Bitcoin’s market capitalization has surpassed the $1 trillion mark during the recent bull market, because of the easy accessibility of cryptocurrencies in present times. Investors had limited options when Bitcoin was last in a bull run.

Bitcoin can now also be purchased via exchanges, such as Kraken and Coinbase. Online brokers like Robinhood and Webull as well as peer-to-peer transactions apps such as CashApp are available. Although each platform charges different fees, commissions and rates for different cryptocurrencies, the most important assets like Bitcoin and Ethereum are available on all platforms. The Cash App was one of the first peer-to-peer services to offer cryptocurrencies to customers, and today in this article, we’ll look at How to buy Bitcoin on Cash App.

Let’s get started!

The Cash App

Square, which is listed on Nasdaq as $SQ, developed the Cash app. It’s a peer-to-peer mobile transaction platform. Square Cash launched the Cash App in 2013. It works similar to Venmo or PayPal, with some additional features. It is possible to choose a username, called a $cashtag. You can send cashless payments without any fees to other users. This works in a similar way to Venmo. Users can send money using Cash App to anyone with a debit card, even if they don’t have Cash App.

You can use Cash App as both a banking and investing account. To invest in Bitcoin and stocks, users can fund Cash App from a debit or bank card. Cash App may not offer as many stock options than Robinhood and TD Ameritrade but clients can purchase fractional shares from it.

Bitcoin purchase on cash app

One of the platform’s key goals is to simplify money for a user base that lacks strong financial literacy. Cash App doesn’t offer sophisticated charting tools or multilegged options trades to investors. It does however offer clients a complete platform to save and invest in stocks and crypto currencies.

The service fee charged by Cash app and the exchange fee applicable to Bitcoin purchases are two separate fees. They are both very affordable and applied to all transactions. According to fluctuations in the BTC prices among US exchanges, the exchange fee changes. Large Bitcoin purchases may be more affected by turbulent markets. Smaller purchases, however, will incur the same costs as crypto exchanges Coinbase and Gemini.

These are the 3 steps that will allow you to purchase Bitcoin with Cash app.

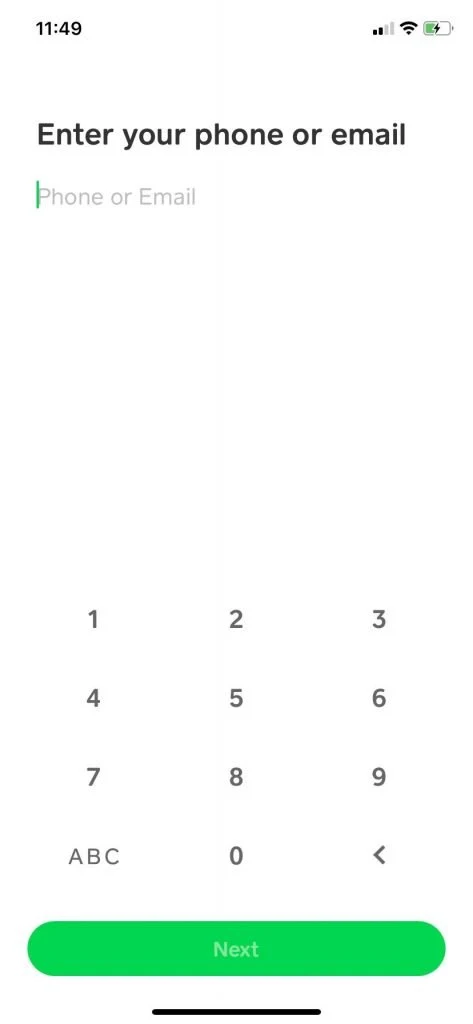

Step 1. Download or open a Cash App

Both the Apple App Store as well as Google Play Store have Cash App. If you haven’t created an account yet, you’ll need a few pieces of information to get started. The following information will be required for your account application:

- Email Address

- Number of the phone

- Bank account or debit card number

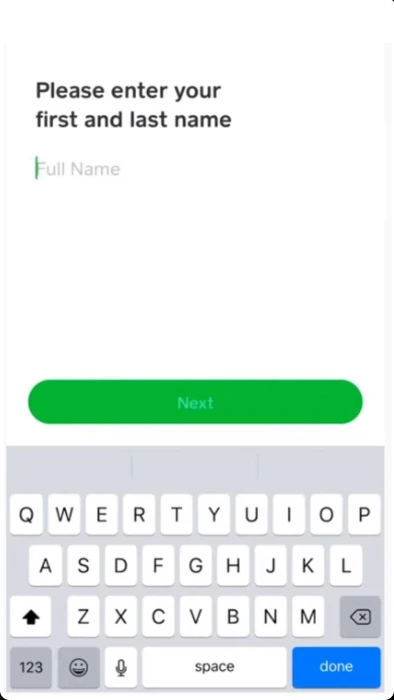

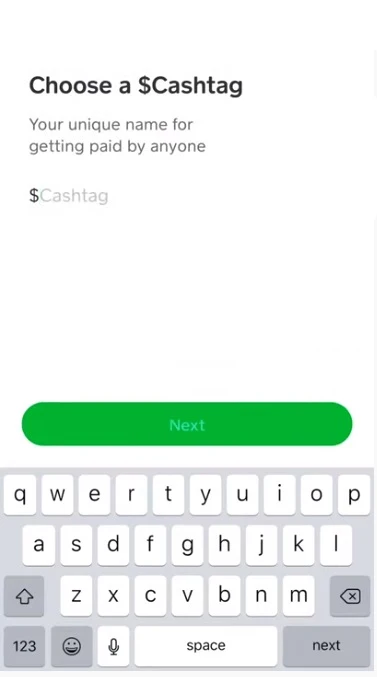

You’ll then need to provide your full name and select a unique $cashtag. You will require this username to be able to get payments. You will also receive a referral code. To earn a bonus, you can give the referral code to your family and friends.

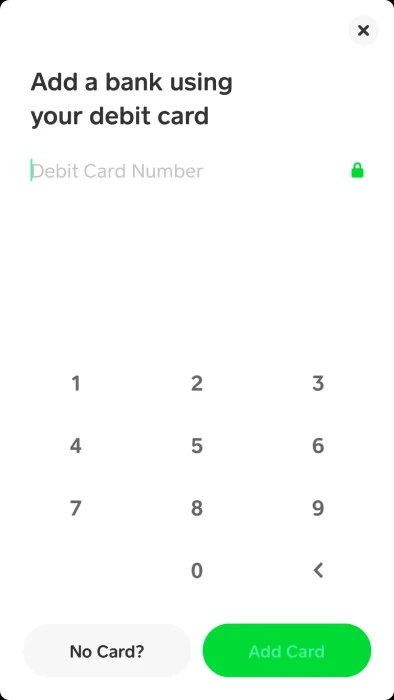

Step #2: Fund Your Account

You must have funds in your Cash App account, or else you’ll be unable to purchase Bitcoin. Go to the homepage and click Add Cash. Next, enter the desired amount. The next step is to verify your identity. You can now add funds to your bank account once you have uploaded all the data. To confirm transactions, you’ll also need to generate a PIN, and create a PIN of your special number so you won’t easily forget (or write it down).

Step 3: Buy Bitcoin

Navigate to the “Investing” tab. Here you can choose from equities or Bitcoin. Click on Bitcoin to see the latest price chart. A BUY button will be displayed. When you click on the “Buy,” button you will be able to pay for the bitcoins all at once or set up regular transactions. You can choose how many Bitcoins you wish to purchase by choosing a USD amount or a custom order.

After you’ve decided on an amount, press “Next”, and an order overview screen will appear Check thoroughly all the details and ensure that everything is in order, and hit on the “Confirm” button.

When it’s finished, click on “Done.” You can now check your Bitcoin balance by going to the Home tab. To deposit or withdraw Bitcoin, a user’s wallet address will be presented. Withdrawing Bitcoin from your own wallet can help you avoid giving the funds to other people. By doing this, you can ensure that your Bitcoin is completely yours.

Bitcoin auto-investing

If you wish to use the Cash App and invest in bitcoin, it is important that your emotions are not volatile. The Auto Invest feature is available to Cash App users.

Your bitcoin transactions can be automated with auto-investing. The user can set up automatic purchases, and they will be made at the exact amount and according to the schedule. It is possible to grow your account significantly by making a weekly purchase of $20 or $10.

Here’s how to set up bitcoin auto-investment on Cash App:

- The bitcoin window is open

- Click on the “Buy” button

- Select “Standard One-Time Order” from the drop-down menu

- You can choose the frequency at which you want to Auto Invest. This could be whether you would like to purchase daily, weekly or bimonthly

- Tap on “Done”

- You can choose a fixed investment amount or your own from the drop-down menu. Auto Invest requires a $10 minimum purchase

- Click on “Next” and “Confirm”

How to sell Bitcoin using Cash App

To make a profit from Bitcoin trading, you must strike while it is still hot. Cash App allows you to sell Bitcoin anytime you like or create automatic sales whenever the price goes up.

