Sponsored

We are approaching the U.S. Tax Season 2022 and crypto traders require all assistance. These are the five most common misconceptions about crypto taxes that you need to be aware of, according to a crypto tax software provider. Cointelli.

“You don’t have to pay taxes on crypto”

One very common mistake that people make is thinking they don’t have to pay tax on cryptocurrency transactions. However, Crypto transactions Are Taxable, and the IRS is very capable of coming after you and your assets if you don’t comply. The IRS refers to cryptocurrency as virtual currency, and any transactions on exchanges, income from mining or staking, crypto received from hard forks and airdrops, and even DeFi transactions – basically the majority of profits and losses resulting from crypto activity – are subject to tax.

According to the IRS’s guidelines from 2014, cryptocurrency is treated as property for taxation purposes. Capital gains or losses resulting from the sale of your assets are taxable. Assets that you only hold or have until they are sold, however, will not be taxable. The IRS hasn’t yet provided clear guidelines for areas that include staking, NFTs, and DeFi transactions.

So, Let’s see what happens if you don’t report crypto transactions to the IRS? The crypto market has grown rapidly in recent years, and the IRS’s enforcement efforts have grown with it. If you don’t report your crypto transactions on your tax returns, you could land yourself in big trouble. The IRS asked the following question, as you might have seen: Form 1040:

“At any time during [the tax year], did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

It is impossible to get around paying tax on crypto. Thankfully, CointelliThis team is available to relieve you of stress and frustration during tax season, and ensure that you comply with all tax laws.

“Reporting my crypto transactions will just lead to me paying more in taxes”

A common myth is that you will have to report your cryptocurrency transactions if you want to pay more taxes. It isn’t always true. A strategy known as “The Strategy” can help you reduce your taxes. tax-loss harvesting. How does it work exactly?

You can harvest assets to generate capital gains. You might think that if crypto prices were dropping, it would be a good idea to continue holding onto the coin until its price recovers. But if you decide to sell your crypto and accept the loss, you could instead “harvest” it. The loss you make can be offset by capital gains in other investments. This could result in a reduction or elimination of capital gains tax.

Before you can harvest your losses, there are four important things to remember:

- Pay attention to the Wash sale rulesThe wash sale rule may apply to cryptocurrency in 2022. This rule will apply to crypto sales. You cannot deduct losses if the purchase is made within 30 days.

- You should harvest your losses all year.

- Always remember that short-term gains should be compensated first.

- Don’t forget about exchange fees.

For your taxes year to be eligible for losses, your crypto losses must be reported to the IRS. Also, your tax loss harvesting must be completed before year’s end. Report capital losses from crypto For Form 8949. You will need to enter the following details: calculate the sum of proceeds; choose the cost base that is most favorable for you and then input your net capital gain and loss at the bottom. For more, check out This guide.

It can be difficult to calculate your capital gains or losses by hand, as you will see from the previous paragraphs. Many cryptocurrency traders already use tax software that calculates crypto taxes like CointelliTo quickly and accurately determine their net cryptocurrency gains or losses from both short-term and longer-term crypto transactions

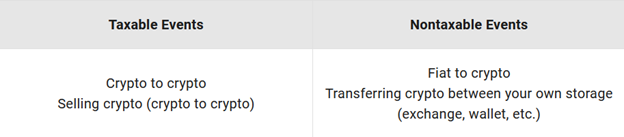

“You only need to pay taxes when converting crypto into fiat currency”

Another common myth is that crypto can be converted into fiat currencies without paying taxes. This is incorrect. It’s not so. Taxable are many different situations and scenarios. Have you ever mined cryptocurrencies? It may surprise you to know that traders must pay Taxes on crypto mining. You owe income taxes on any cryptocurrency that you mine.

Another scenario to consider is if you have received “free” crypto from an airdrop. It is also considered income. It is subject to taxes! The IRS’s cryptocurrency tax guidelines from 2019 state that all crypto received from airdrops is subject to income tax. Regardless of whether you intended to receive it or not, “free” crypto that enters your wallet or exchange account is considered ordinary income.

