Tezos (XTZ) is an open-source, self-upgradable blockchain platform for creating and internet hosting DApps. The platform’s native digital token is XTZ. Tezos permits anybody who owns its XTZ token to vote on any future adjustments to community guidelines, together with adjustments to the governing course of.

Verify the Tezos present value, market cap, circulating provide, buying and selling quantity, historic statistics, and many others., on CoinStats, probably the greatest crypto platforms round.

Learn on to be taught the whole lot you must know concerning the Tezos platform, its native token XTZ and discover ways to purchase Tezos in a couple of easy steps.

Let’s soar proper in!

Execs

- Proof of Stake: Tezos makes use of the energy-efficient and cheap PoS consensus mechanism.

- Staking Alternatives: XTZ house owners can stake their cash to achieve revenue and take part in neighborhood selections.

- Excessive Security Stage: Tezos goals to supply the security and code correctness required for property and different high-value use circumstances.

- Self-amendment: The Tezos blockchain possesses a modular structure and formal improve mechanism, that means it could easily suggest and undertake new technological improvements.

Cons

- Low Reputation: Tezos lacks business help.

- Immature Community: Many builders nonetheless think about the community underdeveloped, because it’s troublesome to foretell its transaction charges and speeds as soon as the platform turns into extra widespread.

The CRC ranks Tezos with a rating of three.75/5. Nonetheless, the CRC has no precise energy to categorise an asset; as a substitute, this job resides with the Securities and Change Fee (SEC). Now, let’s look into the community and see what makes Tezos XTZ distinctive earlier than studying the way to commerce Tezos or the way to purchase Tezos XTZ rapidly and simply.

What Is Tezos

Tezos (XTZ) is an amendable blockchain community that comes with superior protocols to help the event of decentralized purposes (DApps) and the coding of sensible contracts. Whereas Tezos provides related options to different cryptocurrencies, its system of operations has a number of core variations:

- Self-amendment. Whereas Proof-of-Work platforms must fork, when introducing adjustments to the system, protocols that make the most of the Proof-of-Stake consensus mechanism, like Tezos, can vote on the proposed improve and implement it a lot sooner and simpler.

- Staking Alternatives. XTZ holders can take part within the validation mechanism in the event that they personal over 8,000 XTZ tokens. They will additionally delegate their Tezos to a validator to earn curiosity on the tokens whereas having a say within the protocol’s governance.

- Community Dimension. Tezos is way smaller than Ethereum, so the congestion and excessive fuel price issues that plague Ethereum don’t apply to Tezos. On the time of writing, Tezos’ complete worth locked (TVL) stood at $87 million as a substitute of Ethereum’s $84 billion (Verify additionally our article on the way to purchase Ethereum).

Tezos XTZ Historical past

Tezos was based in 2017 by Arthur and Kathleen Breitman. The Tezos ICO managed to boost $232 million from its preliminary coin providing (ICO) in simply 2 weeks however bumped into many administration points shortly after this record-breaking ICO. The corporate known as Tezos Basis held all of the funds and refused to disburse the funds to Tezos co-founders. Nonetheless, after undesirable media consideration and civil lawsuits which had plagued Tezos, issues settled, and the venture began working as meant.

Tezos at the moment has a market cap of over $2.6 billion. New tokens on Tezos are minted at an inflation price of 5.5% yearly, a comparatively excessive inflation price for a cryptocurrency token. The expansion of Tezos could possibly be attributed to traders’ newfound consideration to sensible contracts and the rise of altcoins in 2021.

Tips on how to Purchase Tezos (XTZ) in 4 Fast Steps

Now that you know the way Tezos works and why it’s distinctive, you may observe our easy step-by-step information for purchasing Tezos immediately!

The tactic for buying the XTZ token is similar as shopping for another cryptocurrency. Moreover, there’s normally a scarcity of obtainable XTZ pairs on exchanges, so that you may need to buy one other cryptocurrency first after which commerce it for XTZ.

