuant

You can see that Bitcoin derivative exchange inflows have increased recently from investors older than 2 years.

These BTC hodlers have been moving large amounts of BTC to the exchanges in order to set up positions on the derivatives market.

It’s unclear whether this transfer is with the intent of opening long positions, or if it’s for hedging spot positions using shorts.

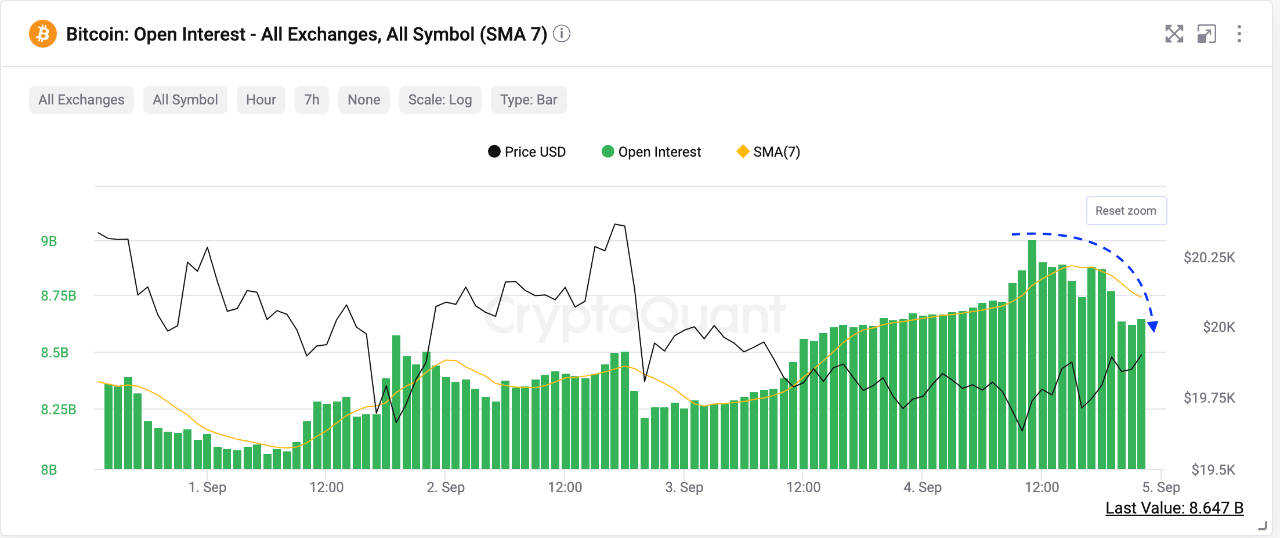

But, open interest may be a hint about where these inflows are headed. This indicator measures the amount of open positions on derivatives exchanges.

Recent funding rates showed a slight negative trend, which suggests that open interest is short-dominated. But as the below chart highlights, this indicator’s value has gone down during the past day.

After rising in the past few days, the value seems to be falling. Source: CryptoQuant| Source: CryptoQuant

If the Bitcoin open-interest value is declining, it could indicate that some short positions are now closed.

The market will shift towards a longer-dominant environment in coming days, as new large inflows to the exchanges are received. It remains to be determined.

BTC price

At the time of writing, Bitcoin’s price floats around $19.7k, down 2% in the last seven days. In the past month, crypto lost 12%.

Here is a chart showing the trends in coin price over the last 5 days.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com