BlackHoleDAO offers a decentralized asset-management protocol based upon DAO governance. “BlackHole DAO Protocol (BHDP)” is a brand new standardized model constructed based on DeFi 3.0. The BHDP burn model, which draws on DeFi 3.0’s stock split and stock merger in the traditional stock exchange, corrects market imbalance between high inflation and low inflation. The DAOs credit-based loans service is also available.

1.0 BHDP Components

Highlights from 1.1 BHDP

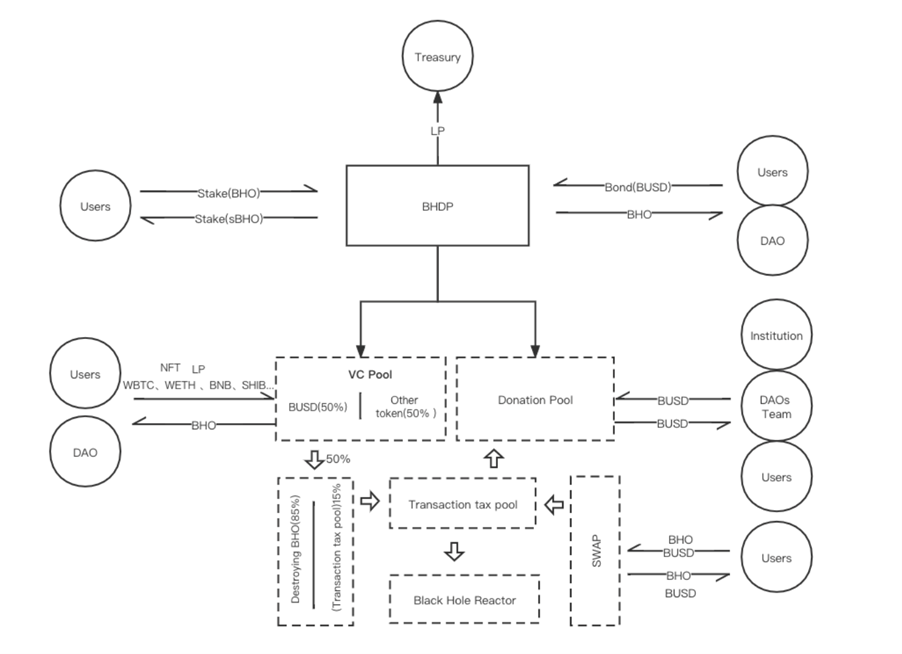

The above image shows that BHDP (BlackHole Dao Protocol) is being supported by a Treasury. It uses smart contracts to link VC Pool with Donation Pool. VC Pool is able to support multi-asset investment certificates. A portion of this can be burned in liquidity pool for BHO, and credit loans are made after DAOs investments succeed.

3 BHDP Ways to Deflate:

- This is an easy way to directly burn 60% of the transaction taxes

- The liquidity pool also burns 50% of the VC Pool.

- When extreme inflation occurs, the BHDP extreme-deflation mechanism will kick in.

The deflation mechanism is activated when the stock (BHO), in the market, reaches a specific amount with a 0. support rate. As the stake rate falls, it will slowly decrease.

X-[X/(Y*H)]=Z

x is the amount that will be burned when the mechanism has been triggered

y: Burn rate

h: Hours (days).

