Crypto markets accepted the depegging and subsequent spiral downward of LUNA. Both of these factors had an impact on Bitcoin’s price as well as the whole digital asset spectrum. According to a recent report by the Glassnode team, the Bitcoin market has been trading lower for eight weeks, making it the ‘longest continuous series of red weekly candles in history.’

The same picture was painted by Ethereum, an altcoin that is most widely used. Directly or indirectly, bearish fluctuations can damage profits and returns.

Derivative markets are forecast to show more falls in the next three-to six months.

Bitcoin is in for more pain from derivative markets

Derivat markets predict that the market will continue to fall in the three to six months ahead. According to the report, blockspace demand for Bitcoin and Ethereum has fallen to multi-year lows and EIP1559 is burning ETH at an all time low.

Glassnode predicted that there will be headwinds on the demand side due to low price performance, uncertainty in derivatives pricing and very low block-space demand on Ethereum and Bitcoin.

Here’s what the report says:

On-chain can be seen that the demand for Ethereum blockspace and Bitcoin has dropped to multi-year lows. The rate at which ETH is being burned via EIP1559 also shows a remarkable drop.

Poor price performance combined with fearful derivatives pricing makes it clear that demand is expected to remain weak.

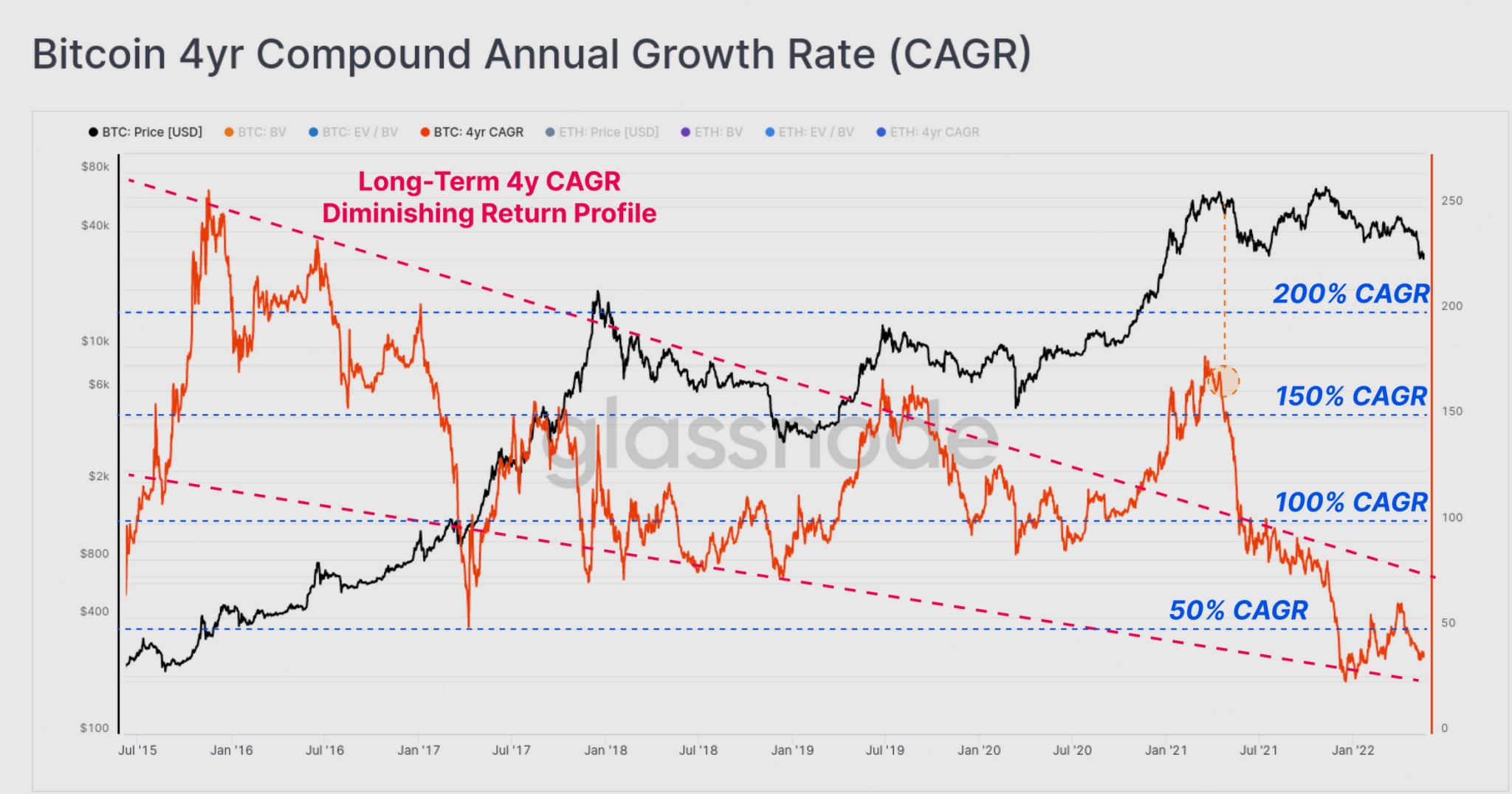

Both Bitcoin and Ethereum’s price performance over the last 12 months has been disappointing. As a result, the CAGR rates long-term for Ethereum and Bitcoin have suffered.

Glassnode

BTC was the most popular cryptocurrency. It moved during a bull-bear cycle that lasted approximately 4 years. This period often included halving events. Looking at the long-term returns of BTC, you will see that it has fallen from close to 200 percent in 2015 down to under 50 percent as this writing.

