WAVES is an open-source and decentralized decentralized Blockchain protocol that supports decentralized solutions. Users can also create custom tokens operations on the platform. Users can create digital tokens that are cryptographically secure and then swap them without having to program smart contracts.

WAVES is the protocol’s inflationary token, with a market capitalization of at least $1 billion, according to data on CoinDesk. It rose to $30 in March 2022 from $20, and has made it onto the market-value top 50 list.

Dubbed as “the Russian Ethereum,” the Waves protocol has been around since 2016 and has achieved this growth without any venture capital funding. Waves founder Sasha Ivanov has revealed his Ukrainian background in a conversation with Bloomberg after the price of the WAVES token skyrocketed partly thanks to the project’s Russian roots.

Learn everything you need about Waves and the WAVES token. Also, learn how to get WAVES coins.

Let’s jump right in!

Waves: What is it?

Waves, a blockchain platform with multipurpose capabilities, allows for the creation and deployment of crypto tokens known as smart assets. It also allows smart contracts to be deployed that can power various decentralized apps (Dapps).

The smart assets could represent anything including real-world properties and other cryptocurrency. These can all be traded or bought in Waves.

WAVES is the Waves decentralized platform’s native token. To run their applications, users pay fees with WAVES tokens. Tokens can be used to generate new tokens, or for rewarding users with stakes.

The value of Waves and its businesses is what affects WAVES’s price. It’s also influenced by the cryptocurrency exchange market prices and strategic global macro factors, such as central bank interest rates for fiat currencies.

Waves Platform

Waves, a cryptocurrency platform allows you to create all types of blockchain-based apps. Waves’ platform facilitates the creation, storage, management, trading, and analysis of digital assets and enables transferring as if they were “attachments” to new transactions on the blockchain. Waves users are able to create their own ICOs worldwide in minutes. This allows them to raise funds for projects. Waves fully supports both crowdfunding and decentralized trading. Waves users can use both cryptocurrency and fiat currencies to participate in the platform. Waves Platform mining uses the Proof-of–Stake method.

The network was designed to appeal to business partners interested in finding blockchain solutions to their enterprises’ challenges and issuing their own fiat currencies.

Waves is a platform that includes Waves DEX (decentralized cryptocurrency exchange) and Waves wallet (crypto wallet). Waves wallet is able to store a variety of cryptocurrencies. It also allows users the ability to trade on DEXs, deposit, store and trade them. Waves DEX will allow users to trade WAVES and bitcoin directly with other Waves tokens on a peer–to-peer basis. It’s one of the fastest decentralized cryptocurrency exchanges globally and enables fast transactions and secure settlements on the blockchain with low fees. This platform incorporates an automated matcher, which allows you to place buy-sell orders. Once orders have been fulfilled, the tokens can be exchanged.

How do waves work?

Waves is secured by the Leased Proof of Stake (LPoS) consensus mechanism, which is a modified version of Proof-of-Stake (PoS) that allows lite nodes to participate in the block validation process by leasing their WAVES tokens to mining nodes (A lite node is a form of cryptocurrency wallet that, unlike a full node, doesn’t require downloading the whole blockchain to operate).

Users can rent Waves to miners nodes and earn a share of the block reward, if they are selected as validators.

The Waves LPoS blockchain

Waves is a blockchain network that aims at achieving distributed consensus and securing the network using the Leased Proof of Stake consensus algorithm. The leased tokens can be used by nodes that have a minimum balance of 1000 Waves in order to generate blocks or receive mining rewards. LPoS is a way for token holders to rent their tokens and receive a share of the payment.

When leasing, the only thing to consider is to choose the right node operator, as the operator’s node may work with different efficiency and send back different percentages as rewards. Fair Proof of Stake will be used for selecting a miner who will create the next block.

Waves-NG

Waves-NG is the protocol that chooses which node has the privilege to generate the next block, and it’s a variation of an idea that was initially suggested (but rejected) for Bitcoin (BTC). Waves-NG divides the Waves blockchain into two sorts of blocks: “key blocks” and “micro blocks.” A Proof-of-Stake miner is chosen randomly to create key blocks. The public key found in the block can be used by other nodes for large numbers of micro-blocks containing transactions.

Smart Assets

The capacity to generate ‘Smart Assets,’ tokens with an associated script written in Ride, a Waves-native programming language, is key to the Waves network. Any token can have functionality by adding a script. The scripts’ execution costs 0.004 WAVES.

