Ethereum Classic is a decentralized, censorship-resistant and decentralized blockchain. It has the exact same purpose as Ethereum. These projects allow developers to run decentralized apps (DApps), and smart contracts on Ethereum’s blockchain network.

After the 2016 hack of Ethereum’s Decentralized Autonomous Organization, (DAO), Ethereum Classic was a hard fork. The project was split in Ethereum (ETH), and Ethereum Classic, following disagreements between developers and miners.

Ethereum Classic (ETC), is one of the two major Ethereum coins. The Ethereum Classic real-time price is available on CoinStats.

Continue reading to find out all about Ethereum Classic.

Let’s jump right in!

The pros

- A completely decentralized network global of nodes.

- You can choose to be immutable.

- Smart contracts and DApps are supported. The company also maintains their own Ethereum Classic tokens.

- Lower cost than ETH.

- More interoperable with Ethereum due to ETC’s Phoenix hard fork, completed in 2020.

Cons

- Ethereum is not backward compatible

- There is low developer activity and low community interest.

- Through several significant attacks over the years.

- Dodgy image.

Now let’s look into buying Ethereum Classic in 4 quick steps.

In 4 Easy Steps, How To Buy Ethereum

Ethereum Classic is among the most widely accessible cryptocurrencies. Coinbase, Kraken and Binance are among the most popular cryptocurrency exchanges. Ethereum Classic’s price has increased more than 80 percent in the week ending March 2022.

Take a look at our steps-by-step guide to get started buying Ethereum immediately.

Step 1. Choose a Crypto exchange

You can buy Ethereum Classic online from a variety of cryptocurrency exchanges. You’ll have to compare them to choose the one that has the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. You should also consider whether the exchange offers Ethereum Classic purchase with any of your preferred payment options, including a credit/debit card, an alternative cryptocurrency or a bank transfer.

Cryptocurrency exchanges can be divided into two categories. Let’s look into some of the advantages and disadvantages of each to help you get started.

Centralized Exchanges vs. Centralized vs. Decentralized Exchanges

Central crypto exchanges (CEX) are similar to traditional crypto exchanges for purchasing crypto. These CEXs have a central management system that charges specific fees to use their services. The majority of cryptocurrency trading is done on centralized exchanges that allow users to directly buy crypto with fiat currencies, such as dollars or euros. However, a CEX holds your digital assets on its platform while trades go through – raising the risk of hackers stealing the assets.

Users of centralized exchanges must comply with KYC (know your client) and AML rules. This means that they will need to provide some personal information as well as identification documents. When it comes to the listing of new tokens, they are even more selective.

Decentralized exchanges (DEX) are not managed by any central authority. They operate over blockchain and charge no fees, except the applicable gas fee on specific blockchains, such as the Ethereum blockchain. Smart contracts are used to allow users to trade crypto assets in decentralized exchanges without the involvement of a regulator. To remove intermediaries, they use an automated market maker and allow users to have complete control of the funds. They are also less intuitive from an interface perspective and can be difficult to convert currencies. For instance, they don’t always allow users to deposit fiat money in exchange for crypto; users have to either already own crypto or use a centralized exchange to get crypto. As DEX is peer-to-peer, it takes longer for someone to look at you and offer you a quick sale or purchase of low volume crypto.

The DEXs do not have a single authority to verify tokens. This could increase fraud or rug pulling.

Each type of cryptocurrency platform comes with its pros and cons, including security and anonymity. Be sure to weigh all the factors before you make a decision.

Ethereum Classic tokens can also be purchased on a variety of decentralized and centralized platforms.

We’ll continue introducing the process by bringing Binance as an example and drawing parallels with DEXs to give you a better picture.

Step 2: Register

Once you’ve selected a reliable cryptocurrency exchange, you can move on to creating your account to buy Ethereum Classic. The specific requirements vary depending upon the platform. Personal information such as your name, contact number, e-mail address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required for most transactions. To purchase ETC tokens, you may need to verify your identity using a phone or webcam.

To add extra security, after verifying your identity, enable the 2-factor authentication system (2FA).

Advanced traders will likely already own a cryptocurrency wallet, so they can skip registration.

Step 3: Deposit funds

Next, deposit money to purchase Ethereum Classic ETC. It is possible to use your bank account or debit/credit card. You may also choose crypto coins from another crypto wallet. The location of your chosen platform and the preferences you have will dictate which payment method is used.

It is possible to link your card with your crypto account. This allows you to make instant purchases or recurring payments. However, it could cost extra. Transfers to a local account are usually free. However, you might want to check with your platform.

ETC can also traded for Ethereum, Bitcoin and other cryptos like Ethereum.

Binance makes it possible to purchase Ethereum Classic from a bank, credit/debit or card. You can also exchange it with another cryptocurrency. So, if you still don’t own a crypto wallet, you can purchase Ethereum Classic directly through a wire transfer.

