On Wednesday, the U.S. Federal Reserve will raise its federal funds rate. JPMorgan economist Michael Ferroli thinks that increasing inflation will force the Fed to hike the rate by 75bps. CME Group data showed that there was a 95% probability of 50-bps US rate increases this month. Some expect a Fed that is hawkish, but others believe the U.S. central banking may be more dovish if things get bad.

Global Markets Shudder With Focus Directed at the Fed’s Next Rate Hike — JPMorgan Economist Expects a 75 bps Increase

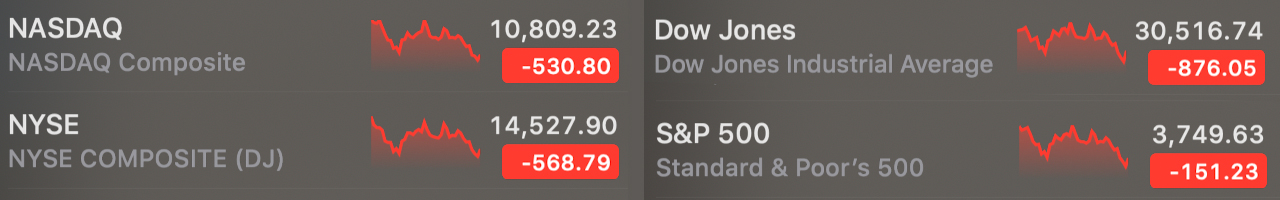

The Monday start to the week was one of the most bloody in recent history. Major U.S stock and cryptocurrency indexes fell significantly. CNBC’s Scott Schnipper said on Monday that the “S&P 500 is now in an official bear market, according to S&P Dow Jones Indices.”

Precious metals like gold and silver dropped in value as well, as gold’s price per ounce slipped 2.67% and silver dropped 3.58%. The crypto market lost 18% over Monday, and BTC fell below $21K. The Federal Open Market Committee’s (FOMC), meeting is currently the focus of all attention. Members of the Federal Reserve System will likely raise the federal funds-rate.

Modest increases could be anywhere from 25 to 50bps. The Fed could increase rates by as much as 75 to 100 basis points at the next meeting. some are predictingIt is possible to increase the benchmark rate by 75 basis point. CME Group data showed last week that 95% of investors believed the Fed would increase the benchmark rate by 50bps. Michael Feroli, a JPMorgan economist believes that a 75-bps rise is possible and that 100 bps are also possible.

Feroli told clients in a note on Monday that a “startling rise in longer-term inflation expectations” may push the Fed to increase the rate by 75 basis points on Wednesday. “One might wonder whether the true surprise would actually be hiking 100bp, something we think is a non-trivial risk,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Surprise Could Happen

Feroli’s Goldman Sachs economists are in agreement with him. They believe that the FOMC will announce a 75 basis point hike. “Our Fed forecast is being revised to include 75 bps hikes in June and July,” Goldman economists explained on Monday.

The Goldman Sachs analysts’ note to investors adds:

In 2023, we anticipate another rate increase to 3.75-4%. Then in 2024, one reduction to 3.5-3.755%. For a 3.25-3.5% terminal rate, we expect a 50bp rise in September. We also anticipate 25bp increases for November and December. The median dot should be between 3.25-3.5% by the end of 2022.

Meanwhile, despite Feroli’s 75 bps prediction, JPMorgan’s Marko Kolanovic told the press that the U.S. will likely avoid a recession. The strategist at JPMorgan Chase & Co. explained that Fed may act dovish going forward due to the craziness in bond markets and stock markets as well.

“Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower,” Kolanovic’s note to clients detailed on Monday. “However, we believe rates market repricing went too far and the Fed will surprise dovishly relative to what is now priced into the curve,” the JPMorgan strategist added.

How do you feel about the FOMC meeting next week and the rate increase? Is it going to be more aggressive than you expect? Are you expecting a surprising dovish turn? Comment below to let us know your thoughts on this topic.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.