First, understand that cryptocurrency is property and not currency. This will help you determine whether a crypto-related event is taxable. Crypto-related income is often classified as capital gain and subject to either income tax or capital gains.

A crypto hard fork can also have tax consequences. So what is a cryptocurrency hard fork exactly? Hard fork? Developers often update or upgrade a cryptocurrency’s programming after it has been in circulation for a while. When a cryptocurrency program or “protocol” gets a significant upgrade or coding modification, we call this a “hard fork.”

If you had a cryptocurrency that went through hard forks but was not redeemed, NotA new cryptocurrency is issued to you via airdrops or any other means. NotHave a taxable income If your cryptocurrency was subject to a hardfork upgrade, and developers have issued you new cryptocurrency, IsA taxable transaction.

“Crypto profits are always taxed at the same rate”

Another misconception that people often have about crypto profits is that they are all subject to the same tax. Don’t be fooled; The rateThere are many factors that affect the tax rates at which crypto profits can be taxed. This makes it very difficult to determine how much you owe. The rate that crypto gains are taxed depends on three things.

This is also known as the holding period. It refers to how long an individual held crypto currency before selling it. Taxes are assessed based on the holding period of crypto-related gains. The tax rate on capital gains for short term can reach 37% while the tax rate for long-term capital growth can go up to 20%.

Your income bracket is the second. The third is your income bracket. High-income taxpayers will have to pay 3.8% net income tax (NIIT), which will impact their taxation rate.

Your location is the third. Your location may impact whether you have to pay taxes in your state or locality. You should be familiar with your state’s tax laws before you sell.

CointelliThis company understands the complexity of tax reporting and how it can become confusing for some people. That’s why it takes care of the hardest parts of preparing crypto tax reports for you.

“Doing my crypto taxes is too complicated”

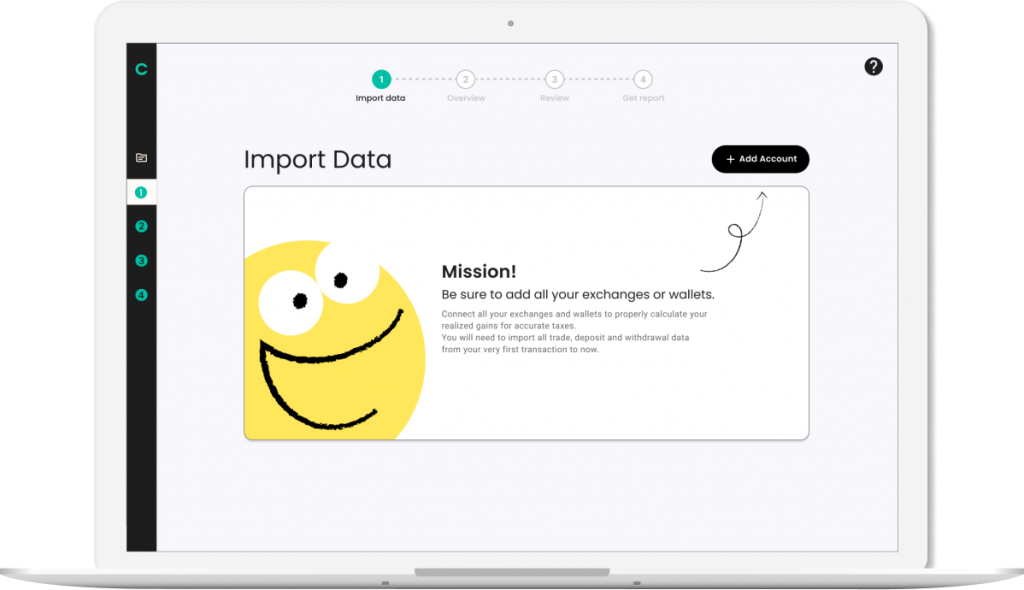

Filling out your crypto tax report doesn’t have to be hard! Cointelli simplifies the process down to these three steps.

- Calculate your crypto losses and gains

- Please complete Schedule D as well as Form 8948.