Waves allows you to easily create transaction attachments. Tokens are used for subsequent transactions. Different transaction types can be added to the blockchain using plug-ins.

What’s the Waves Exchange?

Waves Exchange (previously Waves DEX), is a decentralized trading site for Waves assets as well as other supported cryptocurrencies, such Bitcoin (BTC), and Litecoin. It also includes a variety of Neutrino powered fiat stablecoins such as GBP Neutrino(GBPN) or EUR Neutrino [EURN].

Waves Exchange bills itself as the world’s “safest cryptocurrency exchange” and “fastest DEX,” with exceptionally low transaction fees—at only 0.003% for each filled order. It doesn’t need customers to hand over custody of their assets while trading.

Waves Exchange offers simple crypto trading capabilities, as well as the ability to stake assets and earn variable APRs. It also provides credit card purchasing tools for Bitcoin (BTC), and USD Neutrino ($USDN).

What is the Neutrino Protocol?

Neutrino Protocol is Waves’ flagship decentralized application and by far the most popular DApp on Waves. It’s a technology that allows users to issue stablecoins and other synthetic assets quickly. Stablecoins can be pegged to fiat currencies like the US Dollar (USD Neutrino), the British Pound sterling, and the Japanese Yuan (JPY Neutrino), among others. Contrary to traditional stablecoins such as USD Coin which are directly collateralized by the underlying currency (GBP Neutrino), and Japanese yen (JPY Neutrino), Neutrino synthetics can be collateralized using crypto assets such WAVES tokens.

Neutrino Protocol is controlled by holders of Neutrino Token (NSBT), who can influence the protocol’s parameters and future development by voting on Neutrino’s governance platform.

The Neutrino Protocol also provides a feature known as ‘Decentralized Forex,’ which is the decentralized trading of the Neutrino Protocol’s price-stable assets and can be accessed using Waves Exchange.

Wo to buy waves

When purchasing Waves coins, there are three choices: A cryptocurrency Exchange, Waves DEX or the Waves Client.

Waves is one of the most popular digital currencies and it’s supported by all major cryptocurrency exchanges. This includes the Binance exchange. Here is a listing of cryptocurrency exchanges that offer Waves support to assist you in getting started.

Webull

Webull was launched as a mobile, app-based brokerage in 2017. You can trade stock or ETFs without commissions. The platform is regulated by the Securities and Exchange Commission (SEC) and FINRA in the United States, and it’s even protected by the SIPC scheme, which covers investors up to a total of $500,000.

Transactio allows users to make transactions starting at $1. There are also no transaction fees. Webull, however, charges a 100bps (1%) surcharge on the value of your asset. With Webull, you can purchase Bitcoins and all other crypto currencies including WAVES. You can also use advanced charting features and technical indicators that are suitable for different levels of skill. It is simple to use, and it has 2-step authentication for increased security.

Paybis

Paybis, which is located in Glasgow in Scotland, is a global cryptocurrency trading platform that supports over 50+ coins, as well as WAVES. It’s a good alternative for individuals who travel regularly and want to buy or sell cryptocurrencies from wherever they are.

Paybis is a broker that serves its customers. It doesn’t presently offer any cryptocurrency wallets on the exchange, but it intends to do so in the future. It is essential that customers are familiar with cryptocurrency and how to transfer funds to external wallets.

