Uniswap uses Ethereum to create an innovative, decentralized exchange protocol. It aims to solve decentralized exchanges’ liquidity problem by allowing the exchange platform to swap tokens without relying on buyers and sellers creating that liquidity. Uniswap incentivizes Uniswap users to maintain the exchange’s liquidity, providing portions of the transaction fees and newly minted UNI tokens to those who participate.

UNI token is used to fund Uniswap. It’s a governance token, so owners can participate in decisions on network upgrades and policies, with each vote being proportional to the amount of UNI cryptocurrency they stake.

Learn everything you need about the Uniswap Project, the UNI token, as well as how to invest in UNI.

What is Uniswap? (UNI)

Uniswap works with the Ethereum blockchain to create a decentralized cryptocurrency exchange (DEX) called Uniswap. This cryptocurrency exchange was established in 2018, and it is currently the 2nd-largest in terms of global market capitalization.

Uniswap, an Automated Liquidity Protocol that allows trading ERC20 tokens, is called Uniswap. Uniswap is a public-benefit exchange that does not charge trading fees. This allows token exchange without intermediaries and achieves high levels of decentralization.

Uniswap works through contracts embedded into its protocol. It uses an introductory number statement, tokens and ETH supplies to perform a similar task.

Liquidity providers create liquidity pools across the platform that allow users to swap seamlessly between any ERC-20 tokens, without having to open an order book.

Uniswap is not a centralized platform and there’s no listing procedure. ERC-20 tokens of any size can be used to trade on the Uniswap platform provided that there is a liquidity source. Uniswap doesn’t charge listing fees and is therefore essential for smaller ERC-20 projects.

Uniswap lets users retain ownership of their private keys. This eliminates the possibility of assets being lost if an exchange is ever hacked.

Uniswap charges users a flat 0.30% fee for every trade on the platform and automatically sends it to a liquidity reserve.

Liquidity providers receive an equal share of total reserve fees when they leave the market.

A new protocol fee has been introduced to Uniswap v.2. It can be turned off via a vote of the community and will send 0.05% from every 0.30% trading fees to a Uniswap account to fund future development. Currently, this fee option is turned off; however, LPs will start receiving 0.25% of pool trading fees if it’s turned on.

How Uniswap works (UNI).

Uniswap does not follow the centralized exchanges’ conventional engineering of advanced trade and works without an order book. Constant Product Market Maker, an alternative to the Automated Market Maker (AMM) common exchange model is used.

AMM smart contracts hold liquidity reserves (reserves), which traders can use to exchange for trades. Incentivised liquidity providers finance these pools.

Liquidity providers are those who loan two tokens equal to one in the pool. Liquidity providers pay traders a fee for their shares in the liquidity pool.

You can choose to have one or more ERC-20 tokens in these tokens. These pools are made up of stablecoins such as USDC, DAI, or USDT, yet this isn’t mandatory. Based on the percentage of each liquidity pool, LPs receive liquidity tokens.

Uniswap is powered by Uniswap. This token is used primarily as a governance token. Uniswap (UNI), tokens allow you to have more control of your money through a decentralized method of payment. UNI tokens can be used to speculate, invest, and as an alternative for slow, expensive international transfers. It is also an option financial system that can be used by people who have access to smartphones, but no bank accounts.

How to Purchase Uniswap

If you have Ethereum or some other type of ERC-20 token in your wallet, you can trade on Uniswap through its app right now.

Alternatively, you could buy UNI via cryptocurrency exchanges in the exact same way as other ERC-20 tokens. These are the steps to follow:

- Register for an online account A cryptocurrency exchange should offer access to a trading platform that supports fiat as well as cryptocurrency. To register on most exchanges, you will need an email address and a phone number.

- Purchase a wallet Uniswap uses Ethereum as its platform. This means that UNI can be saved in every Ethereum wallet. While software wallets make it easy to transact, hardware wallets offer more security and long-term storage.

- Funds can be deposited into your account. You can fund your account using a credit card or bank transfer depending on which exchange you choose.

- Place Your Order Your first order can be made now. You might have to indicate the type of order that you wish to place, depending on which broker you select. It’s highly recommended not to hold UNI in your accounts but transfer them to your wallet right away.