- Include any other crypto income in your tax report

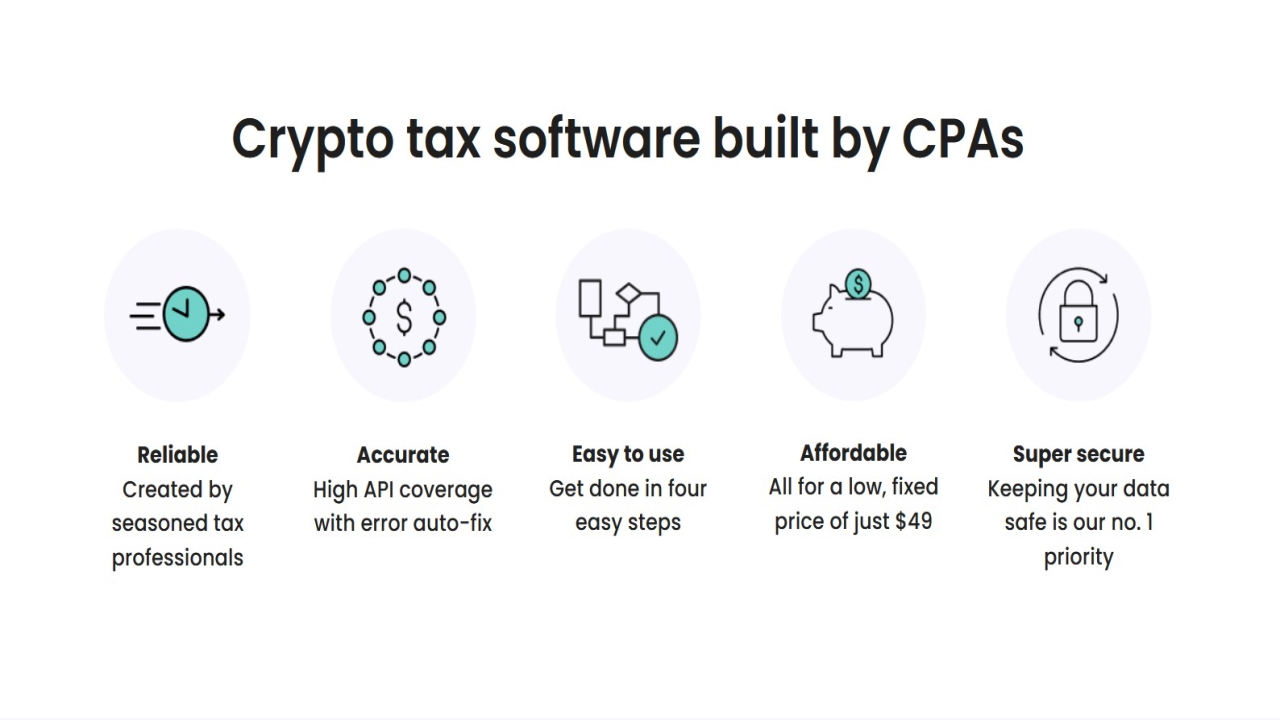

Cointelli was created by CPAs that specialize in crypto and who want to make sure you accurately report your cryptocurrency taxes. You can pay a wide range of taxes depending on how your capital gains are calculated. It is important to use trusted crypto tax software. With a wide compatibility with wallets, exchanges, and blockchains as well as functions like error-fix and error auto-fix CointelliIt is reliable crypto tax software. What’s more, it also makes the whole process quick and easy!

Cointelli automatically organizes your buying costs, selling costs and holding periods.

Are you having trouble with the crypto tax season? Click HereCointelli will handle everything for you. So you can just relax.

- The purpose of this article is to give general information about financial matters that can be used to inform a large audience. It does not offer personalized advice on tax, investments, legal or any other professional areas. You should consult your professional tax advisor before taking any actions. They can advise you on your taxes, investments, and the law.

- Cointelli can currently be purchased only in the US. All financial and tax information above is applicable to the US market.

This post is sponsored. Find out how you can reach our audience. Read disclaimer below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis information is provided for educational purposes only. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.