Statistics present that roughly $80 billion of worth is locked in decentralized finance. Regardless of this determine, many are nonetheless exploring the query, “What’s DeFi?“

Investopedia defines DeFi as “an rising monetary know-how based mostly on safe distributed ledgers much like these utilized by cryptocurrencies.” DeFi has attracted many customers who want to get rid of the management of centralized banks and establishments over their monetary property and actions.

Since 2019, DeFiChain has been delivering purpose-oriented choices to enhance DeFi transaction effectivity, pace, and cost-effectiveness. This text will discover DeFiChain’s options, its DFI token, and methods to purchase DeFiChain.

DeFiChain (DFI): What It Is and How It Works

The DeFiChain blockchain is specifically designed to assist decentralized finance (DeFi) functions. DeFiChain, developed by the DeFiChain Basis, focuses on the blockchain’s performance to allow the success of fast, clever, and clear DeFi companies.

The DeFiChain platform is constructed as a software program fork on the Bitcoin blockchain and tied to it with a Merkle root each few blocks. All transactions on the DeFiChain are non-Turing full to make sure pace and effectivity with low gasoline prices and a decrease danger of errors in sensible contracts.

What Is DFI

DFI serves because the native token of DeFiChain and is an integral account unit in DeFiChain. Customers and companions can be issued $DFI cash that can be utilized to take part within the ecosystem within the following methods:

Paying Charges: The DFI token is the in-house forex used to pay for transactions, DEX charges, ICX charges, sensible contracts, and different DeFi actions on DeFIChain.

Liquidity Swimming pools: DeFi holders can use their tokens to supply liquidity for the DEX between crypto-assets.

Staking Nodes: DeFiChain customers should have not less than 20,000 DFI tokens to fund a brand new staking node.

Mortgage Collaterals and Curiosity: Platform customers can put up their DFI tokens as collateral to borrow different crypto tokens. They will additionally lend different crypto-assets to obtain an instantaneous premium in DFI and curiosity within the type of DFI tokens when the mortgage is paid again.

DeFi Customized Token: Customers should personal 1,000 DFI tokens to create a customized DCT (DeFi Customized Token.) When this practice token is destroyed, the person receives a refund for the DFI they’d used to create it.

Submitting Proposals and Votes: Customers pays 10 DFI to submit a Group Fund Proposal or 50 DFI to submit a Vote of Confidence. The DFI paid for these submissions is non-refundable.

Key Options of DeFiChain

Following are among the most important options of the DeFiChain platform:

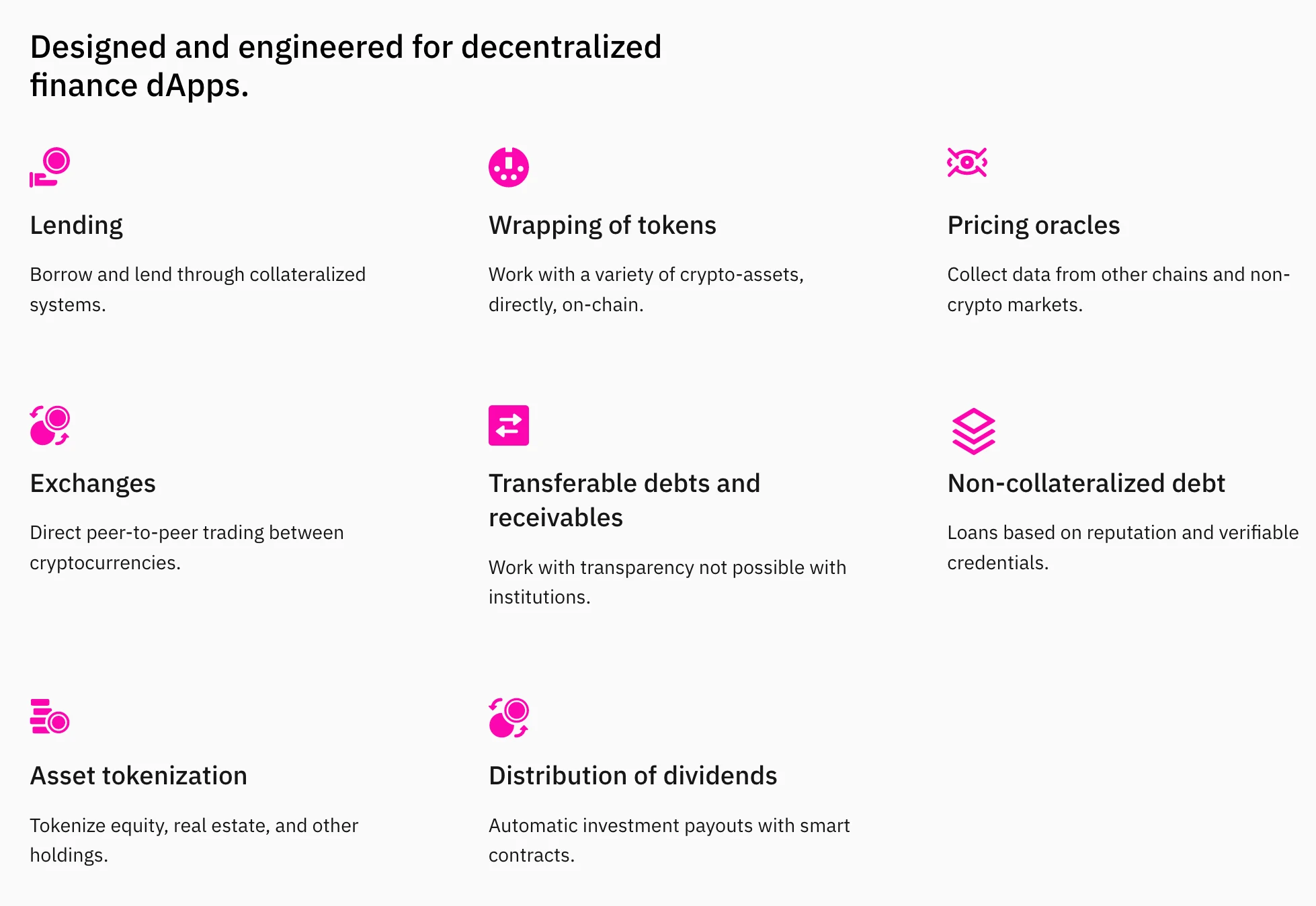

Decentralized Lending

With decentralized lending, people and teams can keep away from the intervention of banks and centralized authorities whereas borrowing and lending. Regardless of main with bitcoin, DeFiChain additionally addresses 100% of the market by way of the decentralized wrapping of tokens.

Decentralized Wrapping of Tokens

Wrapping permits people to make use of any digital asset whereas sustaining the underlying asset however transacting on a unique blockchain. DeFiChain encompasses a distinctive decentralized, trustless wrapping mechanism by way of which the crypto asset proprietor can work all their property on-chain with out counting on a 3rd occasion to behave as a guarantor.

Earlier than DeFiChain, there have been no interoperability requirements connecting totally different currencies. Wrapping or collateralization (sometimes offered by a 3rd occasion) are key necessities because the interplay of various cryptocurrencies and property requires interoperability.

House owners can simply trade their wrapped tokens on their respective blockchains for his or her authentic worth. DeFiChain customers are additionally rewarded for making a wrapped token on the platform.

The on-chain transaction is completed utilizing the native $DFI coin, however DeFiChain can even use Bitcoin, ERC-20, Ethereum, and different crypto-assets by way of wrapping.

Decentralized Pricing Oracles

Oracles collect correct info from different blockchains and non-crypto markets to gather knowledge associated to the pricing of different crypto-assets. DeFiChain options such pricing oracles that assist acquire knowledge from everlasting blockchains.

DeFiChain community customers who take part as an oracle can earn tokens as rewards for the info they supply. These rewards are issued by sensible contracts that measure the oracle’s accuracy based mostly on the consensus proportion, variety of oracles, and different pre-set parameters.

