According to statistics, $80 billion worth of value has been locked up in decentralized financing. Despite this figure, many are still exploring the question, “What is DeFi?“

Investopedia defines DeFi as “an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies.” DeFi has attracted many users who wish to eliminate the control of centralized banks and institutions over their financial assets and activities.

DeFiChain is delivering purpose-oriented offerings since 2019, in order to increase DeFi’s efficiency, speed, cost-effectiveness, and speed. This article will explore DeFiChain’s features, its DFI token, and how to buy DeFiChain.

DeFiChain, (DFI),: The What and How it Works

DeFiChain is a blockchain that was specifically designed for decentralized finance applications. DeFiChain, developed by the DeFiChain Foundation, focuses on the blockchain’s functionality to enable the fulfillment of quick, intelligent, and transparent DeFi services.

DeFiChain’s platform was built on Bitcoin’s blockchain as a software-fork and linked to the Bitcoin blockchain with Merkle roots every few blocks. To ensure efficiency and speed, all transactions on DeFiChain use non-Turing to reduce gas consumption and lower risks of mistakes in smart contracts.

What is DFI?

DFI is the DeFiChain native token and an integral DeFiChain account unit. The $DFI coin will be given to partners and users. These coins can then be used for the following purposes:

You will be charged feesDFI token, also known as the In-House Currency, is used for payments, DeX fees and ICX fee smart contracts.

Liquidity pool:Holders of DeFi tokens can provide liquidity to the DEX, which is a network that connects crypto-assets.

How to stake nodesDeFiChain token holders must have at minimum 20,000 DFI tokens in order to finance a new staking network.

Collateral Loans and InterestTo borrow additional crypto tokens, platform users can use their DFI tokens to secure loans. You can also loan other crypto-assets and receive an instant premium of DFI as well as interest in DFI tokens once the loan has been repaid.

DeFi Custom Token:For a personal DCT (DeFiCustom Token), users must have 1,000 DFI tokens. The user gets a full refund of the DFI tokens they used in creating the custom token.

Submission of Votes and Proposals:To submit a Community Fund proposal, users can either pay 10 DFI or 50 DFI for a Vote of confidence. These submissions are non-refundable.

DeFiChain’s Key Features

Here are the key features of DeFiChain’s platform.

