Grayscale Investments, a company that specializes in digital asset infrastructures, announced on October 6 a new venture. Accredited investors will have the chance to invest in this mining infrastructure. According to the announcement, the co-investment vehicle is called Grayscale Digital Infrastructure Opportunities (GDIO), and the crypto mining firm Foundry will handle the new product’s operations. GDIO is meant to “capture the upside of crypto winter,” Grayscale’s announcement on Thursday details.

Grayscale’s New Co-Investment Vehicle GDIO Looks for Opportunities Within the Crypto Economy’s Market Cycles — Day-to-Day Operations to be Managed by Foundry Digital

The world’s largest digital currency asset manager, Grayscale Investments, announced the launch of a new co-investment opportunity on Thursday, a financial vehicle that aims to take advantage of the crypto economy’s market cycles. The new co-investment product is the first of its kind for Grayscale and the bitcoin mining, and staking infrastructure firm Foundry Digital will “manage the day-to-day operations” of the Grayscale Digital Infrastructure Opportunities (GDIO) co-investment vehicle.

Foundry is the most popular bitcoin mining pool, in terms of hashrate. The firm’s mining pool captured 19.38% of the global hashrate this year, or discovered roughly 10,375 out of the 53,532 BTC blocks found during the past 12 months. Grayscale sees the crypto winter as a unique opportunity for investors, despite this year’s bear market.

Grayscale’s investment thesis states:

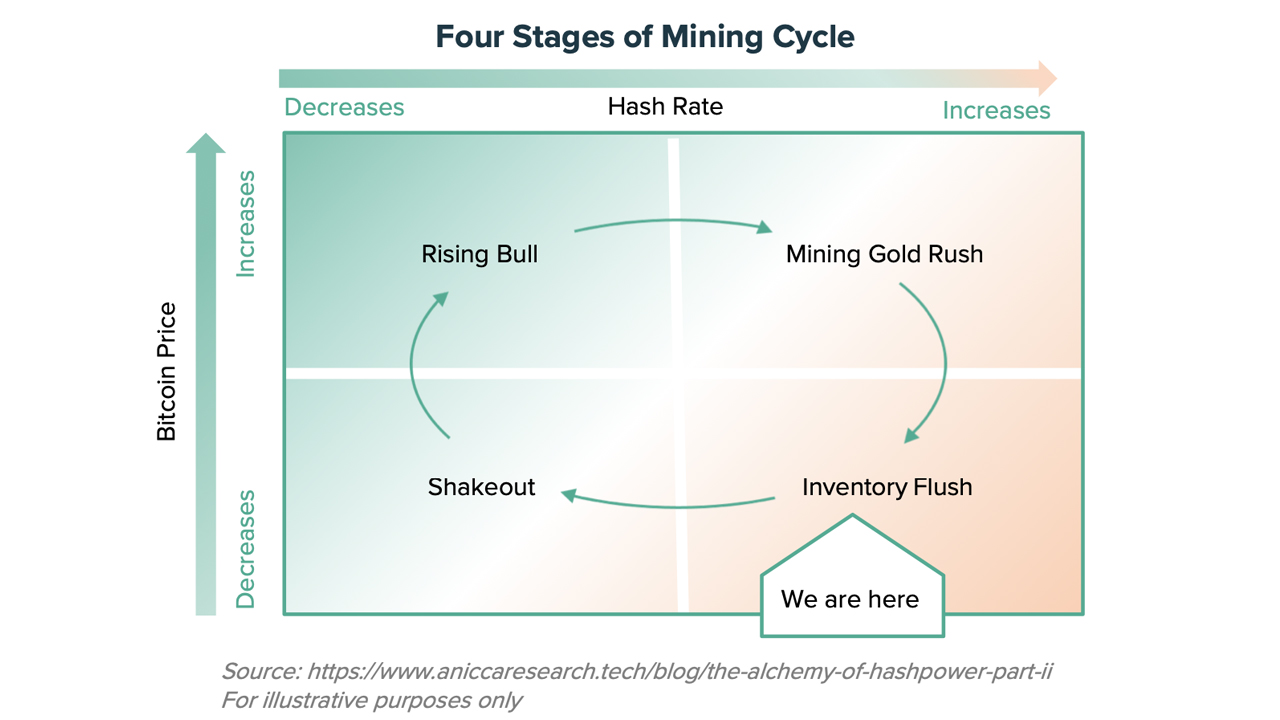

Due to the dramatic drop in bitcoin prices, leveraged miners have felt significant pressure on their operating margins. We expect that many miners will have to sell their equipment in the next months. We think GDIO will be able to buy mining equipment at distress levels, and profitably mine Bitcoin in the future.

For instance, the crypto miner Cleanspark explained this past summer that the crypto economy’s downturn has produced “unprecedented opportunities.” At the end of June, a report noted that $4 billion in bitcoin mining loans were in distress. Moreover, In September, Jihan Wu’s Bitdeer launched a $250 million fund to help distressed miners. Grayscale CEO Michael Sonnenshein believes his company is unique and can help Grayscale find new opportunities during the crypto winter cycles.

“Grayscale’s unique position at the center of the crypto ecosystem enables us to create offerings that allow investors to put capital to work through differing market cycles,” Sonnenshein remarked during the announcement. “Our team has long been committed to lowering the barrier for investing in the crypto ecosystem – from direct digital asset exposure, to diversified thematic products, and now infrastructure through GDIO.”

What do you think about Grayscale’s co-investment vehicle that aims to find opportunity in the crypto winter and market cycles? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons. Grayscale Logo

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com doesn’t offer investment, tax or legal advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.