Bank Transfer

Bank transfer is a valid method if you’re willing to link your bank account to Binance. You should keep in mind that not all fiat currencies can be used to buy Ethereum Classic. It’s usually free to make a bank transfer from your local bank accounts, but you should still double-check with your exchange.

Some exclusions may also apply if you’re a U.S.-based Trader. You cannot trade on Binance if you are a resident of Louisiana, Connecticut, Hawaii or New York. It is possible to register Coinbase accounts instead of Binance as Coinbase is by far the biggest crypto exchange in the nation.

You can choose to use a credit or debit card

You can also buy Ethereum Classic ETC with a debit or credit card.

It is beneficial to link your card with your crypto account. However, you will be charged an additional fee.

Cryptocurrency

Ethereum Classic can trade for Bitcoin and the original Ethereum.

Step 4: Purchase Ethereum ETC

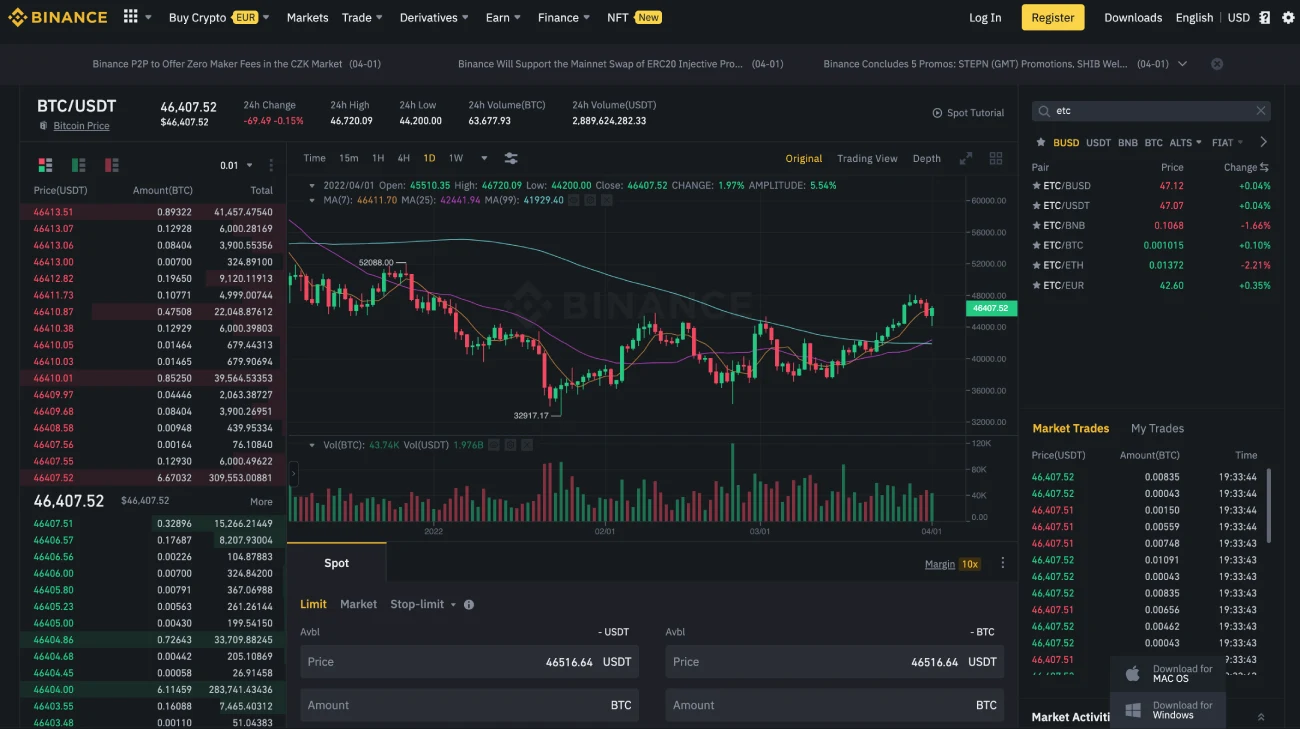

You can purchase Ethereum Classic ETC once your account funds are available. Most centralized and decentralized exchanges offer an “instant buy” option that lets you purchase ETC easily for a set price. Another option is to open a spot market trade and set your price. Although the “instant buy” method is relatively straightforward, it tends to be more expensive than the spot market option. It’s also good to check the market conditions and recent performance to see if it’s the appropriate time to buy Ethereum Classic before going ahead with your purchase.

How to use your ETC after purchase

Congratulations, you’re a proud owner of Ethereum Classic! What are you going to do with Ethereum Classic? There are many options when it comes ETC. It is highly recommended that you create an Ethereum Classic wallet, complete with your keys and full ownership of your crypto assets.