Let’s get began.

Step #1: Select a Crypto Change

A number of cryptocurrency exchanges let you commerce XRZ. You’ll have to match them to decide on a buying and selling platform with the options you need, reminiscent of low charges, an easy-to-use platform, and 24-hour buyer help. Additionally, think about if the cryptocurrency alternate permits shopping for Tezos along with your most popular fee strategies, reminiscent of a credit score or debit card, one other cryptocurrency, or a financial institution switch. Some exchanges help superior buying and selling options and providers like a restrict order or market orders, crypto loans, and crypto staking that allow you to earn curiosity in your crypto holdings.

Cryptocurrency exchanges come down to 2 fundamental classes: Centralized exchanges (CEXs) and Decentralized cryptocurrency exchanges (DEXs). Every of those classes has professionals and cons that merchants ought to think about earlier than registering an account and beginning to commerce. The diploma of the alternate’s decentralization determines how the platform conducts transactions, lists new crypto property, and offers with prospects.

Centralized vs. Decentralized Exchanges

A centralized crypto alternate or CEX is sort of a conventional alternate however for buying and selling in digital property. CEXs like Binance, Coinbase, or eToro USA LLC are ruled by a centralized system and cost particular charges for utilizing their providers. The majority of crypto buying and selling takes place on centralized exchanges, which permit customers to simply convert their fiat currencies just like the euro or {dollars} straight into crypto. Centralized exchanges require their customers to observe KYC (know your buyer) and AML (anti-money laundering) guidelines by offering some data and private identification paperwork. Nonetheless, a CEX holds your digital property on its platform whereas trades undergo – elevating the danger of hackers stealing the property.

Alternatively, a decentralized alternate (DEX) is just not ruled by any central authority; as a substitute, it operates over blockchain and costs no price apart from the fuel price relevant on a selected blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use sensible contracts to let folks commerce in crypto property with out the necessity for a regulatory authority. They deploy an automatic market maker to take away any intermediaries and provides full management over the funds to customers. Decentralized exchanges are much less user-friendly from an interface standpoint and likewise when it comes to forex conversion. As an illustration, they don’t all the time enable customers to deposit fiat cash in alternate for crypto; customers need to both already personal crypto or use a centralized alternate to get crypto. It additionally takes longer to seek out somebody seeking to commerce with you as DEX engages in peer-to-peer commerce, and if liquidity is low, you could have to just accept concessions on value and rapidly promote or purchase low-volume crypto.

Change Platform Safety

Centralized crypto exchanges are straightforward to manage as in comparison with decentralized exchanges. Centralized exchanges are regulated, want licenses to function, and are compliant with the regulatory authorities. So, it usually takes crypto property some time to leap via sufficient hoops to get a CEX itemizing.

Conversely, DEXs are glad to checklist new tokens, which may probably be rug pulls, or fraudulent in another approach. Nonetheless, DEXs’ peer-to-peer buying and selling makes hacks extremely unlikely, because the platform itself doesn’t step in and doesn’t possess any of the funds exchanged. To summarize, CEXs have very strict safety procedures, however Decentralized crypto exchanges provide extra safety.

Tezos tokens can be found on centralized and decentralized platforms, so you may select any platform that most closely fits your funding wants and private preferences. Whereas some customers choose CEXs as a result of their recognition, pace, and have, others go for DEXs for his or her safety and nil transaction charges.

We’ll proceed with the Binance alternate for example, parallelled with DEXs to current you with a greater image.