CoinStats: How to buy Uniswap

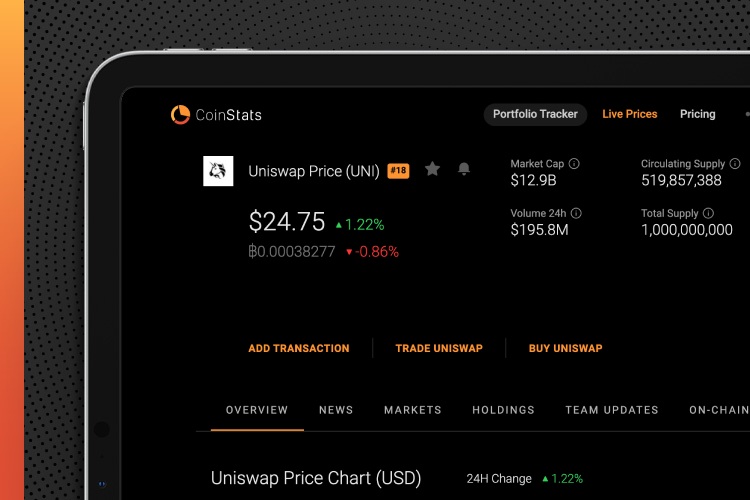

CoinStats has been voted one of the top crypto platforms. This platform allows you to see current market prices and provides detailed information on many of the fastest-growing cryptos.

CoinStats, a cryptocurrency portfolio and research app, provides useful information about cryptocurrency news to investors and offers investment advice.

You can buy UNI at CoinState by creating an account. It is easy and straightforward. When you have created your account, head to the search section. Type UNI. Here you will be able to trade or swap tokens.

Investors are also recommended to read educational blogs and guides such as UNI price and how-to buy guides, like how to purchase cosmos or Coinstats AAVE, and many others.

Things You Need to Know Before Buying Uniswap

There are a few other factors you should consider before purchasing Uniswap (UNI).

Liquidity & Lending

Uniswap gives crypto-lenders a reward for helping to make sure there is enough liquidity in the pool.

You must contribute the same amount of each cryptocurrency to the liquidity pool when adding liquidity. Uniswap will give you a portion of the gas fee for this liquidity pool in return for your contributions.

It is a way for users to earn tokens and provide liquidity so that they can facilitate the trades of specific token pairs on the platform.

Risques

The high-speculative nature of crypto assets means they are extremely risky and could lose value quickly and dramatically in the future.

Before you buy Uniswap, be sure to understand all the potential risks. A potential downside to crypto trading could be regulators trying to regulate decentralized financial institutions, such as DeFi, and this may negatively impact Uniswap.

All information in this article and all content therein are for informational and education purposes and do not represent a recommendation to purchase, sell, hold or transfer any security, financial product or instrument. They also don’t constitute financial advice, investment advice, trading advice, advice, or other types of advice.

Uniswap: Trade or sell

After the purchase of your tokens, you’ll need to decide how to use them. There are three choices: trade, hold or sell.

There are two ways to sell your Uniswap tokens

- You have two options: withdraw the money directly from your bank account or use your credit card to cash out your UNI tokens.

- If the platform you choose does not permit direct sales from UNI currency to fiat currencies, it is worth exchanging your Uniswap in Ethereum or Bitcoin. Then, transfer your ETH and BTC to a platform which can convert this to dollars. The money will be available to you to withdraw to your credit or bank account.

These steps will help you trade tokens with Uniswap:

- Your wallet can be connected. Connect to Uniswap with a wallet

- Select the pair of tokens you want. Choose from available ERC-20 tokens on the “Swap” section of the website. Choose both the token to be sold and one to be purchased.

- Review settings. For traders who are experienced, you can click the settings icon located in the upper left corner of Swap to adjust the slippage tolerance and trade length.

- Swap. Click “Swap,” review the transaction (including Uniswap trading fees), and confirm it through your wallet (which will include Ethereum gas fees). The AMM model will complete the remainder of the Ethereum transaction and your tokens are automatically added to your wallet.

Conclusion

The Uniswap project’s decentralization and open governance through its UNI token make it very popular. Uniswap’s liquidity pools are also attractive for investors who want to earn income on cryptocurrency staking. Uniswap’s AMM processes are permissive, which means that there is no need to meet KYC requirements and cyber attackers are not required. Uniswap is user-friendly – the only thing you need to trade is an Ethereum wallet. Last, but not least: there’s no tax on tokens or coins.