ETC Store

You can keep your Ethereum Classic coins in your wallet for long-term investment if you feel they are an attractive store of value. You have the option of keeping them on the trading platform. However, the majority of traders store their digital assets inside a hardware wallet.

Also known as cold storage or hardware wallet, a hardware wallet is an actual physical device that works in the same way an SSD or HDD. It’s usually considered the most secure wallet to store your digital assets as it offers offline storage, thereby significantly reducing the risks of hacks. The hardware wallet can be secured with a pin. After many unsuccessful attempts to delete your information, it will wipe out all data. This prevents physical theft. These wallets also allow you to sign and confirm transactions on blockchain. You have an additional layer of security against cyber attacks. You can easily install your wallet on your desktop or laptop to manage your assets securely.

The hardware wallet is able to work simultaneously with several blockchains, which gives you the ability to manage ERC-20 coins (e.g., Bitcoin, Ethereum Classic).You can do all of this on one device.

Place Your Ethereum

You can earn rewards for making Ethereum Classic coins work instead of keeping them in a safe place. Ethereum Classic is a Proof-of-Stake Network. Staking can be supported by the ETC network.

To earn rewards, you can temporarily lock tokens on Ethereum Classic. The ETC price fluctuates, so staking can be risky. You can monitor the price changes on several crypto price trackers such as CoinStats and CoinMarketCap.

Spend Ethereum

It is possible to sell Ethereum Classic at any time. ETC coins can be used to directly purchase services and goods, as opposed to other crypto currencies. A growing number of retailers and vendors accept Ethereum Classic.

We are certain that the newly acquired Ethereum Classic coins you purchased will be of great value.

Now, let’s discuss the digital asset itself and its connection to the Ethereum Network.

What Is Ethereum Classic

Due to hacking of the Ethereum network, Ethereum Classic was created in 2016. Hackers took 11.5 Million Ether coins from the Ethereum network, compromising its original Ethereum Network. The project was split in Ethereum (ETH), and Ethereum Classic, following disagreements between developers and miners. Camp 1 (the one that became the modern-day Ethereum) proposed to “roll back” and reverse the transaction.

However, camp 2 (which grew into Ethereum Classic) rejected the reversal, as in their view, it compromised the founding principle of decentralization: “Code is Law.” They believed that the immutable nature of the blockchain technology behind Ethereum meant that nothing should be done.

When the network decided that it would go ahead with a reverse switch, the opposite crew took out Ethereum Classic.

Ethereum Classic ETC can be traded, staked, or stored as a speculative cryptocurrency. Ethereum ETH, however is second in popularity to Bitcoin.

Why is Ethereum different from other ETH currencies?

Ethereum Classic is a Proof-of-Work network, whereas Ethereum’s consensus mechanism is still in a transitional state. The majority of investors still consider ETH the better version.

It is possible to determine the perception of ETC versus ETH in the investment community by comparing how much capital has been invested and how many investment dollars. When comparing the two cryptos’ market caps, ETH is the clear winner.

ETC currently has a market capitalization in excess of $6.3 Billion, and ETH has a close to $400 Billion. The blockchains may be open to cooperation and moving closer, putting aside past rivalry and principles differences.

Conclusion

Over the five-year period since its separation, Ethereum Classic took a completely different route than Ethereum. Ethereum is committed to continued growth, and aims to be adopted on a wider scale in order for the network’s improvement.

Ethereum Classic on the other side aims to keep the systems in their original state with no significant modifications. It provides a permissive way to manage digital assets, and allows money to be transferred by smart contracts.

Ethereum is the most popular blockchain to buy, sell, or create NFTs. Ethereum Classic, which trades over 1,000,000 daily, is one of the 30 most popular cryptos. It’s available on leading crypto exchanges and smaller platforms, both centralized and decentralized.

Information about InvestmentsInformation on this site is for informational purposes only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products or instruments. This information does NOT constitute financial advice or investment advice.

Market risks, such as the possibility of losing principal, are all part and parcel of investing. Because cryptocurrency can fluctuate and be subject to secondary activities, it is important to do independent research and to get professional advice. You should only risk losing what you have invested. CFD trading, stock trading, and cryptocurrency trading can have serious risks. CFDs can result in losses between 74-89% for retail investors accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

FAQ

Does Ethereum Classic look the same as Ethereum Classic?

They were one original blockchain. However, the ETC network was formed as a result a hack. Both have the same foundation.

Ethereum Classic Is Available in the USA

Yes. Yes. Although some platforms might have restrictions, ETC is accessible on both large and small DEXs.

What is the best way to get a prior crypto wallet?

Yes, Ethereum Classic can be purchased directly using fiat currency through several leading trading platforms. However, a wallet makes it easier to purchase Ethereum Classic.