Step #2: Registration

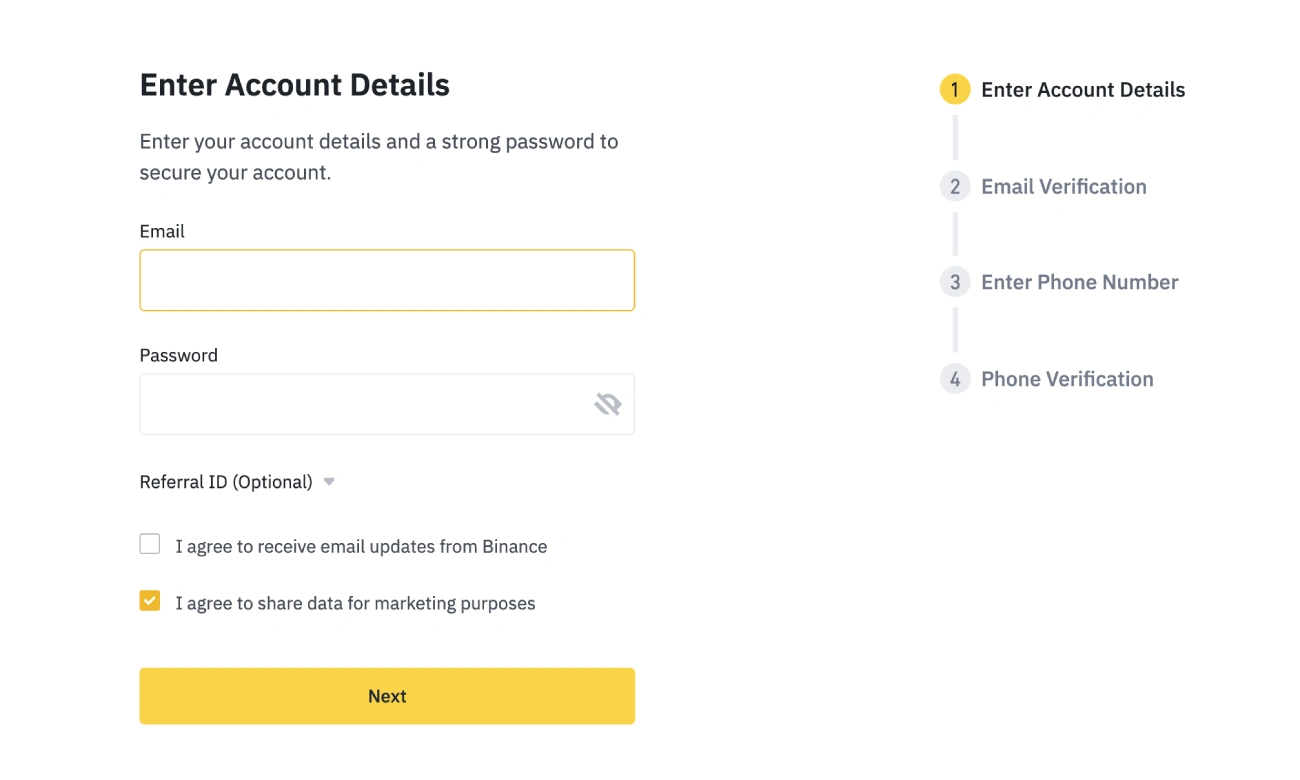

After you’ve selected a dependable alternate, the subsequent step is to open a buying and selling account to purchase or promote Tezos. The necessities differ relying on the platform you decide. Private data reminiscent of your title, contact quantity, e mail tackle, house tackle, social safety quantity, and a duplicate of your driver’s license, passport, or government-issued ID will likely be required in most transactions. You will need to present this data to be authenticated if you happen to plan to deposit fiat forex out of your checking account to buy the XTZ token.

It’s advisable to allow two-factor authentication (2FA) to maintain your funds protected when you’ve verified your id.

Some decentralized exchanges don’t require a registration course of, and also you simply need to hyperlink your current crypto pockets to the platform and be in your approach.

To register on Binance, you must present an e mail or a telephone quantity and give you a safe password. KYC is just not a requirement, however the lack of further data will restrict your buying and selling alternatives on the platform.

