The Bank of England explained that it was meddling in U.K. bonds markets, and the Bank of Japan defending yens in foreign exchange markets last week. On Wednesday, the Hong Kong Monetary Authority revealed it had intervened on forex markets. Hong Kong’s central bank detailed that it interfered in forex markets in order to defend the Hong Kong dollar (HKD) as it showed signs of weakness against the greenback on September 28.

HKMA interferes with Forex Markets to Defend HKD Capital Flight to USD Assets

While the euro and pound sterling lost 12-17% against the U.S. dollar during the last six months, there’s been a significant amount of capital flight to the greenback. The Hong Kong Dollar (HKD), on the other hand, is doing better than any of the fiat currencies against U.S. dollars.

On Wednesday, September 28, reports detail that a “flight of capital from the Hong Kong dollar market” pushed the HKMA to step in and defend the HKD in forex markets. South China Morning Post (SCMP) reporter Enoch Yiu explained on Wednesday that the HKMA said it intervened in order to “support the peg after the local currency hit the weaker end of its HK$7.75 to HK$7.85 trading band.”

SCMP details that it’s the first time in seven weeks the central bank defended the HKD in this fashion and the HKMA has chosen to intervene in the foreign exchange market 32 times this year. De facto central banks have purchased HK$215billion this year, bringing the HKD/USD rate down 0.83%.

The authority sold roughly $27.39 billion USD in 2022 and recent reports detail that the central bank has purchased local dollars “at a record pace to defend the city’s currency peg.” Furthermore, as Hong Kong and Japan recently tampered in the forex arena, India, Chile, South Korea, and Ghana have also defended their currencies in foreign exchange markets.

Hong Kong’s move to defend the local dollar follows the HKMA, Indonesia, and the Philippines raising benchmark bank rates following the United States Fed’s recent rate hike on September 22. The HKMA increased the rate by 75bps, bringing the total lending rate up to 3.5%.

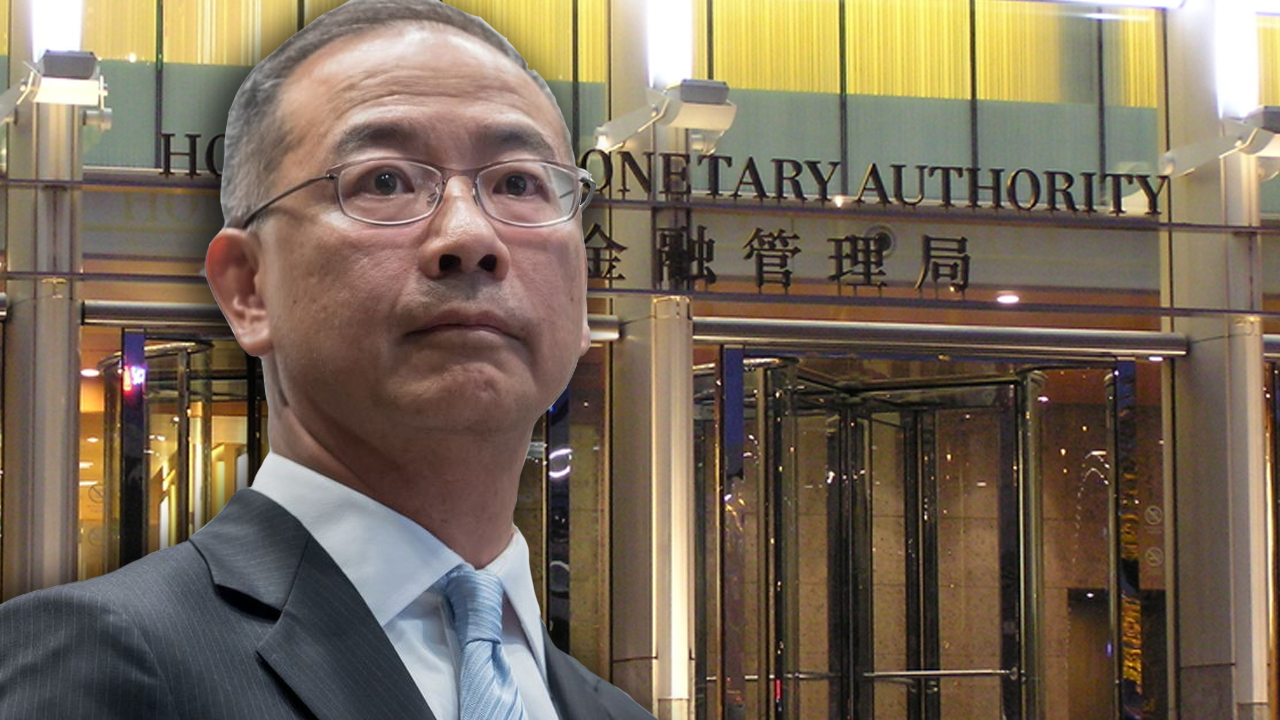

The third and current chief executive of the HKMA, Eddie Yue, detailed that he did not see a major risk to the territory’s housing market. “The latest rate on bad debt is about 1% and may adjust upward a little bit. But it is still low as compared to some international levels,” Yue remarked last week.

How do you feel about the HKMA intervening in forex markets to protect the HKD. Please comment below to let us know your thoughts on this topic.

Image creditShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.