Indexing Protocol. The Graph is well-known and has attracted attention from both developers who require blockchain data access on a regular basis, as well as investors. If you see the protocol’s native token GRT as an investment opportunity or simply want to learn more about it, this guide will show you how to buy The Graph (GRT) and arm you with more knowledge about the project.

The Graph acts as an indexing protocol to query data. The Graph is not only designed to work with networks such as IPFS and Ethereum, but also powers applications within DeFi and wider Web3 ecosystems.

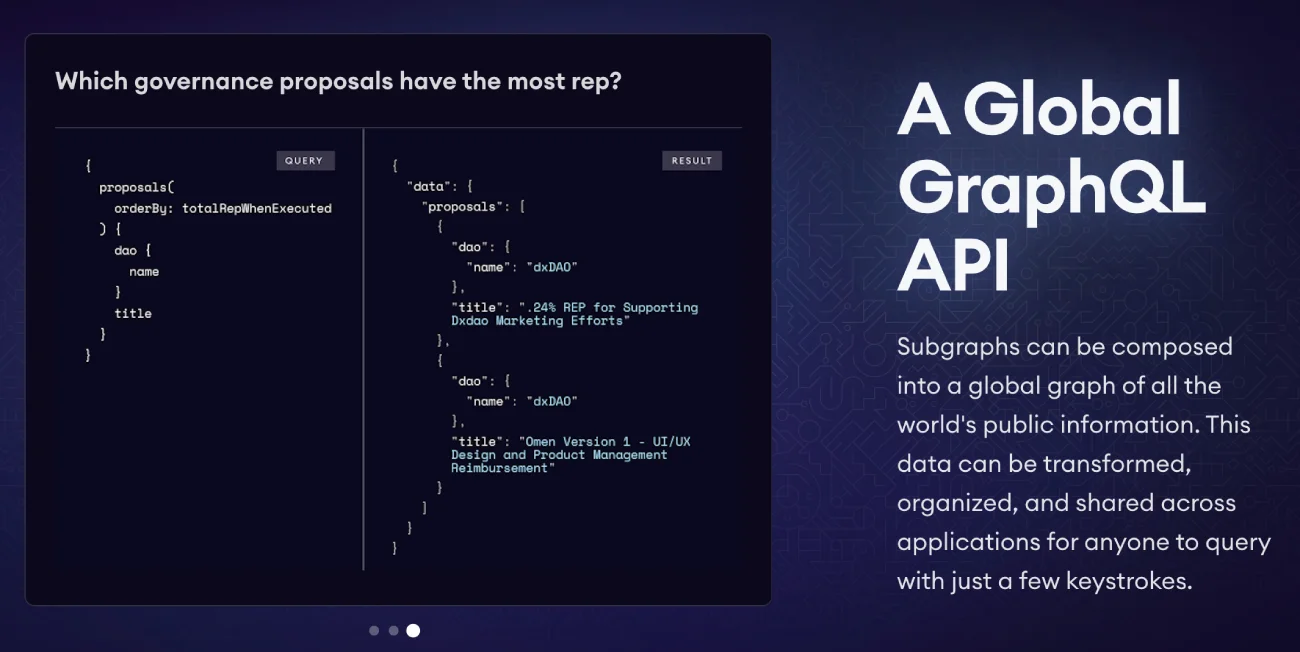

There are also open APIs, or application programming interfaces, that it has called subgraphs. These can be accessed by anyone who wants to create and publish an API. There are also open APIs that can be accessed via GraphQL query language. This allows applications to query these APIs for blockchain data.

Here’s a quick The pros and Cons list of The Graph before we jump into the main review.

Pros

- Developers save money by using query networks like The Graph.

- These save you time.

- This information bridge provides the ability to access blockchain data from decentralized applications.

- Potential for growth

- You can find them on every major exchange

Cons

- There is no fully-developed network.

- This includes a limited number of platforms.

- There is usually a limited amount of pairs you can trade on an exchange.

Now let’s address the elephant in the room and discuss where and how to buy The Graph GRT tokens. We will also look at the project’s features and what makes it stand out from the sea of cryptocurrencies.

Note: This is not an investment advisory. It is important to conduct your own research before you make any financial decisions.

Four Quick Steps to Purchase the Graph GRT

The Graph Network, which has a market capital of $16 billion (Q2 2022) is ranked #58 as of publication You can find it on many cryptocurrency exchanges. However, you shouldn’t pick the first exchange that pops your way.

There’s a difference between CEXs and DEXs in the listing process, regulations, and trading options. You should choose carefully your trading platform.

Step 1: Select a trading platform

Two main kinds of crypto-exchanges exist: DEXs and CEXs. They conduct transactions in a different way than each other. This is what makes the difference. A centralized exchange, like Binance or Coinbase, stands between the sender and the recipient as a “middle man” that moves the transaction along. A DEX, such as Uniswap and PancakeSwap does not need a middleman to facilitate transactions.

CEX Vs. DEX

CEXs are more vulnerable to malware and data hacks because of the presence of middlemen. A CEX, on the other hand, is more likely than not to carefully choose listings and to reduce risk exposure to scam or rug pulling projects.