Step #3: Fund Your Account

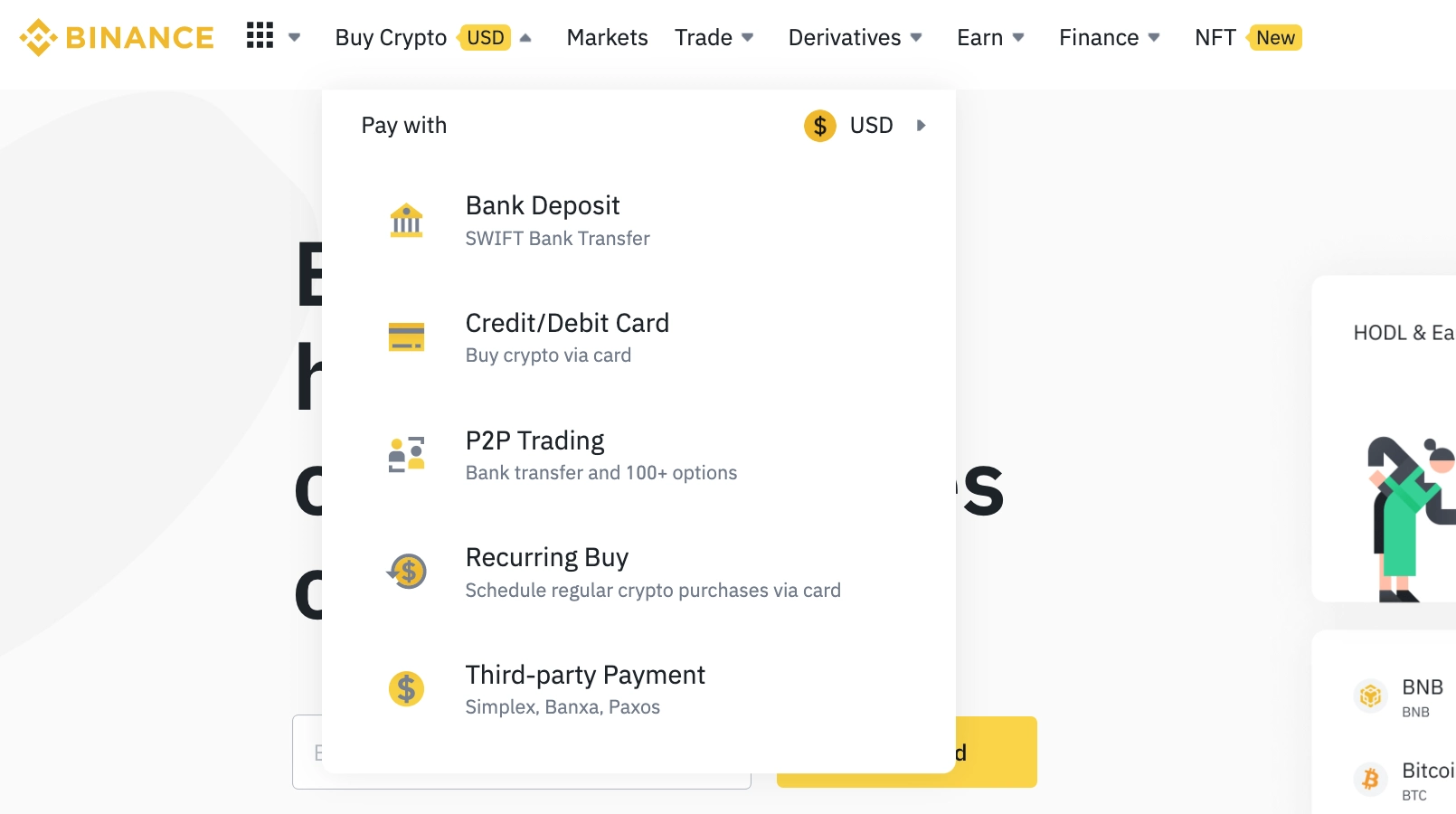

You possibly can deposit funds onto your new account now that you’ve a cryptocurrency account. Binance provides merchants a number of choices, however as there aren’t any direct fiat-Tezos XTZ pairs, you’ll need to buy different cryptocurrencies first. It’s advisable to first purchase main cryptocurrencies, like BTC or USDT stablecoin.

