Mexico’s third-richest billionaire, Ricardo Salinas Pliego, has advised investors to “buy bitcoin right now.” He explained that the U.S. is “looking more and more like any other irresponsible third world country.”

Ricardo Salinas Pliego: The US Economy and Bitcoin

Ricardo Salinas Pliego is a Mexican billionaire who commented on Wednesday’s U.S. economic and bitcoin news. Grupo Salinas is his company, which consists of companies that are involved in media, finance, and retail. According to Forbes’ list of billionaires, his net worth is currently $14.2 billion.

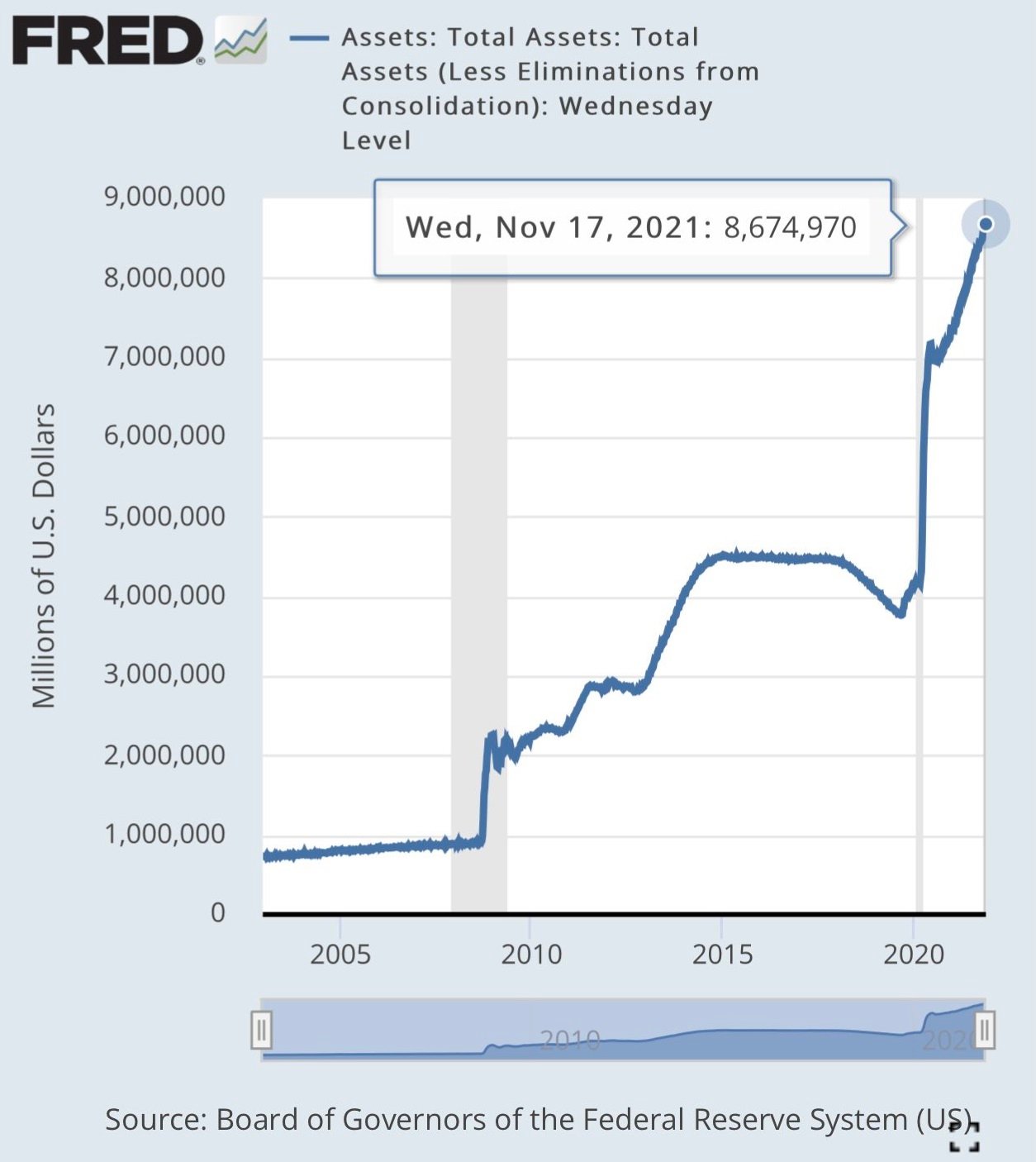

Salinas tweeted a weekly chart of the total value of the Federal Reserve’s assets (less eliminations from consolidation), which was updated on Nov. 18. The total assets are more than 8.67 trillion. He tweeted:

Good old USA is looking more and more like any other irresponsible third world country…wow…look at the scale of fake money creation. Get bitcoin now.

For a long time, the Mexican billionaire was pro-bitcoin. Last November, he disclosed that 10% of the assets in his portfolio were bitcoins.

He announced in June that his bank would accept bitcoin. “I recommend the use of bitcoin, and me and my bank are working to be the first bank in Mexico to accept bitcoin,” he tweeted.

He recommended that bitcoin be used as a currency instead of gold when discussing bitcoin and its advantages over other forms. “Bitcoin is the new gold,” he said in June, adding that it is “much more portable.” He noted that transporting bitcoin “is so much easier” than having gold bars in your pockets.

The third-richest Mexican man, August 2013, tweeted this:

I think bitcoin has a great future and it will change the world…. We will soon see.

Are you surprised by the comments made by Ricardo Salinas Pliego (Mexican billionaire)? Please leave your comments below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.