Findings stemming from a current report printed by the security-focused blockchain agency Certik point out that the Binance sensible chain ↔ Ethereum bridge referred to as Qubit has been hacked for $80 million. Information reveals on January 27, 2022, an attacker siphoned quite a lot of tokens from an exploit on Qubit Finance’s bridge and Certik says the hack is “by far the biggest exploit of 2022 so far.”

Qubit’s Binance Good Chain ↔ Ethereum Cross-Chain Bridge Attacked for $80 Million in Defi Tokens

A decentralized finance (defi) exploit tied to Qubit Finance’s Binance sensible chain ↔ Ethereum bridge has led to the lack of $80 million, in keeping with the blockchain safety consultants at Certik. Qubit Finance is a defi protocol that provides lending capabilities and a cross-chain bridge between BSC and ETH.

Sadly seems to be like @QubitFin from the workforce at @PancakeBunnyFin has been exploited for over $80m in belongings.

Exploiter’s handle:https://t.co/s2WDCCiLho

— Stefan (🦎,🦎) (@0xCryptoStefan) January 27, 2022

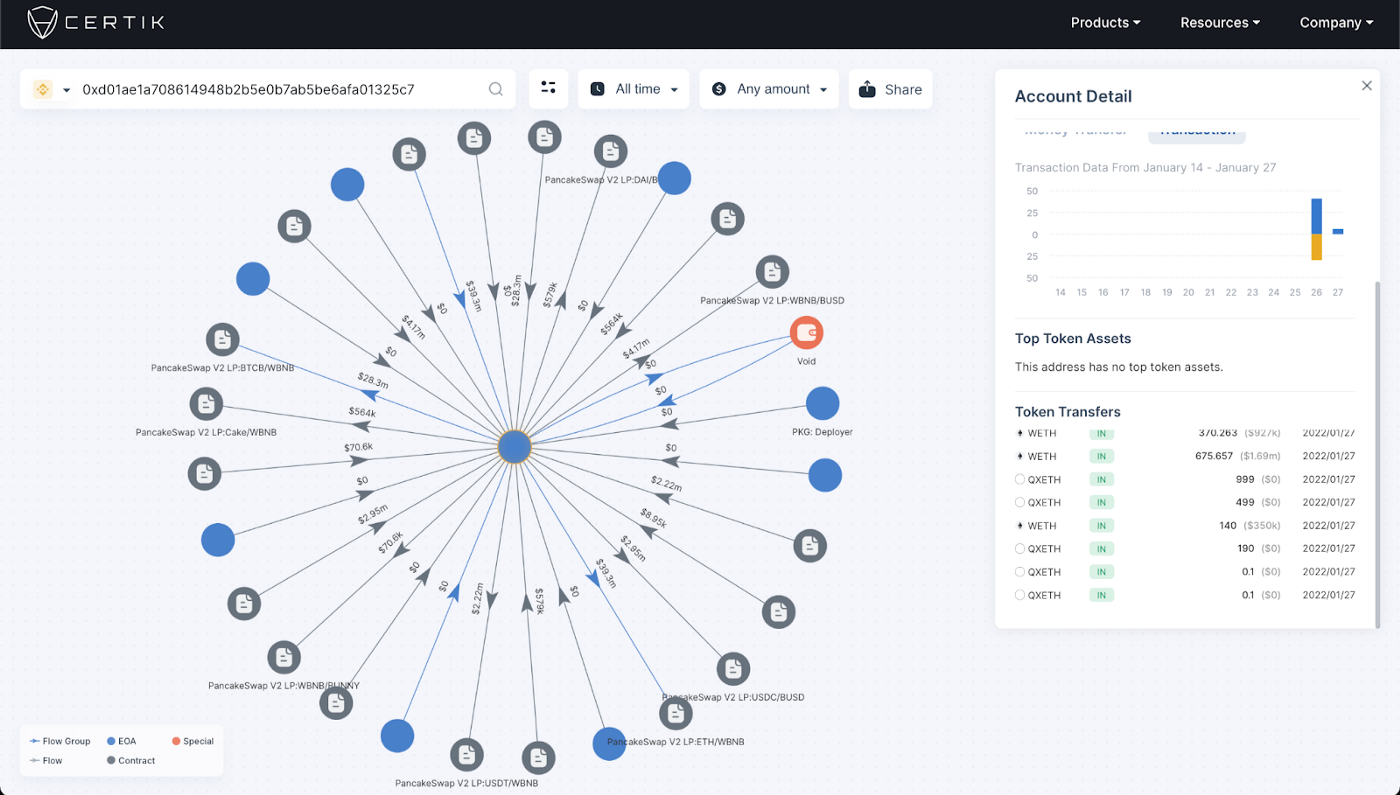

The cross-chain bridge was exploited by the malicious attacker who managed to internet 77,162 qXETH to borrow and convert the funds into different funds. Primarily, the hacker was in a position to leverage stolen cash to acquire “15,688 wETH ($37.6 million), 767 BTC-B ($28.5 million), roughly $9.5 million in numerous stablecoins, and ~$5 million in CAKE, BUNNY, and MDX.” Certik’s autopsy evaluation additional explains:

Primarily what the attacker did is benefit from a logical error in Qubit Finance’s code that allowed them to enter malicious knowledge and withdraw tokens on Binance Good Chain when none had been deposited on Ethereum.

Certik: ‘Individuals Have to Bridge Crypto Belongings in Methods That Are Not Vulnerable to Hackers’

At the moment, the handle nonetheless holds all of the stolen cash that are price roughly $79,332,154 on the time of writing. Certik says that the cross-chain bridge vulnerability highlights two essential issues. “The significance of cross-chain bridges that facilitate interoperability between blockchains [and the] significance of the safety of those bridges.” Over the past 12 months, cross-chain bridge know-how has grown an awesome deal.

Information stemming from Dune Analytics reveals there’s $11.79 billion complete worth locked (TVL) on Friday. Polygon has the biggest (MATIC ↔ ETH) cross-chain bridge TVL with $5.1 billion. Certik’s autopsy evaluation stresses that as cross-chain tech grows bridge safety shall be essential.

“As we transfer from an Ethereum-dominant world to a really multi-chain world, bridges will solely grow to be extra essential,” Certik’s evaluation of Qubit’s losses concludes. “Individuals want to maneuver funds from one blockchain to a different, however they want to take action in methods that aren’t inclined to hackers who can steal greater than $80 million {dollars}.”

What do you concentrate on Qubit’s $80 million cross-chain bridge loss? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Certik,

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.