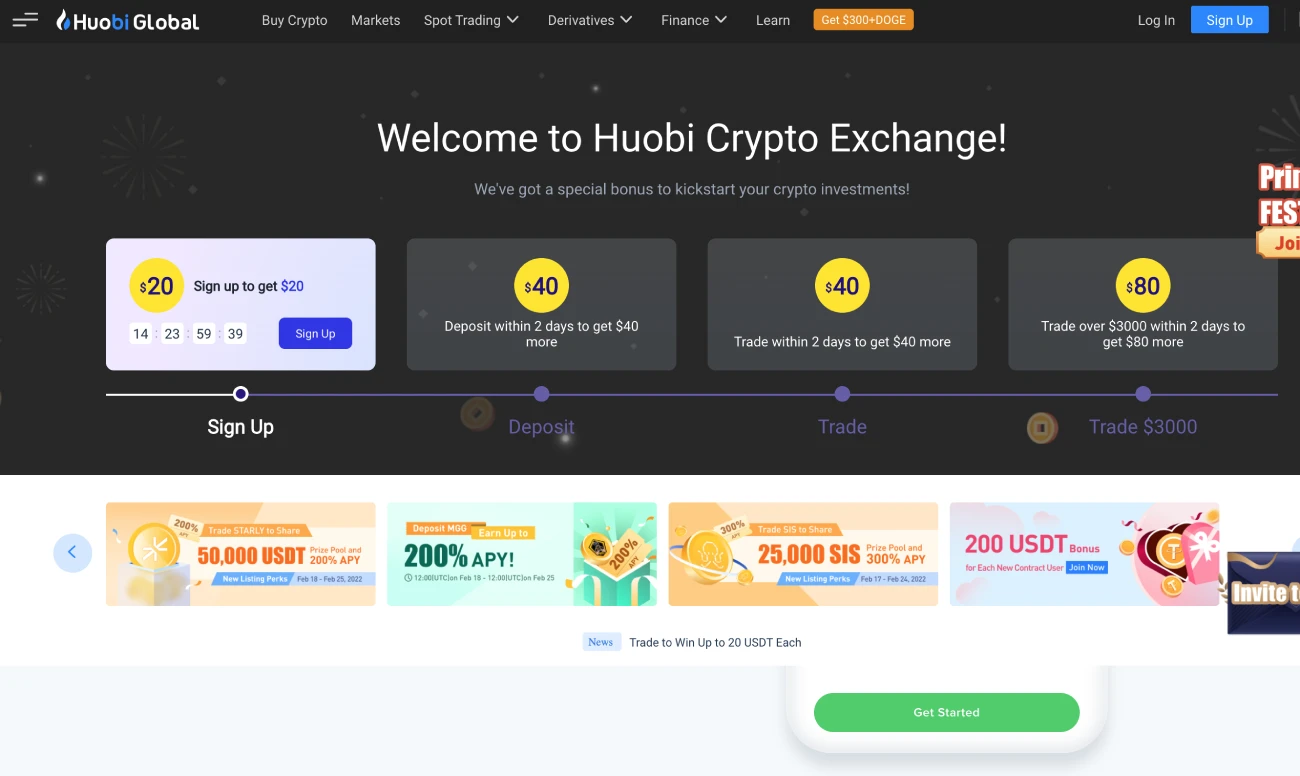

Huobi Global

Huobi Global launched in 2013. It has grown to be one of the most important cryptocurrency exchanges worldwide with an annual trading volume exceeding $1 trillion. Huobi Global has more than 5 million users in 130 countries. This exchange accounts for over half of all global digital asset transactions. Huobi Global doesn’t accept citizens of the United States or Canada.

Coinbase

Coinbase is America’s biggest cryptocurrency exchange. It supports over 100+ coins including WAVES. Coinbase’s fees, on the other hand, are perplexing and far higher than those of its competitors. While Coinbase’s security features are appealing, cryptocurrency trading is highly volatile, so be sure to assess the risks.

Residents of the United States, except Hawaii, can trade on this exchange.

eToro

eToro, one of the largest financial service platforms worldwide, is a very popular choice. You can access a variety of assets and cryptocurrencies, including WAVES, major cryptocurrencies, such as Bitcoin, Ethereum and Litecoin.

eToro customers have many benefits including commission-free trading and a fast account opening process. There is also an Imitate Trading feature which allows you to mimic the movements of top traders around the globe. It does not support all base currencies and will charge a $10 fee for inactivity after one year.

eToro charges very reasonable fees that are comparable to other exchanges within the digital assets sector. There are no fees to buy Waves coins. The broker will charge you a 0.5% Forex fee when you make a deposit, and it’s pretty straightforward to deposit and withdraw funds. PayPal, Neteller, debit cards, and Neteller are all accepted payment options.

How to Purchase Waves

Waves is unique. Follow our step-by-step guide to purchase WAVES coins.

Let’s get started.

Step 1: Choose a Cryptocurrency Exchange

It is important to compare different cryptocurrency exchanges in order to find one that offers Waves support and best suits your investment goals. You should also consider trading fees, support deposit methods, customer service, ease-of-use, local requirements, and other features.

Step 2: Open an account

Once you’ve selected a trustworthy cryptocurrency exchange, you can open an online account to purchase WAVES. You need to enter your email address, create a unique username, and set a strong password on your account using the exchange’s recommended guidelines.