When the support rate exceeds 0

2.0 Olympus Stake, Bond: Wise Use

2.1 The Evolved Share and Bond

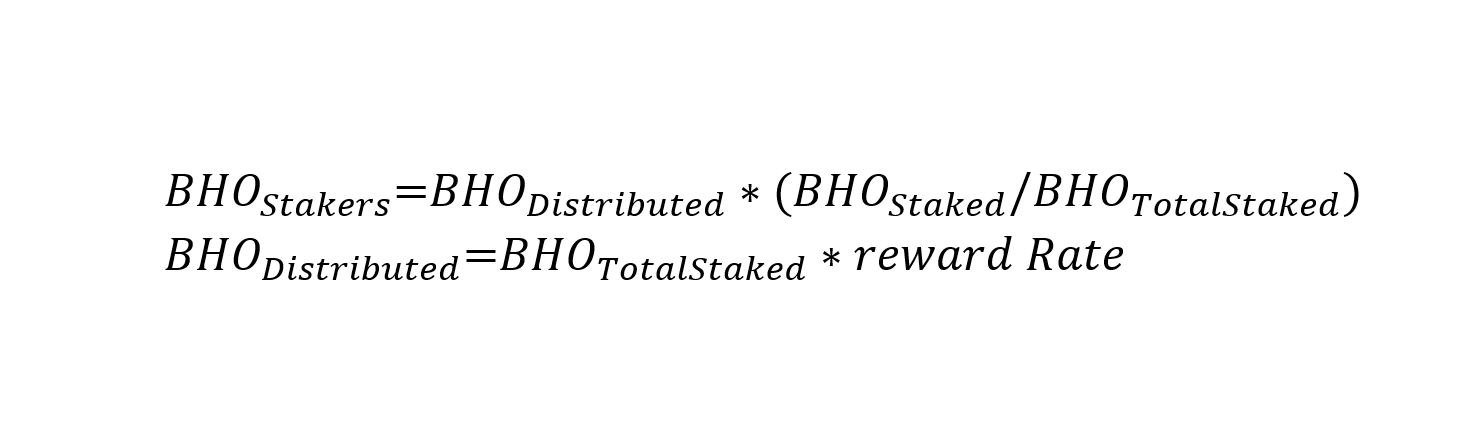

BlackHole DAO Stake controls minting dynamically by the percentage of total stake amount. The market will be in inflation so the staking amount will drop, and in deflation it will go up. It will not exceed the total stake amount. Dynamic regulation’s advantage is that this transaction in the free market prevents any collective behaviour from fleeing after making profits.

You can stake your reward as:

Improvements:

Improvements:

- Olympusdao has the ability to issue tokens 24/7, while BlackHole DAO adjusts the amount of tokens that are minted dynamically according to the inflation rate. The proportion of Bond-minted BHO will drop if there is a high inflation rate. Bond will cease minting after a support rate of 0

- Olympusdao offers a 15% discount on Tokens, while BlackHole DAO provides the exact same price as the market, with a 15% transaction tax.

The most important point about both options is that Bond, when its market circulation value equals the Treasury value, does not continue to mint. This indicates that, before inflation occurs, Bond’s minting will slowly decrease, stopping further asset shrinkage.

