India’s government has announced that a bill on cryptocurrency will be considered at the next session of Parliament, which begins next week. This bill would ban cryptocurrencies, with certain exceptions. This bill also provides a framework to allow the Reserve Bank of India (RBI) to issue a digital rupee.

Indian Government presses for crypto legislation before year-end

The Indian government has listed a cryptocurrency bill to be taken up in the winter session of Lok Sabha, the lower house of India’s parliament, according to the legislative agenda for the upcoming session released Tuesday.

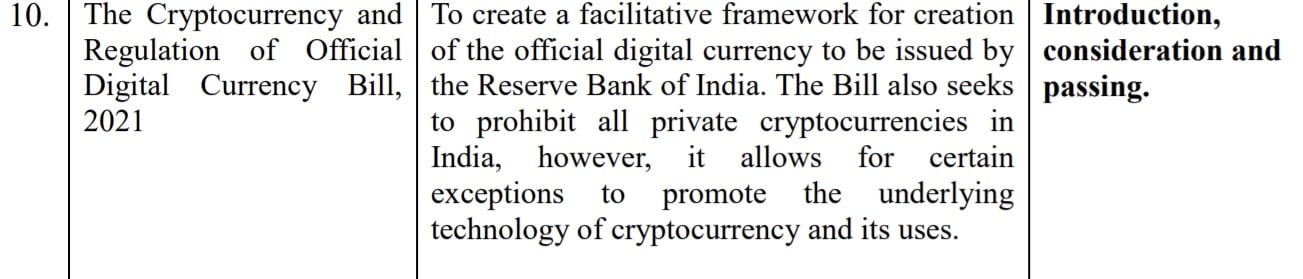

The title of the bill is “The Cryptocurrency and Regulation of Official Digital Currency Bill 2021.” The government expects it to be introduced and passed in the same parliamentary session, which is set to commence on Monday, Nov. 29, and will conclude on Dec. 23.

According to the government’s description, the bill aims “To create a facilitative framework for creation of the official digital currency to be issued by the Reserve Bank of India. The bill also seeks to prohibit all private cryptocurrencies in India, however, it allows for certain exceptions to promote the underlying technology of cryptocurrency and its uses.”

The Indian government is listing a second cryptocurrency bill for parliament. A crypto bill was proposed by the government for the January budget session. The bill was not adopted. It is identical to the list for parliament’s budget session in terms of title and description.

Tanvi Ratna CEO at Policy 4.0 commented on Tuesday’s news that the Indian government had published the crypto bill.

Yes, it’s expected that the government will pass legislation in this session itself. But it might not contain all of the legislation.

She added: “Operational & implementation questions are likely to be debated in the budget session only.”

Ratna is convinced that cryptos like bitcoin (BTC), ether (ETH), could be legalized in one form or another. Noting that “The exemptions that are being mentioned are ones routed through GIFT City,” she clarified:

Private cryptocurrency is not privacy coins, but non-rupee currency. There is a possibility that basic coins, such as BTC or ETH, could be accepted in some form.

According to Reuters, a top government official said Tuesday that they plan to end private cryptocurrency assets and open the door for a new digital currency central bank (CBDC).

Previous statements by the RBI have indicated that they are working to create a digital rupee. This is likely to happen in stages. The central bank repeatedly stated that they have major concerns regarding cryptocurrency.

Indian crypto experts advise investors to not panic-sell, as the crypto bill is not yet public.

One bill has not been published is the one that was originally drafted in the IMC by Subhash Chaudra Garg (ex-Finance Secretary). Published in July 2019, the title of that bill was “Banning of Cryptocurrency & Regulation of Official Digital Currency Bill 2019,” which is slightly different from the one listed to be taken up in the upcoming session of parliament.

As the cryptocurrency ecosystem has changed significantly since Garg’s bill was first published, the Garg committee bill has come to be seen as out of date. Garg admitted to having seen crypto more as a currency than an asset when the bill was written. Now, he believes crypto assets should have regulation. “Regulate, control cryptocurrencies but allow the crypto assets, encourage the crypto services,” the former finance secretary said in May.

Indian Prime Minister Narendra Modi exhorted all democratic countries last week to collaborate on Bitcoin and Cryptocurrencies to make sure they don’t fall into the wrong hands. He presided over a meeting about crypto. Furthermore, India’s Parliamentary Standing Committee on Finance held a meeting with representatives from the crypto industry.

Is India going to ban crypto currencies like bitcoin or ether? Please comment below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.