Decentralized Exchanges

DeFiChain’s decentralized trade allows atomic, peer-to-peer swapping of cryptocurrencies by immediately matching individuals for buying and selling. Utilizing this DEX reduces the dangers of utilizing exchanges whereas guaranteeing that the token holder all the time has custody of their crypto asset. The trade additionally doesn’t should bear the danger of custodianship because the peer-to-peer mechanism relies on an agreed-upon worth or the present market worth.

Asset Tokenization

Asset tokenization includes representing an asset like actual property or firm fairness utilizing immutable blockchain-based tokens.

Many initiatives like LAtoken and Etherparty have made an try at blockchain asset tokenization however have ultimately pivoted to supply companies that aren’t immediately related to asset tokenization.

DeFiChain, however, provides a module that has been designed particularly for asset tokenization. This module is straightforward to make use of for tokenizing actual property, firm fairness, and different valued asset holdings.

This asset tokenization can be provided as a authorized, approved, and but decentralized functionality that may be trusted independently.

Dividend Distribution

The dividends distribution module can be utilized to generate sensible contracts that may routinely pay out returns on funding for tokenized property. DeFiChain provides a leap within the dividends distribution performance by implementing fashions with weekly, month-to-month, quarterly, day by day, hourly, and even minute-by-minute payouts.

Transferable Money owed and Receivables

In centralized finance, solely monetary establishments that deal with loans can handle money owed and accounts receivable. DeFiChain has offered a decentralized different in a set of calls that may work with transferable money owed and receivables. This has been achieved through the use of the blockchain, which provides transparency to the method of exchanging money owed and loans. Good contracts can be employed to observe and handle these loans and money owed based mostly on receivables and different monetary guarantees.

DeFiChain additionally provides the potential to create sensible contracts that may assist peer-to-peer loans with no monetary establishment having to ensure these monetary property.

Decentralized Non-collateralized Debt

At current, DFI is used as collateral for taking out on the platform, and the person’s identification is established based mostly on their pockets KYC. Nevertheless, DeFiChain plans to construct the suitable reputation-based programs and danger evaluation methods to supply non-collateralized loans based mostly on debtors’ reputations and different components. If profitable, this method can be utilized to complement or exchange the presently used credit score rating strategy.

The place to Purchase DFI

When selecting an trade on which to purchase cryptocurrency, you will need to examine for the next key components in crypto exchanges:

Asset and cost assist: Evaluate cryptocurrency exchanges earlier than selecting one which helps the DFI token and the cost technique you’re utilizing to fund your buy. Should you plan on swapping different cryptocurrencies in your portfolio to amass DFI, you also needs to examine whether or not the trade helps that buying and selling pair (e.g., BTC/DFI, ETH/DFI, and so on.)

Safety: Establish a dependable trade and the hyperlink fastidiously to make sure that you entry the genuine trade platform so that you just don’t fall prey to phishing scams.

Whereas DFI is listed on many cryptocurrency exchanges, this text will take you thru the detailed process for buying DeFiChain on CoinStats, a platform that options:

- A dependable crypto trade for getting DeFiChain

- A safe crypto pockets for storing your DFI

CoinStats additionally provides informative content material like “How one can Purchase Cryptocurrency” for freshmen and particular coin-related articles like “How one can Purchase STEPN” for potential traders.

Steps for Shopping for DFI

DFI could be bought with fiat cash or by swapping with different cryptocurrencies. Following are the steps detailing methods to purchase DeFiChain (DFI) on CoinStats:

- To buy DeFiChain, you have to first create an account on the trade and hyperlink a safe pockets. CoinStats additionally supplies its personal pockets that you need to use to maintain your tokens secure.

- You will have to fill in your KYC particulars like your identify, contact quantity, and e-mail ID. After your KYC is accomplished, you may transfer to the shopping for stage.

- Should you plan to pay with fiat forex, you’ll have to fund your account with a financial institution switch or a credit score or debit card. Should you’re utilizing a crypto swap, you’ll have to be sure that the related tokens can be found in your linked pockets.