The platform that you select will have different requirements. Most platforms will require additional information such as your name, contact number, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID.

You may need to be able to access your bank account and deposit money in fiat to buy WAVES tokens.

Once you’ve undergone the verification process, you can also enable the two-factor authentication system (2FA) to add an extra layer of security to your account.

Step #3: Fund Your Account

The next step after setting up an account is to deposit funds in order to buy Waves coins or other cryptocurrencies. It is possible to use your bank account or debit/credit cards, as well as Cryptocurrency via another cryptocurrency wallet. The location of the trade platform and your preference will dictate which payment method you use.

It’s beneficial to link your debit card to your crypto account because it allows you to make instant or recurring transactions, but be aware that there may incur an additional fee. Transfers from a local bank account are usually free, but you should double-check with the platform you’re using.

Step 4: Optional purchase of a wallet

For Cryptocurrency storage, it is strongly recommended that you set up a private wallet and have your own keys. You can choose between two kinds of crypto wallets depending on what you invest.

Hardware wallets, or cold storage, are physical devices that hold the keys necessary to send and receive Cryptocurrency. Because they offer offline storage, hardware wallets can be considered the most secure way to keep your Cryptocurrency. This reduces the risk of theft. You can password protect them and they will erase all data after multiple failed attempts, which prevents physical theft. Additional security is provided by hardware wallets that allow you to confirm and sign transactions on the Blockchain.

Ledger wallets have been voted the safest hardware wallets by users at all levels. Ledger NanoX is the best choice for crypto traders who need to store a large number of assets including Waves tokens.

Software wallets, on the other side, are the easiest to use and allow you to interact with many decentralized financial (DeFi) apps. Software wallets can be vulnerable to security issues because they are online. To avoid security problems, ensure you do your research before selecting a wallet. As an additional layer of security, we recommend that you use a platform with 2-factor authentication.

You can also create a Waves digital wallet by visiting the Waves platform and choosing the “Get Waves” option on the homepage. The following will guide you through setting up an account and creating a digital wallet.

Step 5: Buy Waves

After you’ve funded your account, go to the convert page of the trading drop-down menu to convert your crypto or fiat currency to WAVES. From the drop-down menu, select the currency that you would like to convert and enter the WAVES code for the cryptocurrency. Select the number of coins you wish to purchase, click ‘Exchange now,’ and you’ll then be asked to enter your wallet address. Your wallet will soon be filled with WAVES tokens.

You can also place limit orders that allow you to set the price you wish to purchase Waves (WAVES). Trades will be completed only when Waves reach your preferred price, or lower.

Here are some things to consider when buying waves

Due to the speculation nature of the cryptocurrency markets, there are inherent risks when trading in them. This accounts for volatility in their prices. Before buying Waves coins, consider the following:

Supply:WAVES claims to have a supply total of 100,000,000.

The Waves Platform’s Objectives: The WAVES team was designed to appeal to businesses interested in finding blockchain solutions to their enterprises’ challenges and using the blockchain for their own objectives, such as crowdfunding and loyalty programs. Waves DEX allows companies to use their Waves wallet, their WAVES tokens, and swap, release and mine their tokens. Waves platform is designed to open the blockchain to all and remove any obstacles to developing blockchain-based applications.

Performance:You should research the trends behind the rise and fall in WAVES prices before you buy them. But, past WAVES performance is not a guarantee for future success.

Selling Waves

You can cash out your WAVES coins with the same exchange by placing a sell order:

1. Log in to the exchange for WAVES.

You can compare cryptocurrency exchanges to buy your WAVES tokens if they are kept in a digital pocket.

2. Make a purchase order.

Choose the number of Waves you wish to sell.

3. Finalize your transaction

Confirm your sell price, fees, then close the deal on WAVES tokens.

Closing Thoughts

Waves allows you to create your token easily and utilize basic blockchain capabilities. Waves is a platform that investors can use to create a loyalty token or crowdfund. The platform has been enhanced with smart contract functionality. This makes it a more competitive platform for third-party developers of decentralized apps (DApps).

Waves’ ease-of-use is another advantage. Anyone can create a token personalized with just a few clicks. Waves Exchange, Neutrino protocol and Waves Exchange have been two of Waves’ most successful platforms.