2.2% VC Pool With All Vouchers

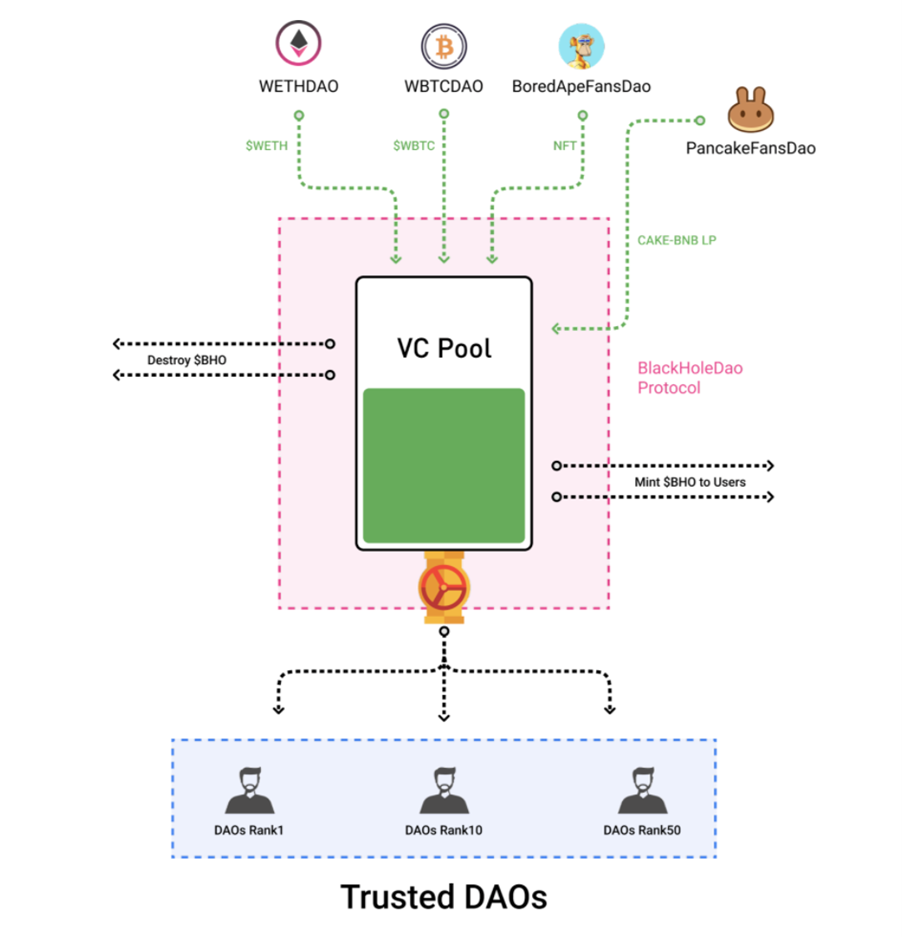

According to the official document, it is defined as a “VC pool with vouchers”. The document describes: Every project Token entering VC Pool is subject to rigorous review. It will be screened to identify malicious behaviour that could cause the long tail effect to disappear on potentially valuable assets.

It is clear that VC Pool is an asset management business. With the final stock reflected as the intrinsic value for VC Pool.

VC Pool can accept such precious vouchers as NFTs, stablecoins, liquidity LPs and NFTs. These vouchers are accepted up to a specified amount in VC Pool and will be used to group LP and to provide liquidity as well as LP loan services for the third party. To support the stock’s circulation value (BHO), all earnings claimed will be entered into the VC Pool. VC Pool can also be used as a credit pool. It is bound to the DAOs Community and uses the DAOs protocol to build credit. Then, the DAOs community will issue credit loans based on the accumulated credit.

VC Pool also plays a role as a regulator in BHDP

- Deflation means that the share of the stock (BHO), minted via VC pool, will rise

- The inflation rate will be lower if the stock (BHO), minted by VC pool is less.

- BHO minted via VC Pool and entering VC Pool are 50% of assets. The liquidity pool will burn the remaining BHO. Half of the assets remaining will be used to fund community credit loans and DAOs.

3.0 Reverse Investment for Diverse Customers

3.0 Reverse Investment for Diverse Customers

Institutions of Investment

Investments start at 10,000 US Dollars. You will receive transaction tax earnings (BUSD+BHO), 10% until you double your investment.

DAOs Community

Investments start at 1000 USD. Earnings from transaction taxes (BUSD+BHO), 3%, and up to double are possible. At the end of your return period, earning ceases.

Individuals

An investment of 100 USD is possible to earn earnings from transaction tax (BUSD+BHO),2% up until your investment doubles. At the end of your return period, earning ceases.

Reactor for 4.0 Black Hole

The Black Hole Reactor’s nature is very similar to that of its prize pool, which was set at various stages. A prize pool is opened when a given condition has been met. Funds are generally 60% of tax. When the market circulates reaches 10 million billion BHO, and the amount of the reactor reaches 100 millions BUSD the reactor will be open. It’s certain that the amount varies depending on the stage of the reactor, and the amount of the reactor in the second stage maybe 1 billion BUSD.

There are some exceptions to the rule that allow you to open the reactor for special purposes.

- When the Blackhole Protocol triggers, the market circulatory mechanism will activate the reactor. The final deflation is to be at 10 billion BHO.

- No matter what, the Black Hole Reactor is expected to be open in 3 years.

- The Black Hole Reactor will then be open and it will cease minting.

More detailEd article:https://blackholedao.substack.com/p/interpretation-of-new-defi-30-blackholedao?s=w