In a report revealed on Saturday, the Worldwide Financial Fund (IMF) has warned that an ongoing struggle in Europe and related sanctions may have a “extreme affect on the worldwide financial system.” The IMF’s report says there may be “extraordinary uncertainty” within the air, and the worldwide monetary establishment believes “financial penalties are already very severe.”

IMF’s Financial Outlook Amid Ongoing Warfare in Europe Predicts Inflationary Pressures, Provide Chain Disruptions, and Value Shocks

With a disaster taking place on the planet, many analysts and economists are involved in regards to the world financial system and the aftermath of the warfare happening in Ukraine. Moreover, Russian sanctions are being mentioned or carried out day by day by a big amount of nations throughout the globe.

On Saturday, the IMF issued a workers assertion in regards to the financial affect of the struggle in Ukraine after the manager board met on March 4. The report notes that the assembly was chaired by the IMF’s managing director Kristalina Georgieva. The IMF’s outlook will not be nice and the worldwide monetary establishment has observed the vitality and commodities increase final week.

All of this has added to “inflationary pressures from provide chain disruptions” and it might sluggish the Covid‑19 pandemic rebound, the IMF’s report particulars. “Value shocks will have an effect worldwide, particularly on poor households for whom meals and gas are a better proportion of bills,” the IMF’s assertion provides.

The IMF’s report explains war-related points might additional trigger financial fallout throughout a myriad of nations. “Ought to the battle escalate, the financial injury can be all of the extra devastating — The sanctions on Russia may also have a considerable affect on the worldwide financial system and monetary markets, with important spillovers to different international locations,” the IMF communications division assertion notes.

Gold Continues to Rise, US Futures Markets Slide, Crypto Economic system Slips Extra Than 3% in 24 Hours

The statements from the IMF revealed on Saturday comply with the latest alerts of a pending recession, and one analyst who famous the financial fallout could possibly be “10x worse than the Nice Despair.” Inflation has been on the rise, and buyers are fearful about hawkish central banks elevating rates of interest and tapering massive asset purchases. Extra particularly, the U.S. Federal Reserve is predicted to boost the benchmark rate of interest, however individuals some predict the continued battle in Europe could stop this from taking place.

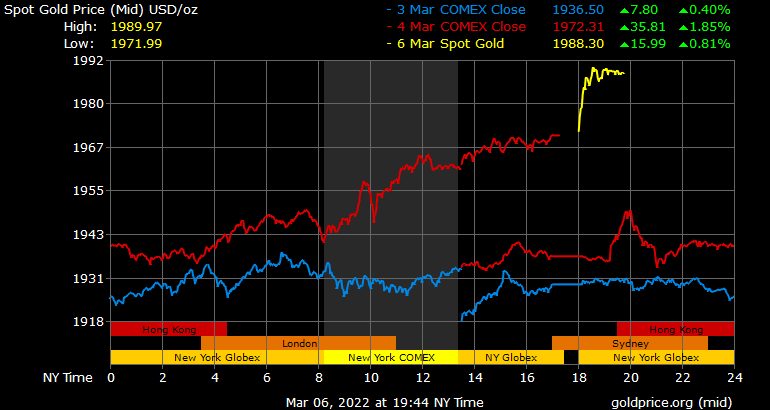

In the meantime, the value of a single ounce of .999 high quality gold has risen 0.84% over the past 24 hours, reaching a excessive of $1,989 per ounce on March 6. On Sunday night (EST) Dow Jones futures dropped considerably, alongside declines stemming from Nasdaq futures and S&P 500 futures. Equities markets are anticipated to get roiled on Monday and the worldwide cryptocurrency market capitalization on Sunday slid in worth. At 8:00 p.m. (EST) on Sunday the crypto financial system is down $1.8 trillion, recording a -3.2% change over the past 24 hours.

The IMF famous that there was crucial infrastructure injury in Ukraine. Final week, the IMF defined that the nation has $2.2 billion obtainable between now and the tip of June. Furthermore, World Financial institution Group, the group of 5 worldwide entities that makes leveraged loans to international locations, is “getting ready a $3 billion package deal of assist within the coming months,” the IMF detailed on March 1.

You’ll be able to assist Ukrainian households, youngsters, refugees, and displaced individuals by donating BTC, ETH, and BNB to Binance Charity’s Ukraine Emergency Reduction Fund.

What do you concentrate on the IMF’s report in regards to the world financial system amid an ongoing struggle? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.