Waves 2.0 is being transitioned to Waves. Waves 2.0 will allow applications to connect with the Ethereum Virtual machine (EVM), allowing them to power smart contracts. Waves 2.0 will be more compatible with the Ethereum Virtual Machine (EVM), making it easier to interoperate with major blockchains such as Ethereum.

If the Waves team continues to improve the network’s speed and usability, the platform will significantly grow in popularity.

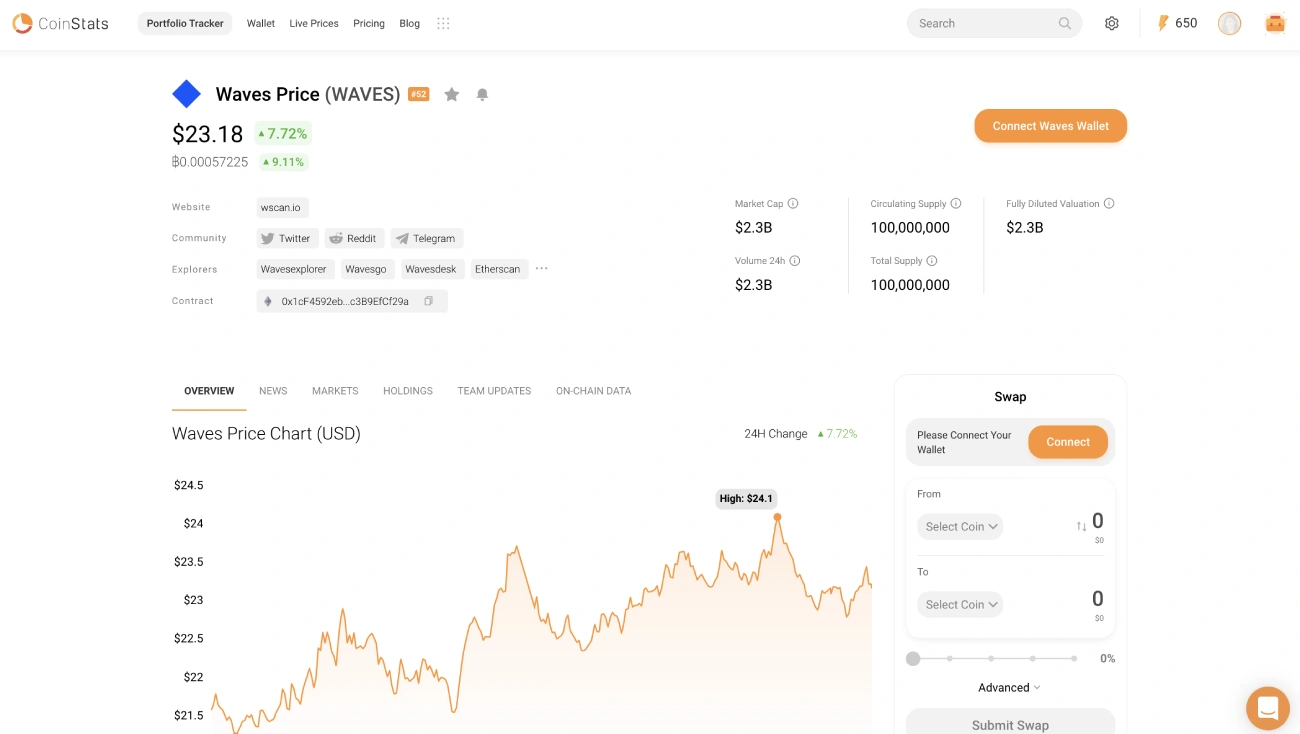

Platforms such CoinStats enable you to easily purchase Waves using fiat currency. The CoinStats Blog provides valuable information on wallets, cryptocurrency exchanges. Portfolio trackers and tokens are also available. We have detailed buying guides that explain how to purchase various crypto currencies such as DeFi, Dash, Bitcoin, and more.

Information about InvestmentsThis website contains information that is intended to be informative. It does not recommend you to purchase, sell or hold any financial products or instruments. This information does not constitute an endorsement of Cryptocurrency.

High risk investments can lead to loss of principal and other consequences. The market for cryptocurrency can be volatile and subject to secondary activity. Make sure you do independent research before investing. Get your own advice. CFDs can be complex and trading stocks and cryptos comes with significant risk. CFD trading can cause losses of between 74-89% in retail investor accounts. Before making an investment, you should carefully consider your situation and seek advice. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.