In the case of shopping for Bitcoin (BTC) or Bitcoin Money, Binance offers you with a number of choices – to buy the coin via a direct wire switch out of your checking account, along with your credit score or debit card, or with different crypto property.

Fund Deposit Choices

You possibly can hyperlink your checking account to your Binance account to make a financial institution switch for purchasing stablecoins listed on the platform and alternate these for BTC. Nonetheless, think about that not all fiat currencies are supported for the Bitcoin buy, and USD, EUR, AUD, and GBP are amongst well-liked choices.

Additionally, in case you are a U.S.-based dealer, some exclusions may apply, and a Coinbase account as a substitute of Binance may turn out to be useful. For instance, Connecticut, Hawaii, New York, Texas, Vermont, Idaho, and Louisiana residents can not commerce on Binance.

An alternative choice is to purchase BTC with a credit score or debit card. Linking your debit card to your crypto account is advantageous because it enables you to make on the spot or recurring purchases, however remember that it attracts an extra price.

Tezos could be traded for an additional forex like Ethereum or a stablecoin like Binance USD (BUSD); the buying and selling pairs differ between exchanges, and you have to to seek for XTZ on the spot market to pick a pair from the checklist of obtainable currencies.

Now that you simply’ve chosen a fee technique that most closely fits your wants let’s proceed to the subsequent step and alternate your contemporary BTC for some XTZ.

Step #4: Puchase Tezos XTZ

As a proud proprietor of BTC, you may lastly alternate them for XTZ. Select your buying and selling pair amongst a number of choices listed on Binance or Coinbase, contemplating the present value, and commerce your BTC or different cryptocurrencies for XTZ.

What to Do With Your Tezos XTZ

In the case of crypto markets, the panorama adjustments quickly. So, even if you happen to plan to retailer your XTZ for the lengthy haul, you may wish to alternate it. Here’s a small checklist of choices on the way to use your Tezos tokens:

- Hold Your Tezos XTZ in a Protected Pockets: {Hardware} wallets are the easiest way to securely retailer crypto tokens. A {hardware} pockets provides offline storage, thereby considerably decreasing the dangers of a hack. Ledger Nano S or Nano X are arguably essentially the most safe {hardware} wallets that retailer your private and non-private keys, letting you securely handle your XTZ tokens.

- Change XTZ Tokens. Day buying and selling is large amongst crypto traders, so don’t fear if you happen to undergo loads of problem to accumulate XTZ after which resolve to commerce it. All choices for buying and selling XTZ are viable.

- Stake Tezos. As Tezos makes use of the Proof-of-Stake mechanism to validate transactions, you may earn rewards by staking your cash. Keep in mind that the Tezos value is risky, and staking could possibly be dangerous, so make certain to trace costs on crypto portfolio trackers.

Conclusion

One of many fundamental objectives of Tezos is to change into a blockchain able to creating one of the best reward construction on the planet. The XTZ token can be utilized for holding, sending, spending, or baking, and XTZ token holders can vote on community upgrades.

Tezos is at the moment used as a staking forex, a speculative funding instrument, and a type of fee.

Funding Recommendation Disclaimer: The knowledge contained on this web site is offered to you solely for informational functions and doesn’t represent a suggestion by CoinStats to purchase, promote, or maintain any securities, monetary product, or instrument talked about within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or another sort of recommendation.

Tezos value is very risky, and like different risky property, it’s prone to fluctuations that may trigger lack of funds. Do your unbiased analysis and solely make investments what you may afford to lose. Investments are topic to market threat, efficiency is unpredictable, and the previous efficiency of Tezos isn’t any assure of its future efficiency.

There are vital dangers concerned in buying and selling CFDs, shares, and cryptocurrencies. Between 74-89% of retail investor accounts lose cash when buying and selling CFDs. It’s best to think about your individual circumstances and take the time to discover all of your choices earlier than making any funding.