- You may then place a restrict order by coming into your order worth in USD or the crypto you want to swap and choosing the DFI quantity. If the worth reaches the quantity you specified, your order can be processed.

Is DFI a Good Funding

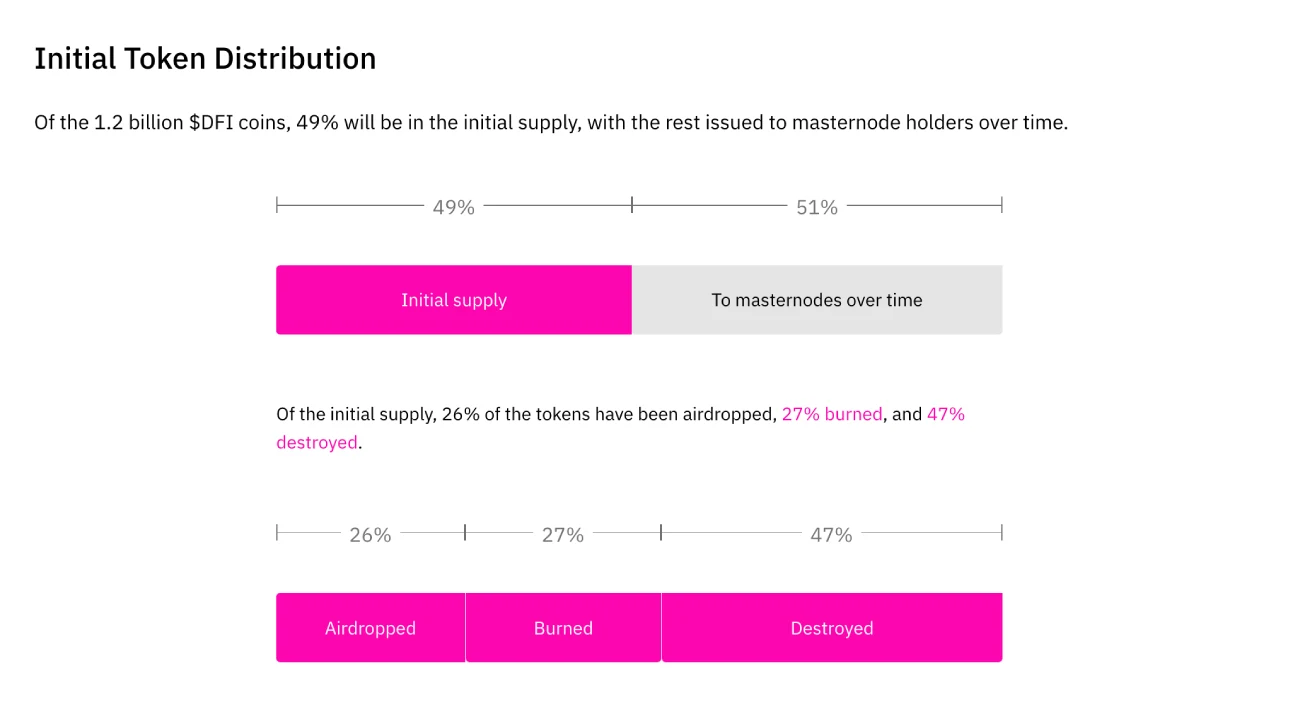

The DeFiChain worth as of twenty fifth Could 2022 is $2.52, with a 24-hour buying and selling quantity of roughly $17 million. The coin presently stands at a rank of #51 on CoinStats, with a circulating provide of round 510 million DFI and a most provide of about 1 billion DFI cash.

In line with forecasts from walletinvestor.com, the DFI worth is anticipated to have a long-term enhance, doubtlessly reaching a worth level of $8.98 by fifteenth Could 2027.

Closing Ideas

Now that you understand how to purchase DeFiChain, all you’ve obtained to do is monitor the charts, analysis the undertaking completely, and DeFiChain tokens based mostly in your current portfolio and crypto funding plans. Please keep alert to potential scams throughout this course of and be sure that you retailer your pockets keys safely after you purchase your DFI tokens.