Similar Reading: New Data shows China still controls 21% of the global Bitcoin mining hashrate| New Data Shows China Still Controls 21% Of The Global Bitcoin Mining Hashrate

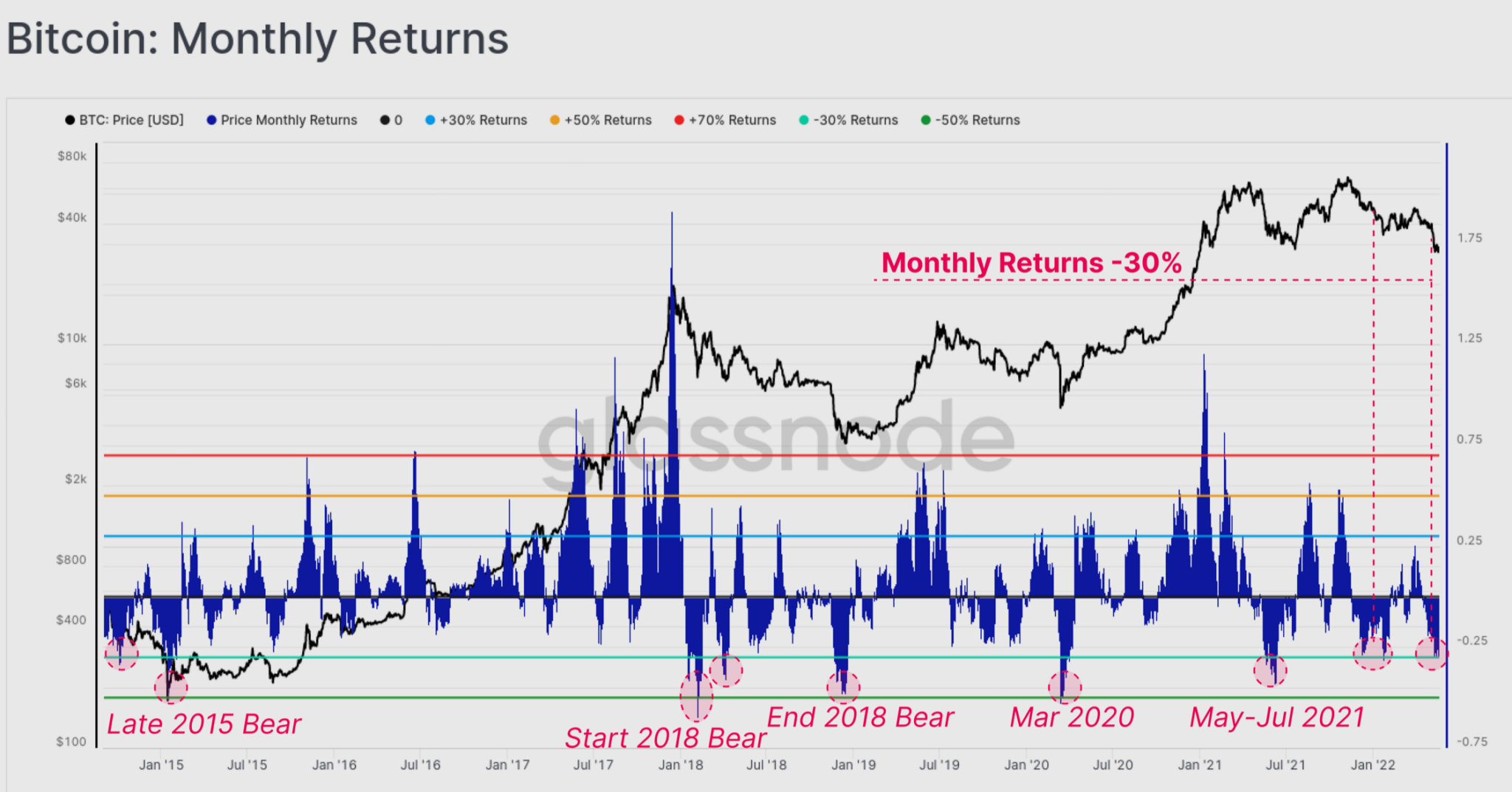

Bitcoin also had a negative 30 percent return in the short-term, which means it was unable to recover by an average 1% per day. Bitcoin’s negative return was very comparable to other bear markets cycles.

Glassnode

The altcoin did worse in ETH than BTC when it came to ETH. Ethereum’s monthly return profile revealed a depressing picture of -34.9 percent. Ethereum appears to see diminishing returns over the long-term.

Additionally, over the last 12 months the CAGR (4-year) for each asset has declined from 100% down to just 36% for BTC. ETH also rose 28 percent in a year, highlighting how severe this bear is.

The derivative market also warned about future market drops. In the coming three to six months, options markets will continue to reflect near-term uncertainties and potential downside risks. In actuality, implied volatility increased dramatically during the last week market selloff.

The total crypto market capitalization is $1.2 Trillion. TradingView

Glassnode’s analysis concluded that crypto investors and traders are suffering from the bear market. Glassnode’s team stressed the fact that markets can often get worse before getting better. However, ‘bear markets do have a tendency of ending’ and ‘bear markets author the bull that follows,’ so there is some light at the end of the tunnel.

Related Reading| TA: Bitcoin Price Stuck In Key Range, Why Dips Might Be Limited

Featured Image from iStockPhoto and Charts From Glassnode.