- Tap the central “Sell” button on the Bitcoin tab.

- The app defaults to a one-time sale, and you’ll be asked to enter a selling price in USD. Like the buying options you have two choices: choose from a pre-determined price or create your own.

- After you’ve decided on a price, you will be prompted to enter your PIN and confirm the transaction. That’s it! The transaction has completed and your Bitcoin balance will reflect the transfer.

- Also, you can set up sales when Bitcoin’s value reaches a threshold. Instead of selecting a one-time selling price when you first press “Sell,” select the “Change Order Type” option.

- Tap “Custom Sell Order” on the following screen.

- Below is a graph showing the Bitcoin value. You can view it daily, weekly, monthly, or annually. Use the slider to choose a Bitcoin price for sale.

- When you’ve decided on a value, press the “Set” button.

- Once you have reached that level, you’ll be asked to enter the amount you want to sell. There are two choices: you can choose a fixed amount, or you can enter your own quantity.

- Now, choose from several options to set an expiration day for the trigger. If you’re observant about the market, setting up automatic sales may be beneficial. However, remember that you only get what you choose. Even though the price may rise, it will still be processed quickly once the target price has been met.

- Once you’ve selected an expiry date, Cash App will ask you to enter your PIN and confirm the data before proceeding with the automated sale.

- After they’ve been established, these rules can not be modified. But you may cancel them or make new ones. Scroll down to the Bitcoin tab’s “Activity” section to see what automated sales you’ve set up.

The Reasons You Should Buy Bitcoin With Cash App

The main reason you should consider Cash App for purchasing Bitcoin is the same reason most people use Cash App for other things: It’s simple & easy.

The app makes it easy to use and is also one of our favorite apps for buying Bitcoin. To buy Bitcoin using your Cash App, go to the Bitcoin option on the main screen, click on “Buy BTC”, choose or enter the amount, and complete the transaction. It’s that simple.

Cash app makes it easy to send Bitcoin to others (or another Bitcoin wallet that you manage) and to also receive Bitcoin. Easy and quick way to send bitcoin to cash app users. Also, you can easily send the Bitcoin to external wallets via QR code or to your Bitcoin address.

Are there any fees for buying Bitcoin using The Cash App?

There will be a transaction fee for buying and selling Bitcoin on Cash App. The fee will appear on your trade confirmation screen prior to you completing the transaction. If you don’t agree with the charge, you can simply refuse to proceed. Cash App charges two kinds of fees for Bitcoin transactions: the first is a fee to perform the transfer and another is due to price fluctuations on US exchanges.

Bitcoin’s Risks

Bitcoin isn’t without risks. It’s been around a little longer than Cash App and is accepted by a lot of large corporations. Bitcoin has not yet established itself as an accepted method to buy and sell goods. Trading and investing in bitcoin is risky because the bitcoin price fluctuates frequently.

The potential for digital currencies to gain popularity with private customers, banks and retailers may be there. But they cannot challenge the power of the dollar and other well-established currencies.

Final Thoughts

Cash App is gaining popularity in recent years. Many users use Cash App to not only send or receive money, but also conduct Bitcoin transactions.

The Cash app is ideal for such transactions and is easy to setup and buy Bitcoin. To start Bitcoin transactions with Cash App, simply download and register the app. Be aware that transaction fees may apply, so you should be ready to pay these before moving forward.

You can also visit our CoinStats blog to learn more about wallets, cryptocurrency exchanges, portfolio trackers, tokens, etc., and explore our in-depth buying guides on buying various cryptocurrencies, such as How to Buy ApeCoin, What Is DeFi, How to Buy cryptocurrency, etc.

Information about InvestmentsInformation on this site is for your informational purpose only. CoinStats does not endorse any recommendation to sell, buy or hold securities or financial products. This information does NOT constitute financial advice or trading advice. Information on this website is not based on any financial institution. It may be different from information you get from service providers.

Market risks, such as the possibility of losing principal, are all part and parcel of investing. Because cryptocurrency can fluctuate and is sensitive to secondary activities, it’s important to do independent research, get advice and not invest in more money than your financial means. CFD trading, stock trading, and cryptocurrency trading can present significant risk. CFD trading can cause losses of between 74-89% in retail investor accounts. It is important to consider all aspects of your financial situation before you make any investments. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.