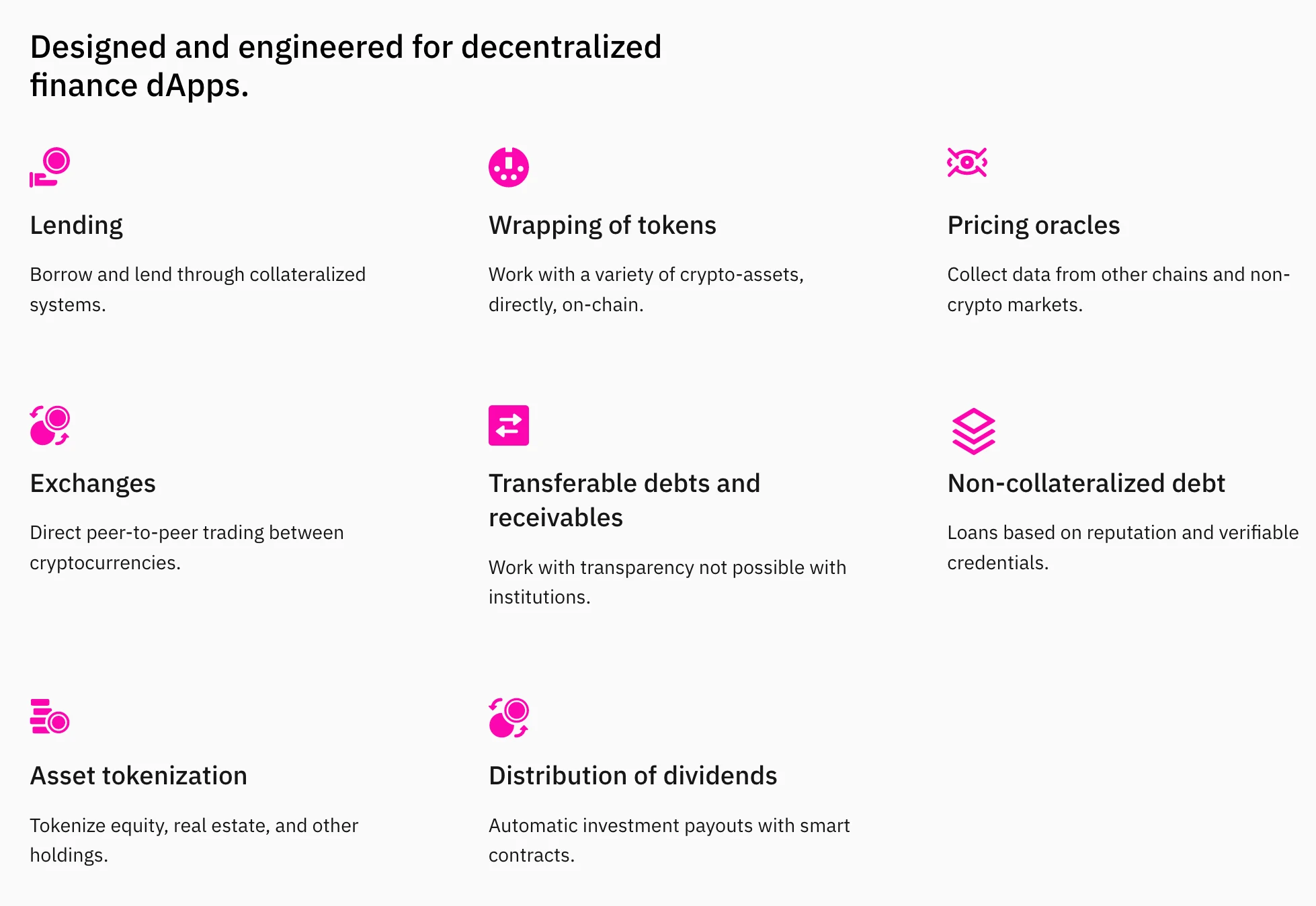

Decentralized Lending

Decentralized lending allows individuals and groups to avoid banks’ intervention while lending and borrowing. DeFiChain, despite being the leader in bitcoin, also targets 100% of the market via the decentralized wrapping tokens.

The decentralized wrapping of tokens

Wrapping permits individuals to access any digital asset, while keeping the asset and transacting on a new blockchain. DeFiChain features a unique decentralized, trustless wrapping mechanismThe crypto asset owner is able to manage all of their assets directly on the blockchain without having any need for a third party as a guarantee.

Prior to DeFiChain there was no standard for interoperability between different currencies. Interoperability of different currencies and assets is dependent on the provision of collateralization or wrapping.

To exchange wrapped tokens, owners are able to easily trade them on the respective blockchains. DeFiChain members are also eligible for a reward for creating a wrapped token.

While the on-chain transaction uses $DFI, DeFiChain also supports Bitcoin, ERC-20 or Ethereum.

Decentralized Pricing Oracles

Oracles use accurate information from blockchains and other non-crypto market to gather data about the pricing of cryptocurrency-assets. DeFiChain has pricing oracles, which help to collect data from immortal blockchains.

DeFiChain users can receive tokens for providing data to the network. These rewards are issued by smart contracts that measure the oracle’s accuracy based on the consensus percentage, number of oracles, and other pre-set parameters.

Decentralized Exchanges

DeFiChain’s decentralized exchange enables atomic, peer-to-peer swapping of cryptocurrencies by directly matching people for trading. This DEX lowers exchange risks and ensures that token holders have custody of any crypto assets. The exchange also doesn’t have to bear the risk of custodianship as the peer-to-peer mechanism is based on an agreed-upon price or the current market price.

Asset Tokenization

Asset tokenization refers to the representation of an asset such as company equity or real estate using immutable, blockchain-based tokens.

Many projects like LAtoken and Etherparty have made an attempt at blockchain asset tokenization but have eventually pivoted to provide services that aren’t directly associated with asset tokenization.

DeFiChain offers an asset tokenization module. It is simple to use this module for tokenizing company equity and real estate as well other assets.

Asset tokenization is also possible as an independent legal and authorized capability.

Dividend Distribution

Smart contracts can be generated using the dividends distribution module. These smart contracts will pay returns for investment in tokenized assets. DeFiChain provides a significant improvement in dividend distribution by offering models that can pay weekly, monthly and quarterly returns.

Transferable Debts or Receivables

Only financial institutions that deal with loans are allowed to manage accounts receivable and debts in centralized finance. DeFiChain offers a decentralized solution in the form of a series of calls that are able to work with receivables and transferable debts. The blockchain has allowed for transparency in the exchange of loans and debts. These loans and debts will be managed using smart contracts based upon receivables or other financial promises.

DeFiChain can also create smart contracts to support peer-to–peer loans, without the need for a financial institution to guarantee them.

Decentralized Non-collateralized Debt

At present, DFI is used as collateral for taking out on the platform, and the individual’s identity is established based on their wallet KYC. However, DeFiChain plans to build the appropriate reputation-based systems and risk assessment techniques to offer non-collateralized loans based on borrowers’ reputations and other factors. This system could be supplemented or replaced by the current credit score approach if it is successful.

DFI: Where can I buy it?

You should look for these key features when selecting a cryptocurrency exchange.

Support for payment and asset management: Compare cryptocurrency exchanges before choosing one that supports the DFI token and the payment method you’re using to fund your purchase. You should verify that the exchange allows you to trade other cryptocurrencies for DFI.

Security: Identify a reliable exchange and the link carefully to ensure that you access the authentic exchange platform so that you don’t fall prey to phishing scams.