In the United States, the Security and Exchange Commission is the most frequent regulator of CEXs. Some traders view regulation as an advantage because they feel it reduces their risk. Others view the crypto market as a “free trade” space and take governmental regulations as an intrusion of privacy and personal choice.

The DEXs give traders complete freedom. And unlike CEXs the transaction does not need a middleman. The platform doesn’t hold funds at any time before, during, and after the transaction. This reduces cyberattack risk by being peer-to-peer.

What to choose?

NOTICE: Do not share any of your crypto keys details with third parties. Instead, protect your crypto currency by using a strong password.

For the purposes of this Graph review, we’ll choose the Binance crypto exchange to illustrate the next steps required for GRT purchase. You can choose any of these reputable exchanges for your transactions to purchase The Graph Network token.

Additionally, we’ll make the necessary references along the way if the steps for Binance exchange differ from those on other platforms.

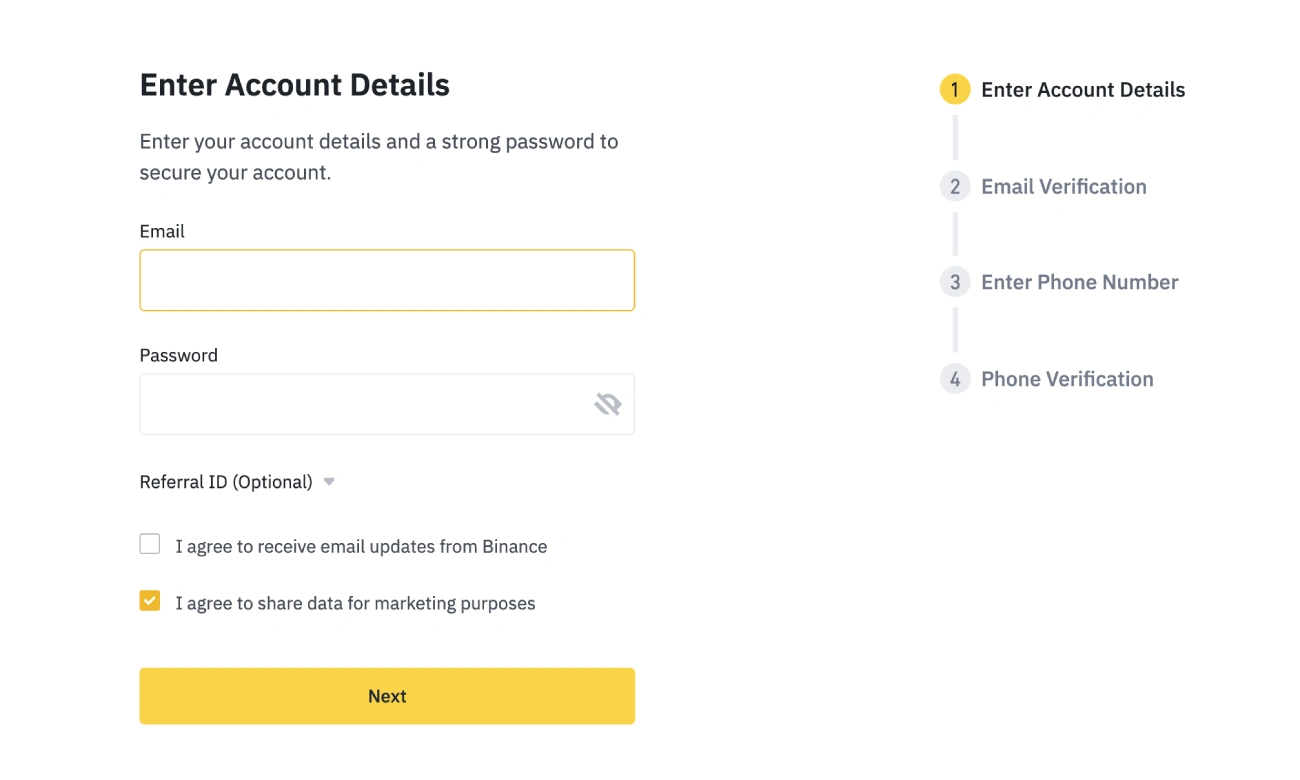

Step 2: Register on a trading platform

Crypto trading can be confusing for beginners, especially if you don’t already have a crypto wallet. Registering is the first step to purchasing crypto.

Registration for Binance is simple enough. You only need a phone number and an email. Although KYC (know Your Customer) is required for the platform, it’s not necessary to start trading.

NOTE: Many exchanges don’t even require registration if you have a running crypto wallet. Just link your existing wallet to the platform, and you’re good to go without submitting any personal details.

Step 3: Deposit the funds

Binance lets users deposit funds in several ways. You can also buy The Graph with any other cryptocurrency, like Bitcoin (BTC), Ether (ETH) and Ethereum token Ether. However, if you don’t own any, you can still choose to deposit funds in fiat currency, then exchange them for crypto assets.

Direct bank wire is now possible to deposit fiat currencies directly from your bank account. But, Binance can be tied to your debit or credit card.

It is best to buy BTC before buying GRT/fiat. This isn’t unusual because not all crypto coins have fiat pairs. So once you’ve bought the BTC, you can then go ahead to exchange it for GRT tokens. Again, we know this might be a bit confusing to new traders, but you’ll get the hang of it quickly enough.

NOTE: You should always double-check what you are putting in, since transactions can often be reversed.

This Will Help If You’re a Beginner

Here are a couple of additional tips if you’re a beginner.

Tip 1:BTC depositing can take a bit longer than ETH, and might result in higher fees. Although trading fees can be low, it is not a guarantee. They depend on what platform you use and which digital asset that you are purchasing.

Tip 2To be safe, start with a lower amount as your first deposit. Once the tiny amount reaches your account, and you have made sure you’re doing it right, proceed to the amount you would like to trade-in for GRT.

Tip #3Make sure to check the current value of any tokens before trading. The cryptocurrency market can be volatile and The Graph’s price changes with other crypto assets. You should also explore trading strategies in order to be aware of the risks and potential rewards.

Voila! It’s done!

Step #4 Buy The Graph token

It will now be easier for you to purchase The Graph Network token once your wallet has one of the most important cryptos.

After you have decided to trade, make sure that your balance is correct. Go to Funds > BalancesThe navigation bar is located at the top and allows you to navigate around the site. There is also the option to change what appears in this window. If you only want to see coins with balances greater than 0.01 BTC click here Keep small assets hidden.

After you’ve verified your assets, place an order to purchase Graph tokens. Go to Exchange > Basic. Now, we will go ahead wih the rest of the transactions, assuming you have BTC to trade, but there’s no difference in the process itself.

Click on BTC to open the BTC tab. To place a trade order, search for GRT in the top-right corner. You should see the GRT/BTC trading pairs.

Congratulations! You’re now a proud owner of GRT!

NOTE:You can also access Binance on your smartphone. To buy cryptocurrency, DeFi coins generally, and GRT specifically, however, you will need to research other networks and to find the best asset for you.

You can also gain access to the cryptocurrency market by buying no assets on exchanges. You can, for example, have a Graph wallet through broker platforms such as Etoro.

What can you do with your graph tokens?

You have many choices once you’ve purchased Graph tokens. You can store, stake, keep or sell Graph tokens. In certain markets, any of these options can be advantageous. Each option should therefore be carefully considered.

Store graph

Your GRT can be stored if you feel your Graph coins are a valuable store of value that could increase in price quickly. The trading platform offers the ability to store your purchased Graph. Many traders opt to store digital assets outside of centralized exchanges. A Trust wallet, for example, is an option that would safely store crypto. Some traders prefer to keep their crypto for a longer time to have a physical wallet over a Trust wallet.

The hardware wallet is also called cold storage. A hardware wallet is similar to a traditional data storage device. It’s hackproof, and can interact with blockchains to provide security and functionality.

Additionally, traders can use hardware wallets to protect themselves against malware and cyber-attacks. The hardware wallet is able to work with several blockchains at the same time, so investors can manage multiple tokens using one device. What’s more, all of them can be backed up easily with a single recovery phrase.

Stake Your Graph Network Tokens

Although keeping your Graph coins safe is a good option, it’s a better way to earn rewards than storing them.

You can stake the same way as you would a savings bank account. Tokens are used to verify transactions. You also temporarily lock tokens on the Graph and earn rewards for your participation in the consensus mechanism. The GRT price fluctuates, so staking can be risky. You should keep an eye out for changes in the GRT price as well as the market cap using different crypto portfolio trackers, such CoinStats and CoinMarketCap. You can also calculate your profit and loss with the CoinStats crypto profit calculator.

Exchange or sell The Graph Network Coins

You can also sell The Graph coins whenever you wish. Moreover, as you can’t directly spend your Graph to purchase goods or services, the only option if you no longer wish to use your GRT is to sell it.

We are certain that the Graph you just purchased will be a good investment. It is the ideal time to talk about the digital asset and its past.

What is the Graph and How Does It Work?

The Graph, a distributed network for indexing and querying blockchain data is supported by the Graph. The protocol also allows you to query difficult data directly.

Projects with complicated smart contracts such as Uniswap or NFT initiatives, like Bored Ape, for example, save their data to the Ethereum blockchain. This makes it difficult to retrieve any data other than basic information. The Graph promises to simplify it.

“If we wanted to query for apes that are owned by a certain address, and filter by one of its characteristics, we would not be able to get that information by interacting directly with the contract itself,” specifies the protocol. It concludes that “Indexing blockchain data is really, really hard.”

The Graph addresses this problem by providing a decentralized protocol to index and enable the fast and efficient querying blockchain data. These APIs, or “subgraphs,” can then be queried with a standard GraphQL API. A hosted service as well as a protocol that can be decentralized offer the same capabilities. Open-source implementations of Graph Node support both.

Conclusion

It can be difficult to navigate the cryptocurrency market. This Graph review should have helped you to understand what The Graph is and how and where they can be found. The Graph can be stored in Trust wallets, hardware wallets, staked, and exchanged for cryptos or fiat currencies once you have purchased it.