DFI can be listed on many cryptocurrency exchanges. This article will walk you through how to purchase DeFiChain from CoinStats.

- DeFiChain is available on trusted crypto exchanges

- Secure crypto wallet to store your DFI

CoinStats also offers informative content like “How to Buy Cryptocurrency” for beginners and specific coin-related articles like “How to Buy STEPN” for potential investors.

How to Buy DFI

DFI can either be bought with fiat money, or traded with other cryptocurrency. Here are the steps to purchase DeFiChain(DFI) from CoinStats.

- First, create an account with the exchange to buy DeFiChain. Next, link your secure wallet. CoinStats offers its own wallet, which you can use for token security.

- Your KYC information, such as your name and contact number, will need to be filled in. Once your KYC has been completed you will be able to move on to the purchasing stage.

- You will need to either fund your account via bank transfer, credit card or debit card if you intend to make payments in fiat currency. If you’re using a crypto swap, you will have to ensure that the relevant tokens are available in your linked wallet.

- The limit order can be placed by simply entering the USD price or crypto amount you want to exchange and choosing the DFI amount. When the order price is at the desired amount, it will be fulfilled.

DFI: Is it a good investment?

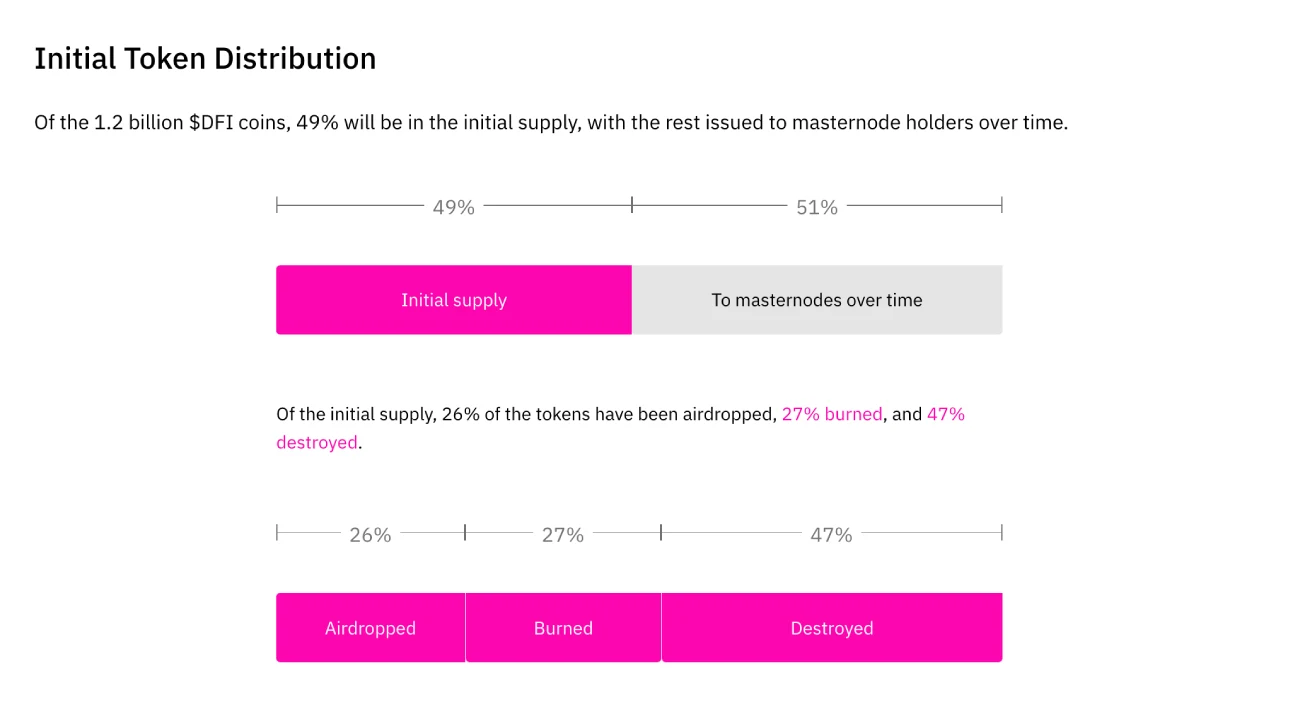

As of May 25, 2022, the DeFiChain cost was $2.52 with an average daily trading volume of $17 million. It currently ranks at #51 in CoinStats with an circulating supply around 510 millions DFI and a maximum stock of roughly 1 billion DFI.

Based on forecasts made by walletinvestor.com the DFI price will likely rise in the long term, reaching an eventual $8.98 price point by May 2027.

Closing Thoughts

Now that you know how to buy DeFiChain, all you’ve got to do is monitor the charts, research the project thoroughly, and DeFiChain tokens based on your existing portfolio and crypto investment plans. You should be alert for potential scams throughout this process. Also, ensure you have your wallet keys stored safely once you’ve purchased your DFI tokens.